There is no such thing as Medicare Part D plans with no donut hole, so you have to just do your best to stay under the threshold. The best way to avoid the donut hole is to take generic medications whenever possible. You can also work with your doctor on reducing your drug spending.

What is the Medicare Donut Hole and how do you avoid it?

· You may have read in the 2010 Medicare & You Handbook that there are some Medicare Part D plans that offer coverage in the donut hole---but these plans may charge a higher monthly premium. (There are also some Part D plans that are “enhanced” and offer fixed co-pays (for example $5, $10, and $20) for prescription drugs instead of the deductible and 25% cost …

What is the donut hole for Part D drugs?

· The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage Prescription Drug plans pay for prescription drug costs. This gap will officially close in 2020, but you can still reach this out-of-pocket threshold where your medication costs may change. Find affordable Medicare plans in your area.

Do Medicare drug plans cover out-of-pocket costs?

· The Medicare donut hole for 2022 starts once you hit $4,430 in out-of-pocket prescription drug costs, and it extends to $7,050. If your prescription drug spending reaches $7,050 in 2022, you’ll have catastrophic coverage for the rest of the year.

How do Medicare drug discounts work in the gap?

· Learn More To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800-MEDICARE (1-800-633-4227), TTY users 1-877-486-2048; 24 hours a day, 7 days a week. Contact a licensed insurance agency such as eHealth, which runs Medicare.com as a non-government website.

Do all Medicare supplements have a donut hole?

No, all Medicare prescription drug plans include the donut hole. If you anticipate reaching the donut hole and have trouble with costs, you can apply for Extra Help with Medicare Part D.

Is there any way to avoid the Medicare donut hole?

The main way to not hit the coverage gap is to keep your prescription drug costs low so you don't reach the annual coverage gap threshold. This is also called the initial coverage limit.

Does SilverScript have a donut hole?

With SilverScript, you have access to more than 65,000 pharmacies, as well as many preferred pharmacies. The SilverScript Plus plan has no deductible and more coverage during the Part D donut hole, while the SilverScript Choice and SilverScript SmartRx plans offer lower monthly premiums.

Will there be a Medicare donut hole in 2022?

In 2022, you'll enter the donut hole when your spending + your plan's spending reaches $4,430. And you leave the donut hole — and enter the catastrophic coverage level — when your spending + manufacturer discounts reach $7,050. Both of these amounts are higher than they were in 2021, and generally increase each year.

Do Medicare Advantage plans cover the donut hole?

En español | It can. The doughnut hole (or coverage gap) is part of the way Part D is structured, at least until 2020. It is not tied to a particular type of Part D plan.

What is the Doughnut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

Is SilverScript Smart Rx a good Part D plan?

All of Aetna's PDPs have a Medicare star quality rating of 3.5 out of five stars. CVS/Aetna's SilverScript Smart RX plan has the lowest average monthly premium in 2022, and CVS is one of four main providers of stand-alone Part D prescription drug plans in the United States.

What will the donut hole be in 2022?

In 2022, that limit is $4,430. While in the coverage gap, you are responsible for a percentage of the cost of your drugs. How does the donut hole work? The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs.

What is the difference between SilverScript choice and SilverScript Smart Rx?

The SilverScript Plus plan has no deductible and more coverage during the Part D donut hole, while the SilverScript Choice and SilverScript SmartRx plans offer lower monthly premiums.

Has the donut hole been eliminated?

The Medicare donut hole is closed in 2020, but you still pay a share of your medication costs.

Does the donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What Is The Coverage Gap (“Donut Hole”), and When Does It Start?

For those who are new to the coverage gap, or “donut hole,” learning about the different Medicare Part D coverage phases is a good place to start....

What Costs Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Once you’ve entered the coverage gap (“donut hole”), it’s important to understand which out-of-pocket costs count towards helping you reach the cat...

What Costs Don’T Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Not all out-of-pocket costs count towards reaching catastrophic coverage. The following costs don’t count towards getting you out of the coverage g...

How Do I Avoid The Medicare Part D Coverage Gap (“Donut Hole”)?

Now that you know about the coverage gap (“donut hole”), here is some good news: 1. Many Medicare beneficiaries won’t have to pay the increased pri...

What If I Have Questions About The Coverage Gap (“Donut Hole”)?

If you have questions about how the coverage gap works and how to avoid it, I can help. A licensed insurance agent such as myself can help you comp...

Why won't Medicare pay the $4,020 coverage gap?

Now that you know about the coverage gap (“donut hole”), here is some good news: Many Medicare beneficiaries won’t have to pay the increased prices during the coverage gap because their prescription drug costs won’t reach the initial coverage limit of $4,020 in 2020.

