Was Medicare reform caught up in partisan politics?

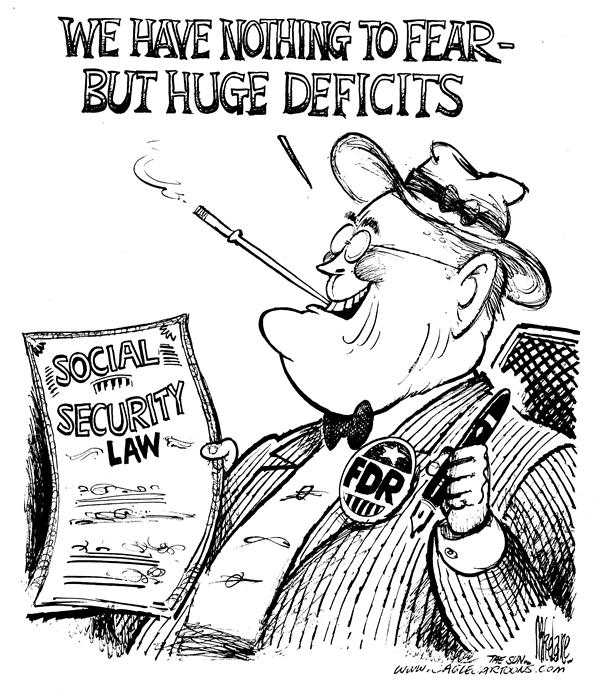

Feb 09, 2011 · The Democratic Party under President Franklin D Roosevelt (for Social Security, 1935), and the same party under Lyndon Johnson for Medicare (1965).

What is the history of Medicare?

President Johnson signed the bill into law at a special ceremony in Independence, Missouri on July 30, 1965. Summary of Party Affiliation on Medicare …

Who was the first Democrat to support Medicare?

The Ways & Means Committee Report on the Social Security Act was introduced in the House on April 4, 1935 and debate began on April 11th. After several days of debate, the bill was passed in the House on April 19, 1935 by a vote of 372 yeas, 33 nays, 2 present, and 25 not voting. (This vote took place immediately followed a vote to recommit the ...

When was the Social Security Act passed?

When Medicare was first being considered Senate Republican Robert Dole (then in the House) voted against it. Also in opposition to Medicare, in a …

Who introduced Social Security and Medicare?

President RooseveltThe Social Security Act was signed into law by President Roosevelt on August 14, 1935. In addition to several provisions for general welfare, the new Act created a social insurance program designed to pay retired workers age 65 or older a continuing income after retirement.

Which president expanded Social Security for Medicare?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19646.REMARKS WITH PRESIDENT TRUMAN AT THE SIGNING IN INDEPENDENCE OF THE MEDICARE BILL--JULY 30, 196515 more rows

Which president opened up Social Security?

A3. The taxation of Social Security began in 1984 following passage of a set of Amendments in 1983, which were signed into law by President Reagan in April 1983. These amendments passed the Congress in 1983 on an overwhelmingly bi-partisan vote.

Who voted for the Social Security Act of 1935?

After several days of debate, the bill was passed in the House on April 19, 1935 by a vote of 372 yeas, 33 nays, 2 present, and 25 not voting. (This vote took place immediately followed a vote to recommit the bill to the Committee, which failed on a vote of Yea: 149; Nay: 253; Present: 1; and Not Voting: 29.)

When did Congress start borrowing from Social Security?

As a stop-gap measure, Congress passed legislation in 1981 to permit inter-fund borrowing among the three Trust Funds (the Old-Age and Survivors Trust Fund; the Disability Trust Fund; and the Medicare Trust Fund).

What did Reagan do to Social Security?

In 1981, Reagan ordered the Social Security Administration (SSA) to tighten up enforcement of the Disability Amendments Act of 1980, which resulted in more than a million disability beneficiaries having their benefits stopped.

Has the government borrowed from Social Security?

Not only is every cent the federal government has borrowed from Social Security accounted for, but the government is paying interest into Social Security, thereby improving the health of the program. In 2018, $83 billion in interest income was collected by Social Security.Feb 15, 2020

Why did Franklin D Roosevelt establish Social Security?

