Full Answer

How do I choose between Medicare and private health insurance?

People looking for health insurance can choose between Medicare and private companies. The best option will depend on a person’s healthcare needs and financial situation. The federal government provides original Medicare, and private companies administer private health insurance and Medicare Advantage plans on behalf of the government.

What parts of Medicare are sold by private insurance companies?

What parts of Medicare are sold by private insurance companies? Medicare Advantage (Part C), Part D, and Medigap are all optional Medicare plans that are sold by private insurance companies. Medicare Advantage plans are a popular option for Medicare beneficiaries because they offer all-in-one Medicare coverage.

Are private insurers paying more for hospital services than Medicare?

The authors of the new RAND report found that over time, private health insurers have been paying more for hospital services relative to Medicare. In 2016, private insurers paid hospital prices that averaged 224 percent of what Medicare paid for the same services.

What is the difference between private insurance and Medicare deductibles?

Private insurance deductibles vary among plans. Below is a rough average of the deductibles for private insurance plans and those that apply to Medicare Part A and Part B plans: As this shows, the deductible for Medicare Part A is lower than the average deductible for private insurance plans. How do the benefits differ?

What percentage does Medicare pay to the providers?

According to the AHA, private insurance payments average 144.8 percent of cost, while payments from Medicare average 86.8 percent of cost.

Does Medicare pay private insurance companies?

Private insurance and original Medicare plans provide varying benefits and coverage. Most of both types of plans cover hospital care and outpatient medical services, including doctor's visits, physical therapy, and diagnostic tests. However, Medicare may have gaps in coverage that private insurers cover.

What percentage or portion of Medicare beneficiaries receive services through Medicare Advantage plans?

Medicare Advantage enrollment has steadily increased both nationally and within most states since 2005, with more than 40 percent of Medicare beneficiaries enrolled in Medicare Advantage plans in 2021.

What percent of new Medicare beneficiaries are enrolling in Medicare Advantage?

In 2020, nearly four in ten (39%) of all Medicare beneficiaries – 24.1 million people out of 62.0 million Medicare beneficiaries overall – are enrolled in Medicare Advantage plans; this rate has steadily increased over time since the early 2000s.

How much more than Medicare do private insurers pay a review of the literature?

Private insurers paid nearly double Medicare rates for all hospital services (199% of Medicare rates, on average), ranging from 141% to 259% of Medicare rates across the reviewed studies.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Does Medicare Advantage cost less than traditional Medicare?

Spending per person. Medicare spent $321 more per person for Medicare Advantage enrollees than it would have spent for the same beneficiaries had they been covered under traditional Medicare in 2019.

Who sells the most Medicare Advantage plans?

UnitedHealthcareStandout feature: UnitedHealthcare offers the largest Medicare Advantage network of all companies, with more than 1 million network care providers. UnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

Which is the largest payer for home health services?

MedicareMedicare is the single largest payer of home health services, accounting for $40 billion in fiscal year 2018, followed by Medicaid ($35 billion in fiscal year 2018).

Why is Medicare Advantage growing so fast?

In 2005, 13 percent of enrollees chose the MA option, and the growth has been steady ever since; enrollment in Advantage plans rose 10 percent between 2020 and 2021 alone. One reason for this growth is all the extra benefits MA plans provide — but which Congress has not yet allowed original Medicare to offer.

What are the top 3 Medicare Advantage plans?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCMS ratingHumana5.03.6Blue Cross Blue Shield5.03.8Cigna4.53.8United Healthcare4.03.81 more row•Feb 25, 2022

Who Has the Best Medicare Advantage Plan for 2022?

For 2022, Kaiser Permanente ranks as the best-rated provider of Medicare Advantage plans, scoring an average of 5 out of 5 stars. Plans are only available in seven states and the District of Columbia.

