What is the penalty for not taking part B Medicare?

Those who do not sign up for Medicare Part B when they’re first eligible and don’t qualify for a Special Enrollment Period may be subject to a late enrollment penalty. This could mean paying a 10% higher monthly premium for every 12-month period that you were eligible for Part B but didn’t enroll.

When to delay Medicare Part B?

When to Sign Up for Medicare--and Why You Might Want to Delay

- The Social Security rule. If you enroll in Social Security before age 65, you’ll automatically be enrolled in Medicare Part A and Part B when you turn 65.

- If you have employer coverage. ...

- HSA versus Medicare. ...

- Adding up the cost of Medicare. ...

Can I delay Medicare Part B without paying a penalty?

You may choose to delay Medicare Part B and enroll during a special enrollment period. If you or your spouse is actively employed and covered under an employer group health plan, you may delay enrollment without penalty. Your 8 month special enrollment period begins when your group coverage ends.

How to delay Medicare Part B?

The takeaway

- Most people benefit by signing up for original Medicare when they first become eligible.

- In some situations, though, it may make sense for you to wait.

- Talk to your current employer or plan administrator to determine how you can best coordinate your current plan with Medicare.

- Don’t let your healthcare coverage lapse. ...

How do I avoid Medicare Part B penalty?

If you don't qualify to delay Part B, you'll need to enroll during your Initial Enrollment Period to avoid paying the penalty. You may refuse Part B without penalty if you have creditable coverage, but you have to do it before your coverage start date.

Can you add Medicare Part B at any time?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during the eight-month Special Enrollment Period that starts when your employer or union group coverage ends or you stop working (whichever happens first).

Can I delay signing up for Medicare Part B?

Once you have signed up to receive Social Security benefits, you can only delay your Part B coverage; you cannot delay your Part A coverage. To delay Part B, you must refuse Part B before your Medicare coverage has started.

How are Medicare Part B late enrollment penalties calculated?

Part B late penalties are calculated as an extra 10 percent for each full 12-month period when you should have had Part B but didn't. If you should have signed up at age 65, the penalty calculation is made on the time that elapsed between the end of your IEP and the end of the GEP in which you finally sign up.

What is a special enrollment period for Medicare Part B?

8 monthsWhat is the Medicare Part B special enrollment period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse's current job. You usually have 8 months from when employment ends to enroll in Part B.

Do you have to enroll in Medicare Part B every year?

For Original Medicare (Parts A and B), there are no renewal requirements once enrolled. Medigap plans ― also known as Medicare Supplement plans ― auto renew annually unless you make a change.

What is the cost of Medicare Part B for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

How long is a member responsible for a late enrollment penalty?

63 daysMedicare beneficiaries may incur a late enrollment penalty (LEP) if there is a continuous period of 63 days or more at any time after the end of the individual's Part D initial enrollment period during which the individual was eligible to enroll, but was not enrolled in a Medicare Part D plan and was not covered under ...

Why was my Medicare Part B Cancelled?

Depending on the type of Medicare plan you are enrolled in, you could potentially lose your benefits for a number of reasons, such as: You no longer have a qualifying disability. You fail to pay your plan premiums. You move outside your plan's coverage area.

Can Medicare penalties be waived?

You may qualify to have your penalty waived if you were advised by an employee or agent of the federal government – for example by Social Security or 1-800-MEDICARE – to delay Part B. Asking for the correction is known as requesting equitable relief.

Is there a maximum Medicare Part B penalty?

That means paying $182.75/month for Medicare Part B instead of $135.50/month in 2019. This new legislation would limit the penalty amount to no more than 15% of the current premium and limit the penalty duration to twice the period of delayed enrollment.

Is there a cap on Part B penalty?

As of now, there is no cap when calculating the Medicare Part B late enrollment penalty. However, legislation has been introduced to cap the Medicare Part B penalty at 15% of the current premium, regardless of how many 12-month periods the beneficiary goes without coverage.

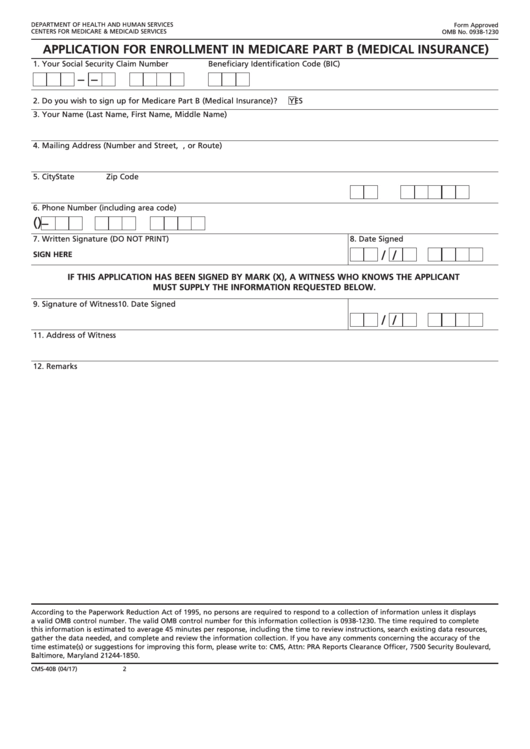

How do I add Part B to Social Security?