Roosevelt signed the Social Security Bill into law on August 14, 1935, only 14 months after sending a special message to Congress on June 8, 1934, that promised a plan for social insurance as a safeguard "against the hazards and vicissitudes of life." The 32-page Act was the culmination of work begun by the Committee ...

How much has the government borrowed from Social Security?

All of those assets are held in "special non-marketable securities of the US Government". So, the US government borrows from the OASI, DI and many others to finance its deficit spending. As a matter of fact, as of this second, the US government currently has "intragovernmental holdings" of $4.776 trillion.

Which Congress passed the Social Security Act?

Roosevelt signed the Social Security Act of 1935 into law. Passed by the House of Representatives on April 5, 1935, the legislation was reconciled in two sets of conference reports which both houses of Congress agreed to in early August. Despite bitter attacks by fiscal conservatives, the House approved H.R.

How was Medicare passed?

On July 30, 1965, President Lyndon B. Johnson signed the Medicare and Medicaid Act, also known as the Social Security Amendments of 1965, into law. It established Medicare, a health insurance program for the elderly, and Medicaid, a health insurance program for people with limited income.Feb 8, 2022

How many nays were in the 1935 House Bill?

After several days of debate, the bill was passed in the House on April 19, 1935 by a vote of 372 yeas, 33 nays, 2 present, and 25 not voting. (This vote took place immediately followed a vote to recommit the bill to the Committee, which failed on a vote of Yea: 149; Nay: 253; Present: 1; and Not Voting: 29.)

How many nays did the Social Security Act pass?

The debate lasted until June 19th, when the Social Security Act was passed by a vote of 77 yeas, 6 nays, and 12 not voting. Due to differences between the House and Senate versions, the legislation then went to a Conference Committee which met throughout the month of July.

When was the House Ways and Means Committee meeting?

The House Ways & Means Committee held hearings on the bill from January 21, 1935 through February 12, 1935. The Senate Finance Committee held hearings from January 22, 1935 through February 20, 1935. During a Ways & Means meeting on March 1, 1935 Congressman Frank Buck (D-CA) made a motion to change the name of the bill to ...

When was the conference report passed?

Final Congressional action on the bill took place when the Conference Report was passed by voice vote on August 8, 1935 in the House and on August 9th in the Senate. On August 14, 1935 President Roosevelt signed the bill into law at a ceremony in the White House Cabinet Room.

When did the Social Security debate take place?

1935 Congressional Debates on Social Security. Shortly after the 74th Congress convened in January 1935 , President Roosevelt sent his "Economic Security Bill" to Capitol Hill.

Who introduced the 1935 reauthorization bill?

The Administration proposal was transmitted to the Congress on January 17, 1935 and it was introduced that same day in the Senate by Senator Robert Wagner (D-NY) and in the House by Congressman Robert Doughton (D-NC) and David Lewis (D-MD). The bill was referred to Senate Finance Committee and the House Ways & Means Committee.

Who made the change to the Social Security Act of 1935?

During a Ways & Means meeting on March 1, 1935 Congressman Frank Buck (D-CA) made a motion to change the name of the bill to the "Social Security Act of 1935.". The motion was carried by a voice vote of the Committee. Committee Reports & Initial Passage.

How much was the Social Security benefit in 1940?

In 1940, benefits paid totaled $35 million . These rose to $961 million in 1950, $11.2 billion in 1960, $31.9 billion in 1970, $120.5 billion in 1980, and $247.8 billion in 1990 (all figures in nominal dollars, not adjusted for inflation). In 2004, $492 billion of benefits were paid to 47.5 million beneficiaries.

What was the Supreme Court ruling on the Railroad Retirement Act?

