When does the Medicare benefit period end?

Nov 02, 2021 · On November 2, 2021, the Centers for Medicare & Medicaid Services (CMS) issued a final rule that includes updates on policy changes for Medicare payments under the Physician Fee Schedule (PFS), and other Medicare Part B issues, on or after January 1, 2022. The …

When are Medicare Advantage open enrollment periods 2020?

Oct 27, 2015 · As of 2022, your Medicare benefits would not begin until July 1. 1 However, CMS has proposed a new rule that could change that starting on January 1, 2023. Anyone using the General Enrollment after that date would start to received benefits the month after they signed …

When is the Medicare Part D disclosure due?

January 1 – March 31, 2020 Annual Medicare Advantage Open Enrollment Period. January 7, 2020 Contract Year (CY) 2021 Initial and Service Area Expansion Applications for MA/MA-PD/PDP, MMP, SNP, EGWP, and 1876 Cost Plan Expansion Applications are posted on the CMS website. …

When does my Medicare deductible reset?

Medicare benefit periods mostly pertain to Part A, which is the part of original Medicare that covers hospital and skilled nursing facility care. Medicare defines benefit periods to help you ...

Does Medicare start on your birthday or beginning of the month?

Does Medicare coverage start the month you turn 65?

Does Medicare deductible start over every year?

What is the difference between plan year and calendar year?

Can I change my Medicare Part B start date?

How do I enroll in Medicare for the first time?

Is Medicare a calendar year plan?

What is the difference between calendar year and benefit year?

What is calendar year deductible?

What is considered a calendar year?

What is calendar year out-of-pocket maximum?

What does per calendar year mean in insurance?

When will Medicare enroll in Social Security?

The Social Security Administration will automatically enroll you in Medicare on the 25th month. If you miss your IEP, you will have to wait to enroll for Medicare during the next General Enrollment Period.

When is the 5 star enrollment period for Medicare?

