How much do you pay for Medicare Part B?

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple.

Is Medicare Part B worth the cost?

Yes is the short answer, but there are a few exceptions and details. Part B coverage (physician and outpatient coverage) is a good deal overall. The basic premium you pay only covers about one-fourth of the cost; the federal government pays the rest through general revenue.

What is the current cost of Medicare Part B?

The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible. From day one ...

How much is the premium for Medicare Part B?

More: Ask Rusty – Does Paying SS Tax Now Increase My Benefit? Although you must pay Medicare Part A and Part B premiums to the federal government to obtain a Medicare Advantage plan, all your healthcare services are handled by the private Medicare ...

What is the Medicare surcharge for 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019.

What is the Medicare surcharge for 2021?

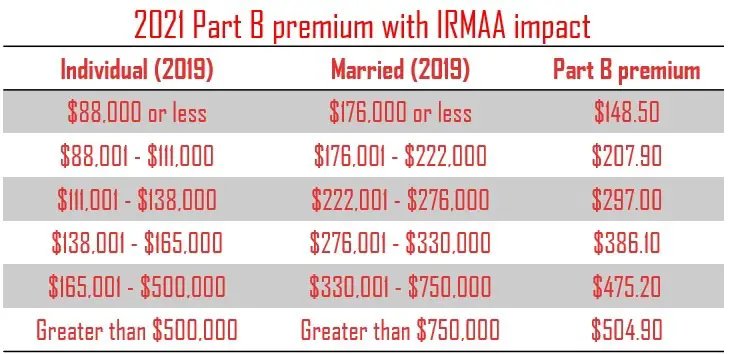

Higher-income Medicare beneficiaries will pay more. In 2021, individuals with modified adjusted gross income of $88,000 or more and married couples with MAGIs of $176,000 or more will pay additional surcharges ranging from $59.40 per month to $356.40 per month on top of the standard Part B premium.

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How is the Medicare surcharge calculated?

How Medicare Surcharges Are Determined. According to the Social Security Administration (SSA), your modified adjusted gross income (MAGI) from two years ago is what counts. This means that benefits for the current period are based on calculations from the income you earned two years earlier.

What is the Medicare surcharge for 2022?

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is the 3.8 Medicare surtax?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Is Medicare premium based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Will Medicare Part B premium go up in 2022?

If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022. That's a 14.5% increase, and is one of the steepest increases in Medicare's history.

How do I avoid Medicare levy surcharge?

In order to avoid the surcharge, you must have the appropriate level of cover. For singles, that means a policy with an excess of $500 or less. For couples or families, it means an excess of $1,000 or less.

How do I avoid Medicare surcharges?

What are the best tips to avoid an IRMAA?Inform Medicare if you've had a life changing event that affected your income. ... Avoid certain income-boosting changes to your annual income. ... Utilize Medicare savings accounts. ... Consider a qualified charitable distribution. ... Explore tax-free income streams.

How do I avoid Medicare surtax?

Despite the complexity of this 3.8% surtax, there are two basic ways to “burp” income to reduce or avoid this tax: 1) reduce income (MAGI) below the threshold, or 2) reduce the amount of NII that is subject to the tax.

What is the difference between Medicare Part B and Part D?

Medicare is made up of several parts. Most have monthly premiums, which is the amount you pay each month for coverage. Part B has a standard premium amount that most people pay each month. That amount changes from year to year , but it's generally consistent for most Medicare enrollees .

What is the Medicare surtax?

If your income is above a specific limit, the federal government adds an extra charge to your monthly premium. This charge is known as the Income-Related Monthly Adjustment Amount (IRMAA). Think of IRMAA as a surcharge or a Medicare surtax, as some refer to it.

What does Medicare look for in a tax return?

Medicare looks at the modified adjusted gross income ( MAGI) reported on your IRS tax return from 2 years ago to determine if you pay higher monthly premiums for Part B and Part D.

What is a Part D plan?

Unlike Medicare Part B, which the federal government provides, Part D prescription drug plans are provided by private health insurance companies that Medicare approves . Part D monthly premiums can vary a great deal from one health insurance company to another. to get the latest monthly premium costs for Part D plans.

Do you get a quarterly bill if you don't take Social Security?

