Most Medicare Advantage HMO plans also include:

- prescription drug coverage ( Medicare Part D)

- dental, vision, and hearing coverage

- additional health coverage, such as home meal delivery or fitness memberships

Full Answer

How do Medicare Advantage HMOs work?

All Medicare Advantage HMO plans must cover at least: Most Medicare Advantage HMO plans also include: To enroll in a Medicare Advantage HMO plan, you must already be enrolled in Medicare parts A and B. Once this is done, you are eligible to enroll in a Medicare Advantage HMO plan in your state. How do Medicare Advantage HMOs work?

Where can I go with a Medicare Advantage HMO?

With a MedicareAdvantage HMO, you can visit any office, medical center, or pharmacy that isaccepted in your plan’s network. How do Medicare Advantage HMOs compare to original Medicare? There are some key differences to consider when choosing between Medicare Advantage HMO and original Medicare.

What are the different types of Medicare Advantage HMO plans?

Medicare Advantage offers different plan structures, such as HMOs, Preferred Provider Organizations (PPOs), Special Needs Plans (SNPs), and more. All Medicare Advantage HMO plans must cover at least:

Do HMO plans pay for prescription drugs?

In most cases, HMO-POS plans pay for prescriptions. However, beneficiaries must enroll in an HMO plan offering prescription drug coverage – Medicare Advantage Plan with Prescription Drug coverage (MAPD).

What does a Medicare HMO cover?

A Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan's network (except emergency care, out-of-area urgent care, or out-of-area dialysis).

What are the advantages of an HMO or PPO for a Medicare recipient?

It's important to consider and compare the differences between Medicare Advantage HMO and PPO plans. HMO plans typically have lower premiums and less out-of-pocket costs. PPO plans have higher premiums and cost sharing, but greater flexibility to choose your doctor or other health care provider.

What is a Medicare Advantage HMO Point of Service option?

What is an HMO-POS Medicare Advantage plan? An HMO-POS plan is a type of MA plan, and it stands for Health Maintenance Organization with a point-of-service option. It has a network of providers that members can use to receive care and services, and an HMO-POS plan will require you to select a PCP.

What services are provided through Medicare?

Medicare Services. Medicare Part A and Part B cover a variety of services, including inpatient hospital care, skilled nursing care, preventive services, home health care and ambulance transportation. Additional services such as vision and dental care may be available through a Medicare Advantage plan.

Do doctors prefer HMO or PPO?

PPOs Usually Win on Choice and Flexibility If flexibility and choice are important to you, a PPO plan could be the better choice. Unlike most HMO health plans, you won't likely need to select a primary care physician, and you won't usually need a referral from that physician to see a specialist.

What are 4 types of Medicare Advantage plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What is difference between HMO and HMO POS?

Most HMOs provide care through a network of doctors, hospitals and other medical professionals that you must use to be covered for your care. With an HMO-POS you can go outside of the network for care, but you'll pay more. You'll need to choose a primary care physician (PCP) to coordinate all your care.

What's the difference between HMO and POS?

What is the difference between an HMO and POS? Members have to receive in-network care for both POS and HMO plans and both types of plans have restricted networks. They're different in one key way: POS plans don't require referrals to see specialists, but HMO plans demand a referral to see a specialist.

Which is better an HMO or an HMO POS?

As with an HMO, a Point of Service (POS) plan requires that you get a referral from your primary care physician (PCP) before seeing a specialist. But for slightly higher premiums than an HMO, this plan covers out-of-network doctors, though you'll pay more than for in-network doctors.

Does Medicare cover eye exams?

Eye exams (routine) Medicare doesn't cover eye exams (sometimes called “eye refractions”) for eyeglasses or contact lenses. You pay 100% for eye exams for eyeglasses or contact lenses.

Does Medicare pay for cataract surgery?

Medicare covers cataract surgery that involves intraocular lens implants, which are small clear disks that help your eyes focus. Although Medicare covers basic lens implants, it does not cover more advanced implants. If your provider recommends more advanced lens implants, you may have to pay some or all of the cost.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Who is covered by Part A and Part B?

All people with Part A and/or Part B who meet all of these conditions are covered: You must be under the care of a doctor , and you must be getting services under a plan of care created and reviewed regularly by a doctor.

What is a medical social service?

Medical social services. Part-time or intermittent home health aide services (personal hands-on care) Injectible osteoporosis drugs for women. Usually, a home health care agency coordinates the services your doctor orders for you. Medicare doesn't pay for: 24-hour-a-day care at home. Meals delivered to your home.

What is an ABN for home health?

