What percentage of Medicare reimbursement goes to providers?

The rate at which Medicare reimburses health care providers is generally less than the amount billed or the amount that a private insurance company might pay. According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1

What percentage of family doctors take on Medicare?

Now, 81 percent of family doctors will take on seniors on Medicare, a survey by the American Academy of Family Physicians found. That figure was 83 percent in 2010. Some 2.9 percent of family doctors have dropped out of Medicare altogether.

What is Medicare Part a reimbursement?

Part A Reimbursement Part A covers doctors, equipment, medications, tests, and other services you receive as an inpatient at the hospital. It also covers a limited amount of time in a skilled nursing facility after a hospital stay, hospice care, and home health care.

How does Medicare pay for 20 percent?

If you have original Medicare you are responsible for the remaining 20 percent by paying deductibles, copayments, and coinsurance. Some people buy supplementary insurance or Medigap through private insurance to help pay for some of the 20 percent. There are 10 different plans that offer various coverage options.

What percentage of the allowable fee does Medicare pay a doctor?

80 percentUnder current law, when a patient sees a physician who is a “participating provider” and accepts assignment, as most do, Medicare pays 80 percent of the fee schedule amount and the patient is responsible for the remaining 20 percent.

How much does Medicare reimburse for?

Medicare pays for 80 percent of your covered expenses. If you have original Medicare you are responsible for the remaining 20 percent by paying deductibles, copayments, and coinsurance. Some people buy supplementary insurance or Medigap through private insurance to help pay for some of the 20 percent.

How do I calculate Medicare reimbursement?

You can search the MPFS on the federal Medicare website to find out the Medicare reimbursement rate for specific services, treatments or devices. Simply enter the HCPCS code and click “Search fees” to view Medicare's reimbursement rate for the given service or item.

What is the reimbursement rate for?

Reimbursement rates means the formulae to calculate the dollar allowed amounts under a value-based or other alternative payment arrangement, dollar amounts, or fee schedules payable for a service or set of services.

Do doctors lose money on Medicare patients?

Summarizing, we do find corroborative evidence (admittedly based on physician self-reports) that both Medicare and Medicaid pay significantly less (e.g., 30-50 percent) than the physician's usual fee for office and inpatient visits as well as for surgical and diagnostic procedures.

Do hospitals lose money on Medicare patients?

Those hospitals, which include some of the nation's marquee medical centers, will lose 1% of their Medicare payments over 12 months. The penalties, based on patients who stayed in the hospitals anytime between mid-2017 and 2019, before the pandemic, are not related to covid-19.

How Much Does Medicare pay for a 99213?

A 99213 pays $83.08 in this region ($66.46 from Medicare and $16.62 from the patient). A 99214 pays $121.45 ($97.16 from Medicare and $24.29 from the patient). For new patient visits most doctors will bill 99203 (low complexity) or 99204 (moderate complexity) These codes pay $122.69 and $184.52 respectively.

Do Medicare reimbursement rates vary by state?

Over the years, program data have indicated that although Medicare has uniform premiums and deductibles, benefits paid out vary significantly by State of residence of the beneficiary. These variations are due in part to the fact that reimbursements are based on local physicians' prices.

What's a fee schedule?

fee schedule (plural fee schedules) A list or table, whether ordered or not, showing fixed fees for goods or services. The actual set of fees to be charged.

Is the 2021 Medicare fee schedule available?

The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021.

How does reimbursement work?

Reimbursement is money paid to an employee or customer, or another party, as repayment for a business expense, insurance, taxes, or other costs. Business expense reimbursements include out-of-pocket expenses, such as those for travel and food.

What is Medicare reimbursement?

The Centers for Medicare and Medicaid (CMS) sets reimbursement rates for all medical services and equipment covered under Medicare. When a provider accepts assignment, they agree to accept Medicare-established fees. Providers cannot bill you for the difference between their normal rate and Medicare set fees.

How much does Medicare pay?

Medicare pays for 80 percent of your covered expenses. If you have original Medicare you are responsible for the remaining 20 percent by paying deductibles, copayments, and coinsurance. Some people buy supplementary insurance or Medigap through private insurance to help pay for some of the 20 percent.

What happens after Medicare pays its share?

After Medicare pays its share, the balance is sent to the Medigap plan. The plan will then pay part or all depending on your plan benefits. You will also receive an explanation of benefits (EOB) detailing what was paid and when.

