Medicare Part D covers prescription drugs. Similar to Part B, it’s encouraged to apply for Part D as soon as you become eligible. Even if you aren’t on medications, dodging Part D could cost you in the long run with higher premiums. The late fee is 1% for every month you delay enrollment.

Full Answer

How can I avoid paying the Medicare Part D penalty?

(Part D). A person enrolled in a Medicare plan may owe a late enrollment penalty if they go without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more after the end of their Initial Enrollment Period for Part D coverage. Generally, the late enrollment penalty is added to the person’s monthly . Part D premium for as long as they have …

How much is the late enrollment penalty for Part D?

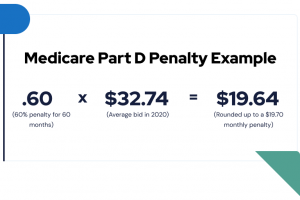

May 27, 2021 · Here is an example of a common Part D penalty. Let’s suppose you started shopping and purchased your Medicare Part D Prescription Drug Plan in 2021, nine months after your Initial Enrollment Period (IEP) ended. One percent of the “national base beneficiary premium of $33.06 is $0.33 which will be multiplied by 9 months. $0.33 x 9 = $2.97

Why is there a late enrollment penalty for Medicare?

Nov 06, 2019 · Your monthly late enrollment penalty would be $16.50 (1% of $32.74, the base premium, multiplied by 50, and rounded to the nearest 10 cents). You’d pay your monthly plan premium plus $16.50. That means paying almost $200 extra every year for your Medicare prescription drug coverage, in that example scenario.

How do you calculate Medicare late enrollment penalty?

Sep 10, 2021 · Medicare Part D covers prescription drugs. Similar to Part B, it’s encouraged to apply for Part D as soon as you become eligible. Even if you aren’t on medications, dodging Part D could cost you in the long run with higher premiums. …

Is there a grace period for Medicare Part D?

A person enrolled in a Medicare plan may owe a late enrollment penalty if they go without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more after the end of their Initial Enrollment Period for Part D coverage.

How long does the Part D late enrollment penalty last?

In most cases, you will have to pay that penalty every month for as long as you have Medicare. If you are enrolled in Medicare because of a disability and currently pay a premium penalty, once you turn 65 you will no longer have to pay the penalty.

How do I calculate Part D Penalty?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $. 10 and added to your monthly Part D premium.

How do I avoid late enrollment penalty for Part D?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

When did Part D become mandatory?

Medicare Part D Prescription Drug benefit Under the MMA, private health plans approved by Medicare became known as Medicare Advantage Plans. These plans are sometimes called "Part C" or "MA Plans.” The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.Dec 1, 2021

When did the Medicare Part D Penalty start?

When the Part D program began in 2006, people already in Medicare could sign up until May 15 of that year without incurring a late penalty.

What happens if I refuse Medicare Part D?

If you don't sign up for a Part D plan when you are first eligible to do so, and you decide later you want to sign up, you will be required to pay a late enrollment penalty equal to 1% of the national average premium amount for every month you didn't have coverage as good as the standard Part D benefit.

Is Medicare Part D required by law?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

Can I opt out of Medicare Part D?

To disenroll from a Medicare drug plan during Open Enrollment, you can do one of these: Call us at 1-800 MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Mail or fax a signed written notice to the plan telling them you want to disenroll.

Can Medicare Part D be added at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

Do I need Medicare Part D if I don't take any drugs?

If you don't take any medications at all, you'll still want to enroll in Part D when you're first eligible (unless you have other creditable drug coverage), to avoid the late enrollment penalty described above.

Can you use GoodRx with Medicare Part D?

So let's get right to it. While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.Aug 31, 2021

Does Mrs Kim have Medicare?

Mrs. Kim didn’t join a Medicare drug plan before her Initial Enrollment Period ended in July 2017. In October 2017, she enrolled in a Medicare drug plan (effective January 1, 2018). She qualified for Extra Help, so she wasn’t charged a late enrollment penalty for the uncovered months in 2017. However, Mrs. Kim disenrolled from her Medicare drug plan effective June 30, 2018. She later joined another Medicare drug plan in October 2019 during the Open Enrollment Period, and her coverage with the new plan was effective January 1, 2020. She didn’t qualify for Extra Help when she enrolled in October 2019. Since leaving her first Medicare drug plan in June 2018 and joining the new Medicare drug plan in October 2019, she didn’t have other creditable coverage. However, she was still deemed eligible for Extra Help through December 2018. When Medicare determines her late enrollment penalty, Medicare doesn’t count:

Is Mrs Martinez on Medicare?

Mrs. Martinez is currently eligible for Medicare, and her Initial Enrollment Period ended on May 31, 2016. She doesn’t have prescription drug coverage from any other source. She didn’t join by May 31, 2016, and instead joined during the Open Enrollment Period that ended December 7, 2018. Her drug coverage was effective January 1, 2019

Medicare Part D Penalty: What is it?

The Medicare Part D late enrollment penalty (also referred as “LEP”) is a specific dollar amount that is added to your Part D monthly premium. If you have enrolled in a Medicare Part D drug plan, you may be responsible to pay an enrollment penalty. This is typically added to your monthly Part D premium.

How the Penalty works

The late enrollment Part D penalty will generally happen for you if the following occurs:

How much are the part d penalties?

How much will you pay for your Part D penalty? The cost will depend on how long you were without a Part D plan (or creditable drug coverage).

When is Medicare Part D enrollment?

