What is Medicare Part D, and do I need It?

What Is Medicare Part D and Do I Need It? CA Medicare January 19, 2015 Announcement. Medicare Part D is a federal-government program introduced in 2003 to help eligible Medicare recipients get subsidized prescription drug coverage. The plans are sold through private insurance companies (approved by Medicare) and often have an additional premium.

How do you qualify for Medicare Part D?

- Moving outside your plan's service area

- Becoming eligible for Medicaid

- Qualifying for Extra Help with Medicare drug costs

- Receiving facility-based long-term services, such as a skilled nursing facility

What are the benefits of Medicare Part D?

- Monthly premiums

- Annual deductible (maximum of $445 in 2021)

- Copayments (flat fee you pay for each prescription)

- Coinsurance (percentage of the actual cost of the medication)

Should you get Medicare Part D?

When you buy Part D, you are not buying it just for the meds you are using now. You are buying insurance coverage for future drug needs. Part D has a catastrophic coverage limit, and it is the best part of the coverage. It protects Medicare beneficiaries from massive drug spending in any given calendar year.

Can you get Part D on disability?

Can I get Medicare benefits for prescription drugs if I have a disability? Anyone eligible for Medicare benefits is eligible to enroll in a Part D prescription drug plan.

Is disability Medicare different than regular Medicare?

Medicare coverage is the same for people who qualify based on disability as for those who qualify based on age. For those who are eligible, the full range of Medicare benefits are available.

What is Social Security Medicare Part D?

The agency has a specific role in the Medicare Prescription Drug Program (Part D). Social Security takes and decides applications for Extra Help with Medicare Prescription Drug Plan Costs, a provision to subsidize costs for Part D prescription drug plans for qualifying low income applicants.

Does Medicare automatically come with disability?

If you're on SSDI benefits, you won't have to pay a Medicare Part A premium. If you are eligible for Medi-Cal and Medicare, you will automatically be enrolled in Medicare Part D.

What happens to my disability when I turn 65?

Nothing will change. You will continue to receive a monthly check and you do not need to do anything in order to receive your benefits. The SSA will simply change your disability benefit to a retirement benefit once you have reached full retirement age.

How much money can you have in the bank with Social Security disability?

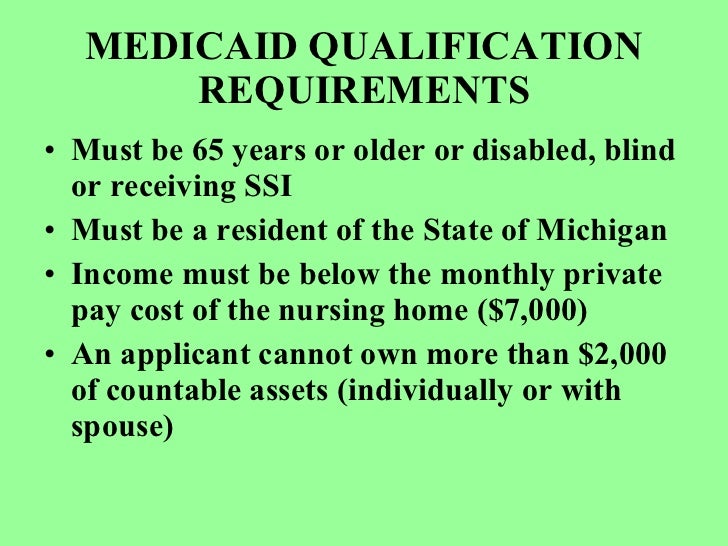

To get SSI, your countable resources must not be worth more than $2,000 for an individual or $3,000 for a couple. We call this the resource limit. Countable resources are the things you own that count toward the resource limit.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

Why is Social Security charging for Part D?

You'll also have to pay this extra amount if you're in a Medicare Advantage Plan that includes drug coverage. If Social Security notifies you about paying a higher amount for your Part D coverage, you're required by law to pay the Part D-Income Related Monthly Adjustment Amount (Part D IRMAA).

Do you have to have Medicare Part D?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

What insurance do you get with Social Security Disability?

Everyone eligible for Social Security Disability Insurance (SSDI) benefits is also eligible for Medicare after a 24-month qualifying period. The first 24 months of disability benefit entitlement is the waiting period for Medicare coverage.

Do people on SSDI pay for Medicare?

If you receive SSDI benefits, when you become eligible for Medicare, Social Security will take money out to pay for Medicare premiums, in most cases. (The fact you were approved for SSDI makes you eligible for Medicare earlier than you otherwise would be (at age 65), but it doesn't pay your premiums.)