What is the Medicare Part D coverage gap?

The Medicare Part D Coverage Gap (“Donut Hole ”) Made Simple. Summary: When it comes to Medicare prescription drug coverage, you might have questions surrounding the Medicare Part D coverage gap, also known as the “donut hole.”. The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage ...

When will the Medicare coverage gap end?

This gap will officially close in 2020 , but you can still reach this out-of-pocket threshold where your medication costs may change. Find affordable Medicare plans in your area.

How much is the coverage gap for 2020?

While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020. You’re out of the coverage gap once your yearly out-of-pocket drug costs reach $ 6,350 in 2020. Once you have spent this amount, you’ve entered the catastrophic coverage phase.

Does Medicare have a gap?

Although most Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans have a coverage gap, some plans offer additional coverage during this phase. Costs for this additional coverage will vary by plan. Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap.

How to avoid coverage gap?

Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap. Here are some tips for how you can lower the amount you spend on medications: Many expensive prescription drugs have a generic or lower-cost alternative. Switching to lower-cost drugs may help you avoid entering the coverage gap.

Does coinsurance affect coverage gap?

Costs like copayments, coinsurance, and deductibles can vary greatly from plan to plan and may affect your chances of entering the coverage gap. Remember, your risk of entering the coverage gap depends, in part, on how high your out-of-pocket costs are. It may be helpful to research Medicare plan options that could save you money.

Does Medicare still have a donut hole?

No. The Medicare donut hole still exists. However, starting in 2020, instead of being responsible for 37% of the cost of generic prescription drugs and 25% of the cost of brand name prescription drugs while in the donut hole (as was the case in 2019), Medicare beneficiaries only pay 25% for both brand name and generic drugs.

What is a Medicare donut hole?

The Medicare donut hole is a gap in coverage that some Medicare beneficiaries may experience at some point during their plan year. The good news? You can save money by knowing how to avoid it and what do to once you’re in it.

What is Medicare Part D?

Medicare Part D is optional prescription drug coverage for Medicare beneficiaries . To get Medicare prescription drug coverage, you can add Part D to your Original Medicare coverage (Medicare Part A and Part B), you can enroll in a Medicare Advantage plan that includes Part D coverage (called a Medicare Advantage Prescription Drug plan, ...

How many stages of Medicare Part D coverage?

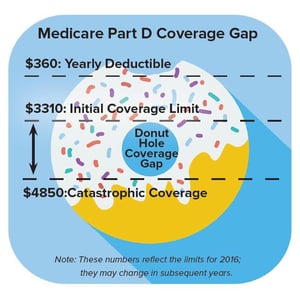

Basically, there are four Medicare Part D coverage stages you need to understand. Your first Medicare Part D coverage phase can be represented by the left side of the donut ring. On this side of the donut, you pay the entire amount for your prescription drugs until you meet your deductible (assuming your plan has one, but not all Part D plans do). ...

What is the Medicare Part D coverage phase?

Your first Medicare Part D coverage phase can be represented by the left side of the donut ring. On this side of the donut, you pay the entire amount for your prescription drugs until you meet your deductible (assuming your plan has one, but not all Part D plans do). This first coverage phase is called the deductible period where you pay ...

How much is coinsurance for Medicare 2021?

After you and your drug plan have combined to spend a set amount for the prescription drugs covered by your plan ($4,130 in 2021), you move into the center of the donut (i.e., the hole) which is your Medicare coverage gap. While you’re in the donut hole coverage ...

What is the Medicare coverage gap in 2021?

After you and your drug plan have combined to spend a set amount for the prescription drugs covered by your plan ($4,130 in 2021), you move into the center of the donut (i.e., the hole) which is your Medicare coverage gap. While you’re in the donut hole coverage gap, you’re responsible for 25% of your prescription drug costs for both brand name ...

What is the Medicare Part D coverage gap?

Summary: Most Medicare Part D prescription drug plans include a coverage gap in Part D benefits, also known as the Medicare “donut hole. ”. During this gap in prescription drug coverage, beneficiaries may have to pay more of their prescription drug costs until they reach the catastrophic coverage phase of their plan.

Will everyone enter the Medicare coverage gap?

Not everyone will enter the Medicare coverage gap, or “donut hole,” each year. For example, Medicare beneficiaries who get Extra Help paying for Part D costs won’t enter this coverage gap. Here are some ways you may be able to save money on prescription drugs:

Is the Medicare coverage gap closed?

Because of provisions in the Affordable Care Act, beneficiaries paid a lower percentage toward their drugs while in the coverage gap each year. As of 2020, the coverage gap is officially closed.