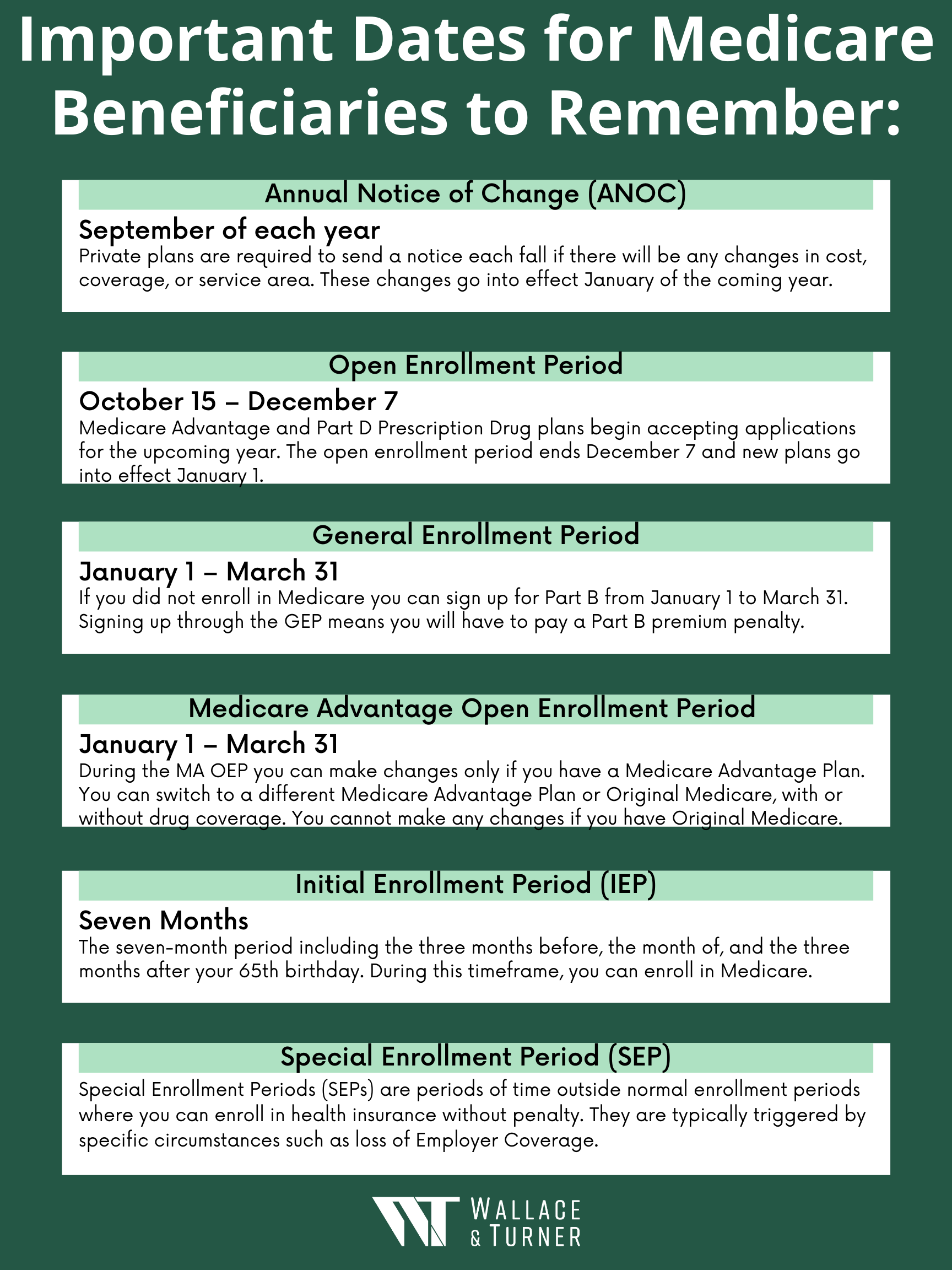

Five Star Enrollment Period. December 8 - November 30. If you want to sign up for a Five-Star Medicare Advantage plan or a Part D plan, you can do so from December 8 after the plan earns its Five-Star rating to November 30 of the following year. You have the option of doing this only once a year.

Is it hard to enroll in Medicare 2020?

Updated on October 19, 2020. Enrolling in Medicare or changing Medicare plans is not hard but knowing when you can do it can be confusing. There are a number of Medicare enrollment periods throughout the year but only a few that may apply to your situation. This calendar will help you to keep them straight.

Is it hard to change Medicare?

Enrolling in Medicare or changing Medicare plans is not hard but knowing when you can do it can be confusing. There are a number of Medicare enrollment periods throughout the year but only a few that may apply to your situation. This calendar will help you to keep them straight.

What is an IEP for Medicare?

First and foremost, you have to understand your Initial Enrollment Period (IEP). This is when you first apply for Medicare. Your IEP dates will vary based on your personal circumstances. Missing your IEP could result in your having to pay late penalties .

When do you get Medicare if you turn 65?

Based on age: You are eligible for Medicare when you turn 65 years old. Your IEP begins three months before and ends three months after your 65th birthday. Based on employer-sponsored health coverage: If you are 65 years old and have health coverage through an employer who hires at least 20 full-time employees, ...

How long can you be on Medicare if you don't have ESRD?

Based on end-stage renal disease: Even if you don't enroll in Medicare for ESRD right away, once you do, you may be eligible for up to 12 months of retroactive coverage. Based on disability with SSDI: You are eligible for Medicare after receiving SSDI benefits for 24 months.

What is Medicare benefit period?

Medicare benefit periods mostly pertain to Part A , which is the part of original Medicare that covers hospital and skilled nursing facility care. Medicare defines benefit periods to help you identify your portion of the costs. This amount is based on the length of your stay.

Is Medicare benefit period confusing?

Certainly, Medicare benefit periods can be confusing. If you have specific questions regarding Medicare Part A costs and how a service you need will be covered, you can contact these sources for help:

How long does Medicare Advantage last?

Takeaway. Medicare benefit periods usually involve Part A (hospital care). A period begins with an inpatient stay and ends after you’ve been out of the facility for at least 60 days.

How long does Medicare benefit last after discharge?

