You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) one-half of your benefits, plus (2) all of your other income, including tax-exempt interest, is greater than the base amount for your filing status.

Full Answer

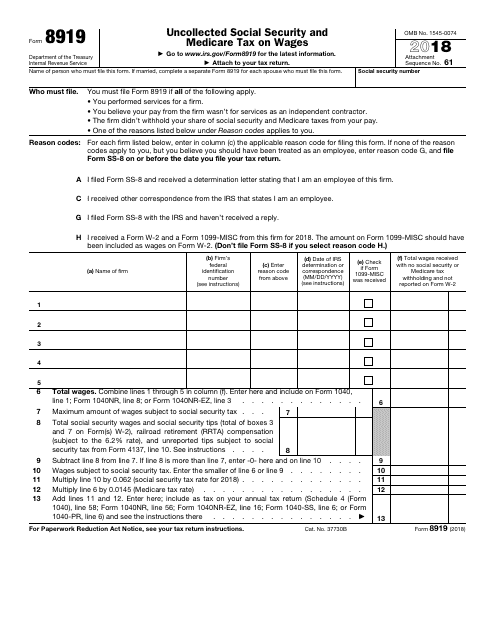

Where do I enter excess Social Security withholding on 1040?

The excess is your total Social Security withholding minus the maximum. Enter this on line 10 of Schedule 3, and transfer the total from Schedule 3 to line 31 of your Form 1040. You can skip this line if your total is less than the maximum.

Where do I enter the tax on form 1040-nr?

If you are filing Form 1040-NR, enter the tax from the Tax Table, Tax Computation Worksheet, Qualified Dividends and Capital Gain Tax Worksheet, Schedule D Tax Worksheet, Schedule J (Form 1040), or Form 8615 on Form 1040-NR, line 16; and the tax on the noneffectively connected income on Form 1040-NR, line 23a.

How do I show Total tax withheld on form 1040-nr-ez?

When filing Form 1040-NR-EZ, show the total tax withheld on lines 18a and 18b. Enter the amount from the attached statement (Form 1040 or 1040-SR, line 17) in the column to the right of line 18a, and identify and include it in the amount on line 18a. 2. Estimated tax paid with Form 1040-ES or Form 1040-ES (NR). 3.

Do employers have to pay Social Security and Medicare taxes?

Employers share the Social Security and Medicare tax obligation equally with their employees. The employer and the employee each must pay 6.2 percent of an employee’s compensation for Social Security up to a salary of $90,000 (in 2005).

Where does Social Security tax go on Form 1040?

The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099, Social Security Benefit Statement, and you report that amount on line 6a of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors.

Are Medicare and Social Security included in federal taxes?

An employer's federal payroll tax responsibilities include withholding from an employee's compensation and paying an employer's contribution for Social Security and Medicare taxes under the Federal Insurance Contributions Act (FICA).

Can 1040NR claim standard deduction?

U.S. nonresident aliens filing Form 1040NR cannot use the standard deduction nor all the itemized deductions afforded to U.S. resident aliens, nor can they file jointly if married. Additionally, the claiming of exemptions for dependents by nonresident aliens is much more difficult.

How do I report 1099 R on 1040NR?

Form 1040NR. Report the entire amount from box 1 (Gross distribution) of Form 1099-R on line 17a, and the taxable amount on line 17b. If your pension or annuity is fully taxable, enter the amount from box 2a (Taxable amount) of Form 1099-R on line 17b; do not make an entry on line 17a.

Where does Medicare tax withheld go on 1040?

Line 5a in Part I of Form 1040-SS. Line 5a in Part I of Form 1040-PR. Use Part V to figure the amount of Additional Medicare Tax on wages and RRTA compensation withheld by your employer.

How do international students get Social Security and Medicare tax refunds?

You must contact the employer who withheld the Social Security/Medicare tax for assistance. Inform your employer of the Social Security/Medicare exemption for nonresident alien students working on OPT or CPT, and ask the employer to issue a refund of your Social Security/Medicare tax.

Can non resident alien use standard deduction?

If you are a nonresident alien, you cannot claim the standard deduction. However, students and business apprentices from India may be eligible to claim the standard deduction under Article 21 of the U.S.A.-India Income Tax Treaty.

Can I use direct pay for 1040NR?

You can pay using any of the following methods. IRS Direct Pay. For online transfers directly from your checking or savings account at a U.S. bank or other financial institution in the United States at no cost to you, go to irs.gov/payments. Pay by Card.

Are nonresident aliens subject to state taxes?

