Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

What does Blue Cross Medicare supplement plan F cover?

Blue Cross Medicare Supplement Plan F pays the Medicare Part A hospital deductible and coinsurance, the Part B deductible, and excess charges. Additionally, it covers foreign travel agency care and skilled nursing facility coinsurance, explains BlueCross BlueShield of Illinois.

What is Medicare F plan?

Medicare Plan F is a supplemental Medigap health insurance plan that is offered to individuals who are disabled or over the age of 65. Known better as simply Plan F, the policy is the most comprehensive of the 10 Medigap plans offered in each state.

What are the benefits of a Medicare supplement plan?

- Non-emergency medical transportation (to and from scheduled healthcare appointments)

- Meal delivery

- Cooking classes designed to improve beneficiaries’ diets

- Air purifiers for the home

- Home carpet cleanings

- Limited home improvements and fixtures that promote safety (like shower rails)

Is Medicare Plan F going away?

Yes. Medicare Supplement Plan F may eventually leave the market, starting in 2020 – but not for everyone. If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs.

What does plan F Medicare cover?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.

Why is Medigap plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Does plan F include drug coverage?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.

Does plan F cover vision?

Plan F is one of the most comprehensive Medicare supplement plans you can purchase, but it doesn't cover everything. This plan will not cover the following: Things that Medicare doesn't normally cover, like acupuncture, vision exams and dental work, are not included in Plan F coverage.

Is the F plan going away?

Summary: Medicare Supplement Plan F is the most comprehensive of the standardized Medicare Supplement plans available in most states. These plans are being phased out, starting in 2021.

Can I switch from Medicare Plan F to plan G?

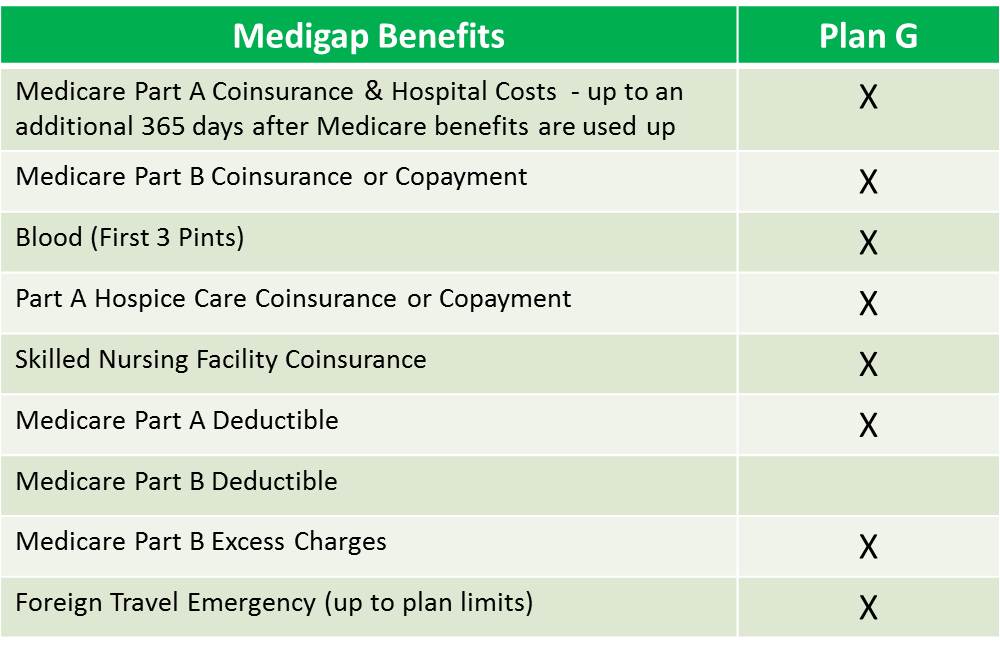

Switching from Plan F to Plan G If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance.

Does Medicare Plan F cover cataract surgery?

