How much Social Security and Medicare tax do I pay?

What is the 2021 Social Security tax rate?

...

Contribution and benefit bases, 1937-2022.

| Year | Amount |

|---|---|

| 2020 | 137,700 |

| 2021 | 142,800 |

| 2022 | 147,000 |

What percentages do both you and your employer pay into Social Security and Medicare?

What is the Medicare tax rate for 2020?

What percentage is Medicare tax 2021?

| Employee pays | Employer pays | |

|---|---|---|

| Medicare tax | 1.45%. | 1.45%. |

| Total | 7.65% | 7.65% |

| Additional Medicare tax | 0.9% (on earnings over $200,000 for single filers; $250,000 for joint filers) |

What percentage is federal income tax?

What percentage should I withhold from my Social Security check?

What percentage of taxes should be withheld from Social Security checks?

How is Medicare tax calculated?

How is Social Security tax calculated?

To calculate FICA tax contribution for an employee, multiply their gross pay by the Social Security and Medicare tax rates. For example, if an employee's taxable wages are $700 for the week, their social security contribution would be: $700.00 x 6.2% = $43.40.Feb 24, 2020

How do you calculate Social Security tax withheld?

What is the max yearly Social Security tax?

What is the Medicare tax rate?

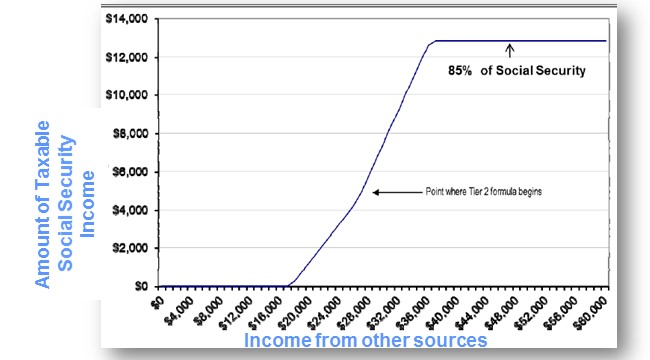

The employee tax rate for Medicare is 1.45% — and the employer tax rate is also 1.45%. So, the total Medicare tax rate percentage is 2.9%. Only the employee portion of Medicare taxes is withheld from your paycheck. There’s no wage-based limit for Medicare tax. All covered wages are subject to Medicare tax. If you receive wages over $200,000 ...

How much Medicare tax is withheld from paycheck?

There’s no wage-based limit for Medicare tax. All covered wages are subject to Medicare tax. If you receive wages over $200,000 a year, your employer must withhold a .9% additional Medicare tax. This will apply to the wages over $200,000.

How much Medicare tax do you pay if you are married?

If you receive wages over $200,000 a year, your employer must withhold a .9% additional Medicare tax. This will apply to the wages over $200,000. This is on top of the 1.45% employer tax rate. If you’re married, you might not have enough Medicare taxes withheld.

What is the Social Security tax rate for 2020?

The employee tax rate for Social Security is 6.2% — and the employer tax rate for Social Security is also 6.2%. So, the total Social Security tax rate percentage is 12.4%. Only the employee portion of Social Security tax is withheld from your paycheck. The 2020 wage-base limit is $118,500.

What is the income limit for married filing separately?

This also applies to married filing separately if your income is over $125,000. If this is the case, cover the additional Medicare taxes needed by: Adjusting your withholding. Making estimated payments.

What is the Social Security tax rate for 2020?

The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, Social Security tax, ...

What is the tax rate for self employment?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, ...

What is self employment tax?

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. You figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040 or 1040-SR).

When do you have to use the maximum earnings limit?

If you use a tax year other than the calendar year, you must use the tax rate and maximum earnings limit in effect at the beginning of your tax year. Even if the tax rate or maximum earnings limit changes during your tax year, continue to use the same rate and limit throughout your tax year.

What is Schedule C for self employed?

If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-emplo yment. If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total ...

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the maximum Social Security tax for 2020?

