Medicare is funded by federal tax revenue, payroll tax revenue (the Medicare tax), and premiums paid by Medicare beneficiaries The trust fund that pays for Medicare Part A is projected to run out of money in 2026 unless more tax revenue is raised

Full Answer

What are the sources of revenue for Medicare Advantage plans?

General revenue: This part of Medicare funding comes primarily from federal income taxes that Americans pay. Payroll taxes : Employers who pay payroll taxes also contribute to Medicare’s solvency. Beneficiary premiums : When Medicare covers your health care needs, you pay a monthly or annual premium to the U.S. government, similar to what you would to a …

Where does the money for Medicare payments come from?

Sep 22, 2021 · Medicare relies on revenue from a variety of sources in order to provide medical coverage to millions of U.S. residents. As of 2019 approximately 43 percent of the Medicare revenues were generated...

How is Medicare funded by the government?

Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare. Hospital Insurance (HI) Trust Fund How is it funded? Payroll taxes paid by most employees, employers, and people who are self-employed Other sources, like these: Income taxes paid on Social Security benefits

How much of the federal budget is spent on Medicare?

Oct 04, 2012 · General revenues currently cover more than 40 percent of the cost of the program. Medicare financing has changed significantly over the past 40 years. In 1970, 60 percent of its costs were financed by payroll taxes. Premiums paid by beneficiaries paid for an additional 13 percent of Medicare's overall costs.

How many people did Medicare cover in 2017?

programs offered by each state. In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds.

Who pays payroll taxes?

Payroll taxes paid by most employees, employers, and people who are self-employed. Other sources, like these: Income taxes paid on Social Security benefits. Interest earned on the trust fund investments. Medicare Part A premiums from people who aren't eligible for premium-free Part A.

What is the CMS?

The Centers for Medicare & Medicaid Services ( CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the. Department Of Health And Human Services (Hhs) The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, ...

What is Medicare Part B?

Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. and. Medicare Drug Coverage (Part D) Optional benefits for prescription drugs available to all people with Medicare for an additional charge.

What is covered by Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

Does Medicare cover home health?

Medicare only covers home health care on a limited basis as ordered by your doctor. , and. hospice. A special way of caring for people who are terminally ill. Hospice care involves a team-oriented approach that addresses the medical, physical, social, emotional, and spiritual needs of the patient.

How much of Medicare was financed in 1970?

Medicare financing has changed significantly over the past 40 years. In 1970, 60 percent of its costs were financed by payroll taxes. Premiums paid by beneficiaries paid for an additional 13 percent of Medicare's overall costs. In total, payroll taxes and premiums covered about 75 percent of Medicare's costs in 1970. General revenues funded the remaining 25 percent.

Is Medicare self-funded?

One of the biggest misconceptions about Medicare is that it is self-financed — through current beneficiaries' premiums and future beneficiaries’ payroll taxes. In truth, the program is heavily subsidized with general revenues. Premiums cover only a small fraction of Medicare's overall costs, while payroll taxes cover less than half of its costs. General revenues currently cover more than 40 percent of the cost of the program.

How much do you pay on Medicare?

Typically, people pay 2.9% on Medicare taxes from their payroll earnings. The 2.9% comes from 2 parties; employers contribute 1.45%, and employees contribute 1.45%.

How to get more information on Medicare?

If you’d like more information on Medicare plans near you, complete an online rate comparison form to have an agent get in contact with you. Also, you can call the number above and speak with a Medicare expert today!

What is Medicare rebate?

When bids are lower than benchmark amounts , Medicare and the health plan provide a rebate to enrollees after splitting the difference in cost. A new bonus system works to compensate for health plans that have high-quality ratings. Advantage plans that have four or more stars receive bonus payments for their quality ratings.

What is benchmark amount for Medicare?

Benchmark amounts vary depending on the region. Benchmark amounts can range from 95% to 115% of Medicare costs. If bids come in higher than benchmark amounts, the enrollees must pay the cost difference in a monthly premium. If bids are lower than benchmark amounts, Medicare and the health plan provide a rebate to enrollees after splitting ...

What are the sources of revenue for Advantage Plans?

Three sources of revenue for Advantage plans include general revenues, Medicare premiums, and payroll taxes. The government sets a pre-determined amount every year to private insurers for each Advantage member. These funds come from both the H.I. and the SMI trust funds.

How does Medicare Supplement Plan work?

Medicare Supplement plan funding is through beneficiary premiums. These payments go to private insurance companies. Many times, seniors who are retired may have their premiums paid by their former employers.

What is supplementary medical insurance?

The supplementary medical insurance trust fund is what’s responsible for funding Part B, as well as operating the Medicare program itself. Part B helps to cover beneficiaries’ doctors’ visits, routine labs, and preventative care.