Do you pay coinsurance on Medicare prescriptions?

In the catastrophic coverage phase of a Medicare prescription drug plan, you only pay a small coinsurance or copayment on covered medications for the rest of the calendar year.

How much of your prescription drug costs will you pay after you reach the coverage gap?

You’ll pay no more than 25% of your drug costs after reaching the coverage gap. The coverage gap ends when your out-of-pocket expenses for medications on the plan’s formulary reach a certain threshold, which may change each year. At this point, you enter the catastrophic coverage phase.

When does the coverage gap end?

The coverage gap ends when your out-of-pocket expenses for medications on the plan’s formulary reach a certain threshold, which may change each year.

What is the coverage gap for Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,130 on ...

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , coinsurance, and copayments. The discount you get on brand-name drugs in the coverage gap. What you pay in the coverage gap.

How much will Medicare cover in 2021?

Once you and your plan have spent $4,130 on covered drugs in 2021, you're in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs won’t enter the coverage gap.

How much does Medicare pay for generic drugs?

Generic drugs. Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

What is out of pocket cost?

out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance. to help you get out of the coverage gap. What you pay and what the manufacturer pays (95% of the cost of the drug) will count toward your out-out-pocket spending.

Why do you have to pay for prescriptions on your own?

Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance. to help you get out of the coverage gap. What you pay and what the manufacturer pays (95% of the cost of the drug) will count toward your out-out-pocket spending. Here's a breakdown:

What is a donut hole in Medicare?

What Is the Medicare Part D “Donut Hole”? Most Medicare Part D prescription drug plans have a coverage gap. More commonly, this has been known as the “donut hole.”. The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs. Once you and your Medicare Part D plan have spent a certain amount on ...

Is the Donut hole going away?

The “donut hole” isn’t really going away, because Medicare Part D still has four payment stages. The “donut hole” is the third stage, and you move through the Part D payment stages based on how much you, your plan, and others on your behalf have paid for your drugs during the year.

What is the Medicare Part D coverage gap?

Most Medicare Part D prescription drug plans have a coverage gap. More commonly, this has been known as the “donut hole. ”. The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Do copays count toward dollar limits?

You may pay a small copay or coinsurance, and you will remain in this stage for the rest of the year. Your out-of-pocket drug costs, including copays, coinsurance amounts and your deductible, if any, count toward the dollar limits. Other amounts that contribute to reaching the limits include:

Can you avoid the coverage gap?

It’s best to avoid the coverage gap all together if you can. People who reach the coverage gap need to get through it wisely so they can get the most from their Part D coverage. Drug costs can take a bite out of your budget. Here are some ideas to help turn that bite into a nibble, even if you are unlikely to reach the coverage gap.

What is the third stage of Part D?

The “donut hole” is the third stage, and you move through the Part D payment stages based on how much you, your plan, and others on your behalf have paid for your drugs during the year.

Does Medicare Supplement cover prescription drugs?

While Medicare Supplement (Medigap) plans don't cover prescription drugs, they can help pay for some of the out-of-pocket costs that Medicare doesn't cover. These costs can include things like Medicare deductibles, copays, coinsurance and more.

What is the coverage gap for Medicare Part D?

If you get your prescription drugs through a Medicare Part D prescription drug plan, your plan probably includes a coverage gap (also called the “donut hole”) if you spend a certain range of money on drugs each year.

How Does Medicare Part D Work?

Whether your prescription drug coverage is through an MA-PD or a standalone Part D plan, there are four coverage phases:

Why Is There Still a Coverage Gap Phase?

So, the big question many Medicare beneficiaries have is, why is there still a coverage gap phase if the donut hole closed in 2020?

Cost-Sharing While in the Coverage Gap Phase

You enter the coverage gap once you and your plan spend a combined total of $4,430. (The majority of Part D beneficiaries never reach this phase.) However, you only leave it when your total out-of-pocket spending – not including what your plan pays – totals $7,050.

Are Your Part D Costs the Same in the Coverage Gap?

This one doesn't have a simple answer. It all depends on the type of Part D plan you have. Although 25 percent is the standard copay until you reach catastrophic coverage, some Medicare drug plans include coverage while you're in the donut hole that lowers your cost. This may be true for both generic and brand-name drugs.

What Costs Don't Count Toward the Coverage Gap?

Not all of your out-of-pocket costs count toward the coverage gap or for getting you out of it. Exclude the following items:

Compare Your Medicare Plan Options

It's easy to find the best Medicare plan for you with our Find a Plan tool. Just enter your zip code to compare Medicare Supplement, Part D, and Advantage plans in your area.