Fill out Form CMS-40B (Application for Enrollment in Medicare Part B). Send the completed form to your local Social Security office by fax or mail. Call 1-800-772-1213. TTY users can call 1-800-325-0778.

How do you enroll in Medicare Part B?

There are 3 ways you can sign up: Fill out a short form, and send it to your local Social Security office. Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778.

What will Medicare Part B cost 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What are the Medicare premiums for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How to avoid Medicare Part B late enrollment penalty?

How to Avoid the Medicare Part B Late Enrollment Penalty. The best way to avoid Part B penalties is to plan ahead. You have several Medicare options to choose from, including Original Medicare plus a Medigap Plan. MedicareFAQ can help you through these decisions by answering your questions and helping you prepare for Medicare.

What happens if you don't sign up for Medicare Part B?

Medicare Part B Late Enrollment Penalty. If you’re new to Medicare and don’t sign up for Part B when you’re first eligible, you may end up having to pay the Part B late enrollment penalty. The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying ...

How long do you have to wait to sign up for Part B?

Usually, you will be allowed to sign up for Part B right away, during a “ Special Enrollment Period .”. This is an eight-month period beginning when the employment coverage ends. If you do not enroll during this period, you’ll have to pay a Part B penalty for each full 12 months you wait, beyond the date, the SEP began.

How long does Medicare Part B last?

Your IEP begins three months before your birth month and ends three months after your birth month.

What is the late enrollment penalty?

The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying it every month for as long as you have Part B.

When does Part B start?

General Enrollment runs from January 1st to March 31st each year. If you enroll at this time, your coverage will not start until July 1st. Meaning you may be without insurance if you have ...

Is there a cap on Part B late enrollment?

As of now, there is no cap on Part B late enrollment penalty. There has been a bill introduced called the “Medicare Part B Fairness Act” or H.R.1788. This bill would cap the amount at 15% for the current premium.

How much is the penalty for Medicare Part B?

For each 12-month period you delay enrollment in Medicare Part B, you will have to pay a 10% Part B premium penalty, unless you have insurance based on your or your spouse’s current work (job-based insurance) or are eligible for a Medicare Savings Program (MSP) .

How much is the Part B penalty for 2021?

Since the base Part B premium in 2021 is $148.50, your monthly premium with the penalty will be $252.45 ($148.50 x 0.7 + $148.50). Note: Although your Part B premium amount is based on your income, your penalty is calculated based on the base Part B premium. The penalty is then added to your actual premium amount.

Do you have to pay Medicare premium penalty every month?

In most cases, you will have to pay that penalty every month for as long as you have Medicare. If you are enrolled in Medicare because of a disability and currently pay premium penalties, once you turn 65 you will no longer have to pay the premium penalty.

What is the late enrollment penalty for Medicare Part B?

This can be when you turn 65, or under the age of 65 if you’ve been receiving disability payments from Social Security or the Railroad Retirement Board for 24 months.

What happens if you sign up for Part B?

If you sign up for Part B after the initial enrollment period and you’re not eligible for a Special Enrollment Period, you may be subject to a late enrollment penalty. The penalty may be imposed for the duration of Part B coverage. The amount may be as much as 10% more than the monthly premium you would normally pay, ...

What age do you have to be to enroll in Medicare?

Sign-up requirements. Anyone approaching age 65 who is not collecting Social Security or Railroad Retirement Board benefits must enroll in Parts A and/or B when they are first eligible for Medicare or risk incurring Part B late enrollment fees. For some Medicare recipients, a Special Enrollment Period may apply.

How much is the 2020 Part B premium?

Part B, on the other hand, will require you to pay a monthly premium. The 2020 Part B premium begins at $144.60 per month and may increase based on an individual’s modified adjusted gross income and tax filing status. Types of enrollment periods. Enrollment periods fall into three categories:

Can you delay enrollment in Part B?

Special enrollment: If you choose to delay enrollment in Part B because you have creditable coverage through an employer or union, you may enroll without a penalty during a Part B Special Enrollment Period when your employment ends.

What is Medicare late enrollment penalty?

What is a Medicare Late Enrollment Penalty? A Medicare Late Enrollment Penalty (LEP) is an additional monthly amount you will be required to pay to Medicare if you did not enroll in Medicare Part B and/or D when you first became eligible.

What is the late enrollment penalty for Medicare Part D?

The late enrollment penalty for Medicare Part D is 1% of the average national base monthly premium, rounded to the nearest 10 cents for each month you did not enroll. This penalty is added to your premium each month you are enrolled, and generally lasts for as long as you have Medicare drug coverage.

How long does Medicare Part A last?

Additionally, for those that have to pay for Medicare Part A, there is also a late enrollment penalty for not signing up when first eligible, which is typically when you turn 65. The penalties for Parts B and D will last for your lifetime. For Part A, the maximum number of years the penalty can last is four.

What is the penalty for Medicare Part A?