What is Medicare Advantage Plan?

By law, Medicare Advantage plans must cover everything that is covered under Original Medicare, except for hospice care, which is still covered by Original Medicare Part A. Some Medicare Advantage plans offer additional benefits such as routine dental and routine vision care. According to 2016 data from the Kaiser Family Foundation, about one in three Medicare beneficiaries are enrolled in a Medicare Advantage plan, or about 17.6 million individuals. This article explains how Medicare funding works with Medicare Advantage plans.

How does HI get money?

The Medicare Hospital Insurance, or HI Trust Fund gets money primarily from payroll taxes. It gets much smaller amounts from income tax on Social Security benefits and Medicare Part A premiums paid by those who don’t qualify for premium-free Part A. The money in this trust fund pays for Part A expenses such as inpatient hospital care, skilled nursing facility care, and hospice.

How does the SMI fund work?

The Medicare Supplemental Medical Insurance, or SMI Trust Fund gets its Medicare funding primarily from money Congress allocates for the program and from Part B premiums and Medicare Part D Prescription Drug Plan premiums. This fund pays for outpatient health care, durable medical equipment, certain preventative services and prescription drugs.

Does Medicare Advantage pay for claims?

The insurance company uses this pool of money from the Medicare Trust Funds plus any additional premiums paid by plan members to pay the covered health care expenses for everyone enrolled in a particular plan. Claims for people enrolled in Medicare Advantage are paid by the insurance company and not by the Medicare program as they are for those enrolled in Original Medicare.

Does Medicare Advantage charge a monthly premium?

In addition to the Part B premium, which you must continue to pay when you enroll in Medicare Advantage, some Medicare Advantage plans also charge a separate monthly premium.

Is Medicare the same as Medicare Advantage?

Although the Medicare funding is the same for all insurance companies offering Medicare Advantage plans, each company chooses what types of plans and benefits it will offer. No matter what company and plan type you select, however, you are still entitled to all the same rights and protections you have under Original Medicare.

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

How is Medicare's financial condition assessed?

Medicare’s financial condition can be assessed in different ways, including comparing various measures of Medicare spending—overall or per capita—to other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

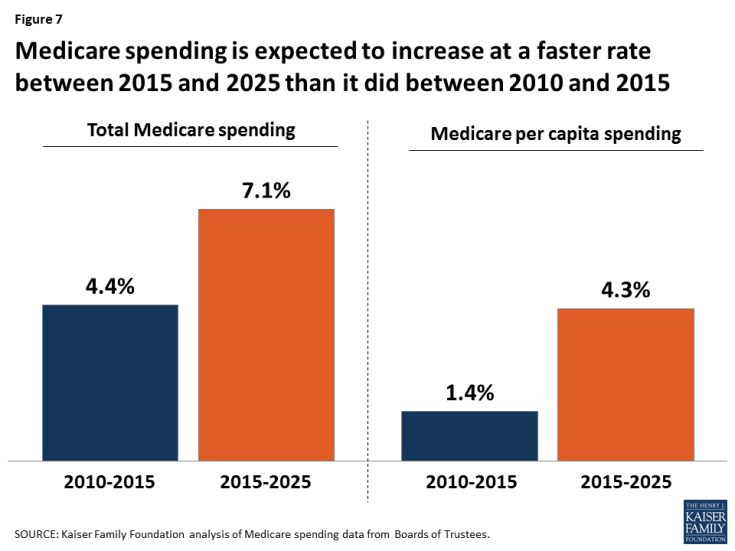

Why is Medicare spending so slow?

Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care and reduce costs, including accountable care organizations (ACOs), medical homes, bundled payments, and value-based purchasing initiatives. The BCA lowered Medicare spending through sequestration that reduced payments to providers and plans by 2 percent beginning in 2013.

What is the average annual growth rate for Medicare?

Average annual growth in total Medicare spending is projected to be higher between 2018 and 2028 than between 2010 and 2018 (7.9 percent versus 4.4 percent) (Figure 4).

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

What is excess health care cost?

Over the next 30 years, CBO projects that “excess” health care cost growth—defined as the extent to which the growth of health care costs per beneficiary, adjusted for demographic changes, exceeds the per person growth of potential GDP (the maximum sustainable output of the economy)—will account for half of the increase in spending on the nation’s major health care programs (Medicare, Medicaid, and subsidies for ACA Marketplace coverage), and the aging of the population will account for the other half.

What are the sources of Medicare funds?

Two trust funds held by the United States Department of the Treasury supply the money for Medicare payments. The funds are the Hospital Insurance Trust Fund and the Supplemental Medical Insurance Trust fund.

Where does Medicare money come from?

