When subtracting your medical expenses and cost sharing (like copayments) lowers your income to a level that qualifies you for Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

What is meant by Medicare/Medicaid spend down?

When subtracting your medical expenses and cost sharing (like copayments) lowers your income to a level that qualifies you for Medicaid, this process is called a “spenddown.” To be eligible as “medically needy,” your resources (like savings accounts and certificates of deposit) have to be lower than your state’s limit.

How does a Medicaid spend-down work?

Spending down is a way to legally bring income and assets in line with eligibility requirements. It is important to research how this is done in your specific area because the parameters vary across the country and even within the states. Since this is complex, some people take advantage of the expertise offered by professional Medicaid planners.

What does Medicaid spend down mean?

Jul 25, 2017 · Medicare premiums may only be allowed as an expense towards meeting spenddown when HCA (through the MSP programs, for Part A and Part B) or the federal government (through the Part D low-income subsidy) is not paying them. Allowable Medicare premiums are coded in ACES as a spenddown expense and aren't used as an income …

What does Medicaid "spend-down" mean?

Via income spend-down, excess income can be “spent down” on medical bills each month in order to qualify for Medicaid. Medical bills can include: Health insurance premiums; Prescription drugs; Physician visits; Unpaid medical bills; While commonly known as a “spend-down” program, some states refer to it by different names, including: Surplus Income

What is a Spenddown for Medicaid MN?

The “spend down” amount is the difference between one's monthly income and the medically needy income limit. Once the “spend down” is met, one will be Medicaid eligible for the remainder of the month. The medically needy asset limit is $3,000 for an individual and $6,000 for a couple.Jan 15, 2022

What assets are exempt from Medicare?

Other exempt assets include pre-paid burial and funeral expenses, an automobile, term life insurance, life insurance policies with a combined cash value limited to $1,500, household furnishings / appliances, and personal items, such as clothing and engagement / wedding rings.Dec 14, 2021

How much money can you have in the bank to qualify for Medicaid in NY?

In just about every state in the union, the Medicaid asset limit is $2000. Here in New York, we have a slightly better arrangement, because the asset limit is $15,900. This is not a lot in the big picture, but it is a step in the right direction.Jun 29, 2021

How does Medi cal spend down work?

How does a spend down work? It works almost like a deductible for car insurance. When you have accumulated medical bills (paid or unpaid) greater than your excess income, you will get Medicaid for that month.

Does Medicare look at your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

How much money can you have in the bank and still get Medicaid?

Your assets must be $2,000 or less, with a spouse allowed to keep up to $130,380. Cash, bank accounts, real estate other than a primary residence, and investments, including those in an IRA or 401(k), all count as assets.May 24, 2021

Can you own a house and be on Medicaid in NY?

Answer: No. Medicaid won't force you out of your house. Your home is an “exempt” resource for the purpose of determining Community Medicaid eligibility.Dec 13, 2017

What is the income limit for Medicaid in NY 2021?

2021-2022 Federal Income GuidelinesHousehold SizeAnnualMonthly1$23,828$1,986232,2272,686340,6263,386449,0254,0865 more rows

What assets are exempt from Medicaid in NY?

Exempt from inclusion in the Medicaid eligibility resource limit is $878,000 equity in your family residence; irrevocable pre-paid burial expenses; personal and household property; one automobile; and any life insurance policies with a face value of less than $1,500.

Does Social Security count as income for Medi-Cal?

Does Social Security Count as Income for Medicaid Eligibility? Most Social Security disability and retirement income does count as income for purposes of Medicaid eligibility.Aug 18, 2021

Does Medi-Cal cover all expenses?

Generally speaking, Medi-Cal will only pay for expenses that it covers and that your other coverage won't pay for. How Medicare works with other insurance shows how it works when you have Medicare and other coverage.

What is Share of cost in Medi-Cal?

“Share of Cost” is the amount you agree to pay for health care before Medi-Cal starts to pay. This is called “meeting your share of cost.” Your Share of Cost is a set amount based on how much money you make. You only need to meet your Share of Cost in the months that you get health care services.

What is asset spend down?

Asset spend down: Spending resources down to meet the asset ceiling set by Medicaid. Countable assets: Sometimes referred to as non-exempt assets or liquid assets that can easily be converted to cash because these assets count toward the maximum you can possess for Medicaid eligibility. Examples are bank accounts, vacation homes, stocks and bonds. ...

