Medicare Part D Creditable and Non-Creditable status determination is the employer's responsibility when the employer is the plan sponsor. If the carrier states that the health plan is non-creditable, the benefits may still be creditable if the employer has an HRA arrangement. The employer would have to override the carrier notice.

What is not considered creditable coverage under Medicare Part D?

An employer with small group insurance is a company with less than 20 employees and may not be creditable coverage under Medicare. Further, a variety of government programs are also considered creditable coverage. Examples of other types of coverage are individual, group, and student health plans. What is Creditable Coverage for Medicare Part D?

What is creditable coverage and how does it affect Medicare?

Coverage that’s as good as Medicare is creditable coverage, meaning the plan benefits are up to the same standards as Medicare. When a person has creditable coverage, they may postpone enrollment in Medicare.

What is creditable coverage for prescription drugs?

Creditable coverage means the coverage is expected to pay on average as much as the standard Medicare prescription drug coverage. Entities that are required to provide creditable coverage include, but are not limited to: group health plans. department of veterans affairs.

Are VA benefits creditable under Medicare Part D?

VA benefits are only creditable coverage under Part D. VA benefits are NOT creditable under Part A and Part B. This is something that is HIGHLY miscommunicated to veterans. Even if you have medical coverage under the VA, there are still many reasons to enroll in Medicare coverage to work with your VA benefits.

What is considered creditable coverage for Medicare Part D?

Under §423.56(a) of the final regulation, coverage is creditable if the actuarial value of the coverage equals or exceeds the actuarial value of standard prescription drug coverage under Medicare Part D, as demonstrated through the use of generally accepted actuarial principles and in accordance with CMS actuarial ...

What is not considered creditable coverage?

Non-creditable coverage: A health plan's prescription drug coverage is non-creditable when the amount the plan expects to pay, on average, for prescription drugs for individuals covered by the plan in the coming year is less than that which standard Medicare prescription drug coverage would be expected to pay.

What does creditable drug coverage mean?

The Medicare Modernization Act (MMA) requires entities (whose policies include prescription drug coverage) to notify Medicare eligible policyholders whether their prescription drug coverage is creditable coverage, which means that the coverage is expected to pay on average as much as the standard Medicare prescription ...

Can Medicare Part D be denied?

Depending on the reason for the denial, you may be entitled to request an Exception (Coverage Determination); to obtain your drug. If your Coverage Determination is denied, you have the right to Appeal the denial. There are several reasons why your Medicare Part D plan might refuse to cover your drug.

How do I know if my Medicare Part D credit is creditable?

A group health plan's prescription drug coverage is considered creditable if its actuarial value equals or exceeds the actuarial value of standard Medicare Part D prescription drug coverage. Prescription drug coverage that does not meet this standard is called “non-creditable.”

How do I know if I have creditable coverage?

How do I know if I have creditable coverage? In order to be considered creditable, the coverage plan's prescription drug coverage must meet or exceed the value of Medicare Part D. Most companies offering prescription drug coverage are required to disclose their status as creditable or non-creditable coverage programs.

Is GoodRx considered creditable coverage?

GoodRx is also not considered creditable coverage. Therefore if you decide to skip enrolling in Part D in favor of GoodRx or another prescription drug discount program you will have to pay a late enrollment penalty once you decide to enroll in Medicare prescription drug coverage.

Are HSA plans Medicare Part D creditable?

Determining whether a prescription drug plan is creditable However, for qualifying high deductible health plans (HDHPs) offered in connection with a health savings account (HSA), the HDHP may not be creditable unless it is expected to pay, on average, at least 60% of participants' prescription drug expenses.

In what circumstances can the plan make a formulary exception for a non covered prescription?

For formulary exceptions, the prescriber's supporting statement must indicate that the non-formulary drug is necessary for treating an enrollee's condition because all covered Part D drugs on any tier would not be as effective or would have adverse effects, the number of doses under a dose restriction has been or is ...

What is a Tier exception?

A tiering exception request is a way to request lower cost-sharing. For tiering exception requests, you or your doctor must show that drugs for treatment of your condition that are on lower tiers are ineffective or dangerous for you.

What drugs are excluded from Part D plans?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

What is creditable coverage?

The Medicare Modernization Act (MMA) requires entities (whose policies include prescription drug coverage) to notify Medicare eligible policyholders whether their prescription drug coverage is creditable coverage, which means that the coverage is expected to pay on average as much as the standard Medicare prescription drug ...

How long does Medicare have to be in effect to be late?