In the 1930s, the Supreme Court struck down many pieces of Roosevelt's New Deal legislation, including the Railroad Retirement Act . The Social Security Act's similarity with the Railroad Retirement Act caused Edwin Witte, the executive director of the President's Committee on Economic Security under Roosevelt who was credited as "the father of social security," to question whether or not the bill would pass; John Gall, an Associate Counsel for the National Association of Manufacturers who testified before the US House of Representatives in favor of the act, also felt that the bill was rushed through Congress too quickly and that the old age provision of the act was "hodgepodge" that needed to be written more properly in order to have a higher likelihood of being ruled constitutional. The Court threw out a centerpiece of the New Deal, the National Industrial Recovery Act, the Agricultural Adjustment Act, and New York State's minimum-wage law. President Roosevelt responded with an attempt to pack the court via the Judicial Procedures Reform Bill of 1937. On February 5, 1937, he sent a special message to Congress proposing legislation granting the President new powers to add additional judges to all federal courts whenever there were sitting judges age 70 or older who refused to retire. The practical effect of this proposal was that the President would get to appoint six new Justices to the Supreme Court (and 44 judges to lower federal courts), thus instantly tipping the political balance on the Court dramatically in his favor. The debate on this proposal was heated and widespread, and lasted over six months. Beginning with a set of decisions in March, April, and May, 1937 (including the Social Security Act cases), the Court would sustain a series of New Deal legislation.

How has Social Security changed since the 1930s?

The provisions of Social Security have been changing since the 1930s, shifting in response to economic worries as well as concerns over changing gender roles and the position of minorities. Officials have responded more to the concerns of women than those of minority groups. Social Security gradually moved toward universal coverage. By 1950, debates moved away from which occupational groups should be included to how to provide more adequate coverage. Changes in Social Security have reflected a balance between promoting equality and efforts to provide adequate protection.

What jobs were excluded from the unemployment act?

Job categories that were not covered by the act included workers in agricultural labor, domestic service, government employees, and many teachers, nurses, hospital employees, librarians, and social workers.

Why were state employees excluded from the federal government?

State employees were excluded for constitutional reasons (the federal government cannot tax state government). Federal employees were also excluded. Many textbooks, however, indicate that the exclusions were the product of southern racial hostility toward blacks; there is no evidence of that in the record.

How long did the New Deal debate last?

The debate on this proposal was heated and widespread, and lasted over six months. Beginning with a set of decisions in March, April, and May, 1937 (including the Social Security Act cases), the Court would sustain a series of New Deal legislation.

What was the purpose of the elderly Act?

The Act was an attempt to limit what were seen as dangers in the modern American life, including old age, poverty, unemployment, and the burdens of widows and fatherless children . By signing this Act on August 14, 1935, President Roosevelt became the first president to advocate federal assistance for the elderly.

Why did McConnell say the Republicans would defend the tax cuts?

This poll was taken a week after Senator McConnell said the Republicans would defend the tax cuts and cut Social Security, Medicare and Medicaid in order to curb the growing deficit, caused in significant part by those very tax cuts. The Republican Party has always been associated with opposition to Social Security.

What percentage of Americans would prefer to reverse the Republican tax cuts?

A poll one week before the election about Republican social and economic policy is a red flag for Republicans. 60% of Americans would prefer to reverse the Republican 2017 tax cuts than cut spending on Social Security, Medicare and Medicaid.

What would happen if Social Security was passed?

A representative of the Illinois manufacturers testified that if Social Security was passed it would undermine America by “destroying initiative, discouraging thrift, and stifling individual responsibility.”. In 1935, Republican congressman John Taber said Social Security “is designed to prevent business recovery, to enslave workers, ...

What is the most popular program in America?

Social Security is the most popular program in America, especially among the voters who are growing the fastest. Social Security is the most popular program in America, especially among the voters who are growing the fastest. Share to Facebook. Share to Twitter. Share to Linkedin.

Did McConnell tell the electorate that Medicare and Social Security were high on the Republican agenda?

It seems Senator McConnell, usually careful not to rock the boat before the upcoming midterm elections, did not set out to tell the electorate that Social Security, Medicare and Medicaid cuts were high on the Republican agenda.

Which party is opposed to Social Security?

The Republican Party has always been associated with opposition to Social Security. Economic historian Max Skidmore shows that the final vote for Social Security was lopsided--only 2% of Democrats voted against it (because it wasn't generous enough) while 33% of Republicans voted against Social Security.

Is Social Security a fiscal discipline?