Why is spending down important?

Understanding spend down. The concept of spend down comes into play because income and assets above a certain level disqualifies applicants for long-term care under Medicaid. Spending down is a way to legally bring income and assets in line with eligibility requirements.

How long does it take for Medicaid to look back?

This period is 60 months in most states and 30 months in California.

How many people are covered by medicaid in 2019?

Funding appropriation is a joint effort by the states and the federal government. Medicaid reports that 63.9 million people were covered at the end of 2019.

What are some examples of assets that can be spent down?

Following are examples of some ways people spend down assets: Pay off credit card balances, a mortgage, or personal or auto loans. Buy medical items not covered by your health insurance, such as dentures, glasses and hearing devices.

Why is it important to research how this is done in your specific area?

It is important to research how this is done in your specific area because the parameters vary across the country and even within the states. Since this is complex, some people take advantage of the expertise offered by professional Medicaid planners.

Who is eligible for medicaid?

Eligible beneficiaries include low-income adults, children, pregnant women, the elderly and people with disabilities, according to the official Medicaid website.

What is benchmark plan?

Benchmark plans are considered average Medicare plans. They have adequate health care coverage and their premiums can be fully covered by the LIS. Other Part D plans have higher premiums than the benchmark plans. The premiums for these plans are higher than what the LIS covers.

How much is Joe's Medicare deductible?

Medicare assigned $1,068 to Joe's Medicare deductible and charged him an additional $2670 for coinsurance. Medicare paid $6,800 to the hospital. The hospital did an insurance adjustment for the remaining balance. If Joe is eligible for QMB coverage, his charges of $1,068 and $2,670 will be paid by the QMB program and can't be used ...

How many levels of Medicare are there?

In summary, the Medicare Savings Program has four levels of coverage, based on income, with the lowest income standard to qualify for QMB and the highest income standard to qualify for QDWI. MN resource standards also apply.

What is the QMB charge for Joe?

If Joe is eligible for QMB coverage, his charges of $1,068 and $2,670 will be paid by the QMB program and can't be used towards his spenddown liability. If Joe isn't eligible for QMB coverage, these charges could be used towards meeting his spenddown liability.

What is the purpose of MSP?

Purpose: This section provides information about what the department allows as medical expenses for individuals who have spenddown, are entitled to Medicare and who may qualify for a Medicare Savings Program (MSP ). To qualify for Medicaid, individuals who are entitled to Medicare must apply for and enroll in Medicare.

When do you lose your Medicaid eligibility?

Medicaid individuals are automatically "deemed" eligible for the LIS and remain eligible until the end of the calendar year in which they lose their Medicaid eligibility. All States have a range of "benchmark" Part D plans. Benchmark plans are considered average Medicare plans.

Does HCA allow spenddown?

HCA allows Part A premium expenses for spenddown only if: The individual incurred the expense in the month of application and is not eligible for QMB until the first of the following month; or. The individual is eligible under an MSP that does not pay for Part A costs; or.

What is the asset limit for Medicaid in 2020?

Again, there are exceptions to this rule. For instance, in 2020, the asset limit in this situation for long-term care is $4,000 in Arizona, $6,000 in North Dakota, and $23,100 in New York. Married Couples with Only One Spouse Applying for Medicaid.

How much can you spend on Medicaid in NJ?

NJ has a countable asset limit of $2,000 for long-term care Medicaid. You are currently over the limit because you have $20,000 in savings. You spend $18,000 adding a downstairs bathroom and a wheelchair ramp to your house, and now you are asset eligible for Medicaid.

What is countable vs non-countable assets?

When thinking about asset spend-down for Medicaid eligibility, it is extremely important to know which assets are considered countable and which ones are considered non-countable. Non-countable assets are also called “exempt” assets.

How much can a healthy spouse keep in California?

And his wife, the “healthy spouse,” is able to keep up to $128,640 of their joint assets. (California is a 100% state, which means the healthy spouse can keep 100% of their joint assets up to $128,640). This means the couple has $22,3600 ($150,000 – $128,640 = $21,360) in excess of the Medicaid asset limit.

How much can a married couple keep on Medicaid?

Typically, the spouse who is applying for Medicaid is able to keep $2,000 in non-exempt assets, while the healthy spouse can keep up to $128,640 (in 2020).

What is excess income on medicaid?

