What are UnitedHealthcare Medicare Advantage plans?

Many Medicare Advantage plans (also called Medicare Part C) offer additional benefits that Medicare Part A and Part B don’t cover. What Do UnitedHealthcare Medicare Advantage Plans Cover? Not all UnitedHealthcare Medicare Advantage plans are available in all locations, and plan programs and service availability can vary by plan and service area.

Does UnitedHealthcare offer Medicare in my state?

UnitedHealthcare offers Medicare Advantage plans and Medicare prescription drug plans in all 50 states and Washington, D.C. Altogether, UnitedHealthcare offers plans in 2,377 counties, or 74% of counties in the U.S. — the second-highest number among providers (Humana tops the list) [2].

How many Medicare beneficiaries does UnitedHealthcare have?

Overall, UnitedHealthcare is the largest health insurer in the country. More than 7.3 million Medicare beneficiaries are enrolled in a UnitedHealthcare Medicare Advantage plan, and the company added 827,000 new members for the 2021 plan year.

Is UnitedHealthcare a good insurance company?

Highly rated plans: UnitedHealthcare has 56 contracts rated 4 stars or higher by the Centers for Medicare and Medicaid Services, and none of its plans scored below 3.5 stars. Home benefits: UnitedHealthcare offers $0 copay telehealth visits, as well as annual home health visits for members who need a house call.

Which Medicare plan is the most popular?

The Bottom Line Plan F, Plan G, and Plan N are the most popular plans because they ensure predictable out-of-pocket Medicare costs. No matter which of these plans you choose, you know how much you'll pay when you receive healthcare.

Is UnitedHealthcare a good Medicare plan?

Overall ratings of AARP/UnitedHealthcare Medicare Advantage plans are good, and the company has an average of 4.2 out of five stars. That's slightly ahead of other national providers including Blue Cross Blue Shield, Humana and Aetna, which average between 4.1 and 3.9 stars.

Why does AARP recommend UnitedHealthcare?

AARP UnitedHealthcare Medicare Advantage plans have extensive disease management programs to help beneficiaries stay on top of chronic conditions — hopefully reducing future health-care costs. Many plans also feature a lengthy roster of preventive care services with a $0 copay.

Is AARP UnitedHealthcare good?

On Better Business Bureau (BBB), both UnitedHealthcare and AARP receive an A+ rating, but their online customer reviews on the platform are low, scoring 1.06 to 1.28 out of 5.

What are the pros and cons of UnitedHealthcare?

Pros and Cons of AARP UnitedHealthcare Medicare AdvantageProsConsThe $0 premium and $0 deductible plans are available in most areas.PPO plan premiums are slightly higher than average in some areas.Most plans include Part D plus generous extra benefits, including dental, vision, nurse hotline, and fitness membership.2 more rows•Oct 21, 2020

Is UnitedHealthcare a good plan for seniors?

Medicare rating: 3.5 stars UnitedHealthcare's Medicare plans received a 3.5 overall quality rating for their health and drug plan services in 2021 from the Centers for Medicare & Medicaid Services (CMS).

Does AARP own UnitedHealthcare?

UnitedHealth Group not only owns UnitedHealthcare, it also owns one of the country's largest PBMs, OptumRx, with whom AARP also has a revenue-generating, branded prescription drug plan.

Is AARP Medicare Advantage Choice PPO a good plan?

AARP Medicare star ratings Based on the most recent year of data, AARP Medicare Advantage plans get an average rating of 4.2, which is the same average as UnitedHealthcare's plans overall [5]. For comparison, the average star rating for plans from all providers in 2022 is 4.37 [6].

Is AARP Medicare Advantage the same as UnitedHealthcare?

AARP Medicare Supplement plans are insured by UnitedHealthcare Insurance Company and endorsed by AARP.

What is the difference between AARP Medicare Complete and AARP Medicare Advantage?