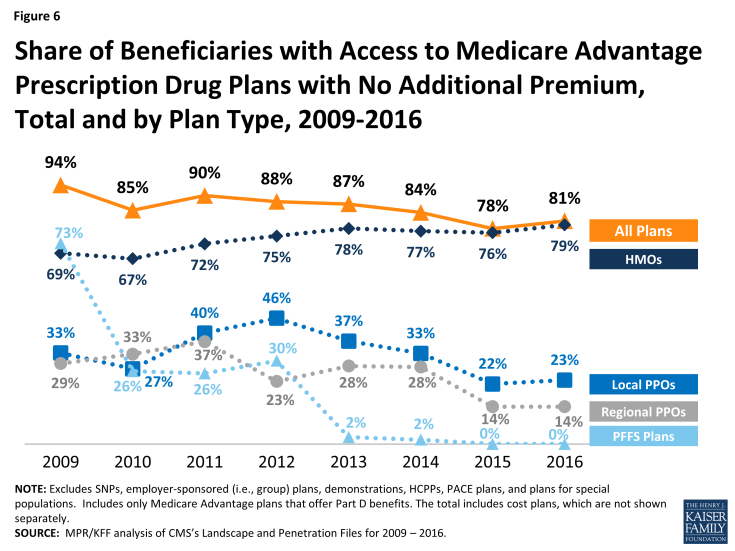

How much of Medicare beneficiaries have access to private plans?

Enrollment has risen to 33 percent of all Medicare beneficiaries; 99 percent of beneficiaries have access to private plans in 2017. Recent policies have improved risk-adjustment methods, rewarded plans’ performance on quality of care, and reduced average payments to private plans to 100 percent of traditional Medicare spending. As enrollment in private plans continues to grow and as health care costs rise, policymakers should enhance incentives for private plans to meet intended goals for higher-quality care at lower cost.

Why is private Medicare important?

Original advocates for private plans in Medicare believed they would lower costs, improve quality of care, and provide consumer choice. It is vital that policymakers hold fast to these aims in the future. In addition, quality measures introduced in the past decade must be improved to ensure broader access to high-quality care. Medicare Part C will not be sustainable if plans are paid more than traditional Medicare. Further, inefficiencies within traditional Medicare may not make it the best standard on which to base payments for Medicare Advantage plans. 43

How long has Medicare been involved with HMOs?

Medicare has involved HMOs since 1966. Because these private plans use salaried physicians, they were originally paid on a reasonable-cost basis for services that Medicare otherwise would have paid on a reasonable-charge basis. 4 Under the 1972 Social Security Amendments, preexisting plans could continue to be paid on a reasonable-cost basis, but new plans would operate on a risk-sharing contract. The expenses of each plan were compared to the adjusted average per capita cost (AAPCC) for their enrollees under traditional Medicare. If the HMO’s costs exceeded the AAPCC, it could carry the excess cost into subsequent years to be offset against any future savings. If the HMO’s costs were lower, up to 20 percent of the difference was shared evenly between the HMO and the government (with the government keeping any additional savings). 5

What is Medicare Modernization Act?

In addition to establishing Medicare Part D, the Medicare Modernization Act of 2003 (MMA) significantly altered how private plans (now renamed Medicare Advantage) were paid. The law limited enrollees to one switch per year during the open enrollment period and allowed plans to include the new drug benefit (MA–PD). 23

How many HMOs were contracted with Medicare in 1979?

By 1979, 65 HMOs were contracting with Medicare, although only one had a risk-sharing contract. 6 Nevertheless, the prospect of an alternative to traditional Medicare spurred continued interest in risk-contracted HMOs within Medicare. 7.

Why did Medicare start with HMOs?

Medicare began including health maintenance organizations (HMOs) as a way to allow retirees with employer-sponsored health insurance to retain their existing patient–provider relationships. 1 Proponents argued that the efficiencies of HMOs could reduce government expenditures, improve quality, and provide additional benefits beyond those offered by traditional Medicare. They also asserted that plans could provide beneficiaries with greater choice and promote innovations in health care delivery. 2

What is Medicare Advantage?

These plans, now known as Medicare Advantage or Medicare Part C, operate under risk-based contracts — the plans agree to assume liability for beneficiaries’ health expenses in exchange for a monthly, per-person (also known as capitated) sum.

Which is better, private or Medicare?

Typically, private insurance is a better option for people with dependents. While Medicare plans offer coverage only to individuals, private insurers usually allow people to extend health coverage to dependents, including children and spouses.

Which is more expensive, private insurance or Medicare?

Generally, private insurance costs more than Medicare. Most people qualify for a $0 premium on Medicare Part A.

What is Medicare approved private insurance?

The health insurance that Medicare-approved private companies provide varies among plan providers, but it may include coverage for the following: assistance with Medicare costs, such as deductible, copays, and coinsurance. prescription drug coverage through Medicare Part D plans.

How much is the deductible for Medicare Part A?

Medicare Part A: $1,484. Medicare Part B: $203. As this shows, the deductible for Medicare Part A is lower than the average deductible for private insurance plans.

What is Medicare Advantage?

