What is a Medicare network? Medicare Advantage (Part C) can cover Original Medicare Parts A and B but limits you to a specific group of healthcare providers you can see (HMO or PPO networks). The Advantage plan provider has their network with specific doctors, facilities, and suppliers.

Full Answer

Where can I use Medicare Part B coverage?

Some of these services not covered by Original Medicare may be covered by a Medicare Advantage Plan (like an HMO or PPO). To find out if Medicare covers a service you need, visit medicare.gov and select “What Medicare Covers,” or call 1-800-MEDICARE (1-800-633-4227). TTY users should call 1-877-486-2048, 24 hours a day/7 days a week.

What are Original Medicare Parts A and B?

With Medicare Advantage, you: Need to use doctors who are in the plan’s network (for non-emergency or non-urgent care). May pay a premium for the plan in addition to the monthly Part B premium. Plans may have a $0 premium or may help pay all or part of your Part B premiums. Can’t buy or use separate supplemental coverage (like Medigap).

Do I have to sign up for Medicare Parts A and B?

Jun 11, 2019 · Both are parts of the government-run Original Medicare program. Both may cover different hospital services and items. Both may cover mental health care (Part A may cover inpatient care, and Part B may cover outpatient services). Both may cover home health care. Both have annual deductibles, as well as coinsurance or copayments, that may apply ...

What is a Medicare Part B enrollment?

Nov 12, 2021 · Medicare Part A is designed to cover the parts of your major medical care that involve being in the hospital or its aftermath. If you need to be hospitalized and the hospital you choose accepts Medicare, Medicare Part A will usually cover these aspects: Inpatient care. Skilled nursing facility care. Medicare Part A also covers other important ...

Is Medicare Part A and B an HMO?

You must have both Parts A and B to join a Medicare HMO. Generally you will continue paying your Medicare Part B premium, though some HMOs will pay part of this premium. Some HMOs may charge an additional premium, on top of your Part B premium.

Does Medicare have a network?

What are Medicare Parts A & B?

Do you get Medicare A and B together?

What is Medicare out-of-network?

What is a Medicare network?

Is MA and Part C the same thing?

What is the difference between Medicare Part C and Part D?

What are the four different parts of Medicare?

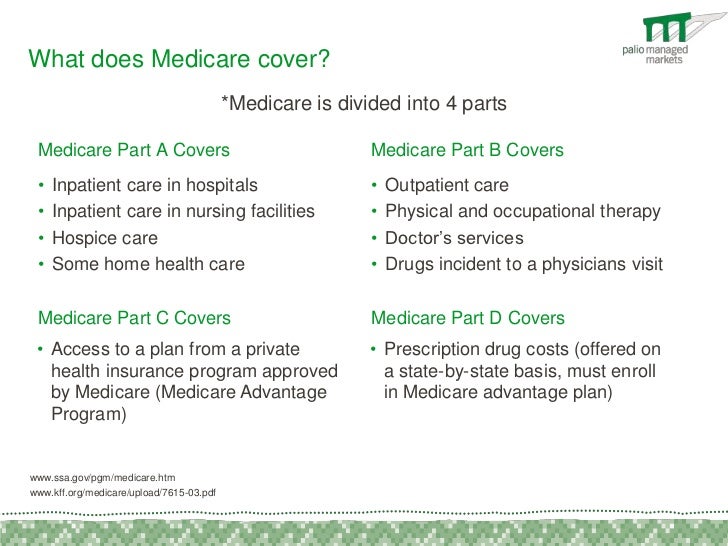

- Part A provides inpatient/hospital coverage.

- Part B provides outpatient/medical coverage.

- Part C offers an alternate way to receive your Medicare benefits (see below for more information).

- Part D provides prescription drug coverage.

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Is Medicare Part A and B free?

Does Medicare Part B pay for prescriptions?

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

Does Medicare pay for group health insurance?

Medicare will pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim. You'll have to pay any costs Medicare or the group health plan doesn't cover.

Do you have to pay for Medicare if you have 20 employees?

