Three Kaiser Family Foundation (KFF) analyses examine the latest data trends in Medicare Advantage (MA). Among the findings: Enrollment is way up, premiums have dropped, and more members are in plans with Star ratings of 4 or higher. MA plans now cover more than 4 in 10 Medicare beneficiaries, more than double the enrollment over the past decade, according to a new KFF analysis.

Does Medicare Advantage offer much advantage?

Medicare Advantage plans must offer everything Original Medicare covers except hospice care, which is still covered by Medicare Part A. Some Medicare Advantages plans offer extra benefits, such as prescription drug coverage, routine dental, routine vision, and wellness programs.

When to choose Original Medicare vs. Medicare Advantage?

You may want to choose between Original Medicare and Medicare Advantage for financial reasons, but you may also want to consider access to certain healthcare services. The important thing is to understand the differences between each type of Medicare before you commit yourself to a plan for the coming year.

Why is Medicare Advantage cheaper than Medicare?

There are lower premiums but more cost sharing with a Medicare Advantage plan. Medicare Advantage (also known as “MA”) plans monthly premiums are typically much lower than a traditional Medicare Supplement plan. The reasoning behind this is “cost sharing.”

Does Medicare Advantage save you money?

While you can save money with a Medicare Advantage Plan when you are healthy, if you get sick in the middle of the year, you are stuck with whatever costs you incur until you can switch plans ...

Is Medicare Advantage growing?

After a 9 percent increase from 2021 to 2022, enrollment in the Medicare Advantage (MA) program is expected to surpass 50 percent of the eligible Medicare population within the next year. At its current rate of growth, MA is on track to reach 69 percent of the Medicare population by the end of 2030.

Is Medicare Advantage becoming popular?

In 2005, 13 percent of enrollees chose the MA option, and the growth has been steady ever since; enrollment in Advantage plans rose 10 percent between 2020 and 2021 alone. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

What percent of seniors choose Medicare Advantage?

[+] More than 28.5 million patients are now enrolled in Medicare Advantage plans, according to new federal data. That's up nearly 9% compared with the same time last year. More than 40% of the more than 63 million people enrolled in Medicare are now in an MA plan.

What percent of Medicare recipients have Medicare Advantage?

Medicare served nearly 63 million beneficiaries in 2019. 62 percent were enrolled in Part A or Part B, and the rest (37 percent) were in Medicare Advantage (Part C). 74 percent were enrolled in Part D drug coverage, 13 percent had private drug coverage, and nearly 9 percent had no drug coverage.

Why are Medicare Advantage plans being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the highest rated Medicare Advantage plan?

Best Medicare Advantage Plans: Aetna Aetna Medicare Advantage plans are number one on our list. Aetna is one of the largest health insurance carriers in the world. They have an AM Best A-rating. There are multiple plan types, like Health Maintenance Organizations (HMOs) or Preferred Provider Organizations (PPOs).

Who sells the most Medicare Advantage plans?

UnitedHealthcareStandout feature: UnitedHealthcare offers the largest Medicare Advantage network of all companies, with more than 1 million network care providers. UnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

Do more people have Medicare or Medicare Advantage?

In 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42 percent of the total Medicare population, and $343 billion (or 46%) of total federal Medicare spending (net of premiums).

Why are more people choosing Medicare Advantage?

Higher Quality and Better Outcomes. Medicare Advantage provides beneficiaries with personalized, higher-quality care that leads to better outcomes. Research shows: Hospital readmission rates are 13% to 20% lower in Medicare Advantage than in Medicare Fee-For-Service.

What is the maximum out-of-pocket for Medicare Advantage plans?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.

Why do Medicare Advantage plans exist?

Medicare Advantage plans try to prevent the misuse or overuse of health care through various means. This might include prior authorization for hospital stays, home health care, medical equipment, and certain complicated procedures.

How many Medicare Advantage plans are there in 2020?

By 2020, that number increased to 3,148. Also in 2020, the average Medicare beneficiary can choose from 28 available plan options, compared to only 18 plan options in 2014. 1. Many Medicare Advantage plans offer $0 premiums. With more Medicare Advantage plan options being sold by more providers, the increased competition between insurance companies ...

How many Medicare beneficiaries were there in 2003?

Based on current trends, here are four predictions Medicare beneficiaries can keep an eye on. In 2003, just over five million Medicare beneficiaries enrolled in a Medicare Advantage plan, which represented only 13 percent of the total Medicare beneficiary population.

What are the benefits of a syringe?

These new benefits may include services such as: 1 Home-delivered meals 2 Air conditioners for people with asthma 3 Transportation to doctor’s offices 4 Grab bars in home bathrooms

Is Humana a Medicare Advantage?

Humana, one company that provides Medicare Advantage plans, pulled out of the individual health insurance exchange in 2018 to invest more heavily in the Medicare Advantage program. 3.

Does Medicare have a star rating?