What does it mean when a provider is not a participating provider?

If the provider is not a participating provider, that means they don’t accept assignment. They may accept Medicare patients, but they have not agreed to accept the set Medicare rate for services.

What is Medicare Part D?

Medicare Part D or prescription drug coverage is provided through private insurance plans. Each plan has its own set of rules on what drugs are covered. These rules or lists are called a formulary and what you pay is based on a tier system (generic, brand, specialty medications, etc.).

How often is Medicare summary notice mailed?

through the Medicare summary notice mailed to you every 3 months

What does ABN mean in Medicare?

By signing the ABN, you agree to the expected fees and accept responsibility to pay for the service if Medicare denies reimbursement. Be sure to ask questions about the service and ask your provider to file a claim with Medicare first. If you don’t specify this, you will be billed directly.

What is Medicare Reimbursement?

If you’re on Medicare, your doctors will usually bill Medicare for any care you obtain. Medicare will then pay its rate directly to your doctor. Your doctor will only charge you for any copay, deductible, or coinsurance you owe.

How to get reimbursement for health insurance?

To get reimbursement, you must send in a completed claim form and an itemized bill that supports your claim. It includes detailed instructions for submitting your request. You can fill it out on your computer and print it out. You can print it and fill it out by hand. The form asks for information about you, your claim, and other health insurance you have.

How long does it take for Medicare to process a claim?

Medicare claims to providers take about 30 days to process. The provider usually gets direct payment from Medicare. What is the Medicare Reimbursement fee schedule? The fee schedule is a list of how Medicare is going to pay doctors. The list goes over Medicare’s fee maximums for doctors, ambulance, and more.

What if my doctor doesn't bill Medicare?

If your doctor doesn’t bill Medicare directly, you can file a claim asking Medicare to reimburse you for costs that you had to pay.

What happens if you see a doctor in your insurance network?

If you see a doctor in your plan’s network, your doctor will handle the claims process. Your doctor will only charge you for deductibles, copayments, or coinsurance. However, the situation is different if you see a doctor who is not in your plan’s network.

Does Medicare cover out of network doctors?

Coverage for out-of-network doctors depends on your Medicare Advantage plan. Many HMO plans do not cover non-emergency out-of-network care, while PPO plans might. If you obtain out of network care, you may have to pay for it up-front and then submit a claim to your insurance company.

Do participating doctors accept Medicare?

Most healthcare doctors are “participating providers” that accept Medicare assignment. They have agreed to accept Medicare’s rates as full payment for their services. If you see a participating doctor, they handle Medicare billing, and you don’t have to file any claim forms.

Why do doctors accept Medicare?

The reason so many doctors accept Medicare patients, even with the lower reimbursement rate, is that they are able to expand their patient base and serve more people.

What happens when someone receives Medicare benefits?

When someone who receives Medicare benefits visits a physician’s office, they provide their Medicare information , and instead of making a payment, the bill gets sent to Medicare for reimbursement.

Do you have to pay Medicare bill after an appointment?

For some patients, this means paying the full amount of the bill when checking out after an appointment, but for others , it may mean providing private insurance information and making a co-insurance or co-payment amount for the services provided. For Medicare recipients, however, the system may work a little bit differently.

Can a patient receive treatment for things not covered by Medicare?

A patient may be able to receive treatment for things not covered in these guidelines by petitioning for a waiver. This process allows Medicare to individually review a recipient’s case to determine whether an oversight has occurred or whether special circumstances allow for an exception in coverage limits.

When will Medicare cut payments?

Combined with the scheduled restoration of the 2% Medicare payment sequester and implementation of a 4% cut as a statutory pay-for in the March 2021 COVID-19 legislation, physicians are looking at a 9.75% payment reduction unless Congress acts before the end of the year.

What is the physician fee schedule in 2021?

The physician fee schedule (PFS) conversion factor will be $33.59, a decrease of $1.30 from 2021. The decrease reflects the expiration of a temporary 3.75% increase and an adjustment to ensure changes to relative value units are budget neutral.

Why do you need a modifier for split visits?

A modifier for split visits is required on the claim “to inform policy and help ensure program integrity,” CMS states. Documentation in the medical record must identify the two clinicians who provided services and be signed and dated by the clinician who provided the substantive portion.

What is the 2022 rule for physician payments?