You'll have to pay any costs Medicare or the group health plan doesn't cover. Employers with 20 or more employees must offer current employees 65 and older the same health benefits, under the same conditions, that they offer employees under 65.

Does Medicare pay first if you are 65?

Your spouse's employer has at least 20 employees. If you don't take employer coverage when it's first offered to you, you might not get another chance to sign up.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

How does Original Medicare work?

Original Medicare covers most, but not all of the costs for approved health care services and supplies. After you meet your deductible, you pay your share of costs for services and supplies as you get them.

How does Medicare Advantage work?

Medicare Advantage bundles your Part A, Part B, and usually Part D coverage into one plan. Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

Do you have to pay Medicare Part A or B?

Although both Medicare Part A and Part B have monthly premiums, whether you’re likely to pay a premium – and how much – depends on the “part” of Medicare. Most people don’t have to pay a monthly premium for Medicare Part A. If you’ve worked and paid Medicare taxes for at least 10 years (40 quarters), you typically don’t pay a premium.

What is Medicare Part A?

Medicare Part A is hospital insurance. It may cover your care in certain situations, such as: You’re admitted to a hospital or mental hospital as an inpatient. You’re admitted to a skilled nursing facility and meet certain conditions. You qualify for hospice care.

Does Medicare cover home health?

There may be some services you get in a hospital or other setting that Medicare doesn’t cover.

How much does Medicare pay if you work for 10 years?

If you’ve worked and paid Medicare taxes for at least 10 years (40 quarters), you typically don’t pay a premium. If you worked 30-39 quarters, you’ll generally pay $240 in 2019. If you worked fewer than 30 quarters, you’ll generally pay $437 in 2019. On the other hand, most people do pay a monthly premium for Medicare Part B.

How much does Medicare pay in 2019?

On the other hand, most people do pay a monthly premium for Medicare Part B. The standard premium in 2019 is $135.50, but you may pay more if your income is above a certain level. If you have a low income or no income, in some cases Medicaid might pay your Part B premium.

How many Medicare Supplement Plans are there?

There are up to 10 standardized Medicare Supplement plans available in most states. Learn more about Medicare Supplement insurance. You can compare Medicare Supplement plans and Medicare coverage options anytime you like, with no obligation. Type your zip code in the box on this page to begin.

Can you get hospice care with Medicare?

You qualify for hospice care. Your doctor orders home health care for you and you meet the Medicare criteria. Medicare Part A may cover part-time home health care for a limited time. Even when Medicare Part A covers your care: You may have to pay a deductible amount and/or coinsurance or copayment.

How often do Medicare networks change?

Networks usually change every year. Doctors and physicians within the network must accept being a part of the network each year. When you have a network-based plan such as Medicare Advantage, we recommend verifying acceptable with your doctor prior to re-enrolling for another year during AEP.

What is network strength in Medicare?

Network strength is often a key factor when comparing Medicare Advantage plan options. Understanding Medicare networks is crucial, as network s can affect your ability to easily visit your doctors and physicians. Determining the best fit for your healthcare needs and budget can be an overwhelming task. If you’re unsure or need answers ...

Why is understanding Medicare important?

Understanding Medicare networks is crucial, as networks can affect your ability to easily visit your doctors and physicians. Determining the best fit for your healthcare needs and budget can be an overwhelming task. If you’re unsure or need answers to your questions, our licensed agents are here to help you!

What percentage of Medicare Advantage plans are HMOs?

For health care providers not on the plan’s preferred provider list, you will likely pay more for services. 64% of those enrolled in Medicare Advantage plans are in HMOs and 31% in PPOs. 3.

What services do you pay for Medicare Part B?

“ Durable Medical Equipment ,” such as canes, walkers, wheelchairs, oxygen tanks, and many other devices. Mental health care. Ambulance services. You will likely pay a premium and deductible for your Medicare Part B insurance. After your deductible is met, coinsurance ...

How to learn Medicare ABCs?

To start learning your Medicare ABCs, you need to distinguish between the first two letters of the alphabet: A and B. HealthMarkets is here to help you learn the difference between Medicare Parts A and B, the services they insure, and their costs.