The home health agency should give you a notice called the Advance Beneficiary Notice" (ABN) before giving you services and supplies that Medicare doesn't cover. Note. If you get services from a home health agency in Florida, Illinois, Massachusetts, Michigan, or Texas, you may be affected by a Medicare demonstration program. ...

Does Medicare cover home health services?

Your Medicare home health services benefits aren't changing and your access to home health services shouldn’t be delayed by the pre-claim review process.

Do you have to be homebound to get home health insurance?

You must be homebound, and a doctor must certify that you're homebound. You're not eligible for the home health benefit if you need more than part-time or "intermittent" skilled nursing care. You may leave home for medical treatment or short, infrequent absences for non-medical reasons, like attending religious services.

Can you get home health care if you attend daycare?

You can still get home health care if you attend adult day care. Home health services may also include medical supplies for use at home, durable medical equipment, or injectable osteoporosis drugs.

What is an HMO plan?

Summary. Medicare health maintenance organization (HMO) plans are a type of Medicare Advantage plan. The plans are offered by private insurance companies, with varied coverage and costs. In this article, we discuss Medicare Advantage, look at the HMO plans, and examine how they compare with original Medicare.

What is the focus of HMO?

The focus of HMO plans is on prevention and wellness. They provide coordinated care, often using care managers within the company or a primary care doctor. Usually, the doctors and other service providers must either contract with, or work for, the company offering the HMP plan.

How much is the HMO premium in 2021?

Advantage HMO plans may offer premium-free plans, or a person may have to pay the premium. A person has to pay the Medicare Part B monthly premium, which is $148.50 in 2021. Some plans cover the premium. The deductible for the HMP plan may be as low as zero, depending on the plan.

What is HMOPOS in healthcare?

In addition to plans such as the health maintenance organization (HMO) and HMO point-of-service (HMOPOS) plans, the program offers: Advantage healthcare plans are offered by private companies that must follow Medicare rules and offer the same benefits as original Medicare (Part A and Part B).

What is Medicare Advantage?

Medicare Advantage plans combine the benefits of parts A and B and may offer prescription drug coverage. The Balanced Budget Act of 1997 added a new Part C to Medicare called the Medicare+choice program. It included various coordinated healthcare plans, including health maintenance organizations (HMOs). The Medicare+choice program is now known as ...

What is Advantage Healthcare?

Advantage healthcare plans are offered by private companies that must follow Medicare rules and offer the same benefits as original Medicare (Part A and Part B). Many also offer prescription drug coverage.

What is receivership in Medicare?

The Centers for Medicare and Medicaid Services (CMS) added two special enrollment periods for a person enroll ed in an Advantage plan who has a consistent record of poor performance, or is having financial problems and the assets are held by a third party called receivership.

How to find out if you have an HMO?

Call 1-800-MEDICARE or your State Health Insurance Assistance Program (SHIP) to find out if there is an HMO available in your area. To enroll in an HMO, call Medicare or the plan directly. Be sure to make an informed decision by contacting a plan representative to ask questions before enrolling.

Do HMOs have the same benefits as Medicare?

Like all Medicare Advantage Plans, HMOs must provide you with the same benefits, rights, and protections as Original Medicare, but they may do so with different rules, restrictions, and costs. Some HMOs offer additional benefits, such as vision and hearing care.

Do HMOs pay Medicare Part B?

Generally you will continue paying your Medicare Part B premium, though some HMOs will pay part of this premium. Some HMOs may charge an additional premium, on top of your Part B premium. If you want Part D coverage, you will receive it through your HMO. Plans may charge a higher premium if you also have drug coverage.

What is the maximum out of pocket limit for HMOs in 2021?

This limit may protect you from excessive costs if you need a lot of care or expensive treatments. The maximum out-of-pocket limit for HMOs in 2021 is $7,550, but plans may set lower limits.

Do you pay for out of network HMO?

Generally, you are only covered for care you get from in-network providers and facilities. Except in emergencies or urgent care situations, you will pay the full cost of the care you receive from out-of-network providers. Keep in mind that doctors may leave the HMO’s network at any time (even during the plan year).

Do you pay a premium for Part B?

Plans may charge a monthly premium in addition to the Part B premium, or choose to pay part of your Part B premium. Plans may charge a higher premium if you also have Part D coverage. Plans may set their own deductibles, copayments, and other cost-sharing for services.

Do HMOs have the same benefits as Medicare?

Register. Health Maintenance Organizations (HMOs) must provide you with the same benefits as Original Medicare but may do so with different rules, restrictions, and costs. HMOs can also offer additional benefits. Below is a list of general cost and coverage rules for Medicare HMOs.

What is an HMO POS plan?