The 2022 rule for physician payments provides a transition period to mitigate the impact of scheduled changes to clinical labor rates.

When will the new labor rate be implemented?

A scheduled update to clinical labor rates will be implemented over a four-year period, culminating with the new rates taking full effect in 2025, according to a provision in the final rule. That’s a change from the proposed rule, which indicated the full change would be in 2022.

Who should bill for split E/M?

The visit should be billed by the clinician who provides “the substantive portion of the visit.”

Can critical care be paid the same day?

The rule also sets new policies for billing of critical care visits, including that such services “may be paid on the same day as other E/M visits by the same practitioner or another practitioner in the same group of the same specialty, if the practitioner documents that the E/M visit was provided prior to the critical care service at a time when the patient did not require critical care, the visit was medically necessary and the services are separate and distinct, with no duplicative elements from the critical care service provided later in the day.” Modifier -25 should be used on the claim when clincians report such services.

How many types of reimbursement rates are there for LTSS?

The different reimbursement rates available to your LTSS program can be highly complex. The information in the sections below highlights eight different types of rates that may be available to your program, as well as guidance on comparing those rates.

What is fee for service?

The fee-for-service rate reimburses providers for specific services, like office visits or tests. For example, if you visit your family doctor because you have a fever, and your doctor notices other symptoms and tests you for strep throat, the office visit and the test may count as two separate services. Insurers usually decide what types of things qualify as different services.

What is FQHC in Medicare?

The FQHC rate is a benefit under Medicare that covers Medicaid and Medicare patients as an all-inclusive, per-visit payment, based on encounters. Tribal organizations must apply before they can bill as FQHCs. Allowable expenses vary by state. Each tribe and state must negotiate the exact reimbursement rate.

How does Medicaid work?

Many states deliver Medicaid through managed care organizations, which manage the delivery and financing of healthcare in a way that controls the cost and quality of services. More states are joining this trend because they think it may help manage and improve healthcare costs and quality.

What is capitated rate?

A capitated rate is a contracted rate based on the total number of eligible people in a service area. Funding is supplied in advance, creating a pool of funds from which to provide services. This rate can be more beneficial for providers with a larger client base because unused funds can be kept for future use.

Does LTSS qualify for reimbursement?

LTSS delivered through a CA H facility may qualify for different reimbursement rates. Reimbursement is on a per-cost basis instead of the standard Medicare reimbursement rates. Learn more about critical access hospitals.

Can tribes negotiate with states for Medicaid?

Tribes can negotiate with their states for an enhanced or higher reimbursement rate for Medicaid-covered services based on a 100% Federal Medical Assistance Percentage or any other known factors about a particular state that may affect the negotiation. Learn more about Medicaid financing and reimbursement.

What is a Medicare participating provider?

Physicians who agree to fully accept the rates set by Medicare are referred to as participating providers. They accept Medicare’s reimbursements for all Medicare-covered services, for all Medicare patients, and bill Medicare directly for covered services. Most eligible providers are in this category. A Kaiser Family Foundation analysis found that 93 percent of non-pediatric primary care physicians were participating providers with Medicare in 2015, but only 72 percent were accepting new Medicare patients.

What is a non-participating Medicare provider?

Because the reimbursement rates are generally lower than physicians receive from private insurance carriers, some physicians opt to be non-participating providers. This means that they haven’t signed a contract agreeing to accept Medicare reimbursement as payment-in-full for all services, but they can agree to accept Medicare reimbursement for some procedures.

Why is the Medicare population growing?