The Social Security tax rate remains at 6.2 percent. The resulting maximum Social Security tax for 2020 is $8,537.40. There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax.

What is the FICA tax rate for 2020?

The FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold). The information in the following table shows the changes in Social Security withholding limits from 2019 to 2020.

What percentage of your paycheck goes to Medicare?

1.45 percent of your paycheck will be deducted and routed toward Medicare. Much like Social Security, this is a non-negotiable element of taxation that cannot be dodged through the use of a W-4.

How much is deducted from paycheck for Medicare?

In every paycheck, 1.45 percent is deducted and routed toward Medicare programs. When it comes to federal taxes, the amount being taken from each paycheck will depend not only on the amount of income being earned by the employee but also the specific withholdings they have requested on their employer W-4.

Who is Ryan Cockerham?

Ryan Cockerham is a nationally recognized author specializing in all things business and finance. His work has served the business, nonprofit and political community. Ryan's work has been featured on PocketSense, Zacks Investment Research, SFGate Home Guides, Bloomberg, HuffPost and more. Related Articles.

How to calculate Social Security taxes?

The math works like this: 1 If your wages were less than $137,700 in 2020, multiply your earnings by 6.2% to arrive at the amount you and your employer must each pay for a total of 12.4%. If you were self-employed, multiply your earnings up to this limit by 12.4% to calculate the Social Security portion of your self-employment tax. 2 If your wages were more than $137,700 in 2020, multiply $137,700 by 6.2% to arrive at the amount you and your employer must each pay. Anything you earned over this threshold is exempt from Social Security tax. You would do the same but multiply by 12.4% if you're self-employed.

How much is Social Security taxed in 2020?

If your wages were more than $137,700 in 2020, multiply $137,700 by 6.2% to arrive at the amount you and your employer must each pay. Anything you earned over this threshold is exempt from Social Security tax. You would do the same but multiply by 12.4% if you're self-employed. For taxes due in 2021, refer to the Social Security income maximum ...

What is the Social Security tax rate for 2021?

Everyone pays the same rate, regardless of how much they earn, until they hit the ceiling. As of 2021, a single rate of 12.4% is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of $142,800. 1.

What is the maximum amount of Social Security income in 2021?

As of 2021, a single rate of 12.4% is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of $142,800. 1.

Do self employed people pay Social Security taxes?

If You're Self-Employed. Self-employed persons must pay both halves of the Social Security tax because they're both employee and employer. They pay the combined rate of 12.4% of their net earnings up to the maximum wage base. This is calculated as the self-employment tax on Schedule SE.

Who is William Perez?

William Perez is a tax expert with 20 years of experience who has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income. He previously worked for the IRS and holds an enrolled agent certification.

What is Social Security tax?

Social Security tax, like Medicare tax, is designed to help support the millions of retired Americans. This tax pays for federal disability and retirement benefits. Both employers and employees must pay Social Security Tax.

What is the Medicare tax rate for self employed?

In 2019, the rate of Medicare tax was 1.45% of an employee’s gross earnings. The employer’s rate matches that rate.

What is the Medicare tax rate for 2019?

In 2019, the tax rate for employees was 1.45% for Medicare and 6.2% for Social Security. High-income employees are charged an additional 0.9% Medicare surtax. Employers have the responsibility of withholding FICA taxes from their employees’ wages.

Do self employed people pay Medicare taxes?

If you are self-employed, you will pay self-employment tax, which is the equivalent of both employee and employer portions of the Medicare Tax. In 2019, the rate of Medicare tax was 1.45% of an employee’s gross earnings. The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional ...

What is FICA tax?

FICA Tax. FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA.

Do self employed pay Social Security taxes?

Both employers and employees must pay Social Security Tax. As with Medicare tax, self-employed individuals will have to pay both the employee and employer portion of Social Security Tax. The rate for Social Security tax in 2019 was 6.2% of an employee’s gross wages below $132,900. The employer must match the amount paid by the employee.

Do employers have to pay FICA taxes?