How can I increase my Social Security Disability payments?

You can increase Social Security Disability payments by working at least 35 years before retiring, understanding the benefits of working past retirement age, and avoiding Social Security's tax consequences. If you are married, married applicants can maximize their disability payments by claiming their spousal benefits.

How much does Medicare cost on disability?

If you qualify for SSDI, you'll typically qualify for premium-free Medicare Part A based on your work record. Part B requires a monthly premium ($144.60 in 2020), automatically deducted from your Social Security check. You can technically opt out of Part B if you don’t want to pay the premiums. Just know that without Part B, you’ll forego extensive medical coverage. It’s usually not a good idea to opt out of Part B unless you have other health insurance—like from an employer.

How long does it take to get Medicare if denied SSDI?

The result: your wait for Medicare will be shorter than two years.

How long do you have to collect SSDI to get Medicare?

Once you have collected SSDI payments for two years , you will become eligible for Medicare. You won’t even have to sign up—Medicare will automatically enroll you in Part A and Part B and mail your Medicare card to you shortly before your coverage begins.

What is ESRD in Medicare?

ESRD, also known as permanent kidney failure, is a disease in which the kidneys no longer work. Typically, people with ESRD need regular dialysis or a kidney transplant (or both) to survive. Because of this immediate need, Medicare waives the waiting period. 2

What to do if your income is too high for medicaid?

If your income is too high to qualify for Medicaid, try a Medicare Savings Program (MSP), which generally has higher limits for income. As a bonus, if you qualify for an MSP, you automatically qualify for Extra Help, which subsidizes your Part D costs. Contact your state’s Medicaid office for more information.

What conditions are considered to be eligible for Medicare?

Even though most people on Social Security Disability Insurance must wait for Medicare coverage to begin, two conditions might ensure immediate eligibility: end-stage renal disease (ESRD) and Lou Gehrig’s disease (ALS).

How long does a disability last?

The government has a strict definition of disability. For instance, the disability must be expected to last at least one year. Your work history will also be considered—usually, you must have worked for about 10 years but possibly less depending on your age.

How long does a disability last?

You have a disability that is expected to last longer than 12 months. This disability can be for any number of reasons but must be approved for Social Security Disability Insurance (SSDI) to be eligible for Medicare. You cannot sign up for Medicare until you have been on SSDI for 24 months.

What happens if you don't sign up for Medicare?

If you do not sign up yourself, you will be automatically enrolled in Original Medicare and a Part D plan by the government. You will have the option to change to a MA-PD or pick a different Part D plan at a later time. What It Means to Be Dual Eligible for Medicare and Medicaid.

What is MA PD?

There are Medicare Advantage Prescription Drug Plans (MA-PD plans) that include Part D coverage. In summary, you will need to have one of these Medicare plans or combinations to be eligible for Part D coverage: Part D + Part A. Part D + Part B. Part D + Original Medicare (Parts A and B) MA-PD. There are times you may be eligible for Medicare ...

What is the second requirement for Medicare?

The second requirement for Medicare eligibility is to demonstrate medical need. Medicare leaves no room for interpretation here. You will be eligible for the program if you meet at least one of the following criteria.

What is Medicare a federal program?

Medicare is a federal healthcare program that Americans pay into with taxes. It makes sense that the government would want to make sure that you have ties to the country before they allowed you access to that benefit.

Is Medicare and Medicaid the same?

Millions of Americans are eligible for both Medicare and Medicaid every year. This dual eligibility may provide extra coverage to beneficiaries but with that comes extra regulation. It is important to note that both programs are managed by the same federal agency, the Centers for Medicare and Medicaid Services (CMS).

Can you switch to a MA-PD plan if you are dual eligible?

Although Part D plans are voluntary for most Medicare beneficiaries, those who are dual eligible have no choice. Medicaid requires that you sign up for Medicare as soon as you are eligible and this includes signing up for a Part D plan. If you do not sign up yourself, you will be automatically enrolled in Original Medicare and a Part D plan by the government. You will have the option to change to a MA-PD or pick a different Part D plan at a later time.

How Much Does Medicare Cost?

Your out-of-pocket costs will depend on which Medicare coverage you have. Medicare Part A typically costs nothing, but you may have to pay an annual premium if you didn’t pay Medicare taxes for enough quarters through your work. Medicare Part B, Part C, and Part D all have separate premiums and deductibles.

What is the Medicare website?