In simple terms, excess income, income over the Medicaid income limit, is directly deposited into an account each month. It is then spent on the elderly individual’s care and / or medical expenses. To learn more about this option, click here. As with the medically needy option, not all states allow QITs.

What is the maximum amount of assets for long term care?

The asset limit for a single elderly individual for long-term care is $2,000 in most states. However, there are some exceptions. For example, as of 2020, the asset limit for a single individual in Connecticut is $1,600, in Nebraska it is $4,000, and in Minnesota it is $3,000. Married Couples with Both Spouses Applying for Medicaid.

What is spend down on medicaid?

The spend-down is sometimes called a “medically needy” or “excess income” program. Applicants for the Medicaid spend-down usually have to meet the same asset limit for other aged, blind and disabled Medicaid enrollees. This asset limit is less than $2,000 for single applicants and $3,000 for married couples in many states.

How many states offer Medicaid spend down?

A total of 33 states and D.C. offered Medicaid spend-down coverage as of 2018. In some states, the Medicaid spend-down covers Long Term Services and Supports (LTSS), ...

How long does it take for Medicaid to pay off excess income?

Enrollees activate their spend-down coverage by showing they have paid or unpaid medical bills equal to this excess income over a specific period of time (one to six months). Some states also allow enrollees to pay their excess income directly to Medicaid.

Can you use Medicare to pay for spend down?

Enrollees can use any medical services not reimbursed by an insurer (such as Medicare, Medicaid, or Medigap) to meet their spend-down. If an insurer reimbursed part of an expense, enrollees usually can only apply the amount that wasn’t reimbursed toward the spend-down.

Does Medicaid cover LTSS?

But in many states the spend-down program does not cover LTSS.

What is a trust for Medicaid?

Trusts allow people with disabilities and income or assets higher than Medicaid eligibility guidelines to place a portion of their income or assets into the trust, where it will not be counted. Rules about how these trusts work vary greatly by state.

What is Medicaid spend down?

If you have medical expenses that significantly reduce your usable income, you may qualify for a Medicaid spend-down. The spend-down program may also be referred to as a medically needy program or Medicaid’s Excess Income Program. Below is a general guide to the Medicaid spend-down process.

How long does it take to get a spend down on medicaid?

Your spend-down amount will be the difference between your income and the Medicaid eligibility limit, as determined by your state over a given length of time (one to six months). Some states require you to submit receipts or bills to Medicaid to show your monthly expenses.

Can you get Medicaid spend down for blind people?

Register. If you need Medicaid coverage and your income is above the Medicaid income guidelines in your state, your state may offer a Medicaid spend-down for aged, blind, and disabled (ABD) individuals who do not meet eligibility requirements.

Does Medicare pay for nursing home care?

Note: If your state does not have a spend-down program, it should have more generous Medicaid income guidelines for people who need nursing home care than for those who do not. Medicare will pay first for covered medical services, and Medicaid will pay second for qualifying costs, such as Medicare cost-sharing.

Does Medicare pay for inpatient hospital?

Medicare will pay first for covered services, and Medicaid will pay second for qualifying costs, such as Medicare cost-sharing. Your state may require you to qualify and apply for spend-down for multiple periods in order to qualify for Medicaid inpatient hospital coverage. States with spend-down programs may allow you to use ...

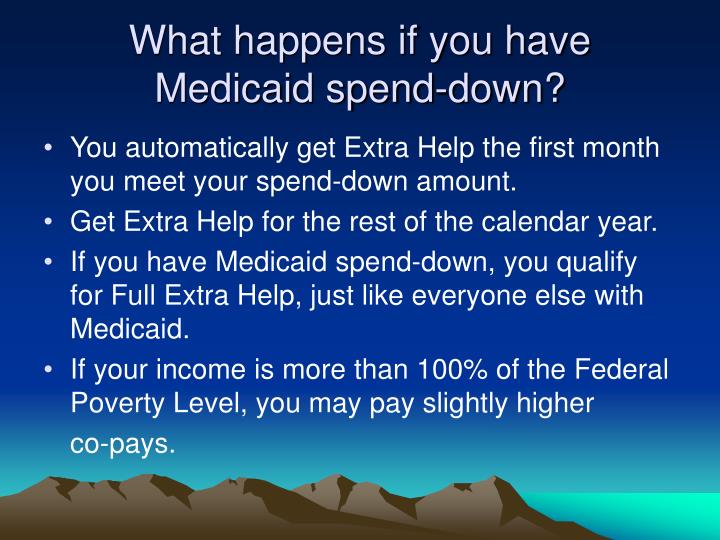

When do you get extra help on medicaid?