A Medicare Advantage HMO plan with a POS option is known as an HMO-POS. This is a type of plan beneficiaries may choose for Medicare coverage. HMO-POS plans allow members to receive care outside of the plan’s network, but the cost of care will be more expensive. An HMO-POS policy has the flexibility of a PPO with restrictions like an HMO.

Is HMO POS larger than HMO?

Although, depending on the insurance carrier, policy rules may be different. HMO-POS plans often have larger provider networks than HMOs. Although, monthly premium costs and copayments for care may also be higher for members.

Do PPOs require referrals?

Unlike HMOs, PPOs don’t require referrals to visit with a specialist. Both HMO-POS and PPO plans allow members to visit with providers inside or outside of the plan’s network. However, the cost will be less when staying inside a plan’s network.

Does Medicare Advantage Part D cover prescription drugs?

Medicare Advantage Part D. Prescription drug coverage can be costly, Part D prescription drug plans can help with this expense. In most cases, HMO-POS plans pay for prescriptions. However, beneficiaries must enroll in an HMO plan offering prescription drug coverage – Medicare Advantage Plan with Prescription Drug coverage (MAPD).

Can you have HMO without POS?

Working with their PCP to coordinate care during times of travel, members don’t have the stress of finding their own provider. HMOs without the POS option may not have coverage while outside their service area. Otherwise, the HMO-POS is the same, with the addition of the point of service option.

Is HMO POS a good plan?

HMO-POS plans aren’t for everyone. Some individuals may not travel as much and seek lower monthly premiums and copayments. In this case, an HMO plan without the POS option may be the best plan type. However, some beneficiaries want to coordinate their own health care or see specialists without needing a referral.

What is an HMO and PPO?

What are HMO and PPO Plans and How Do They Work? A Health Maintenance Organization (HMO) is a type of health insurance plan that, in most cases, restricts policyholders from seeking care outside of its provider network. A Preferred Provider Organization (PPO) is a type of managed care organization that provides access to a network of doctors, ...

What is a PPO?

A Preferred Provider Organization (PPO) is a type of managed care organization that also utilizes a provider network. These providers, called “preferred providers,” have agreed to offer their services at a discounted rate. However, unlike an HMO plan, you can receive plan coverage for providers outside of the network.

When will Medicare plan F and C be available?

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare.

Do HMOs require you to work in their network?

In most cases, HMOs don’t offer health care services from providers who aren’t within their networks, with the exception of emergency medical care. HMOs also sometimes require that you live or work in their service area. With most HMOs, you select a primary care physician (PCP).

Is HMO insurance covered by HMO?

The costs for services you receive outside the HMO network will generally not be covered. HMO plans often focus on prevention and wellness measures, as well as integrated care.

Is Medicare Advantage a PPO?

Most Medicare Advantage plans are either HMO or PPO plans. But there's an alternative that doesn't restrict you to a provider network. Medicare Supplement Insurance (also called Medigap) works alongside your Original Medicare (Medicare Part A and Part B) benefits by helping pay for out-of-pocket medical costs such as deductibles, ...

How does Medicare Advantage HMO work?

How do Medicare Advantage HMO plans work? A health maintenance organization (HMO) gives you access to a network of doctors and hospitals that you must use in most cases. Some HMO plans require you to get a referral from a primary care physician for hospital care and specialist visits.

Does RX include mail order?

Yes, in most plans . Includes Rx mail-order benefit. Yes, if plan has Rx coverage. Yes. Yes, if plan has Rx coverage. Dental, vision and hearing coverage. Yes, in most plans. Yes. Yes, in many plans.

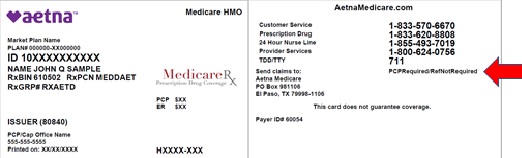

Does Aetna have a meal at home program?

Meals-at-home program. (meals delivered to your home after a hospital stay) Yes, in many plans. Yes, in many plans. Yes, in many plans. Aetna Medicare Advantage plans at a glance. Our HMO plans. Requires you to use a provider network. Yes, unless it’s an emergency.

Can you get meals at home after a hospital stay?

Yes, in many plans. Meals-at-home program. (meals delivered to your home after a hospital stay) Yes, in many plans. Our HMO-POS plans. Requires you to use a provider network. Varies by plan.

Does Aetna offer Medicare Advantage?

Medicare Advantage plans for every need. In addition to HMO plans, Aetna offers you other Medicare Advantage plan options — some with a $0 monthly plan premium. We can help you find a plan that’s right for you.