Social Security is one of the few government programs with built-in fiscal discipline. Bottom Line: Though Senator McConnell may not have meant to publicize the Republican agenda to cut Social Security, Medicare and Medicaid, the long history of Republican opposition may be an example of what Sigmund Freud and modern psychologists believe--a slip ...

What is CMS in healthcare?

The Centers for Medicare and Medicaid Services (CMS), a component of the U.S. Department of Health and Human Services (HHS), administers Medicare, Medicaid, the Children's Health Insurance Program (CHIP), the Clinical Laboratory Improvement Amendments (CLIA), and parts of the Affordable Care Act (ACA) ("Obamacare").

How much does Medicare cost in 2020?

In 2020, US federal government spending on Medicare was $776.2 billion.

What is Medicare and Medicaid?

Medicare is a national health insurance program in the United States, begun in 1965 under the Social Security Administration (SSA) and now administered by the Centers for Medicare and Medicaid Services (CMS). It primarily provides health insurance for Americans aged 65 and older, ...

How is Medicare funded?

Medicare is funded by a combination of a specific payroll tax, beneficiary premiums, and surtaxes from beneficiaries, co-pays and deductibles, and general U.S. Treasury revenue. Medicare is divided into four Parts: A, B, C and D.

What is a RUC in medical?

The Specialty Society Relative Value Scale Update Committee (or Relative Value Update Committee; RUC), composed of physicians associated with the American Medical Association, advises the government about pay standards for Medicare patient procedures performed by doctors and other professionals under Medicare Part B.

How many people have Medicare?

In 2018, according to the 2019 Medicare Trustees Report, Medicare provided health insurance for over 59.9 million individuals —more than 52 million people aged 65 and older and about 8 million younger people.

When did Medicare Part D start?

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan (PDP) or public Part C health plan with integrated prescription drug coverage (MA-PD). These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies; almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare (Part A and B), Part D coverage is not standardized (though it is highly regulated by the Centers for Medicare and Medicaid Services). Plans choose which drugs they wish to cover (but must cover at least two drugs in 148 different categories and cover all or "substantially all" drugs in the following protected classes of drugs: anti-cancer; anti-psychotic; anti-convulsant, anti-depressants, immuno-suppressant, and HIV and AIDS drugs). The plans can also specify with CMS approval at what level (or tier) they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

How many Medicare beneficiaries will have private prescription coverage?

At that time, more than 40 million beneficiaries will have the following options: (1) they may keep any private prescription drug coverage they currently have; (2) they may enroll in a new, freestanding prescription drug plan; or (3) they may obtain drug coverage by enrolling in a Medicare managed care plan.

How much does Medicare pay for Part D?

The standard Part D benefits would have an estimated initial premium of $35 per month and a $250 annual deductible. Medicare would pay 75 percent of annual expenses between $250 and $2,250 for approved prescription drugs, nothing for expenses between $2,250 and $5,100, and 95 percent of expenses above $5,100.

What was the Task Force on Prescription Drugs?

Department of Health, Education and Welfare (HEW; later renamed Health and Human Services) and the White House.

What was the Byrnes bill?

The counterproposal offered by Republicans, the Byrnes bill, called for voluntary enrollment in a health insurance program financed by premiums paid by the beneficiaries and subsidized by general revenues. It had more benefits, including physician services and prescription drugs.

How much did Medicare cut in 1997?

Nonetheless, reducing the budget deficit remained a high political priority, and two years later, the Balanced Budget Act of 1997 (Balanced Budget Act) cut projected Medicare spending by $115 billion over five years and by $385 billion over ten years (Etheredge 1998; Oberlander 2003, 177–83).

How long have seniors waited for Medicare?

Seniors have waited 38 years for this prescription drug benefit to be added to the Medicare program. Today they are just moments away from the drug coverage they desperately need and deserve” (Pear and Hulse 2003). In fact, for many Medicare beneficiaries, the benefits of the new law are not so immediate or valuable.

How much money would the federal government save on medicaid?

The states would be required to pass back to the federal government $88 billion of the estimated $115 billion they would save on Medicaid drug coverage. It prohibited beneficiaries who enrolled in Part D from buying supplemental benefits to insure against prescription drug expenses not covered by the program.