What does Medicare cover?

If you need to be hospitalized and the hospital you choose accepts Medicare, Medicare Part A will usually cover these aspects: 1 The cost of your hospitalization and surgery 2 The skilled nursing care you’d need as part of your recovery

Does Medicare Part A cover hospitalization?

If you need to be hospitalized and the hospital you choose accepts Medicare, Medicare Part A will usually cover these aspects: The cost of your hospitalization and surgery. The skilled nursing care you’d need as part of your recovery. Medicare Part A also covers other important services: Hospice care. Some home health services.

Does Medicare pay for home health?

Some home health services. Most people who qualify for Medicare Part A will not pay a premium for their care. If you or your spouse are over 65 and qualify for Social Security benefits, currently receive benefits from Social Security or the Railroad Retirement Board, or had Medicare-covered government employment, ...

Can you get Medicare Part A for ESRD?

Some younger people with disabilities or life-threatening diseases, such as End-Stage Renal Failure (ESRD), may also qualify for premium-free Medicare Part A. You likely will pay certain out-of-pocket expenses, such as coinsurance and deductibles, with Medicare Part A.

What is the coinsurance for Medicare Part B?

You will likely pay a premium and deductible for your Medicare Part B insurance. After your deductible is met, coinsurance for most services will be 20% when the doctor accepts Medicare assignment.

Does Medicare cover telehealth?

In response to the coronavirus outbreak, Medicare has temporarily expanded coverage of telehealth services . Beneficiaries can use a variety of devices — from phones to tablets to computers — to communicate with their providers.

What is Medicare Advantage?

Medicare Advantage is the private health insurance alternative to the federally run original Medicare. Think of Advantage as a kind of one-stop shopping choice that combines various parts of Medicare into one plan.

Do you have to pay Medicare premiums?

Most people don’t have to pay a premium for Part A. You’ve already paid into the system in the form of the Medicare tax deductions on your paycheck. However, Part A isn’t totally free. Medicare charges a hefty deductible each time you are admitted to the hospital.

How much is Medicare deductible for 2021?

Medicare charges a hefty deductible each time you are admitted to the hospital. It changes every year, but for 2021 the deductible is $1,484. You can buy a supplemental or Medigap policy to cover that deductible and some out-of-pocket costs for the other parts of Medicare.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage plans also fold in prescription drug coverage. Not all of these plans cover the same extra benefits, so make sure to read the plan descriptions carefully. Medicare Advantage plans generally are either health maintenance organizations (HMOs) or preferred provider organizations (PPOs).

When is open enrollment for Medicare 2021?

The next open enrollment will be from Oct. 15 to Dec. 7 , 2021, and any changes you make will take effect in January 2022. Editor’s note: This article has been updated with new information for 2021.

How much is Part B insurance for 2021?

The federal government sets the Part B monthly premium, which is $148.50 for 2021. It may be higher if your income is more than $88,000. You’ll also be subject to an annual deductible, set at $203 for 2021. And you’ll have to pay 20 percent of the bills for doctor visits and other outpatient services.

Do I need to sign up for Medicare if I have Indian health care?

Q. If I receive health care from the Indian Health Service, do I need to enroll in Medicare? A: Yes, you are required to sign up for Medicare Parts A and B, though not necessarily for Part D.— Read Full Answer.

Does Medicare cover tricare for life?

A: Medicare becomes your primary health insurance and TRICARE For Life becomes supplemental coverage that wraps around Medicare benefits. So you must sign up with Medicare in order to maintain eligibility for TFL. — Read Full Answer.

Can I delay Medicare enrollment?

A: No, you can’t delay Medicare enrollment until COBRA expires — not without facing a gap in coverage and late penalties. — Read Full Answer. Q. I will continue to work after turning 65. My employer’s health insurance is a high-deductible health plan paired with a health savings account.

How does Medicare work with insurance carriers?