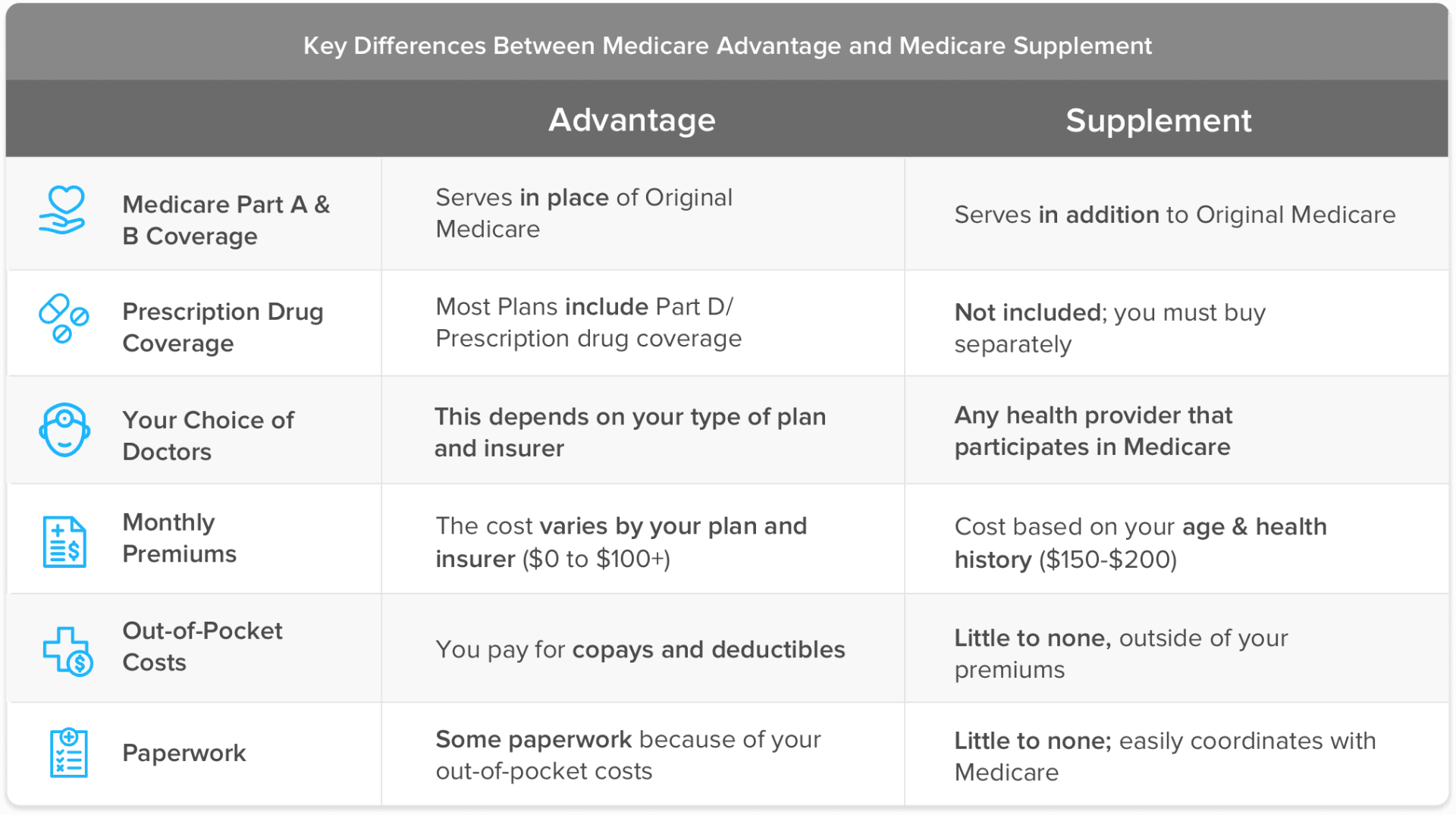

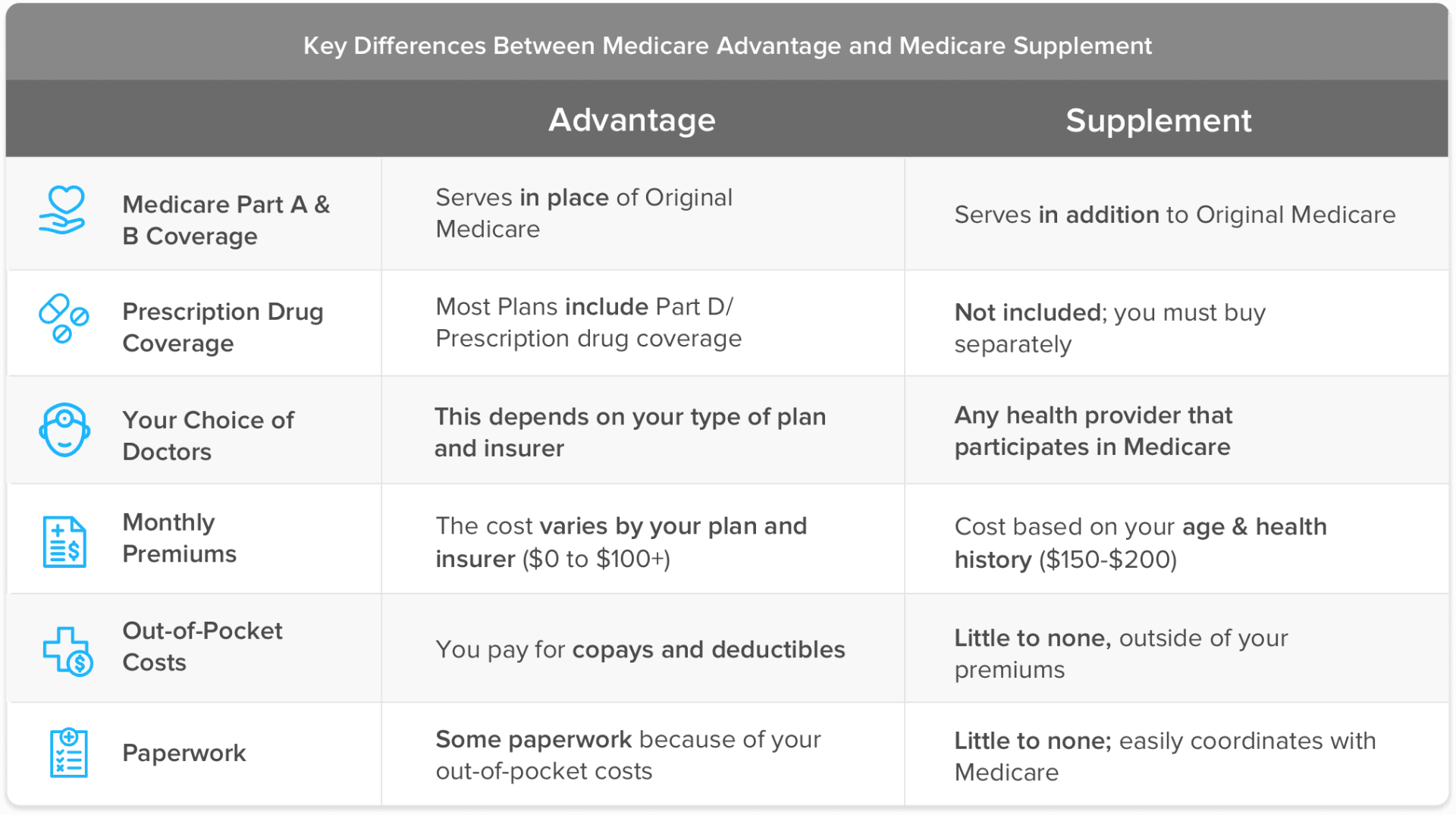

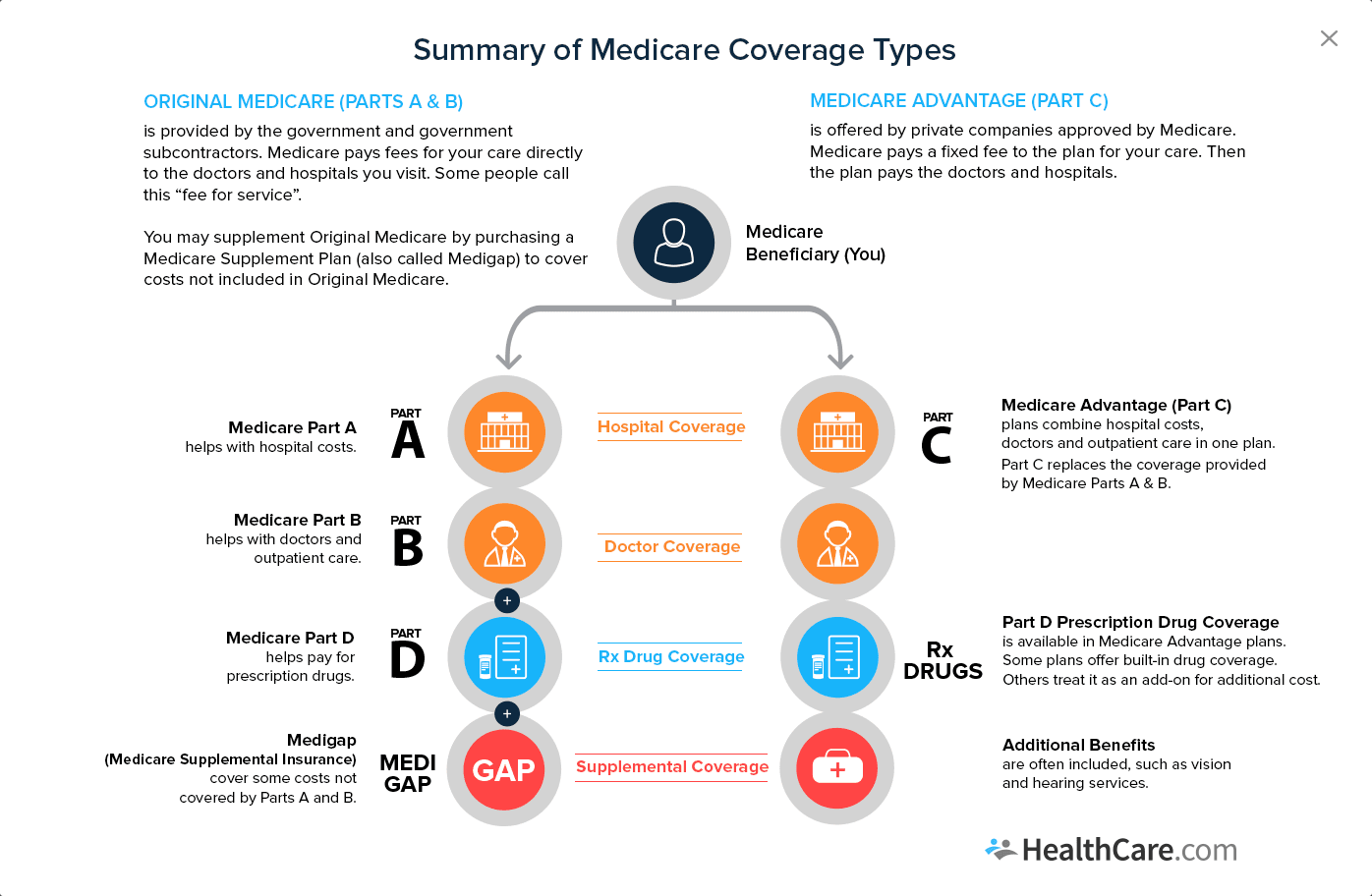

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What is the deductible for UnitedHealthcare Plan G?

The standard version of Plan G has no deductible, which means your Plan G coverage will begin with the very first dollar spent on covered care. The high-deductible version features a deductible of $2,370 (in 2021) that must be met before the plan coverage kicks in.

How do I choose a Medicare Advantage plan?

Factors to consider when choosing a Medicare Advantage plancosts that fit your budget and needs.a list of in-network providers that includes any doctor(s) that you would like to keep.coverage for services and medications that you know you'll need.Centers for Medicare & Medicaid Services (CMS) star rating.

What is Medicare Advantage Plan?

Many Medicare Advantage plans (also called Medicare Part C) offer additional benefits that Medicare Part A and Part B don’t cover. According to the Kaiser Family Foundation, 25 percent of all Medicare Advantage plan beneficiaries in 2018 were members of a Medicare Advantage plan from UnitedHealthcare.2.