Then, when you haven’t been in the hospital or a skilled nursing facility for at least 60 days after being discharged, the benefit period ends. Keep reading to learn more about Medicare benefit periods and how they affect the amount you’ll pay for inpatient care. Share on Pinterest.

What facilities does Medicare Part A cover?

Some of the facilities that Medicare Part A benefits apply to include: hospital. acute care or inpatient rehabilitation facility. skilled nursing facility. hospice. If you have Medicare Advantage (Part C) instead of original Medicare, your benefit periods may differ from those in Medicare Part A.

How much is Medicare deductible for 2021?

Here’s what you’ll pay in 2021: Initial deductible. Your deductible during each benefit period is $1,484. After you pay this amount, Medicare starts covering the costs. Days 1 through 60.

Does Medicare require post acute care?

Trusted Source. of people with Medicare require post-acute care after a hospital stay – for example, at a skilled nursing facility. Coinsurance costs work a little differently when you’re admitted to a skilled nursing facility. Here is the breakdown of those costs in 2021:

Is disclosure required for Medicare?

The disclosure is required whether the coverage is primary or secondary to Medicare. A Safe Assumption – If you are an employer sponsoring a group health plan with prescription drug coverage, this disclosure requirement likely applies to you.

How many days do you have to disclose a prescription drug plan?

The disclosure must be completed: Within sixty (60) days after the first day of the plan year (this is March 2, 2021 for calendar-year plans); Within thirty (30) days of a mid-year change in the prescription drug plan’s status (from creditable to non-creditable or vice versa); and.

Who is subject to Medicare Part D disclosure?

Employers who offer group health plans with prescription drug coverage that cover Medicare eligible employees, retirees, spouses, or dependents are subject to the Medicare Part D disclosure (and notification [1]) requirements. The disclosure is required whether the coverage is primary or secondary to Medicare.

When does Medicare deductible reset?

Your Medicare deductible resets on January 1 of each year. The Medicare deductible is based on each calendar year, meaning that it lasts from January 1-December 31, and then it resets for the new year.

How many Medicare Supplement Plans are there?

There is a way to avoid paying Medicare deductibles, which is to have a Medicare Supplement – also called a Medigap plan. There are 11 total Medicare Supplement plans, and each one varies in terms of price and benefits. The 3 most popular plans are Plan F, Plan G, and Plan N, because they provide the most coverage.

Does Medicare Supplement pay for deductible?

However, many of the Medicare Supplement plans help pay for your Medicare deductibles. If you’re on a Medicare Advantage plan, your deductible will vary depending on where you live and which plan you’re enrolled in. Your agent will be able to confirm your plan’s benefits.

When does a calendar year end?

A calendar year is the one-year period that begins on January 1 and ends on December 31. The following chart provides guidance on when to split a claim by provider specialty or by federal fiscal year or calendar year in these situations. Provider Type. Provider Fiscal Year End. Federal Fiscal Year End.

When does the fiscal year end?

A fiscal year end can be the end of any quarter — March 31, June 30, September 30, or December 31. The federal fiscal year is the 12-month period ending on September 30 of that year, having begun October 1 of the previous calendar year. A calendar year is the one-year period that begins on January 1 and ends on December 31.

How many months does an inpatient hospital stay in fiscal year?

There are times when an inpatient admission may cross over the provider’s fiscal year end, the federal fiscal year end or calendar year end. The fiscal year is any 12 consecutive months chosen to be the official accounting period by a business or organization.

When does the benefit period end?

The benefit period ends when 60 days have passed since you last received either hospital care or care from a skilled nursing facility.

When does deductible reset for hospitalization?

Once you meet it, your plan will pay all or part of your costs for the remainder of the year, but then your deductible resets on January 1. So if you happen to be hospitalized from December 30 to January 2, you’d have to pay two deductibles with most non-Medicare plans.

Why is a benefit period important?

The concept of a benefit period is important because the Medicare Part A deductible is based on the benefit period, rather than a calendar year. With most other types of health insurance (ie, non-Medicare), the deductible is based on the calendar year. Once you meet it, your plan will pay all or part of your costs for the remainder of the year, ...

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022.