What percentage of federal budget is spent on Medicare?

Medicare is the second largest program in the federal budget. In 2018, it cost $582 billion — representing 14 percent of total federal spending.1. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending.

How much of the federal government budget goes to Social Security?

Presently, the Social Security program is the largest single item in the annual federal government budget. As a percentage of total federal expenditures, in 2002 Social Security benefits were approximately 22.6% of federal expenditures.

How is Social Security and Medicare funded?

The majority of Social Security and Medicare funding comes from tax revenue and interest on trust fund reserves. For 2019, income for these programs was $1.86 trillion. However, costs exceeded revenue starting in 2018 for Medicare Part A and are expected to exceed revenue beginning in 2021 for Social Security.

What percentage of federal outlays are spent on social security?

As a percentage of federal outlays, Social Security benefits have ranged from a low of 0.22% (during World War II) to a high of 23.2% in 2001. There are several other points of interest in the data.

What percent of US budget is Social Security and Medicare?

Major categories of FY 2017 spending included: Healthcare such as Medicare and Medicaid ($1,077B or 27% of spending), Social Security ($939B or 24%), non-defense discretionary spending used to run federal Departments and Agencies ($610B or 15%), Defense Department ($590B or 15%), and interest ($263B or 7%).

What percentage of federal budget is Social Security?

Social Security is mainly funded through a dedicated payroll tax created by the Federal Insurance Contributions Act of 1935. Employers and employees each pay 6.2 percent of wages, with a cap on the amount of wages subject to the tax ($142,800 for 2021, adjusted annually for growth in economy-wide wages).

What percentage of the US budget is spent on social programs?

In 2019, major entitlement programs—Social Security, Medicare, Medicaid, Obamacare, and other health care programs—consumed 51 percent of all federal spending, larger than the portion of spending for other national priorities (such as national defense) combined.

What are the 5 largest federal expenses?

Military (Discretionary)Social Security, Unemployment, and Labor (Mandatory)Medicare and Health (Mandatory)Government (Discretionary)Education (Discretionary) Whether you owe money to the IRS or you have a State tax debt, our staff of Enrolled Agents and Tax Professionals can help you!

What are the 3 largest categories of federal government spending?

The U.S. Treasury divides all federal spending into three groups: mandatory spending, discretionary spending and interest on debt. Together, mandatory and discretionary spending account for more than ninety percent of all federal spending, and pay for all of the government services and programs on which we rely.

What is the largest component of the federal budget?

Social Security takes up the largest portion of the mandatory spending dollars. In fact, Social Security demands $1.046 trillion of the total $2.739-trillion mandatory spending budget. It also includes programs like unemployment benefits and welfare.

Where does most of the US budget go?

More than half of FY 2019 discretionary spending went for national defense, and most of the rest went for domestic programs, including transportation, education and training, veterans' benefits, income security, and health care (figure 4).

What percent of our taxes go to healthcare?

In other words, the federal government dedicates resources of nearly 8 percent of the economy toward health care. By 2028, we estimate these costs will rise to $2.9 trillion, or 9.7 percent of the economy. Over time, these costs will continue to grow and consume an increasing share of federal resources.

