This means that only those who were enrolled in Medicare prior to January 1, 2020 are only eligible for a guaranteed issue Medicare Supplement Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …Medigap

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

What is the best Medicare supplement insurance?

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. ...

- You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. ...

- A Medigap policy only covers one person. ...

What is the most comprehensive Medicare supplement plan?

Medicare Supplement Plan G is the best overall plan that provides the most coverage for seniors and Medicare enrollees. Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible — $233 for 2022 — before insurance benefits will begin to pay for your health care.

How much does a Medicare supplement insurance plan cost?

Medicare Supplement Insurance Cost Factors

- Plan Coverage. One big factor in the cost of a Medicare Supplement Insurance plan is the level of coverage provided.

- Carrier. Medicare Supplement Insurance is sold by private insurance companies that set their own plan prices.

- Location. ...

- Enrollment Time. ...

- Pricing Structure. ...

- Discounts. ...

- Gender. ...

Is Medigap plan G guaranteed issue?

Medigap Plan G is only available as a guaranteed issue plan to people who became eligible for Medicare on or after January 1st, 2020. You may still apply for Medigap Plan G through the usual methods (link to article) if you entered Medicare before 2020, but your acceptance may not be guaranteed.

Is plan G guaranteed issue in 2021?

First of all, Plan G is not offered as a “guaranteed issue” (no health questions) option in situations where someone is losing group coverage or Medicare Advantage plan coverage.

Is plan N guaranteed issue in 2020?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Is plan F guaranteed issue?

Outside of your Medicare Supplement OEP, guaranteed-issue rights are often limited to certain Medicare Supplement insurance plans: A, B, C**, D, F**, G, K, or L. Please note: Not all plans are sold in every state. A high-deductible Plan G might be available in your state.

What is a qualifying reason for a Medigap guaranteed issue right?

You have a guaranteed issue right (which means an insurance company can't refuse to sell you a Medigap policy) in these situations: You're in a Medicare Advantage Plan, and your plan is leaving Medicare or stops giving care in your area, or you move out of the plan's service area.

What is the most comprehensive Medicare supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What's the difference between plan G and plan N?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

What is the difference between open enrollment and guaranteed issue?

Whereas in open enrollment, you can choose any Medigap plan that is offered in your state, during a guaranteed issue you can typically only choose Medigap Plans A, B, C, F, K or L that's sold in your state by any insurance company.

What is a guaranteed issue plan?

A requirement that health plans must permit you to enroll regardless of health status, age, gender, or other factors that might predict the use of health services.

Why is plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

What states have guaranteed issue rights Medigap?

Only four states (CT, MA, ME, NY) require either continuous or annual guaranteed issue protections for Medigap for all beneficiaries in traditional Medicare ages 65 and older, regardless of medical history (Figure 1).

Are Medicare Supplement plans guaranteed renewable?

You can buy a Medigap policy from any insurance company that's licensed in your state to sell one. Any standardized Medigap policy is guaranteed renewable even if you have health problems. This means the insurance company can't cancel your Medigap policy as long as you pay the premium.

What Are the Top Medicare Supplement Plans in 2020?

Medicare beneficiaries who are newly eligible for Medicare in 2020 have a range of choices when it comes to Medicare Supplement plans, including Plan G, High-deductible Plan G, Plan D and Plan N.

Which Medicare Supplement plans offer the most standardized benefits?

The Medicare Supplement plans that offer the most standardized benefits in 2020 (for beneficiaries who became eligible for Medicare after January 1, 2020) are Medigap Plan G , Plan D and Plan N.

What is a Medigap Plan N?

Medigap Plan N is another plan that offers a number of Medicare Supplement benefits. Like Plan D, Plan N provides coverage for each Medigap benefit except for the Part B deductible or Part B excess charges. Plan N is different from Plan D in one particular way, however.

What are the benefits of Medigap 2020?

The nine possible Medigap benefits include: Medicare Part A coinsurance and hospital costs. Medicare Part B coinsurance. First three pints of blood used for a transfusion. Part A hospice care coinsurance and copayments. Skilled nursing facility coinsurance.

How much does Plan N cost?

Plan N also charges you a copayment of up to $50 for emergency room (ER) visits that don’t result in admission for inpatient hospital care. Picking the right Medicare Supplement plan for you may depend on your coverage needs and may also depend on your budget.

What is the deductible for a F and G plan?

1. Plans F and G also offer a high-deductible plan that each have an annual deductible of $2,340 in 2020. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is Medicare excess charge?

These providers reserve the right to charge you up to 15% more than the Medicare-approved amount for their services. These are called Medicare excess charges.

What are Medicare Guaranteed Issue Rights?

There are a handful of instances in which you are eligible for guaranteed issue rights with Medicare plans. They usually occur when you lose coverage for reasons out of your control or because you move. You are entitled to know about all of your Medicare rights and protections.

What are guaranteed issue rights for Medicare?