In addition to the bonus program, Medicare issues star ratings for all Medicare Advantage plans each year, and these Medicare Star Ratings can be a large point of emphasis for shoppers. 2. Medicare offers a Special Enrollment Period for anyone who is not enrolled in a five-star Medicare Advantage plan (the highest Medicare Star Rating) ...

Is Medicare Advantage plan going to drop?

Medicare Advantage plan prices should remain stable or possibly drop. The number of available Medicare Advantage plan options in the U.S. is on the rise. In 2012, there were a total of 1,974 Medicare Advantage plans available nationwide. By 2020, that number increased to 3,148.

Who is the CEO of UnitedHealthcare?

Steven Nelson, CEO of Medicare Advantage plan provider UnitedHealthcare, predicted that 50% of seniors will soon be enrolled in a Medicare Advantage plan. 4.

What percentage of Medicare beneficiaries live in a county?

Nationally, 29 percent of Medicare beneficiaries live in a county where more than half of all Medicare beneficiaries are enrolled in MA plans. RELATED: The 2021 ‘State of Medicare Advantage’: 7 findings from BMA’s annual report.

How many people will be covered by MA plans in 2021?

MA plans now cover more than 4 in 10 Medicare beneficiaries, more than double the enrollment over the past decade, according to a new KFF analysis. More than 26 million of the country’s nearly 63 million Medicare beneficiaries enrolled in MA plans in 2021.

What is KFF in Medicare?

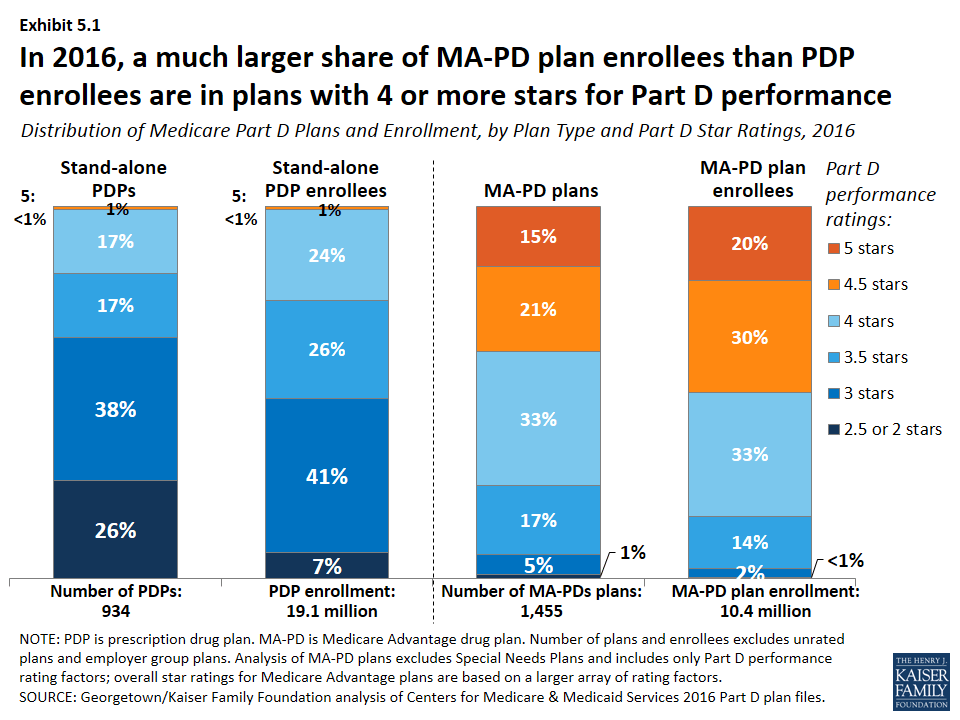

Three Kaiser Family Foundation (KFF) analyses examine the latest data trends in Medicare Advantage (MA). Among the findings: Enrollment is way up, premiums have dropped, and more members are in plans with Star ratings of 4 or higher.

Plan Offerings in 2022

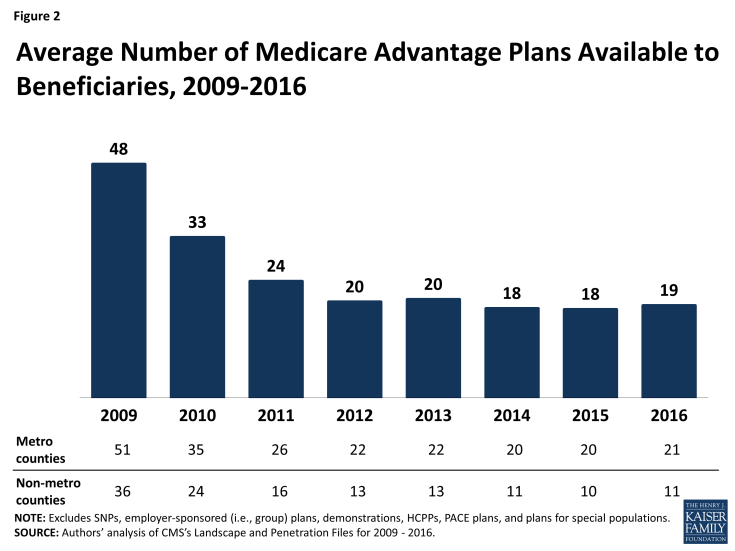

Number of Plans Available to Beneficiaries. For 2022, the average Medicare beneficiary has access to 39 Medicare Advantage plans, more than double the number of plans per person in 2017, and the largest number of options available in more than a decade (Figure 1).