Medicare: The Medicare website provides information about each type of Medicare coverage, along with plan comparison tools and other resources to help you make informed decisions about enrolling in Medicare. The site also has resources specifically for individuals with a disability, such as fact sheets on enrolling with ALS or ESRD.

What is the monthly income limit for Medicare 2021?

To be eligible, you must meet certain income and resource limits. For 2021, the monthly income limit is $1,094 for individuals and $1,492 for married couples, while the resource limit is $7,970 for individuals and $11,960 for married couples. Resources include bonds, mutual funds, stocks, and money in checking or savings accounts. The QMB program helps pay Medicare Part A and Medicare Part B premiums, and it may also help with coinsurance, deductibles, and copays under certain circumstances.

How to apply for Medicare in person?

In person: If you prefer to apply in person, visit your local Social Security office. Use the Office Locator to determine which SSA office serves your area. You don’t need to make an appointment to discuss Medicare enrollment with a Social Security employee.

What is Medicare Part C?

Medicare Part C, also known as Medicare Advantage, is a type of Medicare health plan administered by a private insurer instead of the federal government. Medicare Advantage Plans combine Part A and Part B coverage, and frequently offer drug coverage as well. Medicare Advantage Plans may also cover dental care, vision care, and other services not covered by Original Medicare. Medicare Part D is a drug coverage plan that helps pay for prescription medications. You can enroll in Part D if you’re enrolled in Original Medicare, or if you are enrolled in a Medicare Advantage plan that doesn’t include prescription drug coverage. You must be enrolled in Medicare Parts A and B to join a Medicare Advantage (Part C) or Part D plan.

How to compare Medicare Advantage plans?

Online: Use the Medicare Plan Finder to compare plans based on covered services and out-of-pocket costs. Select Medicare Advantage Plan if you want to enroll in Medicare Part C. If you want to sign up for a Medicare Part D plan, choose Original Medicare. The Medicare Plan Finder displays important information about each plan, such as the monthly premium, the annual deductible, and the copays for primary and specialty care. It also explains what’s included with each plan. For example, some plans cover hearing, vision, and dental services. When you’re ready to apply for Medicare online, visit the Social Security Administration

How long can I work without losing my SSDI?

Once the trial period is over, you have 36 months to work without losing your SSDI benefits, provided you don’t have “substantial” earnings. As of 2021, a monthly income of $1,310 counts as substantial earnings to determine your continued eligibility. This amount increases to $2,190 per month if you’re blind. You may be able to earn more if you have certain expenses that help you work, such as specialized equipment or a personal attendant. Even if your substantial earnings prompt Social Security to stop your SSDI benefits, you’ll still have free Medicare Part A for at least 93 months after you finish the trial work period. After 93 months, you’ll need to pay a monthly premium if you want to keep your Medicare Part A coverage.

What are the requirements for Medicare for ESRD?

The requirements for Medicare eligibility for people with ESRD and ALS are: ALS – Immediately upon collecting Social Security Disability benefits. People who meet all the criteria for Social Security Disability are generally automatically enrolled in Parts A and B.

How long do you have to wait to collect Medicare?

There is a five month waiting period after a beneficiary is determined to be disabled before a beneficiary begins to collect Social Security Disability benefits. People with ESRD and ALS, in contrast to persons with other causes of disability, do not have to collect benefits for 24 months in order to be eligible for Medicare.

How long does SSDI last?

This new period of eligibility can continue for as long as 93 months after the trial work period has ended, for a total of eight-and-one-half years including the 9 month trial work period. During this time, though SSDI cash benefits may cease, the beneficiary pays no premium for the hospital insurance portion of Medicare (Part A). Premiums are due for the supplemental medical insurance portion (Part B). If the individual’s employer has more than 100 employees, it is required to offer health insurance to individuals and spouses with disabilities, and Medicare will be the secondary payer. For smaller employers who offer health insurance to persons with disabilities, Medicare will remain the primary payer.

How long does Medicare coverage last?

Medicare eligibility for working people with disabilities falls into three distinct time frames. The first is the trial work period, which extends for 9 months after a disabled individual obtains a job.

How long do you have to wait to collect Social Security?

There is a five month waiting period after a beneficiary is determined to be disabled before a beneficiary begins to collect Social Security Disability benefits. People with ESRD and ALS, in contrast to persons with other causes of disability, do not have to collect benefits for 24 months in order to be eligible for Medicare.

How long can disabled people receive Medicare?