You will automatically qualify for Extra Help the first month that you meet your Medicaid spend-down amount until the end of the calendar year (even if you do not meet your spend-down amount every period).

How long does MO HealthNet allow for spend down?

MO HealthNet allows up to a year to meet the spend down either through pay-in or bills.

Can a consumer submit bills to DMH?

Applying incurred medical expenses. The consumer or a provider can submit bills for medical services which the client is personally responsible for or which are billable to DMH. Coverage will begin the day the client reaches the Spend Down amount.

Can you meet spend down?

Even if the consumer normally cannot meet spend down, by maintaining an open case the consumer is protected in the event of an unexpected medical expense. The spend down can be met at any time during the month either with bills or by payment, and previous months within the past year can also be met.

Can I send a check to MO HealthNet?

The consumer may send a payment (check, money order, or cashiers check) to the MO HealthNet Division. The consumer will have coverage for the whole month that they pay for. You must put your MO HealthNet number (case number) on the check or money order.

Do I have to put my MO HealthNet number on a check?

You must put your MO HealthNet number (case number) on the check or money order. You should mail your payment along with the invoice stub for the month you want to pay. If you do not have the correct invoice stub to send you must write on the check or money order what month you are paying for.

What is over the asset limit for medicaid?

An applicant must have assets, also called resources, under a certain amount to qualify for Medicaid. However, being over the asset limit does not mean one cannot qualify for Medicaid benefits. When considering one’s assets, it’s important to be aware that some assets are exempt, or said another way, not counted towards the asset limit. (Further detail is below under Countable Assets and Non-Countable Assets). If one is over the asset limit after considering all non-countable assets, one will have to “spend down” assets in order to meet Medicaid’s asset limit. That said, one needs to proceed with caution when doing so. Medicaid has a look-back period in which all past transfers are reviewed. If one has gifted assets or sold them under fair market value during this timeframe, a period of Medicaid ineligibility will ensue.

What happens if you exceed the asset limit for Medicaid?

If one is over the asset limit after considering all non-countable assets, one will have to “spend down” assets in order to meet Medicaid’s asset limit. That said, one needs to proceed with caution when doing so. Medicaid has a look-back period in which all past transfers are reviewed.

What is an annuity for Medicaid?

One can purchase an annuity, which in simple terms, is a lump sum of cash converted into a monthly income stream for the Medicaid applicant or their spouse. The payments can be for a set period shorter than one’s life expectancy or equal to the beneficiary’s life expectancy. Irrevocable Funeral Trusts.

How long does it take for medicaid to pay off excess income?

Once Medicaid applicants have spent their excess income (the amount over the income limit) on medical expenses, they will be Medicaid eligible for the remainder of the “spend down” period, which is between 1 and 6 months. Not all states have a medically needy pathway.

How much can a community spouse keep in 2021?

In very simplified terms, in 50% states, the community spouse can keep up to 50% of the couple’s assets, up to the maximum allowable amount. (As mentioned above, this figure, as of 2021, is $130,380 in most states). There is also a minimum resource allowance, which as of 2021, is $26,076.

How much can a married couple keep in North Dakota?

Put differently, together a couple can often keep up to $4,000 in assets. Other exceptions exist. North Dakota allows married couples to keep up to $6,000 in assets, regardless of if they are applying for regular Medicaid, nursing home Medicaid, or a HCBS Medicaid Waiver.

What is a way to spend down assets?

Vehicle repairs, such as replacing the battery, getting an engine tune-up, or replacing old tires are also a way to spend down assets, as is selling an existing car at fair market value and purchasing a new one. Life Care Agreements.

What is extra help?

And, you'll automatically qualify for. Extra Help. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. paying for your.

Which pays first, Medicare or Medicaid?

Medicare pays first, and. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. pays second.

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

Does Medicare cover prescription drugs?

. Medicaid may still cover some drugs and other care that Medicare doesn’t cover.

Does Medicare have demonstration plans?

Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They’re called Medicare-Medicaid Plans. These plans include drug coverage and are only in certain states.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. . If you have Medicare and full Medicaid, you'll get your Part D prescription drugs through Medicare.

Can you get medicaid if you have too much income?

Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid. The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid. In this case, you're eligible for Medicaid because you're considered "medically needy."