If the amount isn't taken from your payment, you should receive a quarterly bill in the mail. And if you're not taking Social Security retirement benefits, you'll get a bill in the mail for the standard Part B premium amount, plus any IRMAA you owe.

Is it important to get Medicare?

So as part of your retirement income planning, it's important to get the Medicare decisions right. Many older Americans are working longer and continuing to earn income well into their 60s and 70s. This income can help boost their retirement security, but it may also mean they face higher Medicare premiums.

Is a Medicare savings account tax exempt?

An MSA is like a health savings account (HSA). Contributions made to an MSA are tax-exempt, and withdrawals are tax-free, if the money taken out is spent on qualified health care expenses. Moving money into an MSA could potentially lower your taxable income.

Defer Income To Avoid A Premium Surcharge

The standard premium for Medicare Part B is $148.50 per month in 2021 but that assumes youre not a higher earner. Those with higher income levels are subject to higher premium costs. For 2021 heres what youre looking at:

How Your Income May Affect Your Medicare Costs

The federal Medicare program has costs that come with it. There may be premiums, copayments, coinsurance, and deductibles associated with Medicare Part A, Part B, and the optional Part D . If your income is below certain limits, you might qualify for programs that reduce your Medicare costs.

Your Medicare Premium Is Based On Your Tax Return From Two Years Ago

When you decide to sign up for Medicare, the Social Security Administration needs to look at your federal tax return to figure out your MAGI. The way it works is that Social Security routinely checks your federal return from two years ago.

What Does Medicare Part B Cover

If youre enrolled in Medicare Part B, you receive coverage for both medically necessary services and preventive services.

How Much Are Part B Irmaa Premiums

If an individual makes $91,000 or more or a jointly filing household makes $182,000 or more then the IRMAA assessment increases the 2022 Part B premium to the amounts shows in Table 1.

What Is The Part B Premium Amount For 2022

The standard monthly Part B premium for 2022 is $170.10. This amount has increased by $21.60 from the standard monthly Part B premium for 2021, which was $148.50.

What Does Medicaid Cover

If you have Medicare and full Medicaid coverage, most of your health care costs are covered. You can get your Medicare coverage through Original Medicare or a Medicare Advantage Plan.

How much is the penalty for Part B?

Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers.

When will Part B coverage start?

You waited to sign up for Part B until March 2019 during the General Enrollment Period. Your coverage starts July 1, 2019. Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.)

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

Does Medicare have a 0 premium?

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.

Does Medicare Advantage cover Part A?

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B (Original Medicare)? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

Who sells Medicare Part C?

Medicare Part C plans (also called Medicare Advantage) and Medicare Supplement Insurance plans (also called Medigap) are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

What does Part B cover?

Part B helps pay for your doctors’ services and outpatient care. It also covers other medical services, such as physical and occupational therapy, and some home health care. For most beneficiaries, the government pays a substantial portion — about 75 percent — of the Part B premium, and the beneficiary pays the remaining 25 percent.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What happens if your MAGI is greater than $88,000?

If you file your taxes using a different status, and your MAGI is greater than $88,000, you’ll pay higher premiums (see the chart below, Modified Adjusted Gross Income (MAGI), for an idea of what you can expect to pay).

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

Does Medicare pay for prescription drugs?

Medicare prescription drug coverage helps pay for your prescription drugs. For most beneficiaries, the government pays a major portion of the total costs for this coverage, and the beneficiary pays the rest.

How much is Medicare Part B 2021?

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes.

What percentage of Medicare premiums do Medicare beneficiaries pay?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

How long does it take to pay Medicare premiums if income is higher than 2 years ago?

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes.

How many income brackets are there for IRMAA?

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay.

How much does Medicare cover?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%. Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with ...

How much does Medicare premium jump?

If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

When will IRMAA income brackets be adjusted for inflation?

The IRMAA income brackets (except the very last one) started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2021 coverage and the projected brackets for 2022 coverage. Before the government publishes the official numbers, I’m able to make projections based on the inflation numbers to date.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What age does QDWI pay Medicare?

The QDWI program helps pay the Medicare Part A premium for certain individuals under age 65 who don’t qualify for premium-free Part A.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Is Medicare plan change every year?

Medicare plan options and costs are subject to change each year. Healthline.com will update this article with 2022 plan information once it is announced by the Centers for Medicare & Medicaid Services (CMS).