All Medicare beneficiaries are protected by law from unfair medical underwriting. Guaranteed issue rights prohibit insurance companies from denying or overcharging you a Medigap policy, regardless of any pre-existing health conditions.

What is trial rights in Medicare?

Trial rights when you enroll in Medicare Advantage or drop your Medigap coverage. Your Medicare Advantage plan is leaving your specific area or leaving Medicare. You decide to move out of the plan’s service area. An employer plan that supplements Medicare ends. The Medicare company did not follow the rules.

How long do you have to go back to Medicare if you change your mind?

The same rule applies if you enroll in a Medicare Advantage plan after turning 65. If you start with Original Medicare and a Medigap plan, you have 12 months to try Medicare Advantage.

How long do you have to wait to apply for Medigap?

You can apply for Medigap starting 60 days before you lose coverage, and your guaranteed issue right ends 63 days after you lose coverage. If an employer plan is ending, you must apply for Medigap no later than 63 days. Those that have COBRA can either wait until COBRA ends or buy a Medigap plan right away.

What happens if you move out of your Medicare Advantage plan?

If you move out of your plan’s service area, you will lose coverage. As a result, you will be given a guaranteed-issue right to purchase a Medicare supplement plant in your NEW area. Your second option: choose a new Medicare Advantage plan. Another common situation is a Medicare Advantage plan folding or being terminated in your area.

How long is Medicare trial?

Medicare Advantage Trial Rights. Once you become eligible for Medicare at 65, you are given a 12 month trial with Medicare Advantage. If you change your mind, you can return back to Original Medicare. The same rule applies if you enroll in a Medicare Advantage plan after turning 65.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Does Medicare cover prescription drugs?

Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D). If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

What age do you have to be to get Medicare supplement guaranteed issue rights?

Medicare supplement guaranteed issue rights exist to protect you in specific situations. The most common one occurs when you are working past age 65 for a large employer with more than 20 employees and enrolled in Medicare A and B. When you leave that employer, you will have ...

What is a guaranteed issue period for Medicare?

Guaranteed issue periods allow Medicare beneficiaries to enroll in a Medigap plan with no health questions asked. Since GI windows exist only for special circumstances in most other states, you need to keep any records that will help you qualify.

How long do you have to join a Medigap plan after losing coverage?

When using a guaranteed-issue window to join a Medigap plan after losing other coverage, you have up to 63 days from the date that coverage ends to elect a new plan under GI rules. It’s also important to note that Medicare supplement guaranteed issue rules vary from state to state. In some states, you must have lost that other coverage ...

What is GI rights?

These are called your Medicare Supplement Guaranteed Issue (GI) Rights. These rights are different from your one-time Medicare supplement open enrollment period, during which you can purchase any Medicare supplement without ...

How long after your birthday can you switch to another Medicare plan?

During the 30 days after your birthday each year, you can switch from a Medigap plan to another plan of equal or lesser benefits without underwriting. Switching Medicare supplement plans allows residents here to continually stay insured at the lowest possible premiums.

What happens if Medicare Advantage Plan folds?

Likewise, if a Medicare Advantage plan folds or terminates coverage in your service area, you lose your coverage through no fault of your own , this is another situation in which you would be given a GI window. For other scenarios in which GI exists, visit this page on Medicare’s website.

How long does a guaranteed issue last for Medicare?

In this scenario, the guaranteed issue window lasts 63 days.

When is a Medicare Supplement Guaranteed Issue?

A different type of eligibility for Medicare Supplement coverage is called Medicare Supplement guaranteed issue. Guaranteed issue periods have the same basic implications as the Medigap open enrollment period, in that you cannot be turned down for coverage or made to pay more based on your health. However, there are some additional considerations.

What is Medicare Supplement?

A Medicare Supplement gives you predictable out of pocket costs once you are on Medicare and limits, or eliminates, your exposure to potentially high medical costs. But, if you don’t sign up for one when you are eligible to do so, you may have difficulty getting a plan at a later time. Because of this, it’s important to understand ...

What is Medicare Supplement Open Enrollment?

Open enrollment, as it pertains to Medicare Supplement plans, is a 6 month period that begins the first day of the month that you are both 65 or older and enrolled in Medicare Part B (see page 14 of the “Choosing a Medigap” booklet ).

What is the difference between open enrollment and guaranteed issue?

One of the big differences between open enrollment and guaranteed issue is which plans are offered . Whereas in open enrollment, you can choose any Medigap plan that is offered in your state, during a guaranteed issue you can typically only choose Medigap Plans A, B, C, F, K or L that’s sold in your state by any insurance company.

What happens if Medigap goes bankrupt?

Your Medigap company goes bankrupt and you lose your coverage or your Medigap coverage ends through no fault of your own.

How long do you have to be in Medicare before you can enroll?

Additionally, most insurance companies allow you to enroll in a Medigap plan up to 6 months before your Medicare coverage starts. When you do that, the coverage does not start ...

What is 65Medicare.org?