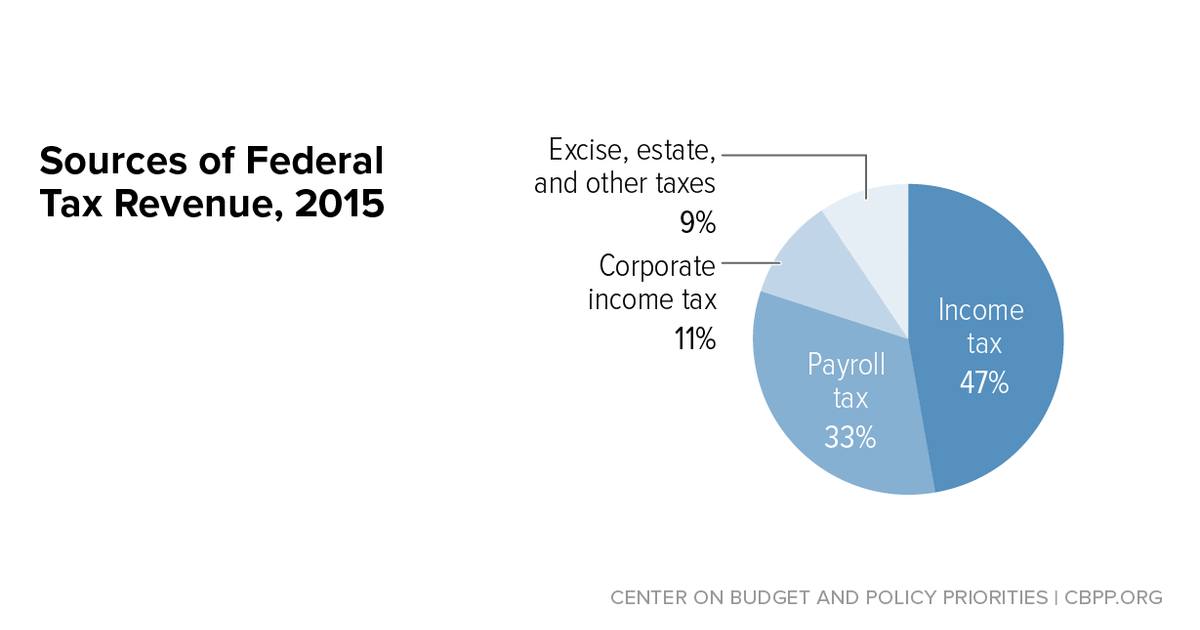

What is the largest source of revenue for the federal government?

individual income taxesThis is especially important as the economic recovery from the pandemic continues. In the United States, individual income taxes (federal, state, and local) were the primary source of tax revenue in 2020, at 41.1 percent of total tax revenue.

What percentage of the US budget goes to military?

The United States spent $754 billion on national defense during fiscal year (FY) 2021 according to the Office of Management and Budget, which amounted to 11 percent of federal spending; that percentage was lower than the 15 percent of the budget spent on defense in the four years before the pandemic.

Will America ever pay its debt?

1:5312:10What Happens If The U.S. Can't Pay Its Debt? - YouTubeYouTubeStart of suggested clipEnd of suggested clipGovernment promises to do is pay a certain amount of interest on that periodically. And then after aMoreGovernment promises to do is pay a certain amount of interest on that periodically. And then after a certain amount of time repay the thousand dollars.

What is Medicare Part A?

Medicare has two sections: The Medicare Part A Hospital Insurance program, which collects enough payroll taxes to pay current benefits. Medicare Part B, the Supplementary Medical Insurance Program, and Part D, the new drug benefit. Payroll taxes and premiums cover only 57% of benefits.

What does it mean when the government has a high level of mandatory spending?

In the long run, the high level of mandatory spending means rigid and unresponsive fiscal policy. This is a long-term drag on economic growth.

How much of Medicare will be paid by 2034?

That means Medicare contributes to the budget deficit. Rising health care costs mean that general revenues would have to pay for 49% of Medicare costs by 2034. 13 As with Social Security, the tax base is insufficient to pay for this.

How is Social Security funded?

Social Security is funded through payroll taxes.

What is mandatory program?

Congress established mandatory programs under so-called authorization laws. 3 These laws also mandated that Congress appropriate whatever funds are needed to keep the programs running. The mandatory portion of the U.S. budget estimates how much it will cost to fulfill these authorization laws.

How much is mandatory spending in 2021?

Mandatory spending is estimated to be $2.966 trillion for FY 2021. 1 The two largest mandatory programs are Social Security and Medicare. That's 38.5% of all federal spending. It's more than two times more than the military budget. 2.

Why is mandatory spending growing?

That's one reason mandatory spending continues to grow. Another reason is the aging of America. As more people require Social Security and Medicare, costs for these two programs will almost double in the next 10 years. 18 At the same time, birth rates are falling. As a result, the elder dependency ratio is worsening.

What percentage of Medicare is home health?