When is the Medicare Part D enrollment period? Your initial Medicare Part D enrollment period begins when you first become eligible for Medicare or when you turn 65. You can enroll in Medicare prescription drug coverage during the Initial Enrollment Period, or during the Annual Election Period that occurs each year.

How to avoid late enrollment penalty?

Here are three ways to avoid the late enrollment penalty: 1 Enroll in Medicare Part D prescription drug coverage during your Medicare Initial Enrollment Period or (if applicable) a qualifying Special Election Period. 2 Make sure you never go more than 63 consecutive days after your initial enrollment period without creditable coverage for prescription drugs. 3 Sign up for, or maintain, creditable prescription drug coverage through another source such as your current or former employer, TRICARE, your union, the Department of Veterans Affairs, or Indian Health Service (this is not a complete list).

What is creditable prescription drug coverage?

Creditable prescription drug coverage is coverage that’s expected to cover, on average, at least as much as Medicare’s standard prescription drug coverage. For example, if your Medicare Initial Enrollment Period ended on July 31, 2016, and you waited to sign up for Part D coverage until the Annual Election Period in October 2020, ...

Does Medicare Part D cover prescription drugs?

Medicare Part D prescription drug coverage is offered by private insurance companies contracted with Medicare. To get this optional coverage, you can either enroll in a stand-alone Medicare Prescription Drug Plan to supplement your Original Medicare benefits, or receive your Original Medicare benefits through a Medicare Advantage Prescription Drug ...

Do I have to pay a separate premium for Medicare Part D?

When you sign up for a stand-alone Medicare Part D Prescription Drug Plan or a Medicare Advantage Prescription Drug plan, you might pay a separate premium to the company that offers your plan (although some Medicare Advantage plans have premiums as low as $0) . You’ll also need to keep paying your monthly Part B premium.

Is Medicare Part D automatic?

For many people, enrollment in Original Medicare (Part A and Part B) happens automatically when they become eligible, but Medicare Part D enrollment is not automatic. You may wonder whether it makes sense to delay enrolling in Medicare Part D (optional prescription drug coverage) until you really need the benefits.

What Happens if You Delay Medicare?

Medicare isn’t mandatory, but delaying enrollment may come with lifelong penalty fees. Therefore, it is wise to explore all your options before postponing coverage.

Reasons People Delay Medicare

Life happens, and now may not be the right time to enroll. Keep in mind that delaying Medicare isn’t always a bad thing, and it could make sense in certain situations. Luckily, not all circumstances will result in late fees.

Medicare Part A Enrollment Penalty

Part A covers hospital expenses. Again, Part A is premium-free for everyone who has worked long enough to pay Medicare taxes. If you get Medicare Part A for free and decide to delay enrollment, you won’t have to pay a late penalty. Yet, those who don’t qualify for free Part A and sign up when they turn 65 could face higher premiums.

Do I Need Medicare Part B?

Part B pays for outpatient medical costs and covers 80% of doctor visits, lab work, and physical therapy, among other expenses. While Part B is optional, it will certainly help with unexpected medical bills.

Medicare Part B Enrollment Penalty

You should enroll during your Initial Enrollment Period, which begins three months before your 65th birthday, or three months before your 25th month of receiving Social Security disability benefits. If you don’t enroll during your IEP, you may have to wait for the Annual Enrollment Period, which runs from October 15 through December 7.

Medicare Part D Enrollment Penalty

Medicare Part D pays for prescription drug costs. Similar to Part B’s fine, beneficiaries pay the penalty for late enrollment at the same time as they pay their monthly premium. The Part D enrollment penalty is 1% for every month you went without coverage when you first became eligible.

Employer Coverage from Work or Through a Spouse

People who have creditable coverage through their employer can enroll later without being penalized. However, the employer must have at least 20 employees.

What happens if you don't follow Medicare guidelines?

And if you don’t follow those guidelines, you might end up paying a price for it. “You could be accruing late-enrollment penalties that last your lifetime,” said Elizabeth Gavino, founder of Lewin & Gavino in New York and an independent broker and general agent for Medicare plans.

How long does it take to enroll in Medicare if you stop working?

First, once you stop working, you get an eight-month window to enroll or re-enroll. You could face a late-enrollment penalty if you miss it. For each full year that you should have been enrolled but were not, you’ll pay 10% of the monthly Part B base premium.

How long does it take to enroll in Medicare?

You get a seven-month window to enroll that starts three months before your 65th birthday month and ends three months after it. You could be accruing late-enrollment penalties that last your lifetime.

What happens if you don't sign up for Part B?

Also, be aware that if you don’t sign up for Part B during your eight-month window, the late penalty will date from the end of your employer coverage (not from the end of the special enrollment period), said Patricia Barry, author of “Medicare for Dummies.”.

Who is Elizabeth Gavino?

Elizabeth Gavino. founder of Lewin & Gavino. Generally speaking, if you (or your spouse) have group coverage at a company with 20 or more employees, you can delay signing up for Medicare. Some workers sign up for Part A (hospital coverage) because it typically comes with no premium and then delay Part B (outpatient care) and Part D ...

Pros of delaying Medicare Part D enrollment

You may not need Medicare Part D if you already have other creditable prescription drug coverage. Creditable coverage is prescription drug coverage that is expected to pay at least as much as standard Medicare Part D coverage. It might include:

Cons of delaying Medicare Part D enrollment

The most significant risk of delaying enrollment in a Medicare plan providing prescription drug coverage is that you could incur substantial costs for medications if you become ill or injured and you are without prescription drug coverage.