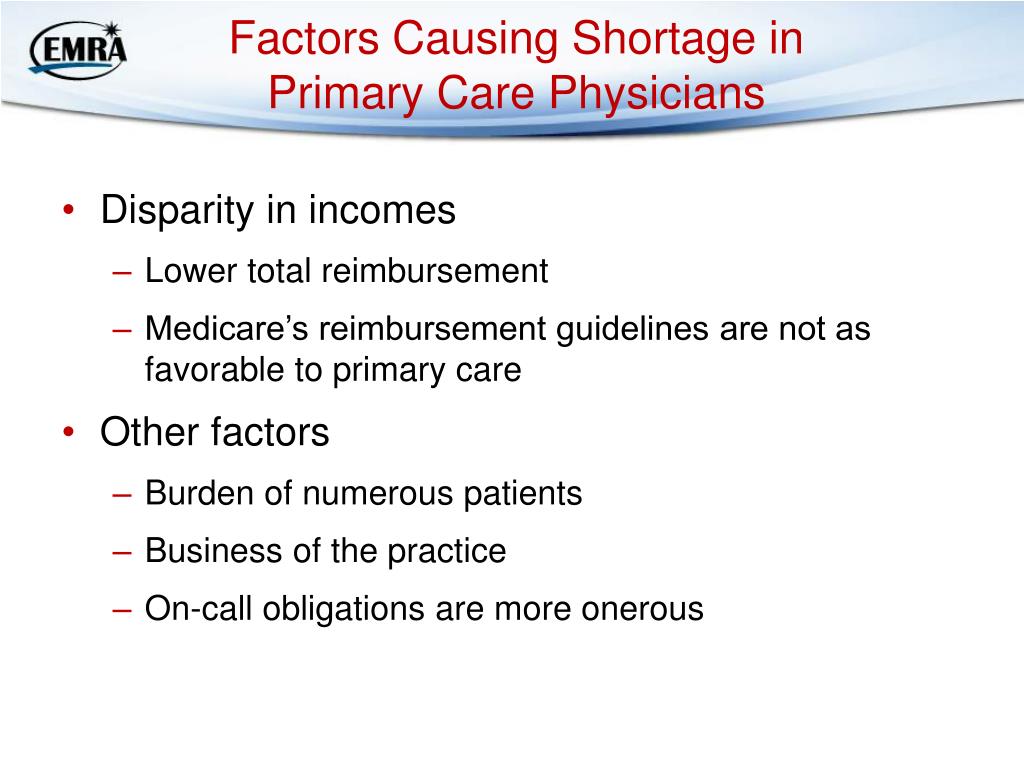

They’ve done this in several ways. At the same time, the Medicare population is growing because of the retirement of baby boomers now and over the next couple of decades. The number of doctors not accepting Medicare has more than doubled since 2009.

Is Medicare a low income program?

Medicare now faces the same tell-tale signs of trouble as Medicaid, the low-income health program. One-third of primary care doctors won’t take new patients on Medicaid. While the number of Medicare decliners remains relatively small, the trend is growing.

Can Medicare cut provider payments?

Efforts to contain Medicare spending may show signs of being a double-edged sword. You can’t arbitrarily cut provider payment rates without consequences. It seems one consequence is driving more doctors away from Medicare at the time Medicare’s population is growing. Health leaders advocate market-based, consumer-centered incentives that drive both higher quality and cost containment without subjecting providers and patients to harsh situations.

Is Medicare losing doctors?

The federal health program that serves seniors and individuals with disabilities is losing doctors who’ll see its patients. The Centers for Medicare and Medicaid Services says the number of doctors who’ll take Medicare patients is falling.

What percent of physicians have opted out of Medicare?