Medicare is a major player in our nation's health system and is the bedrock of care for millions of Americans. The program pays for about one-fifth of all healthcare spending in the United States, including 32 percent of all prescription drug costs and 39 percent of home health spending in the United States — which includes in-home care by skilled nurses to support recovery and self-sufficiency in the wake of illness or injury. 4

How much of Medicare was financed by payroll taxes in 1970?

In 1970, payroll taxes financed 65 percent of Medicare spending.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

What percentage of GDP will Medicare be in 2049?

In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2019 to 6.1 percent of GDP by 2049. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

How much did Medicare cost in 2019?

In 2019, it cost $644 billion — representing 14 percent of total federal spending. 1. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending. In 2019, Medicare provided benefits to 19 percent of the population. 2.

Why is Medicare underfunded?

Medicare is already underfunded because taxes withheld for the program don't pay for all benefits. Congress must use tax dollars to pay for a portion of it. Medicaid is 100% funded by the general fund, also known as "America's Checkbook.".

What is the budget for 2022?

The discretionary budget for 2022 is $1.688 trillion. 1 Much of it goes toward military spending, including Homeland Security, the Department of Veterans Affairs, and other defense-related departments. The rest must pay for all other domestic programs.

How much is discretionary spending?

Discretionary spending, which pays for everything else, will be $1.688 trillion. The U.S. Congress appropriates this amount each year, using the president's budget as a starting point. Interest on the U.S. debt is estimated to be $305 billion.

What is the most expensive program in 2022?

It also includes welfare programs such as Medicaid. Social Security will be the biggest expense, budgeted at $1.196 trillion.

How much is Biden's budget for 2022?

President Biden’s budget for FY 2022 totals $6.011 trillion, eclipsing all other previous budgets. Mandatory expenditures, such as Social Security, Medicare, and the Supplemental Nutrition Assistance Program account for about 65% of the budget. For FY 2022, budget expenditures exceed federal revenues by $1.873 trillion.

How long does it take for the President to respond to the budget?

The president submits it to Congress on or before the first Monday in February. Congress responds with spending appropriation bills that go to the president by June 30. The president has 10 days to reply.

Why are investors reluctant to buy Treasury notes?

Eventually, investors may become hesitant to purchase Treasury notes because they fear the U.S. government may not be able to repay the debt.

What is the purpose of the Justification of Estimates for Appropriations Committees?

The Justification of Estimates for Appropriations Committees informs members of Congress about SSA’s funding request, including how it will support performance goals and initiatives to improve service. For specific sections, please see the following:

Why are Social Security benefits part of the federal government?

The benefits these programs pay are part of the Federal Government’s mandatory spending because authorizing legislation ( Social Security Act) requires us to pay them. While Congress does not set the amount of benefits we pay each year, they decide funding for our administrative budget.

How much of the federal budget was spent on Social Security in 2001?

As an interesting point of comparison, even the peak year of 2001 in which expenditures for Social Security topped 23% of the federal budget, this was far from the most the federal government has ever committed to social welfare spending. Following the Civil War, the federal government funded pensions for Union veterans and their survivors ...

What percentage of Social Security was spent in 2002?

As a percentage of total federal expenditures, in 2002 Social Security benefits were approximately 22.6% of federal expenditures. As a percentage of federal outlays, Social Security benefits have ranged from a low of 0.22% (during World War II) to a high of 23.2% in 2001. There are several other points of interest in the data.

Which amendments significantly increased the value of Social Security benefits?

There are several other points of interest in the data. The 1950 Amendments, for example, which significantly increased the value of Social Security benefits, produced the largest year-to-year jump in the percentage (almost doubling from 1950 to 1951).

What is Medicare 570?

This category consists of the Medicare function (570), including benefits, administrative costs, and premiums, as well as the “Grants to States for Medicaid” account, the “Children’s health insurance fund” account, the “Refundable Premium Tax Credit and Cost Sharing Reductions,” and two other small accounts supporting the Affordable Care Act’s marketplace subsidies (all in function 550).

What are the subcategories of education?