Nonresident aliens are required to pay income tax only on income that is earned in the U.S. or earned from a U.S. source. 2 They do not have to pay tax on foreign-earned income.

When a taxpayer receives Form 1099-R with no amount entered in Box 2a and Code 7 entered in Box 7?

When a taxpayer receives form 1099R with no amount entered in box 2a and a 7 in box 7 the entire distribution is handled how? No, you are correct, you can't report your 1099-R in your Federal Return to claim State Tax Paid with $0 in Box 1.

Where does Form 1099-R go on tax return?

You'll most likely report amounts from Form 1099-R as ordinary income on line 4b and 5b of the Form 1040. The 1099-R form is an informational return, which means you'll use it to report income on your federal tax return.

What is distribution code G on 1099-R?

Distribution code G on your 1099-R indicates that your WRS benefit was rolled over to another qualified plan. In most cases, your 1099-R will show $0.00 as the taxable amount in Box 2a, unless you rolled over your distribution to a Roth IRA.

When do you file a 1040-NR?

Owner, on or before the 15th day of the 3rd month after the end of the trust’s tax year. For more information, see the Instructions for Form 3520-A.

What chapter is 1040-NR?

If you are filing Form 1040-NR for a nonresident alien estate or trust, change the form to reflect the provisions of subchapter J, chapter 1 , of the Internal Revenue Code. You may find it helpful to refer to Form 1041 and its instructions for some purposes when completing the Form 1040-NR rather than looking to these instructions for details.

How long does it take to get a 1040X amended?

Go to IRS.gov/WMAR to track the status of Form 1040-X amended returns. Please note that it can take up to 3 weeks from the date you mailed your amended return for it to show up in our system, and processing it can take up to 16 weeks.

What to include when claiming a refund from portfolio interest?

tax withheld from portfolio interest, include a description of the relevant debt obligation, including the name of the issuer, CUSIP number (if any), interest rate, and the date the debt was issued.

How to get a copy of my tax return?

The quickest way to get a copy of your tax transcript is to go to IRS.gov/Transcripts. Click on either "Get Transcript Online" or "Get Transcript by Mail" to order a copy of your transcript. If you prefer, you can order your transcript by calling 800-908-9946.

Is a payment of gross proceeds from a securities contract subject to U.S. tax?

Payments of gross proceeds from the sale of securities or regulated futures contracts are generally exempt from U.S. tax. If you received such payments and they were subjected to backup withholding, specify the type of payment on line 12 and show the amount in column (d).

Is my income tax exempt from 2020?

Your income is exempt from U.S. tax under a tax treaty or any section of the Internal Revenue Code. However, if you have no gross income* for 2020, do not complete the schedules for Form 1040-NR other than Schedule OI (Form 1040-NR). Instead, attach a list of the kinds of exclusions you claim and the amount of each.

What line do you report 1040?

Add up all the amounts that appear on Form 1040 lines 16 through 32. Report the total on line 33. This amount represents your total tax payments throughout the year.

What line is the 1040 for 2021?

Updated March 01, 2021. Completing IRS Form 1040 isn't just about tallying up all the sources of income you earned during the year. It records your tax payments as well on lines 25 through 32 of your 2020 tax return. They're totaled on line 33 and applied to your total tax due.

What is the American Opportunity Tax Credit?

The American Opportunity Tax Credit is for educational costs you paid on behalf of you, your spouse, or any of your dependents. You can calculate it by completing Form 8863. The amount of the credit you're entitled to appears on line 8 of Form 8863, and you would enter this amount on line 29 of your 1040 tax return.

How many times has the 1040 been redesigned?

The 2020 Form 1040 is significantly different from the ones that were used for tax years 2017 and earlier. The IRS has redesigned three times beginning in 2018. 1 All lines and boxes cited here refer to the 2020 version of the form.

What is the tax withheld from 1099?

Withholding on 1099 Income. Income tax isn't withheld from 1099 income in most cases, but some income sources from which it might be include: 1099-G, box 4: Withholding on unemployment income. 1099-R, box 4: Withholding on retirement income. SSA-1099, box 6: Withholding on Social Security benefits.

