Key Takeaways

- Medicare taxes fund hospital, hospice, and nursing home expenses for elderly and disabled individuals.

- In 2022, the Medicare tax rate is 2.9%, which is split between an employee and their employer. ...

- Self-employed individuals are responsible for both portions of Medicare tax but only on 92.35% of business earnings. ...

How much do I pay for Medicare tax?

Feb 24, 2022 · Medicare tax pays for Part A of the Medicare program, which includes hospital insurance for individuals age 65 or older and people who have certain disabilities or medical conditions. 2 Medicare...

How much do tax payers pay for Medicare?

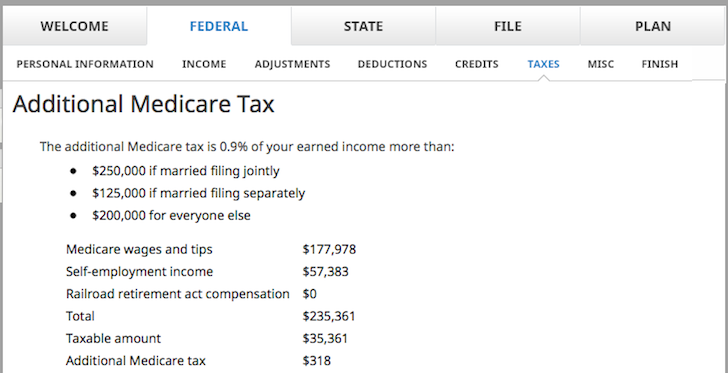

Medicare Taxes and the Affordable Care Act. The Affordable Care Act (ACA) added an extra Medicare tax for high earners. This surtax is known as the Additional Medicare Tax. As of January 2013, anyone with earned income of more than $200,000 ($250,000 for married couples filing jointly) has to pay an additional 0.9% in Medicare taxes beyond the standard 1.45%. That …

What is the maximum income taxed for Medicare?

The funds collected through Medicare Taxes that fund this account pay for Part A hospital insurance benefits, home health care, skilled nursing facilities and hospice care. This fund also pays for the administration costs associated with the program including the actual collection of Medicare taxes.

What income is subject to Medicare tax?

May 07, 2018 · Medicare taxes fund Medicare coverage, a federal health insurance program that gives millions of retired and disabled individuals access to medical treatment. There are four parts of the Medicare program: hospital insurance, medical insurance, Medicare Advantage plans, and prescription drug coverage.

What is Medicare tax?

Medicare tax is a payroll tax that funds the Medicare Hospital Insurance program. Employers and employees each pay Medicare tax at a rate of 1.45% with... Menu burger. Close thin.

What is the Medicare surtax rate?

It is not split between the employer and the employee. If your income means you’re subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000.

What is the Social Security tax for 2017?

As of 2017, the employee share of Social Security and Medicare taxes is 7.65%. If you make over $200,000, remember to account for the Additional Medicare Tax. It may seem like a lot of trouble now, but all this tax withholding is designed to give you a safety net when you reach retirement.

When did Medicare HI start?

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though it’s still below the Social Security tax rate.

Is NIIT the same as Medicare?

According to the IRS, a taxpayer may be subject to both the Additional Medicare Tax and the NIIT, but not necessarily on the same types of income .

Is there a limit on Medicare taxes?

Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes. Medicare Taxes and the Affordable Care Act. The Affordable Care Act (ACA) added an extra Medicare tax for high earners.

When did Medicare start paying taxes?

Taxpayers and employers began paying Medicare taxes in 1966 at a combined rate of 0.7 percent. Today, taxpayers and employers pay a combined 2.9 percent toward FICA. You may often wonder why you must pay taxes for Medicare. Here are a few things you need to know that will help you understand why you pay Medicare taxes.

What is Medicare trust fund?

The agencies oversee what are known as Medicare trust funds. The U.S. Treasury Department holds the two Medicare trust fund accounts which can only be used to fund Medicare. Payroll taxes, employer taxes and interest earned on the two accounts are used to fund both trust fund accounts.

What is FICA tax?

FICA is a payroll tax deduction from the paychecks of employees and a contribution by employers. FICA taxes are used specifically to fund Medicare and social security benefits. The taxes that employees and employers pay under FICA are mandatory, and the IRS revises the tax rates annually.

When did the net investment tax take effect?

Enacted on Jan. 1, 2013, the net investment income tax took effect under the Affordable Care Act. If you earned any income that resulted from dividends, interest, capital gains, royalty income or rental income, you may be subject to the net investment income tax.