How much will Medicare increase in 2040?

The Congressional Budget Office projects that Medicare spending will increase from 3 percent of GDP in 2014 to 4.7 percent by 2040, the Kaiser Family Foundation reports, which defenders of the program say is manageable with some reforms.

What was the passage of Medicare and Medicaid?

But the passage of Medicare and Medicaid, which shattered the barriers that had separated the federal government and the health-care system, was no less contentious than the recent debates about the Affordable Care Act," also known as Obamacare.

How can the government do big things?

It's that government can do big things and succeed in massive projects if officials stick to their guns, offer effective leadership, nurture public support and take advantage immediately when the public mood shifts in their direction. Medicare – the government's program providing health insurance for the elderly – and Medicaid – which offers ...

Why did Ike support Social Security?

Ike wasn't interested in a big expansion of government into health care, although he maintained Social Security and other popular parts of the New Deal because they were so popular and valuable to everyday people. Gradually, momentum began to build to provide health care coverage for people 65 and older.

When did Medicare start adding prescription drug benefits?

The program became so popular that President George W. Bush, a self-described conservative, embraced a change to add a prescription drug benefit to Medicare, and millions of Americans have come to rely on it. The drug benefit was enacted in 2003 and went into effect in 2006.

When was Medicare signed into law?

The Senate passed another version 68-21 on July 9. After Congress reconciled the House and Senate measures, President Johnson signed Medicare into law on July 30 in Independence, Missouri, the hometown of former President Truman, the earlier champion of the idea, who attended the ceremony.

Is Medicare part of the health care system?

Medicare – the government's program providing health insurance for the elderly – and Medicaid – which offers assistance to the poor – has become part of the fabric of American life. According to the U.S. News & World Report Health Care Index, the government now dominates the health care industry, and Medicaid continues to expand under ...

Why did Johnson pass Medicare?

Johnson had the political muscle to pass Medicare because the 1964 elections ushered in 42 new Democrats to the House of Representatives, giving the party a two-thirds majority overall and a larger majority on the Ways and Means Committee, where the legislation would originate.

How long did it take for the Banking Committee to vote out of committee?

The Banking Committee voted a 1,336-page bill "out of committee in 21 minutes with no amendments, with the understanding that before the bill came to the floor, we would reach this bipartisan agreement."

Why was the 1935 labor bill so controversial?

The legislation was controversial for a number of reasons, including its perceived effects on the labor market and whether its benefits favored working white men. Nevertheless, on Aug. 8, 1935, the conference report — the final version of the bill that melds together changes made in the House and in the Senate — passed in the House 372-33, ...

When was Medicare signed into law?

President Lyndon B. Johnson signed the Medicare bill into law on July 30, 1965.

Did Howard Dean pass Medicare?

Dean claims Social Security and Medicare were passed without Republican support. With virtually no Republican support for the health care reform bill, some Democrats believe they will have to go it alone. But Howard Dean, the former chairman of the Democratic National Committee, isn't worried about the political repercussions.

Which committee voted against the bill?

Likewise, all four Republicans on the House Rules Committee — the panel that sets the boundaries of debate on all bills that come to the House floor — voted against the bill. In the Senate, however, there was Republican support in the Finance Committee.

Was Medicare done without Republicans?

Medicare was done without Republican support until the last vote where they realized they had to get on board," De an said on the Aug.

What is surplus payroll?

Conservative politicians have asserted for years that the surplus payroll funds collected in previous years have been stolen by government officials and used to fund other federal programs without the knowledge or consent of taxpayers. At best, such statements represent a misunderstanding of security investments, as the surplus has been invested in special issue Treasury bonds backed by the full faith and credit of the United States Government.

Why is Social Security called Social Insurance?

Ball, a past Commissioner of Social Security, the Social Security Program is “social insurance” designed to help people “when earnings stop because one is too old to work or too disabled to work, or because the wage earner in the family dies, or because there is no job to be had, or when there are extraordinary expenses connected say with illness.” The Motley Fool echoes this sentiment, saying that Social Security isn’t a retirement plan, but rather is a universal insurance program that protects workers, retirees, and their families from life’s unknowns.