Also good: Plan A, B, D, G, M and N pay 100% of Part B coinsurance, which is your portion of cataract procedure costs. Best plans if you're eligible: Plan C and Plan F pay 100% of the Medicare Part B coinsurance and the Part B deductible.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

What's the difference between plan F and plan G in coverage?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Does Medicare Plan F cover shingles vaccine?

En español | Unlike some common vaccines, like those for the flu, hepatitis B and pneumonia, shingles shots are not covered under Medicare Part B, the component of original Medicare that includes doctor visits and outpatient services.

Does AARP Medicare Supplement plan F cover Part B deductible?

Medicare Supplement Plan F covers all services Medicare Part A and Part B cover. As long as your doctor accepts Original Medicare and Medicare pays its benefit first, your Medigap Plan F will cover the rest of the costs. Medicare Supplement Plan F covers: Deductibles for Medicare Part A and Part B.

Does Medicare Plan F have a deductible?

Are Medicare Plan F premiums tax-deductible? When filing your federal tax return, Medicare Plan F premiums would be tax-deductible. Additionally, any medical expenses that you pay for out of pocket can also be deducted on your taxes.

What is the difference between Plan F and Plan F high deductible?

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium. As a reminder, your...

Does Plan F cover dental?

Original Medicare doesn’t cover routine dental care, like cleanings or extractions, and there are no supplement plans that fill the gap. If you wan...

Is there an alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers,...

What Does Plan F Cover at My Doctor’S Office?

All of your preventive care is covered 100% by Medicare Part B. This includes items like: 1. Your annual physicals, well-woman exams and vaccines 2...

What Does Plan F Cover at The Hospital?

Medicare Part A covers inpatient hospital services, skilled nursing, blood transfusions and home health services that occur in the hospital. Medica...

What’S Not Covered by Plan F?

The only things Plan F does NOT cover would be those things that Medicare itself also does not cover, such as: 1. Acupuncture, acupressure and othe...

Does Medicare Plan F Cover Prescriptions?

Medicare decides what is covered and what is not. Medicare Part B covers injectable or infusion drugs given in a clinical setting. If Medicare pays...

Am I Guaranteed to Be Approved For Plan F?

Not always. You will get ONE open enrollment window to choose your first Medicare supplement without health underwriting. This window starts on Par...

Do Different Insurance Companies Have Different Plan F Benefits?

Fortunately NO. We get questions all the time about this – for instance a caller may ask us whether an AARP Plan F is the same as a Mutual of Omaha...

What is the deductible for Plan F?

High-deductible plan F. Plan F also has a high deductible option. While monthly premiums for this option may be lower, you must pay a deductible before Plan F begins paying for benefits. For 2021, this deductible is set at $2,370.

What is a plan F?

Plan F is a very comprehensive plan, helping cover expenses that original Medicare doesn’t. This includes your deductibles, coinsurance, and copays when receiving medical care. It even covers a portion of your medical expenses during foreign travel.

How many Medicare Supplement Plans are there?

There are 10 different Medicare supplement plans. You’ll see them designated as letters: A through D, F, G, and K through N. Each of these different plans is standardized, meaning the same set of basic benefits needs to be offered.

What are the disadvantages of Medigap Plan F?

Disadvantages of Medigap Plan F. On the downside of this plan option, its large amount of coverage can be costly and have high monthly premiums. Also, if you’re newly eligible for Medicare as of January 1, 2020, or later, you will not be eligible to buy this plan, as it is being phased out for new enrollees.

Does Medicare Supplement cover healthcare?

Medicare supplement insurance can help pay for healthcare costs that original Medicare doesn’t cover. About 25 percent. Trusted Source. of people who have original Medicare are also enrolled in a Medicare supplement plan. Private companies sell Medicare supplement plans. There are 10 different Medicare supplement plans.

Is Medicare Supplement Plan F a part of Medicare?

You may have also heard of something called Medicare Supplement Plan F. Medicare Plan F isn’t a “part” of Medicare. It’s actually one of several Medicare supplement insurance ( Medigap) plans.