Generally, a Medicare recipient’s health care providers and health insurance carriers work together to coordinate benefits and coverage rules with Medicare. However, it’s important to understand when Medicare acts as the secondary payer if there are choices made on your part that can change how this coordination happens.

Is Medicare a secondary payer?

Medicare is the secondary payer if the recipient is: Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization with more than 20 employees.

Does Medicare pay conditional payments?

In any situation where a primary payer does not pay the portion of the claim associated with that coverage, Medicare may make a conditional payment to cover the portion of a claim owed by the primary payer. Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment.

Who is responsible for making sure their primary payer reimburses Medicare?

Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment. Medicare recipients are also responsible for responding to any claims communications from Medicare in order to ensure their coordination of benefits proceeds seamlessly.

How old do you have to be to be covered by a group health plan?

Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization that shares a plan with other employers with more than 20 employees between them.

Is ESRD covered by COBRA?

Diagnosed with End-Stage Renal Disease (ESRD) and covered by a group health plan or COBRA plan; Medicare becomes the primary payer after a 30-day coordination period. Receiving coverage through a No-Fault or Liability Insurance plan for care related to the accident or circumstances involving that coverage claim.

What is Medicare Part B?

Part B – Costs. Premium. Medicare Part B has a monthly insurance premium that is based on when you enroll and your annual household income. This premium is commonly paid through Social Security withholdings.

When will Medicare Part A and Part B be automatically enrolled?

You will be automatically enrolled in Medicare Part A and Part B if you reach age 65 and receive Social Security or Railroad Retirement Board (RRB) retirement benefits. You will also be automatically enrolled if you are under age 65 with an eligible disability.

Is there a premium for Medicare Part A?

Premium. There is no insurance premium for Part A if you or your spouse contributed to Social Security for at least 10 years. Otherwise, an option to buy Medicare Part A is available. Deductible.

How long does Medicare Part A last?

Title. When to Enroll. Description. When you are first eligible, your Initial Enrollment Period for Medicare Part A and Part B lasts seven months and starts when you qualify for Medicare, either based on your age or an eligible disability.

What is open enrollment period for Medicare?

The Medicare Open Enrollment Period provides an annual opportunity to review, and if necessary, change your Medicare coverage. Below are some examples of changes that you can make during Open Enrollment:

What percentage of Medicare coinsurance is required?

Coinsurance. You pay 20 percent for some medical services, such as doctor services, outpatient therapy and durable medical equipment. Preventive Care. No deductibles, copays or coinsurance are required for Medicare-covered preventive care services, such as annual wellness visits and mammograms for women.

What Is An HMO?

- An HMO is a Health Maintenance Organization. If you visit a doctor, health care provider, or hospital outside of the HMO network, you will likely pay full cost for your services. To see a specialist with an HMO-based plan you may need a referral from your primary care doctor. Additionally, some HMO plans offer drug coverage. There are currently about 470 HMO plans thr…

What Is A PPO?

- PPO stands for Preferred Provider Organization. Unlike an HMO, you can get your health care services performed by anyone on or off their list. For health care providers noton the plan’s preferred provider list, you will likely pay more for services. 64% of those enrolled in Medicare Advantage plans are in HMOs and 31% in PPOs.

What Is A Medicare Network?

- Medicare Advantage (Part C) can cover Original Medicare Parts A and B but limits you to a specific group of healthcare providers you can see (HMO or PPO networks). The Advantage plan provider has their network with specific doctors, facilities, and suppliers. Since plan providers determine their own rules and costs, if you see someone outside of th...

Do Networks Change Or Stay The Same Each Year?

- Networks usually change every year. Doctors and physicians within the network must accept being a part of the network each year. When you have a network-based plan such as Medicare Advantage, we recommend verifying acceptable with your doctor prior to re-enrolling for another year during AEP.

How Do Networks Differ Between Urban and Rural areas?

- Rural areas often have smaller, more limited networks. A general rule of thumb is that networks centered around areas of greater population will have more robust provider options. Network strength is often a key factor when comparing Medicare Advantage plan options. Understanding Medicare networks is crucial, as networks can affect your ability to easily visit your doctors and …