What would happen if interest rates increased to 5%?

If interest rates increased to 5%, the market value of the bond would fall to $500 – a 50% loss – since an investor could buy a new bond and earn 5%. Social Security Treasuries are guaranteed redeemable at face value even if they are redeemed early.

How long can you get partial unemployment?

Those Who Are Involuntarily Unemployed. These people can receive partial income replacement for up to 39 weeks if they have a prescribed amount of employment and earnings within a specified base period. Unemployment benefits are administered by the states, but paid from a public fund administered by Social Security.

How much money did Apple invest in 2012?

If we applied that same logic to the largest corporations in America, none of them would last a year. For example, Apple had approximately $57 billion in short-term cash and investments at the end of September 2012. Annual expenses, excluding revenues, are approximately $87.4 billion.

How much did Social Security receive in 2012?

Social Security received more than $725 billion in taxes in 2012, a number that is likely to increase as more people return to work and income levels rise. The Social Security program is analogous to a large lake that provides water to a community.

When was Social Security created?

Social Security was created on August 14, 1935 when President Franklin D. Roosevelt signed the Social Security Act and has been controversial since its beginning. A Cato Institute commentary compared Social Security to Otto von Bismarck’s welfare state in Germany, calling it a “Ponzi scheme, with new contributions used to pay off earlier ‘investors.'” The author of the Cato commentary, Marc Rudov, doubles down his criticism in a second American Thinker article, stating that “Social Security is irreversibly insolvent.” These negative statements assume that future beneficiaries will receive no benefits or will receive payments less than their contributions because their contributions are being used to support current beneficiaries.

Overview

A limited form of the Social Security program began as a measure to implement "social insurance" during the Great Depression of the 1930s, when poverty rates among senior citizens exceeded 50 percent.

The Social Security Actwas enacted August 14, 1935. The Act was drafted during President Franklin D. Roosevelt's first term by the President's Committe…

Origins and design

In his failed 1932 campaign for governor of Louisiana, entrepreneur and politician Dudley J. Leblanc proposed a monthly stipend for the elderly. Huey Long witnessed the popularity of the idea with Louisiana voters, and subsequently adopted it in his national platform.

Political Scientists at the University of Wisconsin–Madison, including Edwin Witte, known as the "Father of Social Security," Arthur J. Altmeyer, and Wilbur Cohendeveloped the 1934 proposal for …

Implementation

The first reported Social Security payment was to Ernest Ackerman, a Cleveland motorman who retired only one day after Social Security began. Five cents were withheld from his pay during that period, and he received a lump-sum payout of seventeen cents from Social Security.

The first monthly payment was issued on January 31, 1940 to Ida May Fuller of Ludlow, Vermont. In 1937, 1938, and 1939, she paid a total of $24.75 into the Social Security System. Her first check …

Expansion and evolution

The provisions of Social Security have been changing since the 1930s, shifting in response to economic worries as well as concerns over changing gender roles and the position of minorities. Officials have responded more to the concerns of women than those of minority groups. Social Security gradually moved toward universal coverage. By 1950, debates moved away from which …

The Supreme Court and the evolution of Social Security

The Supreme Court has established that no one has any legal right to Social Security benefits. The Court decided, in Flemming v. Nestor(1960), that "entitlement to Social Security benefits is not a contractual right". In that case, Ephram Nestor, a Bulgarian immigrant to the United States who made contributions for covered wages for the statutorily required "quarters of coverage" was nonetheless denied benefits after being deported in 1956 for being a member of the Communis…

Dates of coverage for various workers

• 1935 All workers in commerce and industry (except railroads) under age 65.

• 1939 Age restriction eliminated; sailors, bank employees added; food-processing workers removed

• 1946 Railroad and Social Security earnings combined to determine eligibility for and amount of survivor benefits.

See also

• United States labor law

Notes

1. ^ "A Reader's Companion to American History: Poverty". Retrieved March 17, 2006.

2. ^ "History 1930". Social Security Administration. Retrieved May 21, 2009.

3. ^ Achenbaum, Andrew (1986). Social Security Visions and Revisions. New York: Cambridge University Press. p. 25-6.