Even after the eight-and-one-half year period of extended Medicare coverage has ended, working individuals with disabilities can continue to receive benefits as long as the individual remains medically disabled. At this point the individual – who must be under age 65 – will have to pay the premium for Part A as well as the premium for Part B. The amount of the Part A premium will depend on the number of quarters of work in which the individual or his spouse have paid into Social Security. Individuals whose income is low, and who have resources under $4,000 ($6,000 for a couple), can get help with payment of these premiums under a state run buy-in program for Qualified Disabled and Working Individuals.

What is covered by Medicare?

Coverage includes certain hospital, nursing home, home health, physician, and community-based services. The health care services do not have to be related to the individual’s disability in order to be covered.

What is Medicare Advantage?

Medicare Advantage Plans for Disabled Under 65. Most Social Security Disability Advantage plans combine Medicare coverage with other benefits like prescription drugs, vision, and dental coverage. Medicare Advantage can be either HMOs or PPOs. You may have to pay a monthly premium, an annual deductible, and copays or coinsurance for each healthcare ...

How long do you have to apply for Medicare if you have ALS?

You won’t need to apply; you’ll automatically get Parts A and B of Medicare once you collect SSDI for 24 months. If you have ALS or ESRD, you’ll get Parts A and B automatically, as soon as your SSDI begins.

How long do you have to be on Medicare if you are 65?

When you’re under 65, you become eligible for Medicare if: You’ve received Social Security Disability Insurance (SSDI) checks for at least 24 months. At the end of the 24 months, you’ll automatically enroll in Parts A and B. You have End-Stage Renal Disease (ESRD) and need dialysis or a kidney transplant. You can get benefits with no waiting period ...

How long do you have to be on SSDI to get Medicare?

To enroll in Medicare, you must be receiving SSDI for 24 months.

When does Medicare start?

You automatically get Medicare when your disability benefits begin for ALS or ESRD. Otherwise, they automatically begin 24 months after you start receiving SSDI benefits.

What happens when you turn 65?

Often, the best solution is an Advantage plan. When you turn 65, you’ll qualify for the Medicare Supplement Open Enrollment Period. Then, you can get a policy without having to answer any questions about your health.

How long do you have to wait to get Medicare if you don't have ESRD?

Once you start collecting SSDI, you must wait 24 months before becoming Medicare-eligible if you don’t have ESRD or ALS.

What is SSI disability?

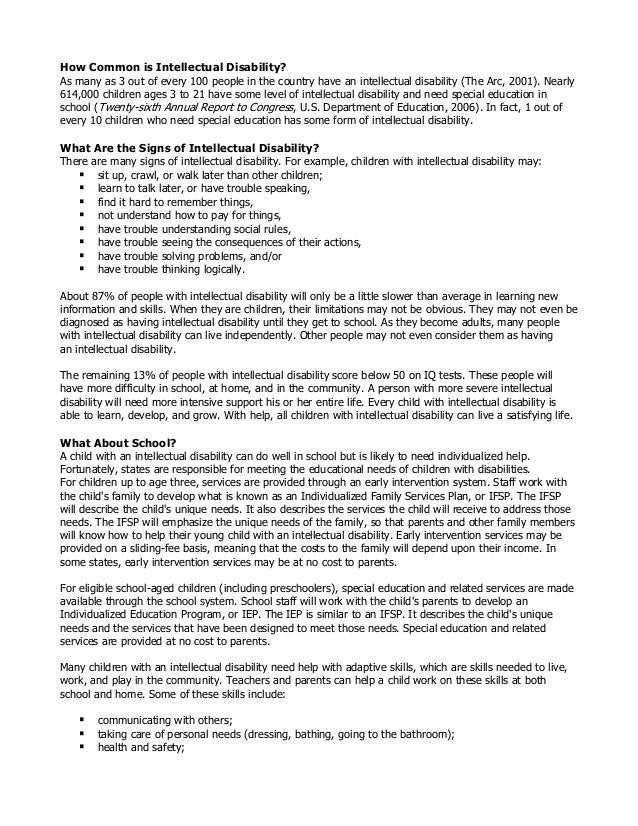

Supplemental Security Income (SSI) Disability & Medicaid coverage. Waiting for a disability status decision and don’t have health insurance. No disability benefits, no health coverage. The Marketplace application and disabilities. More information about health care for people with disabilities.

How long do you have to wait to get Medicare if you have Social Security Disability?

Social Security Disability Insurance (SSDI) & Medicare coverage. If you get Social Security Disability Income (SSDI), you probably have Medicare or are in a 24-month waiting period before it starts. You have options in either case.