Does Roth 401(k) count toward income?

However, any withdrawals from a qualified Roth IRA or a Roth 401 (k) does not count toward any earn ed income or net adjusted income. Trying to determine what qualifies as net investment income and how it affects Medicare taxes is quite tricky, so you should always consult first with a qualified tax advisor.

How much is Medicare tax?

The Medicare tax rate is 1.45% of an employee’s wages. Again, Medicare is an employer and employee tax. You must withhold 1.45% from an employee’s pay and contribute a matching 1.45%. Altogether, Medicare makes up 2.9% of the FICA tax rate of 15.3%. The rest goes toward Social Security taxes. Let’s say an employee earns $1,000 in gross wages each ...

How much Medicare tax do you have to pay if you are married filing separately?

Married filing separately: $125,000. For example, when a single employee earns more than $200,000, you must withhold 2.35% (1.45% + 0.9%) from their wages. As an employer, you are only required to begin withholding the additional Medicare tax when an employee earns more than $200,000.

What is FICA tax?

You must do this for each one of your employees. Both Medicare and Social Security taxes make up FICA (Federal Insurance Contributions Act) tax.

How often do you have to deposit Medicare?

To make Medicare tax deposits, you must follow your depositing schedule, which is either monthly or semi-weekly. Your schedule is determined by your reported tax liability using a four-quarter, IRS lookback period.

How much is self employment tax?

If you are self-employed, you must pay self-employment tax, which goes toward Medicare and Social Security tax. Self-employment tax is 15.3% of your income. You are responsible for paying the full amount of 15.3%. Of the 15.3% self-employment tax rate, 2.9% goes toward Medicare tax.

Is there a limit on Medicare wages?

Unlike the Social Security wage base , there is no limit to taxable Medicare wages. Continue withholding Medicare tax regardless of what your employees earn. And if an employee earns a certain amount, they are subject to an additional Medicare tax.

Is Medicare taxed on wages?

For the most part, all compensation is subject to Medicare tax. This includes regular wages, tips, commissions, bonuses, overtime, and some fringe benefits. However, some benefits are exempt from Medicare tax, like health insurance premiums and employer contributions to a qualified deferred compensation plan.

What Is Medicare Tax?

The Medicare tax, often known as the “hospital insurance tax,” is a federal employment tax that helps to support a portion of the Medicare healthcare program. Moreover, Medicare tax is a deduction from an employee’s paycheck or paid as a self-employment tax, similar to Social Security tax.

What is FICA?

The Federal Insurance Contributions Act, or FICA, was first enacted in 1935. It is a payroll tax that both employees and employers must pay to the IRS, and it consists of two taxes:

Social Security

The Social Security tax rate is a percentage of your pay used to fund the program. This rate will be 6.20% in 2021. Self-employed people will have to pay twice as much. You may be able to pay half of that with proper deductions. You will settle into the program while working, and the program will repay you when you retire.

In 2021, What Will the Medicare Tax Rate Be?

The Medicare tax rate for 2021 is 2.9%. In most cases, you are responsible for half of the entire Medicare tax amount (1.45%), and your employer is responsible for the remaining 1.45%. Your Medicare tax is a part of your paycheck automatically.

Is This a Tax That Everyone on Medicare Has to Pay?

While everyone pays some Medicare taxes, you’ll only pay the additional tax if your income is at or over the threshold. If your income falls below a specific point, you will not be obliged to pay any other taxes.

What Is the Purpose of the Medicare Tax?

The Medicare tax supports Medicare Part A, which provides health insurance to adults 65 and older. Part A of Medicare, generally known as hospital insurance, pays for inpatient hospital stays, skilled nursing care, hospice, and home health services.

When Will I Be Able to Quit Paying Medicare Tax?

FICA taxes will continue to be paid to Social Security and Medicare as long as you have earned income. If you have no source of income, you stop paying Medicare taxes.

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Can an employer withhold AMT?

Any shortfall to withholding must be paid by the taxpayer at tax time. Employers can be subject to penalties and interest for not withholding the AMT, even if the oversight was due to understandable circumstances.

How much Medicare tax is due in 2013?

Starting with the 2013 tax year, you may be subject to an additional 0.9 percent Medicare tax on wages that exceed a certain threshold. The Additional Medicare Tax is charged separately from, and in addition to, the Medicare taxes you likely pay on most of your earnings.

Does the above article give tax advice?

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.