Medicare Advantage plans, which replace original Medicare , may offer coverage that more closely resembles that of a private insurance plan. Many Medicare Advantage plans offer dental, vision, and hearing care and prescription drug coverage.

Why does Medicare cost more?

However, Medicare plans may cost more because they do not have an out-of-pocket limit, which is a requirement of all Medicare Advantage plans.

How many employees does Medicare have?

For example, Medicare is the primary payer when a person has private insurance through an employer with fewer than 20 employees. To determine their primary payer, a person should call their private insurer directly.

What percentage of Medicare would be paid by private health plans in 2017?

Private health plans paid providers at 241 percent of what Medicare would have in 2017, according to a RAND study. This is an increase from 236 percent in 2015.

What states have relative prices for Medicare?

Relative prices also varied among the 25 states in the study. Michigan, Pennsylvania, New York and Kentucky had relative prices in the range of 150 to 200 percent of Medicare rates. Colorado, Montana, Wisconsin, Maine, Wyoming and Indiana had relative prices in the range of 250 to 300-plus percent of Medicare rates.

Does transparency reduce hospital prices?

ON THE RECORD. "Transparency by itself is likely insufficient to reduce hospital prices, and employers may need state or federal policy interventions to rebalance negotiating leverage between hospitals and employer health plans," the report said.

How much does Medicare Advantage cost in 2021?

The most a Medicare Advantage plan can charge in out-of-pocket costs is $7,550 in 2021.

What is Medicare Advantage?

Medicare Advantage plans are a popular option for Medicare beneficiaries because they offer all-in-one Medicare coverage. This includes original Medicare, and most plans also cover prescription drugs, dental, vision, hearing, and other health perks.

How to talk to an unbiased Medicare expert?

If you’d like to discuss your specific situation with an unbiased Medicare expert, contact your local State Health Insurance Assistance Program (SHIP) office.

How many tiers of insurance are there?

Another option is purchasing insurance through the federal Healthcare Marketplace. There are four tiers of private insurance plans within the insurance exchange markets. These tiers differ based on the percentage of services you are responsible for paying.

What age do you have to be to get medicare?

Anyone age 65 or older qualifies for Medicare, which is a federal program that offers affordable healthcare coverage. However, some people may prefer to compare this coverage with private insurance options.

What is Part B insurance?

Part B, or medical insurance, covers outpatient visits and services, as well as preventive healthcare.

Which has the lowest deductible?

Platinum plans cover 90 percent of your healthcare costs. Platinum plans have the lowest deductible, so your insurance often pays out very quickly, but they have the highest monthly premium.

How many people have Medicare Supplement insurance?

In 2018, some 14.1 million Americans owned a Medicare Supplement insurance (Medigap) policy. That number represents an increase compared to the 9.7 million who owned a Medigap policy in 2010.

How many people are married on Medicare Supplement?

Most Americans who buy Medicare Supplement insurance are married and over half (58%) are women according to the most recent data.

Can Medicare Supplement Insurance negotiate a better rate?

Others are more regional in their offerings. For that reason, we strongly recommend consumers work with a knowledgeable Medicare Supplement agent who can help provide the most current information on available policies and share rates. Rates can vary significantly from one insurance company to another. But agents can’t negotiate or get you a better rate (it’s not like buying a car). For that reason, work with someone with knowledge and experience. That’s how to get the best options.

Which pays more for hospital services: Medicare or private insurers?

A new study published by RAND Corporation finds that private insurers pay much higher prices for hospital services than Medicare does.

How much would Medicare have reduced?

If employers and health plans that participated in the study had paid for services at Medicare rates, it would have reduced total payments to hospitals by $19.7 billion from 2016 to 2018.

What does variability in hospital pricing reflects?

Commentators sometimes suggest that variability in hospital pricing reflects differences in healthcare quality.

What is reference based pricing?

In a reference-based pricing approach, private insurers contract for hospital services based on a fixed-price arrangement. For example, their pricing may be set at a specific multiple of what Medicare pays.

Why do employers compare hospitals?

This may help employer groups and other insurers compare pricing across hospitals, allowing them to make more informed judgements about appropriate pricing and negotiate more effectively.

What is Medicare fee schedule?

Every year, Medicare issues a fee schedule that determines how much the federal insurance program will reimburse hospitals for specific services.

Why is the healthcare market declining?

Competition in the healthcare market has been declining as a result of increased consolidation, which commonly occurs through hospital mergers or the acquisition of hospitals by larger health systems.