What is a Medicare a deductible?

A deductible is the annual amount you pay for covered healthcare services before your Medicare plan starts to pay. Once you've satisfied your deductible, you'll typically only pay a copayment or coinsurance, and Medicare pays the rest.

Does Medicare Advantage have a deductible for prescription drug coverage?

If you have Medicare Advantage (Part C) or prescription drug coverage (Part D), you may or may not have a deductible depending on your plan's design. The Centers for Medicare & Medicaid Services (CMS) recently released the 2022 Medicare deductibles for Parts A and B along with premiums and coinsurance amounts.

How much is Medicare Part B for 2021 and 2022?

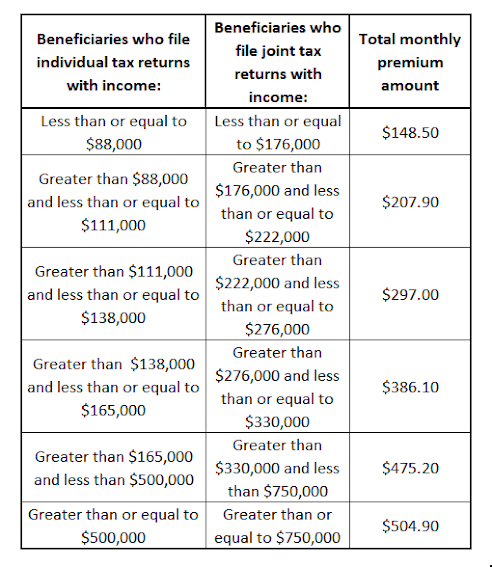

It covers medical treatments and comes with a monthly premium of $148.50 in 2021 and $158.50 in 2022. A small percentage of people will pay more than that amount if they report income greater than $88,000 as single filers, or more than $176,000 as joint filers. Part B also comes with a deductible of $203 per year in 2021 and $217 in 2022.

How much does Medicare cost per month?

In 2021, it costs $259 or $471 each month, depending on how long you paid Medicare taxes. In 2022, you would expect to pay $499 or $274 each month. This doesn’t mean that you're not charged a deductible.

What was the Medicare Part B premium for 2015?

Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.

What was the Medicare deductible in 2014?

$1,216The Medicare Part A deductible that beneficiaries pay when admitted to the hospital will be $1,216 in 2014, an increase of $32 from this year's $1,184 deductible.

What is the deductible for Medicare each year?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How do I find my Medicare deductible?

You can find out if you've met your Medicare Part A or Part B deductible for the year at MyMedicare.gov.

What is the Medicare Part B deductible 2012?

$140In 2012, the Part B deductible will be $140, a decrease of $22 from 2011.

How much did Medicare cost in 2013?

Most people will pay more for this government health care plan for seniors.2011 ADJUSTED GROSS INCOME$85,000 or less (single), $170,000 or less (joint)More than $214,000 (single), more than $428,000 (joint)2013 Medicare Part B monthly premium$104.90$335.702013 Medicare Part D monthly premiumpremium only$66.40 surcharge

What is the 2022 deductible for Medicare?

$233The annual deductible for Medicare Part B will increase by $30 in 2022 to $233, while the standard monthly premium for Medicare Part B will increase by $21.60 to $170.10, CMS announced.

What is the Medicare Plan G deductible for 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

What is the average deductible for Medicare Advantage?

Average Cost of Medicare Advantage Plans in Each StateStateMonthly PremiumPrescription Drug DeductibleCalifornia$48$377Colorado$49$343Connecticut$79$318Delaware$64$23946 more rows•Mar 21, 2022

Does everyone on Medicare have a deductible?

Summary: Medicare Part A and Part B have deductibles you may have to pay. Medicare Part C and Part D may or may not have deductibles, depending on the plan. Original Medicare has two parts: Part A for hospital insurance and Part B for medical insurance.

How do I find out my deductible?

“Your deductible is typically listed on your proof of insurance card or on the declarations page. If your card is missing or you'd rather look somewhere else, try checking your official policy documents. Deductibles are the amount of money that drivers agree to pay before insurance kicks in to cover costs.