Is Medigap part of Medicare?

It’s actually one of several Medicare supplement insurance ( Medigap) plans. Medigap comprises several plans you can buy to help pay for things that original Medicare (parts A and B ) doesn’t. Keep reading to find out more about plan F, what it includes, and if it may be a good fit for you.

What is Plan F for Medicare?

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are exhausted. Part A Hospice care coinsurance or copayment.

What does Plan F cover?

Plan F also covers the Medicare Part B expenses. Part B covers doctor visits and related charges covered under Medicare for providers. Like Part A, Part B only covers 80% of the Medicare-approved expenses. It leaves the remaining 20% on the Part B participant.

What is Plan F?

Plan F covers the Medicare-approved expenses not covered under Medicare Part A (deductibles, coinsurances, and copays). Part A is the hospitalization component of Original Medicare and covers Medicare expenses typically associated with a hospital stay.

How long does Medicare cover skilled nursing?

Medicare limits this benefit to the first 100 days of a stay in a skilled nursing facility.

Why is Plan F standardized?

They did this with the specific goal of making shopping for a plan more manageable. No matter which company provides Plan F, they all must pay for Medicare approved expenses.

What is the 80% travel insurance?

This plan coverage also includes 80% of approved costs associated with foreign travel emergencies, which is vital for the many seniors who enjoy taking cruises or other trips outside the United States. There are plan limits, but this coverage can help offset charges associated with becoming sick or injured while traveling outside of the U.S.

Does Plan F cover Medicare Part B?

It leaves the remaining 20% on the Part B participant. Plan F covers Medicare Part B approved services at the doctor’s office, such as: Plan F is one of only two Medicare Supplement plans that cover the Medicare Part B excess charges (the other being Plan G).

What is Medicare Plan F?

Medicare Plan F covers all of the gaps in Original Medicare. It is considered to be the “Cadillac” coverage among the available Medicare supplements today. Plan F gives you first-dollar coverage for all Medicare-approved services. Whether you have a hospital stay, or a diagnostic exam or a doctor’s visit, you will simply present your Medicare card ...

How much is Plan F for 2021?

Here’s a list view of your Plan F coverage at the hospital: Hospital deductible ($1,484 in 2021) and coinsurance. 365 days of additional hospital coverage after Medicare’s coverage is exhausted. Hospice care at any hospice facility. Blood (if needed in a transfusion)

What are the important imaging exams for Medicare?

Important imaging exams like colonoscopies and mammograms. Screenings for diabetes, cardiovascular conditions, bone density and other conditions. Medicare dictates which preventive screenings are allowed – your primary care doctor will know which screenings to provide to you that will be covered.

Does Plan F pay for deductible?

Then your Plan F supplement pays your deductible and the other 20%. Some doctors charge a 15% excess charge beyond what Medicare pays. Plan F covers that for you. Plan F also pays the 20% for a long list of other Part B services.

Does Medicare pay for eyeglasses after cataract surgery?

The answer is no if the matter is routine. Medicare will, however, pay for one pair of very basic eyeglasses after a cataract surgery. One exception is that Medicare supplement Plan F will cover up to $50,000 in foreign travel emergency benefits. Since this care occurs outside the U.S., Medicare obviously does not cover that.

Does Medicare cover outpatient prescriptions?

If Medicare pays its 80% share on such a drug, your Plan F will cover the rest of it. However, neither Original Medicare nor Plan F cover outpatient prescriptions.

Does Medicare pay for Supplement Plan F?

Then your Medicare Supplement Plan F will pay the remaining amount that Medicare does not cover.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Why is Medicare Plan F so popular?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

What is the most comprehensive Medicare plan?

If you became eligible for Medicare on or after January 1, 2020, you’ll find that Plan G is the most comprehensive Medigap plan available to you. (In recent years, Plan G has been the second most popular Medicare Supplement plan, and you can read more on that below.) A Medigap plan, or Medicare Supplement, pays after Medicare to help cover your ...

What is the best Medigap plan for 2021?