The MMA imposes a late enrollment penalty on individuals who do not maintain creditable coverage for a period of 63 days or longer following their initial enrollment period for the Medicare prescription drug benefit.

How long does it take to complete a CMS 2nd disclosure?

The Disclosure should be completed annually no later than 60 days from the beginning of a plan year (contract year, renewal year), within 30 days after termination ...

What is creditable coverage?

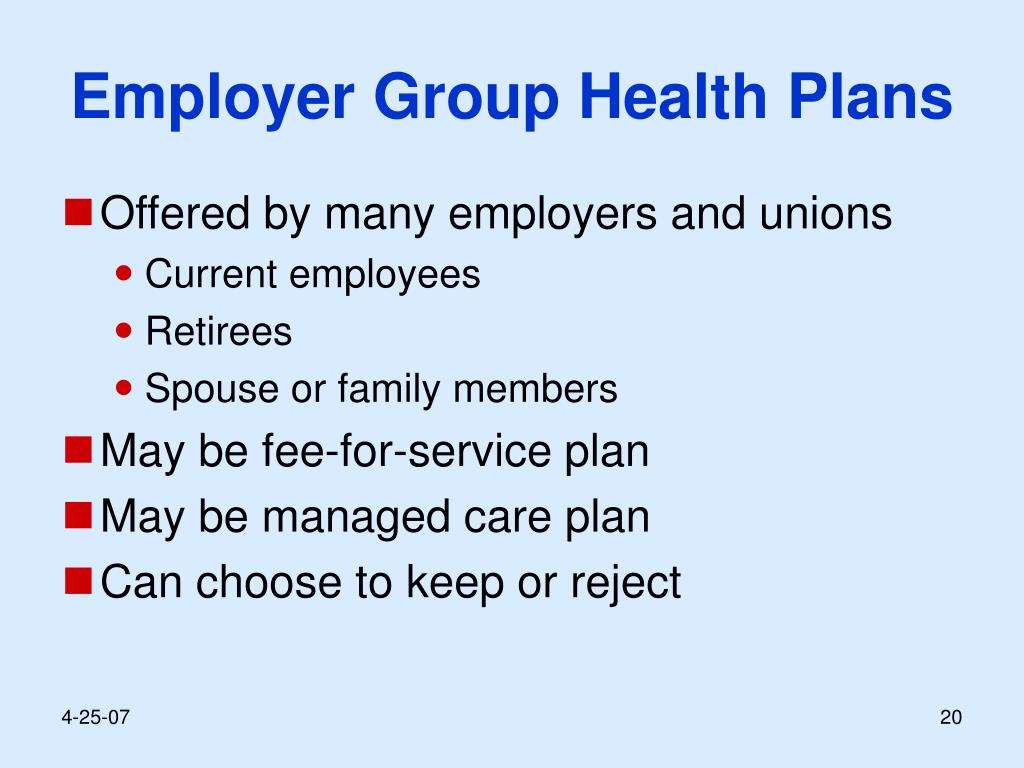

The most common type of creditable coverage is a large employer group plan. Meaning, a company that employs 20 or more people. When working for an employer, you likely receive health coverage through the company. If the company you work for has more than 20 employees, you have creditable coverage for Medicare.

How does a notice of creditable coverage work?

The Notice of Creditable Coverage works as proof that you obtained coverage elsewhere when you first became eligible for Medicare. Your Notice of Creditable Coverage comes in the mail each year for those who obtain drug coverage through an employer or union.

Is VA coverage creditable?

VA benefits are only creditable coverage under Part D. VA benefits are NOT creditable under Part A and Part B. This is something that is HIGHLY miscommunicated to veterans. Even if you have medical coverage under the VA, there are still many reasons to enroll in Medicare coverage to work with your VA benefits.

Is Medicare coverage good for 2021?

Updated on July 12, 2021. Coverage that’s as good as Medicare is creditable coverage, meaning the plan benefits are up to the same standards as Medicare. When a person has creditable coverage, they may postpone enrollment in Medicare. Creditable coverage allows beneficiaries to delay enrolling without worrying about being late enrollment penalties.

Is Part D a creditable plan?

A plan is creditable for Part D as long as it meets four qualifications. Pays at least 60% of the prescription cost. Covers both brand-name and generic medications. Offers a variety of pharmacies. Does not have an annual benefit cap amount, or has a low deductible.

Is FEHB considered creditable?

No, FEHB is NOT considered creditable coverage. However, some beneficiaries choose to still delay enrolling in Medicare when they have FEHB benefits. Some may find the FEHB benefits to be more cost-effective and vice versa.