65Medicare.org is a leading, independent Medicare insurance agency for people turning 65 and going on Medicare. If you have any questions about this information, you can contact us online or call us at 877.506.3378.

What are the changes to Medicare Supplement 2020?

In 2015, Congress passed the Medicare Access and CHIP Reauthorization Act, known as MACRA . It became effective 1/1/2020 and had a serious impact on Medicare Supplement (Medigap) plans. Whether the new law is applied to a particular beneficiary ...

When is a beneficiary eligible for Medicare?

A beneficiary is newly Medicare-eligible if he/she turns 65 or become eligible for Medicare before 65 (due to disability or end-age renal disease) on or after 1/1/2020. Otherwise, a beneficiary is NOT newly Medicare-eligible.

When will MACRA make guaranteed issue?

Starting 1/1/2020, MACRA is making both Plan D and Plan G guaranteed issue plans for newly Medicare-eligible beneficiaries who are not allowed to enroll in Plan C or Plan F. If you’re Medicare-eligible before 2020, then you will NOT be given guaranteed issue for Plan D and Plan G.

What replaces Plan C?

Medigap Plan D replaces Plan C. You also may consider Medigap Plan N as an alternative solution.

Does Senior65 sell your information?

Senior65 believes in your privacy. We will not sell your personal information. This is a solicitation for insurance.

Is Medigap Plan F available for people turning 65?

The main development is that Medigap Plan F is now not available for people turning 65 after 2020. This raises questions about Medigap Plan G and its guaranteed issue situation, both for Normal Enrollment and Special Enrollment.

Is Medigap Plan G still available?

Is Medigap Plan G guaranteed issue for those new to Medicare in 2020? The answer is yes. Medigap Plan G will still be guaranteed issue for “newly eligible” members of Medicare.

Is Medigap Plan G guaranteed issue for Special Enrollment in 2020?

The answer is also yes. Until 2019, people who left work coverage could not purchase Medigap Plan G under Special Enrollment, but could get Plan F and other Medigap plans. That is no longer the case. Seniors can now also get Plan G under the Special Enrollment period .

Other Common Guaranteed Issue Rights Situations

Guaranteed-Issue Rules

- When using a GI window, you can only buy certain Medigap plans. These are Medigap plans A, B, C*, D, G*, F*, K, or L. You cannot buy Medigap plans M and N. When using a guaranteed-issue window to join a Medigap plan after losing other coverage, you have up to 63 days from the date that coverage ends to elect a new plan under GI rules. It’s also imp...

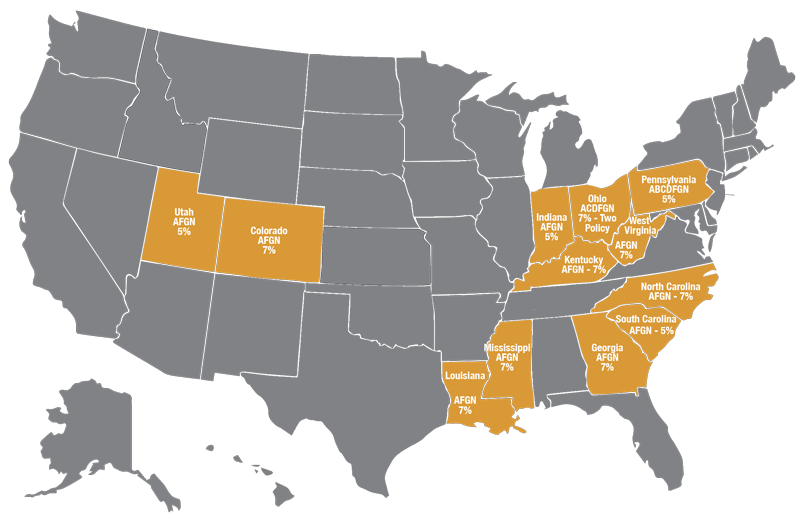

Guaranteed Issue States

- Some states have laws that go beyond the federal laws for guaranteed issue. Here’s a run-down of those states and their rules: 1. In California and Oregon, there is a birthday rule. Each year around your birthday, you can switch from a Medigap plan to another Medigap plan of equal or lesser benefits without underwriting — the timeframe to make this change varies by insurance c…

Helpful Tips For Your Medigap Guaranteed Issue Period

- Since GI windows exist only for particular circumstances in most other states, you need to keep any records that will help you qualify. So, if your employer coverage ends, you should keep the creditable coverage letter from the prior insurance carrier. The insurance company will usually send this to you within two weeks of the last date of coverage. If you left or lost a Medicare Adv…

Need Help Understanding Guaranteed Issue Guidelines?

- Our Medicare experts are very familiar with GI rules in all states. If you have a question about GI rules in your state, you can contact us for guidance. The Boomer Benefits team has worked with just about every Medicare situation under the sun. If you are unsure of your next move with Medicare, the team will get to know your situation and recommend the best way forward. Conta…