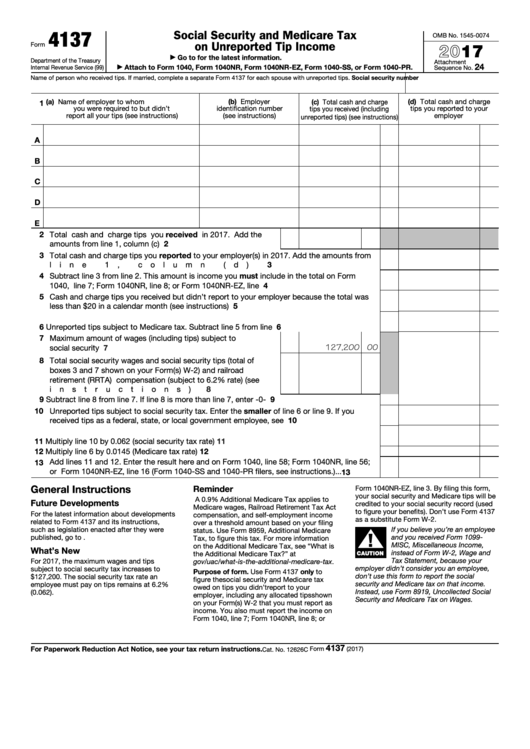

How much is Social Security tax in 2020?

The maximum Social Security tax was $8,537.40 per year in 2020, which represents 6.2% of taxable wages up to that year's Social Security wage base: $137,700. Your employer would match this and pay another 6.2%. 6 . You don't have to pay Social Security tax on wages over the wage base, at least for the current year.

Do you have to pay Social Security taxes on wages?

You don't have to pay Social Security tax on wages over the wage base, at least for the current year. Withholding begins again on January 1 of the new year, however. This maximum limit can increase annually, so make sure you get the right number for the year for which you're filing a tax return.

How much will Social Security be taxed in 2021?

You—and your employer—would pay the Social Security tax on only the first $142,800 in 2021 if you earned $143,000, for example. That remaining $200 is Social Security tax-free. The Social Security tax will apply again on January 1 of the new year until your earnings again reach the taxable minimum.

How are FICA taxes paid?

How FICA Taxes Are Paid. You, the employee, pay half the FICA taxes, which is what you see deducted on your pay stub. Your employer must match these amounts and pay the other half to the government separately at regular intervals. 1 2.

What are the deductions on W-2?

Most W-2 employees' pay stubs detail the taxes and deductions that are taken from their gross pay. You'll almost certainly see two items among these deductions, in addition to federal and state or local income taxes: Social Security and Medicare taxes.

What is the purpose of FICA tax?

The bulk of the FICA tax revenue goes to funding the U.S. government's Social Security trusts. These trusts are solely designated to fund the programs administered by the Social Security Administration, including: Retirement benefits. Survivor benefits.

What is the minimum wage for Social Security in 2021?

Earnings to $200,000 in 2021. Employees are no longer required to pay the Social Security tax in a given year when their earnings hit the contribution and benefits base, often referred to as the “taxable minimum.”.

When did the Medicare tax become effective?

It became effective on November 29, 2013. 5

Can you deduct Medicare taxes from your paycheck?

An Additional Medicare Tax can be deducted from some employees’ pay as well. After federal and state income taxes, Social Security and Medicare, or FICA taxes, make up the bulk of taxes that are routinely withheld from your paychecks.

Why is there no tax withholding on 1099?

You may be wondering why there was no tax withholding on your 1099-NEC form. That's because the payer didn't withhold any taxes from your payments during the year. Employers are not required to withhold federal income taxes from non-employees, except in specific circumstances.

How is personal income tax determined?

Your personal income taxes are determined by your total adjusted gross income. If your business is a partnership, multiple-member LLC, or corporation, your 1099 income is reported as part of your business income tax return.

What is backup withholding?

Sometimes the IRS requires withholding from payments to non-employees. This is called backup withholding, and it happens in specific cases, mostly when the payee's tax ID is missing or incorrect. In these cases, the payer receives a notice from the IRS requiring them to begin backup withholding.#N##N#

What is self employment tax?

For self-employed individuals, these taxes are called self-employment taxes. Self-employment taxes are calculated on the individual's federal income tax return based on the net income from the business, including 1099 income. .

What is the 1099-NEC used for?

For 2020 taxes and beyond, Form 1099-NEC now must be used to report payments to non-employees, including independent contractors. Form 1099-MISC is now bused to report other types of payments.

Do you report 1099 income on Schedule C?

If you are a sole proprietor or single-member LLC owner, you report 1099 income on Schedule C—Profit or Loss From Business. When you complete Schedule C, you report all business income and expenses.

Do employers withhold Social Security taxes?

Employers also do not withhold Social Security and Medicare taxes from non-employees. . . Because no taxes are withheld on 1099 income during the year, you may have to pay quarterly estimated taxes on this income. Failing to pay taxes during the year can result in fines and penalties for underpayment.