Medicare’s funding comes from a variety of sources, such as taxes and funding authorized by Congress. Medicare’s payments to Advantage plans account for one-third of Medicare’s total spending.

How does Medicare bidding work?

First, each plan submits a bid to Medicare, based on the estimated cost of Part A and Part B benefits per person. Next, Medicare compares the amount of the bid against the benchmark.

What determines the amount of Medicare payments?

The amount of the monthly payments depends on two main factors: the healthcare practices in the county where each beneficiary lives, which influences a procedure called the bidding process. the health of each beneficiary, which governs how Medicare raises or lowers the rates, in a system known as risk adjustment.

How does Medicare payment depend on the county?

The amount of the payments from Medicare depends partly on the anticipated costs of healthcare in the county where each beneficiary lives.

What is Medicare Advantage?

Medicare spending. Summary. Medicare Advantage, or Part C, is a health insurance program. It is funded from two different sources. The monthly premiums of beneficiaries provide part of the funding. However, the main source is a federal agency called the Centers for Medicare & Medicaid Services, which runs the Medicare program.

What happens if Medicare bid is lower than benchmark?

If the bid is lower than the benchmark, the plan gets a rebate from Medicare that is a percentage of the difference between the bid and the benchmark. Plans that receive rebates should use a portion of the rebates to fund supplemental benefits or to reduce premiums.

What is Medicare Part A?

Medicare also has two accounts: the Hospital Insurance Trust Fund (HI), also known as Medicare Part A, and the Supplementary Medicare Insurance Trust Fund (SMI). These funds pay for hospital, home health, skilled nursing, and hospice care for the elderly and disabled.

Where does government revenue come from?

Government revenue also comes from payments to federal agencies like the U.S. Department of the Interior. Have you visited a national park recently? Did you know your national park entry fee also applies towards government revenue? Other agencies generate revenue from leases, the sale of natural resources, and various usage and licensing fees.

What is the largest source of federal revenue in 2020?

Bar chart showing source categories of revenue collected by the federal government in 2020, with the largest category being individual income taxes. Most of the revenue the government collects comes from contributions from individual taxpayers, small businesses, and corporations through taxes that get collected on a yearly or quarterly basis.

What is the Federal Reserve?

The Federal Reserve Act of 1913 established the Federal Reserve System (the Fed) as the central bank for the United States. The Fed works closely with the Department of the Treasury, which manages the finances of the federal government.

Do you pay taxes on your paycheck?

You may recognize these taxes on your paycheck. Unlike personal income taxes, these taxes are used to help fund specific social service programs. Funds are collected from your paycheck, and in most cases, matched by your employer, and then divided into the various trust fund accounts.

How does healthcare get its money?

There are four primary sources of healthcare revenue. Government aid is provided through grants and subsidies. The industry also gets revenue through government-sponsored programs like Medicare and Medicaid. American citizens provide the funds indirectly through taxes in addition to the government borrowing to finance the budget. The Medicaid program provides low-cost or free benefits to low-income adults, pregnant women, children as well as seniors and persons with disabilities. In addition, each state determines if persons applying for this program are eligible or not. The Medicare, on the other hand, is a program for persons over the age of 65 years, those under 65 but with certain disabilities and at any age with renal disease (Cleverley et al., 2010).

Where do premiums for healthcare come from?

Premiums paid by private insurance companies to healthcare providers come from the policyholders and form a major source of revenue. The fee-for-service is a system of insurance where the care providers receive a fee for each specific service rendered. This type is inflationary as it raises the costs of health care. Another type of private insurance is the managed care organizations that have contracts with health care providers and other health facilities to offer care for their members at a discounted cost. The providers ordinarily make up the network of the plan. Depending on the rules of the network, the plan pays different amounts for the care provided (Wendt et al., 2009).

How does billing affect health care?

Billing is one of the many ways that care providers defraud the patients and health care industry. The activity achieved by presenting fraudulent claims for items that were not provided, making inaccurate records, faking frequency, and description of items and services, billing at high levels and falsifying eligibility, the providers defraud the insurance providers and consumers of their services. The consequence of such practice is detrimental to the industry because it results in higher costs for healthcare as well as increased costs for coverage (Li et al., 2008).

What is consumer directed health insurance?

The consumer-directed health plan is perhaps one of the most flexible insurance that essentially gives one control over their healthcare savings. The plan is a healthcare savings account where the consumer is allowed to make decisions based on the factors that are important to him or her. The consumer is able to make choices on what hospitals and doctors to use as well as working with the doctor to decide the appropriate medications right for them (Cleverley et al., 2010). The liability insurance, on the other hand, protects individuals or businesses from the risk of being sued and held liable for malpractice, negligence, and injury. This is especially important to medical practitioners.