Access to Medicare Advantage Plans, by Plan Type

As in recent years, virtually all Medicare beneficiaries (99.7%) have access to a Medicare Advantage plan as an alternative to traditional Medicare, including almost all beneficiaries in metropolitan areas (99.99%) and the vast majority of beneficiaries in non-metropolitan areas (98.4%).

Number of Firms

The average Medicare beneficiary is able to choose from plans offered by 9 firms in 2022, one more than in 2021 (Figure 6). Despite most beneficiaries having access to plans operated by several different firms, enrollment is concentrated in plans operated by UnitedHealthcare, Humana, and Blue Cross Blue Shield affiliates.

New Market Entrants and Exits

Medicare Advantage continues to be an attractive market for insurers, with 20 firms entering the market for the first time in 2022, collectively accounting for about 19 percent of the growth in the number of plans available for general enrollment and about 6 percent of the growth in SNPs ( Appendix Table 2 ).

Premiums

The vast majority of Medicare Advantage plans for individual enrollment (89%) will include prescription drug coverage (MA-PDs), and 59 percent of these plans will charge no premium, other than the Part B premium, somewhat higher than 2021 (54 percent).

Extra Benefits

Medicare Advantage plans may provide extra benefits that are not available in traditional Medicare, are considered “primarily health related,” and can use rebate dollars (including bonus payments) to help cover the cost of these extra benefits.

Discussion

More Medicare Advantage plans are being offered for 2022 than in any other year. Twenty insurers are entering the Medicare Advantage market for the first time, and seven insurers are exiting the market, suggesting that Medicare Advantage remains an attractive, profitable market for insurers.

Best of the Blues: Highmark

Service area: Available in Delaware, New York, Pennsylvania and West Virginia.

How to shop for Medicare Advantage plans

The right Medicare Advantage plan for you will depend on your health history, prescription medications and where you live, among other things. Here are some strategies for selecting the best plan:

How many baby boomers are delaying Medicare?

In addition, currently around 40 percent of baby boomers are delaying their enrollment into Medicare until after the end of their initial enrollment period. These consumers look and act differently than enrollees who enter Medicare on time.

Will baby boomers be on Medicare?

Baby boomers and Medicare. While leading-edge baby boomers have already aged into the Medicare program, the tailwind of baby boomers will continue to come into the Medicare space for the next eight or so years, notes Brousseau. Health plans need to prepare for these trailing edge baby boomers to enter Medicare and make sure they are targeting them ...

Is there a guarantee that Medicare beneficiaries will stay in their plan?

MA plan switching. There is no longer a guarantee that a Medicare beneficiary will stay in your plan even after enrollment during the Annual Election Period (AEP). Brousseau notes that after a three-year decline, the MA switch rates spiked during the 2019 Medicare AEP. Even then some had buyer’s remorse.

Plan Offerings in 2022

Access to Medicare Advantage Plans, by Plan Type

Number of Firms

- The average Medicare beneficiary is able to choose from plans offered by 9 firms in 2022, one more than in 2021 (Figure 6). Despite most beneficiaries having access to plans operated by several different firms, enrollment is concentratedin plans operated by UnitedHealthcare, Humana, and Blue Cross Blue Shield affiliates. Together, UnitedHealthcare and Humana accoun…

New Market Entrants and Exits

- Medicare Advantage continues to be an attractive market for insurers, with 20 firms entering the market for the first time in 2022, collectively accounting for about 19 percent of the growth in the number of plans available for general enrollment and about 6 percent of the growth in SNPs (Appendix Table 2). Thirteen new entrants are offering HMOs available for individual enrollment…

Premiums

- The vast majority of Medicare Advantage plans for individual enrollment (89%) will include prescription drug coverage (MA-PDs), and 59 percent of these plans will charge no premium, other than the Part B premium, somewhat higher than 2021 (54 percent). More than nine out of ten beneficiaries (98%) have access to a MA-PD with no monthly premium in 2...

Extra Benefits

- Medicare Advantage plans may provide extra benefitsthat are not available in traditional Medicare, are considered “primarily health related,” and can use rebate dollars (including bonus payments) to help cover the cost of these extra benefits. Beginning in 2019, CMS expanded the definition of “primarily health related” to allow Medicare Advantage plans to offer additional sup…

Discussion

- More Medicare Advantage plans are being offered for 2022 than in any other year. Twenty insurers are entering the Medicare Advantage market for the first time, and seven insurers are exiting the market, suggesting that Medicare Advantage remains an attractive, profitable market for insurers. Overall, more than 99 percent of beneficiaries will have access to one or more Medi…