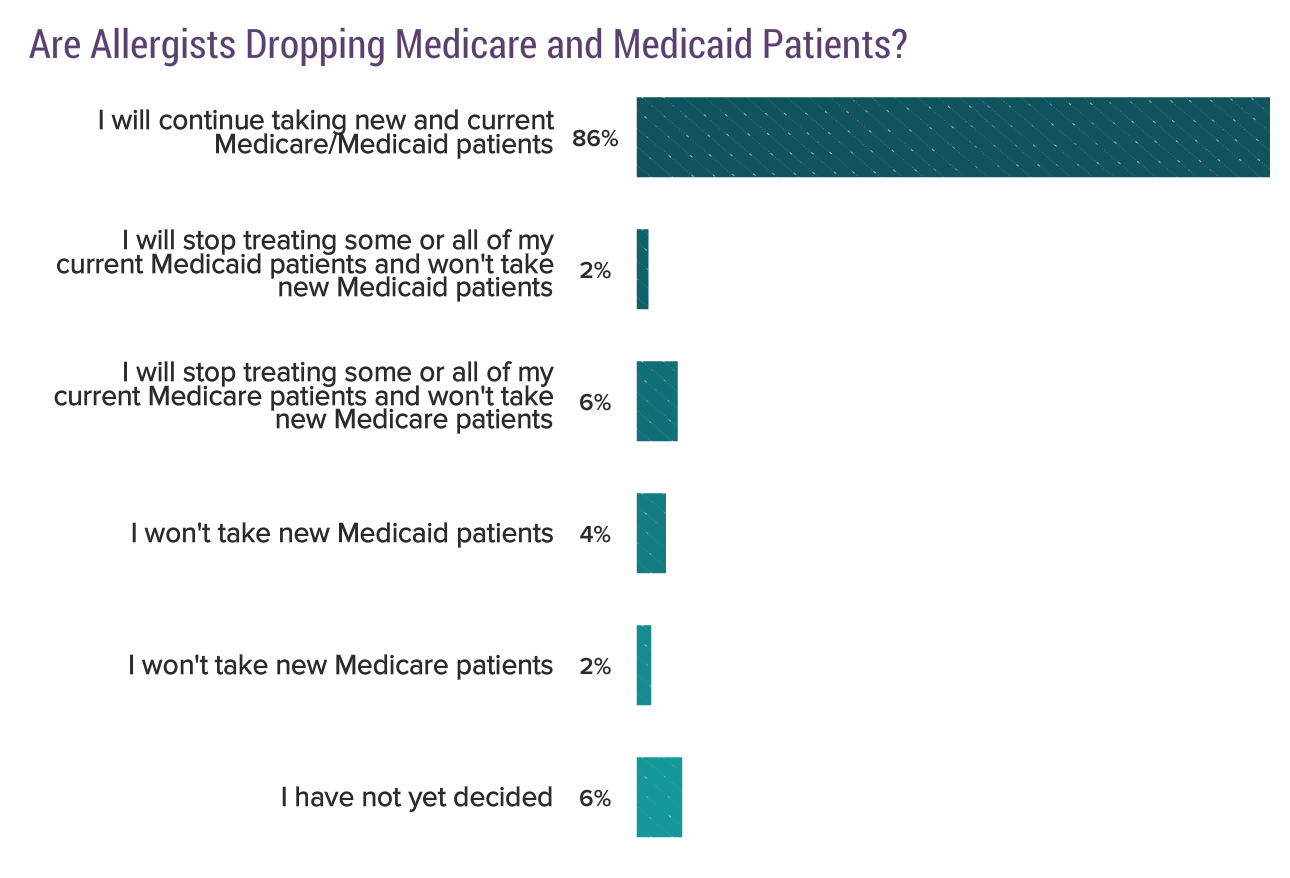

One percent of all non-pediatric physicians have formally opted-out of the Medicare program in 2020, with the share varying by specialty, and highest for psychiatrists (7.2%). Psychiatrists account for the largest share (42%) of all non-pediatric physicians who have opted out of Medicare in 2020. In all states except for 3 ...

How much Medicare is paid for non-participating physicians?

Unlike participating providers, who are paid the full Medicare allowed payment amount, nonparticipating physicians who take assignment are limited to 95% of the Medicare approved amount. In 2018, 99.6% of fee schedule claims by non-participating providers were paid on assignment. Physicians who choose to not accept assignment can charge ...

How many Medicare beneficiaries have stable access to care?

Further, according to a recent analysis by MedPAC, Medicare beneficiaries have stable access to care, with the majority reporting having a usual source of care (92% of beneficiaries) and having no trouble finding a new primary care physician (72% of beneficiaries) or specialist (85% of beneficiaries).

What are the options for Medicare?

Currently, physicians and other health care providers may register with traditional Medicare under three options: 1) participating provider, 2) non-participating provider, or 3) an opt-out provider.

Which states have the highest rates of non-pediatric physicians opting out of Medicare?

As of September 2020, Alaska (3.3%), Colorado (2.1%), and Wyoming (2.0%) have the highest rates of non-pediatric physicians who have opted out of Medicare (Table 2). Nine states (Iowa, Michigan, Minnesota, Nebraska, North Dakota, Ohio, South Dakota, West Virginia and Wisconsin) have less than 0.5% of non-pediatric physicians opting out of Medicare.

How many non-pediatrics have opted out of Medicare?

Only 1 percent of non-pediatric physicians have formally opted-out of the Medicare program. As of September 2020, 9,541 non-pediatric physicians have opted out of Medicare, representing a very small share (1.0 percent) of the total number active physicians, similar to the share reported in 2013.

When did doctors have to opt out of Medicare?

Prior to changes in law made in 2015, physicians and practitioners were required to opt-out of Medicare for all of their Medicare patients for a 2-year period and were also required to file a new affidavit to renew their opt-out. Past proposals, including a 2019 executive order issued by President Trump, have called for policy changes ...