Education: The education subcategory combines three subfunctions of the education, training, employment, and social services function: elementary, secondary, and vocational education ; higher education; and research and general educational aids (subfunctions 501, 502, and 503, respectively).

How much of the federal budget is interest on debt?

In 2019, these interest payments claimed $375 billion, or about 8 percent of the budget.

How much did the federal government spend in 2019?

In fiscal year 2019, the federal government spent $4.4 trillion, amounting to 21 percent of the nation’s gross domestic product (GDP). Of that $4.4 trillion, over $3.5 trillion was financed by federal revenues. The remaining amount ($984 billion) was financed by borrowing. As the chart below shows, three major areas of spending make up ...

What is the Center on Budget and Policy Priorities?

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.

What is the 601 income security?

The latter contains the Pension Benefit Guarantee Corporation and also covers programs that provide pension and disability benefits to certain small groups of private-sector workers.

What are the benefits of a retired federal employee?

These include providing health care and other benefits to veterans and retirement benefits to retired federal employees, ensuring safe food and drugs, protecting the environment, and investing in education, scientific and medical research, and basic infrastructure such as roads, bridges, and airports.

What is the additional type of spending that impacts federal spending?

An additional type of spending that impacts federal spending is. supplemental appropriations. , also referred to as supplemental spending. In 2020, the U.S. Congress passed four supplemental. appropriations.

Why is Social Security mandatory?

Programs like Social Security, Medicare, and various income security programs, are based on laws previously established that dictate the money budgeted for spending each year, which is why spending for those programs is referred to as mandatory.

What is the MTS?

Monthly Treasury Statement (MTS) as the data source for federal government spending of the United States. Some categories from the MTS have been renamed in order to be more easily understood. The Social Security and Medicare Boards of Trustees publish their. Annual Report.

How much does Social Security cost?

In 2019, the cost of the Social Security and Medicare programs was $1.86 trillion.

When will Medicare be depleted?

While Medicare Parts B and D are largely funded by general revenues and beneficiary premiums, the Boards project that Medicare Part A trust fund will be depleted by 2026 and the Social Security trust fund will be depleted by 2034.

What does the government buy?

The government buys a variety of products and services used to serve the public — everything from military aircraft, construction and highway maintenance equipment, buildings, and livestock, to research, education, and training.

Where does Medicare and Social Security money come from?

The majority of Social Security and Medicare funding comes from tax revenue and interest on trust fund reserves. For 2019, income for these programs was $1.86 trillion. However, costs exceeded revenue starting in 2018 for Medicare Part A and are expected to exceed revenue beginning in 2021 for Social Security.

How much did tax breaks cost in 2015?

Tax breaks are expected to cost the federal government $1.22 trillion in 2015 - more than all discretionary spending in the same year. Unlike discretionary spending, which must be approved by lawmakers each year during the appropriations process, tax breaks do not require annual approval.

What is spending in the tax code?

Spending in the Tax Code. When the federal government spends money on mandatory and discretionary programs, the U.S. Treasury writes a check to pay the program costs. But there is another type of federal spending that operates a little differently.

What is mandatory spending?

Mandatory spending is spending that Congress legislates outside of the annual appropriations process, usually less than once a year. It is dominated by the well-known earned-benefit programs Social Security and Medicare.

What are the three groups of federal spending?

The U.S. Treasury divides all federal spending into three groups: mandatory spending, discretionary spending and interest on debt. Mandatory and discretionary spending account for more than ninety percent of all federal spending, and pay for all of the government services and programs on which we rely.

What percentage of the federal budget is Medicare?

Social Security alone comprises more than a third of mandatory spending and around 23 percent of the total federal budget. Medicare makes up an additional 23 percent of mandatory spending and 15 percent of the total federal budget.

What is discretionary spending?

Discretionary spending refers to the portion of the budget that is decided by Congress through the annual appropriations process each year. These spending levels are set each year by Congress.

What does it mean when the government issues a tax break?

When the government issues a tax break, it chooses to give up tax revenue for a specific purpose - so both spending and tax breaks mean less money in the U.S. Treasury, and both reflect spending priorities laid out by Congress in various pieces of legislation.