Can you get medicaid after enrolling in Medicare?

If you’re eligible for Medicaid, your Medicaid eligibility may continue even after you enroll in Medicare.

Can I get medicaid if I have SSDI?

You may be able to get Medicaid coverage while you wait. You can apply 2 ways: Create an account or log in to complete an application. Answer “ yes” when asked if you have a disability.

Do you have to include SSDI income on Marketplace?

When asked about your income on your Marketplace application, be sure to include your SSDI income.

Do you have to pay a penalty if you don't have health insurance?

You’re considered covered under the health care law and don’t have to pay the penalty that people without coverage must pay.

Do I Qualify for Social Security Disability and Medicare Benefits?

You may qualify for Social Security Disability Insurance if you’re at least 18 years old, and can’t work for 12 months or longer. You can learn more about the requirements on the Social Security Administration’s website, and even apply online.

Do I have to Pay for Medicare on SSDI?

Medicare isn’t free for most people on Social Security Disability Insurance . Unless you qualify for another form of income-based help, you’ll most likely need to pay the Medicare Part B premium, which for most people in 2021 is $148.50. It’s unlikely that you’ll have to pay for Part A. In addition to the Part B premium, you may be responsible for other costs, as outlined below.

How long do you have to be on Medicare to receive Social Security?

You’ll be eligible and automatically enrolled in Medicare Part A and Medicare Part B once you’ve been receiving Social Security Disability benefits, or disability benefits from the Railroad Retirement Board, for 24 months .

How long do you have to wait to get Medicare if you have ALS?

If you have Lou Gehrig’s disease (ALS) or ESRD, you don’t have to wait through the 24-month period before you’re eligible for Medicare. If you have ALS, your Medicare coverage starts when you begin collecting disability benefits.

What is Medicare Advantage?

Medicare Advantage plans are a form of private insurance, and are primary instead of Original Medicare. While the claims-paying process and doctor networks may be different, they’re required to offer benefits that are considered at least equal to Medicare. Some Advantage plans include prescription drug coverage.

Can I get Medicare if I can't work?

Social Security Disability and Medicare can help support you if you’re unable to work. Once you’re eligible for Medicare, it’s important to keep in mind that all of your costs won’t be covered. You should begin looking into your options for additional coverage before your SSDI Medicare benefits begin, so that you know what to expect and don’t have any gaps in your coverage.

Does Medicare Supplement cover prescriptions?

Unfortunately, the premiums for Medicare Supplement plans for people under 65 on disability can be expensive, and they don’t cover prescription medications .

How to qualify for ESRD?

Note, according to Medicare in order to qualify with ESRD all of the below must apply:9 1 Your kidneys no longer work 2 You need dialysis regularly or have had a kidney transplant 3 One of the following must be true for you:#N#You’re already eligible for or are currently getting Social Security or Railroad Retirement Board (RRB) benefits#N#You have worked the required amount of time under Social Security, the RRB or as an employee of the government#N#You are either the spouse or dependent child of someone who meets either of the above requirements

What happens when you turn 65?

When you turn 65, you essentially lose your entitlement to Medicare based on disability and become entitled based on age. In short, you get another chance to enroll, a second Initial Enrollment Period if you will.6. If you decided not to take Part B when you were eligible for disability under 65, when you do turn 65, ...

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How long can you keep Medicare if you are disabled?

If you get Medicare due to disability and then decide to go back to work, you can keep your Medicare coverage for as long as you’re medically disabled.3 And, if you do go back to work, you won’t have to pay the Part A premium for the first 8.5 years.

How long does it take to get Medicare at 65?

Just like when you become eligible for Medicare at age 65, when you are eligible with disability, you have an Initial Enrollment Period of 7 months. Your Initial Enrollment Period will begin after you have received either disability benefits from Social Security for 24 months or certain disability benefits from the Rail Road Retirement Board ...

When do you get Medicare if you qualify for ALS?

If you qualify with ALS: You will automatically get Medicare Part A and Part B the month your disability benefits begin. 7

Does Medicare cover Lou Gehrig's disease?

Special Circumstances: Medicare with ALS (Lou Gehrig’s Disease) or End-Stage Renal Disease (ESRD) Medicare eligibility rules for people with ALS (Lou Gehrig’s disease) or end-stage renal disease (ESRD) are different. Individuals who qualify for Medicare with ALS or ESRD do not have to wait for your 25th month of disability to be eligible ...