The best Medigap plans in 2021 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no longer available to new enrollees. Get a quote for both and see which ones offer you the best annual savings.

What happens if you don't have a Supplement?

You would also pay 20% of expensive procedures like surgery because Part B only pays 80%.

Is Medicare Supplement Plan F the #1 seller?

This post has been updated for 2021. Medicare Supplement Plan F has also been the #1 seller with Baby Boomers for many years. According to a report from America’s Health Insurance professionals in 2016, about 57% of all Medigap policies in force were a premium Medicare Plan F policy.

Does Medicare Plan F cover outpatient deductible?

Plan F fully covers both your Part A hospital deductible and your Part B outpatient deductible. It covers all of the 20% that Medicare Part B normally leaves for you to pay. Medicare Plan F covers all Part B excess charges. You will never pay the standard 15% excess charges that doctors under Medicare are allowed to charge for Part B services.

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

Do you have to pay a deductible on a Plan G or F?

Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F. However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost.

What is Medicare Plan F?

These can include deductibles, copayments, and coinsurance. Medicare Plan F is a Medigap policy. These policies help people pay some of the extra expenses of Medicare Part A and Part B. Together, Medicare Part A and Part B are called Original Medicare. Part A covers hospital expenses, and Part B covers other medical expenses.

When will everyone be eligible for Medicare Plan F?

A person may not qualify for a Medigap policy after the Open Enrollment Period. Before January 1, 2020, everyone was eligible for Medicare Plan F.

How to enroll in Medicare Plan F?

To enroll in Medicare Plan F, a person must determine whether they are eligible and whether it is available in their area. They can use the Medicare Plan Finder or contact the State Health Insurance Assistance Program (SHIP) or State Insurance Department.

How much does Medicare cost if you have worked for 10 years?

If a person has worked and paid Medicare taxes for between 7.5 and 10 years, the premium is $252 per month.

Is Medicare Plan F deductible higher?

If more benefits become added to the policy, its cost may be higher. Some states offer high deductible Medicare Plan F policies. People can use the Medicare Plan Finder to find the average cost of Medicare Plan F policies in their zip code.

Does Medicare plan F have the same benefits?

Private insurance companies offer the insurance plans. All Medicare Plan F plans offer the same benefits, but not all plans cost the same amount. Each insurance company can set its premiums and may provide more benefits. Not all insurance companies offer Medigap policies in every state.

Does Medicare Plan F cover Part B?

As Medicare Plan F covers the Medicare Part B deductible , it is not available to people who have only become eligible for Medicare after this date. In this article, learn more about Medicare Plan F, including who is eligible, what it covers, the costs, and how to enroll.

What is Medicare Supplement Plan F?

In addition, Plan F provides coverage for skilled nursing facility care, Medicare Part A and B deductibles, and international travel medical emergency help.

How much is the deductible for Plan F?

International travel medical emergency help. Plan F also has a high-deductible option. If you choose this option, you have to pay a deductible of [$2,240] for [2018] before the plan pays anything. This amount can go up each year.

What is Medicare Part B excess?

Medicare Part B excess charges (this is the difference between what a doctor or provider charges and the amount Medicare will pay up to Medicare's limiting amount) Skilled nursing facility care. Medicare Part A deductible for hospitalization. Medicare Part B deductible for medical and hospital outpatient expenses.

Does Medicare Supplement cover 100% of Part B?

One of only two Medicare Supplement plans that cover 100% of Medicare Part B excess charges . This plan may help protect you from additional out-of-pocket expenses if you need treatment that exceeds what Medicare will approve.

Is Medicare Supplement insurance endorsed by the government?

Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Coverage may be limited to Medicare-eligible expenses. Benefits vary by insurance plan and the premium will vary with the amount of benefits selected.

Does Medicare Supplement Plan F cover out-of-pocket expenses?

Because the plan also covers costs in excess of Medicare-approved amounts, you may have no out-of-pocket costs for hospital and doctor's office care with this plan. Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. ...