Medicare Part A Late Enrollment Penalties. The late enrollment penalty for Medicare Part A (for those who are not automatically enrolled), is 10% of your monthly premium if you miss your Medicare enrollment deadline. This is applied no matter how long the delay is, and the penalty is added to your premium cost for twice the number ...

How much is Part B insurance in 2021?

So for 2021, the base cost would be $148.50, multiplied by 50%, and would equal $74.25, which would be added to your Part B monthly premium costs.

Can you speculate on the amount of your Medicare penalty?

You can speculate on the amount of your penalty; however, you will be notified of the actual amount when you formally apply for Medicare Parts A, B or D. Once the government is aware of your enrollment into these parts of Medicare, they will calculate your penalty and send you, in writing, the actual amount you owe for the upcoming year. ...

What is the late enrollment penalty for Medicare?

What Is the Late Enrollment Penalty. The Medicare Part B late-payment penalty amounts to an increase of 10% for each 12-month period that you were late enrolling in Medicare Part B. For example, if you were eligible when you turned 65, but didn’t enroll until you turned 67, you will be charged 20% more in Medicare Part B premiums as everyone else, ...

Does Medicare Part B late enrollment go away?

This penalty doesn’t go away, which is why you need to do everything you can to avoid it. The Medicare Part B late enrollment penalty is in place to help guide Medicare seniors to enroll in Part B at the right time. You can read more about the Medicare Part B late enrollment penalty on Medicare.gov.

How long can you delay Part B?

In this case, you can delay signing up for Part B until your employment ends. When that happens, you have eight months to sign up without incurring the penalty.

How long do you have to be on Medicare if you are not on Social Security?

If you wish to do so, contact the SSA . If you are not yet on Social Security, you have an initial window of seven months , sandwiched around your 65th birthday, to enroll in Medicare. Updated December 28, 2020.

How much is Part B 2021?

If you’re carrying a one-year late fee, you’ll pay an extra $178.20 for Part B in 2021, and bigger surcharges in future years as premiums rise. Now for those exceptions. You can choose not to sign up for Part B at 65 without facing a late fee down the road if: You are still working and have group coverage through a company ...

What is the Medicare rate for 2021?

Medicare Part A, which covers hospitalization, comes at no cost for most recipients, but Part B carries premiums. The base rate in 2021 is $148.50 a month.

How long does it take to get Medicare Part B?

Visit the Social Security Administration website to complete an online application. This process takes less than 10 minutes.

What happens if you miss your first Medicare enrollment?

Individuals who miss their first chance to enroll into Medicare Part B (Initial Enrollment Period or a Special Enrollment Period) could receive a late enrollment penalty . This is a penalty that will last as for the rest of your life or as long as you have Medicare.

What is the special enrollment period?

The Special Enrollment Period is a timeframe that you can use to enroll into Medicare when specific life events occur. Some of those events include: Switching from your employer health insurance to Medicare after the age of 65. When you move out of your current plan’s service area.

How long do you have to sign up for Medicare after your 65th birthday?

Your IEP typically happens around the time of your 65th birthday. You will have 7 months to sign up for Medicare during the year of your 65th birthday. Those months include: 3 months prior to your 65th birthday. 1 month of your 65th birthday. 3 months after your 65th birthday.

What happens if you miss your IEP?

If you miss your IEP, you could face a penalty if you did not have sufficient health insurance on your 65th birthday. The most common example of sufficient health insurance is someone working past 65 ...

How much is the 2020 Medicare premium?

Based on the 2020 monthly premium of $144 per month, this individual who waited 4 years to enroll and incurred a 40% penalty would pay $198 per month. For this reason, it is extremely important to enroll in Part B on time.

Do you have to pay late enrollment penalty for Medicare Part B?

If you had sufficient health insurance when you first became eligible for Medica re Part B, you may not have to pay the late enrollment penalty. Here is another example…. If you were still working on your 65th birthday and still had your employer health insurance then you may be protected from the late enrollment penalty.

How long do you have to sign up for Part B?

You may qualify for a Special Enrollment Period when your employer coverage ends if you meet these qualifications. You’ll have eight months to sign up for Part B without penalty.

When do you get Medicare card?

You will be enrolled in Original Medicare (Parts A & B) automatically when you turn 65. You’ll get your Medicare card in the mail. Coverage usually starts the first day of your 65th birthday month.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What percentage of Medicare pays for outpatient care?

Medicare Part B pays 80 percent of outpatient health care costs and 100 percent for many preventive services. But it pays to think carefully about when to sign up. Here’s why. Part B comes with a monthly premium. You could save money if you delay enrollment.

When do you get your disability insurance?

Coverage usually starts the first day of the 25th month you receive disability benefits. You may delay Part B and postpone paying the premium if you have other creditable coverage. You’ll be able to sign up for Part B later without penalty, as long as you do it within eight months after your other coverage ends.

Can you keep Cobra if you have Medicare?

Usually you can’t keep COBRA once you become eligible for Medicare. You’ll want to sign up for Medicare Part A and Part B when you turn 65, unless you have access to other creditable coverage. However, you may be able to keep parts of COBRA that cover services Medicare doesn’t, such as dental care.