Is the Medicare deduction the same for everyone?

Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much is Medicare Part B in 2015?

Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147. The Medicare Part A deductible, which covers the first 60 days of Medicare-covered inpatient hospital care, will rise to $1,260 in 2015, a $44 increase from 2014.

How much is Medicare Advantage going up?

The average premium for a Medicare Advantage plan is going up by about 9.5%, to $33.90 per month (you’re still on the hook for Part B premiums). However, premiums will remain the same for about 61% of people if they elect to stay with the same Medicare Advantage plan.

How long can you open enrollment for Medicare Supplement?

Medicare supplement policies don’t have an annual open-enrollment period; you can buy them anytime. But you usually can be rejected or charged more because of your health if you get the policy more than six months after signing up for Medicare Part B.

2015 Medicare premiums stable but changes to deductibles and coinsurance

The Centers for Medicare and Medicaid has released data on 2015 Medicare premiums, deductibles and coinsurance amounts. Any change in these amounts can either directly or indirectly affect your healthcare costs.

Deductible and coinsurance changes

The Part A deductible will increase $19 in 2015 to $1,260. The Part A deductible must be paid in the event that you are hospitalized. If you are covered by Original Medicare only, this will be your responsibility.

How much is Medicare Part B deductible in 2015?

If you have to pay a higher amount for your Part B premium and you disagree, you can appeal the IRMAA. The 2015 Medicare Part B annual deductible remains $147 (unchanged from 2014 and 2013).

How much is Medicare Advantage premium for 2015?

The 2015 Medicare Advantage plan premiums range from $0 to $348.

What is Medicare Part D 2015?

2015 Part D (Medicare Prescription Drug Plan) Monthly Premium & Deductible. Medicare Prescription Drug Plan (Part D) premiums*, deductibles, and benefits vary by plan and state. Remember that you can receive Part D prescription drug coverage from a stand-alone Medicare Part D plan (PDP) or a Medicare Advantage plan that includes drug coverage ...

How much is the 2015 Part D premium?

The 2015 Part D plan premiums range from $0 to $172. The 2015 standard Part D plan deductible is $320, however the actual plan deductible can be anywhere from $0 to $320 .

Do you pay Social Security if your adjusted gross income is above a certain amount?

However, if your modified adjusted gross income as reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS) is above a certain amount (see chart below), you may pay more.

How much does Medicare pay for a hospital stay in 2021?

Part A also charges coinsurance if your hospital stay lasts more than 60 days. In 2021, for days 61 to 90 of your hospital stay, you pay $371 per day; days 91 through the balance of your lifetime reserve days, you pay $742 per day. 3 Lifetime reserve days are 60 days that Medicare gives you to use if you stay in the hospital for more than 90 days.

How much will Medicare cost in 2021?

In 2021, it costs $259 or $471 each month, depending on how long you paid Medicare taxes. 2 . That doesn’t mean you aren’t charged a deductible. For each benefit period, you pay the first $1,484 in 2021. A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days.

What does Medicare cover?

What you pay for Medicare depends on the type of enrollment you have: Parts A, B, C, and/or D. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. It doesn't generally charge a premium. Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium ...

What is Medicare Part A 2021?

Medicare Part A Costs in 2021. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. 1 For most people, this is the closest thing to free they’ll get from Medicare, as Medicare Part A (generally) doesn't charge a premium. 2 . Tip: If you don't qualify for Part A, you can buy Part A coverage.

What is the Medicare Advantage premium for 2021?

The average plan premium is about $21.00 a month in 2021. 7 . But coinsurance, copayments, premiums, and deductibles may still vary depending on your plan of choice. 3 .

What is the premium for Part B?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. A small percentage of people will pay more than that amount if reporting income greater than $88,000 as single filers or more than $176,000 as joint filers. 3

How long does a hospital benefit last?

A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days . If you re-enter the hospital the day after your benefit period ends, you’re responsible for the first $1,484 of charges again. 3 .

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022.