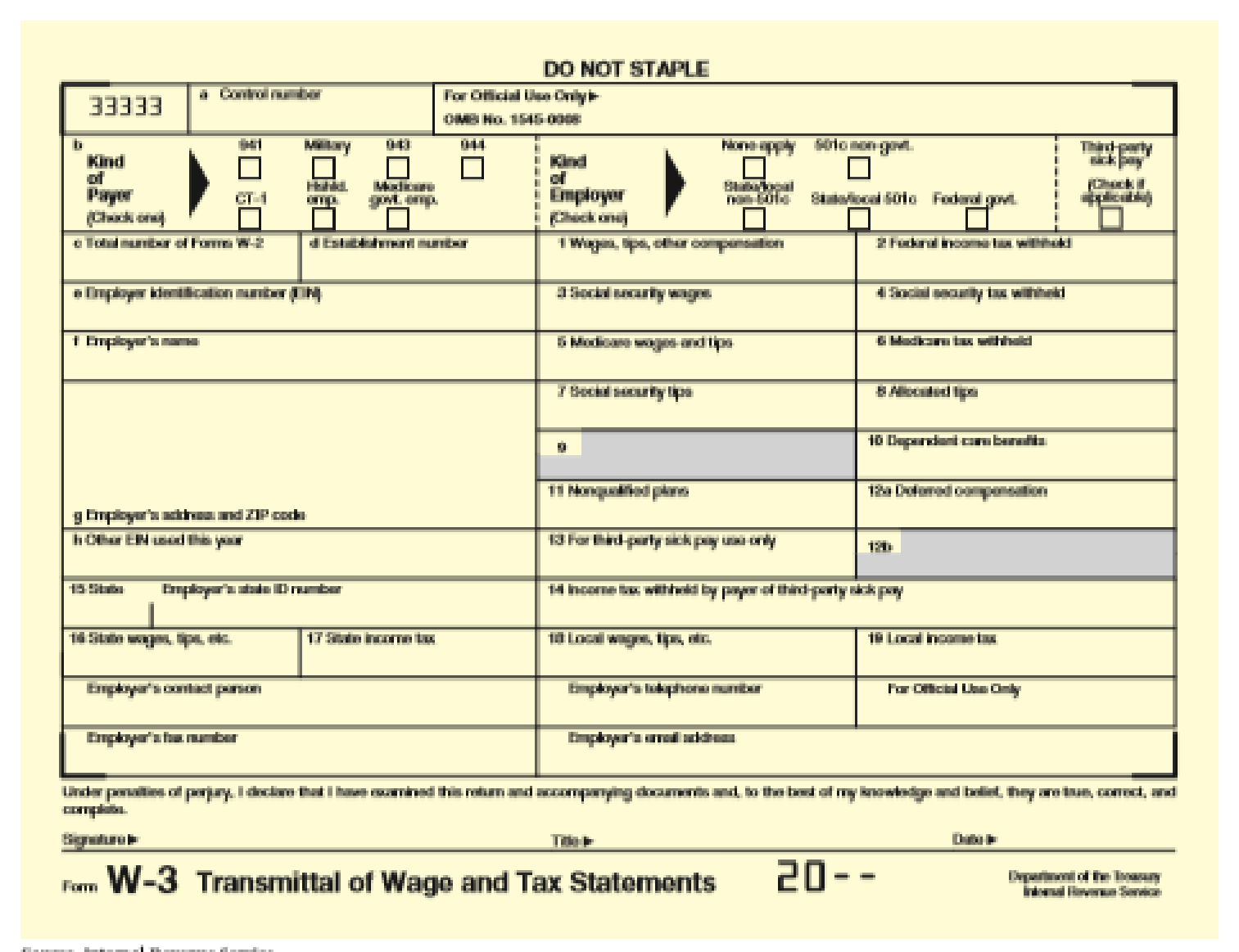

In addition, employers must also pay their own employer FICA taxes and report both these and their employees’ portions to the IRS. FICA taxes are the most important tax to stay on top of and get correct. Not withhold or paying the correct amount of FICA taxes will result in serious consequences for the employer.