What are the services covered by UnitedHealthcare?

Flu shots. These are just a few of the preventive services covered by your UnitedHealthcare Medicare Advantage plan. Depending on your plan and location, you may also have access to: Disease management programs. Health management programs. Alternative care services. Fitness program. Seasonal flu shot information.

What percent of Medicare beneficiaries are members of UnitedHealthcare?

Fitness and wellness programs. According to the Kaiser Family Foundation, 25 percent of all Medicare Advantage plan beneficiaries in 2018 were members of a Medicare Advantage plan from UnitedHealthcare.2.

What is the number to enroll in UnitedHealthcare?

Learn more about UnitedHealthcare Medicare Advantage plan options and find plans that may be available in your area. Call. 1-855-580-1854.

Can you get out of network with UnitedHealthcare?

Some plans allow you to receive out-of-network care, but it may come with higher out-of-pocket costs. Not all plans are available in all areas.

Best of the Blues: Highmark

Service area: Available in Delaware, New York, Pennsylvania and West Virginia.

How to shop for Medicare Advantage plans

The right Medicare Advantage plan for you will depend on your health history, prescription medications and where you live, among other things. Here are some strategies for selecting the best plan:

What are the benefits of UnitedHealthcare?

What are the benefits of Medicare Advantage plans from UnitedHealthcare? All UnitedHealthcare Medicare Advantage plans offer ways to help members to connect to the care they need. Plan benefits and features may include help finding a doctor, getting a ride to appointments , or talking to a nurse 24/7. Find a Medicare Advantage plan that may be right ...

What does Medicare Advantage cover?

What do Medicare Advantage (Part C) plans cover? Medicare Advantage plans are required to offer all the benefits included in Original Medicare (except hospice care which continues to be covered by Part A). These plans combine coverage for hospital (Part A) and doctor (Part B) visits all in one plan. Many Medicare Advantage plans also include ...

Does Medicare Advantage include prescriptions?

Many Medicare Advantage plans also include prescription drug coverage (Part D). You may also find plans that offer additional benefits like routine eye and dental care coverage not offered by Original Medicare.

What Is Medicare Advantage?

Medicare Advantage is an all-in-one plan choice alternative for receiving Medicare benefits. You may also hear it referred to as Medicare Part C. This plan is bundled with Medicare Part A and Part B and usually includes Part D, which provides prescription drug coverage.

The Average Cost of a Medicare Advantage Plan

Some Medicare Advantage plans may have lower out-of-pocket costs than Original Medicare, and some have a $0 monthly premium. Here are a few questions to consider before purchasing a plan.

Types of Medicare Advantage Plans

There are four common types of Medicare Advantage plans to compare when making your selection.

Medicare Advantage vs. Original Medicare

Consider the following details when deciding whether a Medicare Advantage plan or Original Medicare is best for you.

Methodology

To determine the best Medicare Advantage providers of 2021, the Forbes Health editorial team evaluated all insurance companies that offer plans nationwide in terms of:

What is Medicare Advantage?

Medicare Advantage plans are a different way to get Original Medicare coverage. Original Medicare has Part A and Part B. Part A covers your hospital costs while Part B covers your doctor visits and other outpatient services. UnitedHealthcare Medicare Advantage plans combine Part A and Part B coverage and may cover additional services as well. For example, some plans include routine vision, hearing, or dental care. Many plans also include Part D prescription drug coverage. Look for a plan that covers the services you need.

What are the costs of United Health Care?

Most UnitedHealthcare Medicare Advantage plans have out-of-pocket costs. Some of the costs might include: 1 Premiums – Some plans have a monthly cost called a premium 2 Deductible- Some plans have a medical deductible for certain services, which you pay each year before the plan begins to pay 3 Copayment or Coinsurance – This is a type of cost sharing that you pay when you receive a service or prescription

What is a PPO plan?

One popular choice is a UnitedHealthcare Medicare Advantage PPO. PPO stands for Preferred Provider Organization. These plans have networks of providers. If you use a provider in the network, your costs are usually lower. You can also visit any out-of-network provider nationwide that accepts Medicare, but the cost may be higher.