...

2020 Social Security and Medicare Tax Withholding Rates and Limits.

| Tax | 2019 Limit | 2020 Limit |

|---|---|---|

| Medicare liability | No limit | No limit |

What is the current tax rate for Medicare?

Mar 15, 2022 · The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural …

What is Medicare tax cap?

Jan 04, 2022 · For instance, if you make $300,000 per year, you and your employer each pay the standard 1.45 percent Medicare tax for the first $200,000 you make, and you pay the additional 0.9 percent Medicare tax on the $100,000 that is left. Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self …

Are Medicare payments taxable?

There's no earnings cap on Medicare contributions, but there is for Social Security. In 2021, the wage limit is $142,800. That's the maximum wage you'll owe Social Security taxes on. Medicare doesn't have a cap, so you'll owe the Medicare tax on your wages regardless of what they are.

Why is there a cap on the FICA tax?

Nov 24, 2021 · Views: 170977. In 2021, the highest amount of earnings on which you must pay Social Security tax is $142,800. We raise this amount yearly to keep pace with increases in average wages. There is no maximum earnings amount for Medicare tax. You must pay Medicare tax on all of your earnings. See Retirement Benefits: Maximum Taxable Earnings for more …

Is there a cap on Medicare tax 2021?

FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.Jan 13, 2022

What is the Medicare wages cap for 2020?

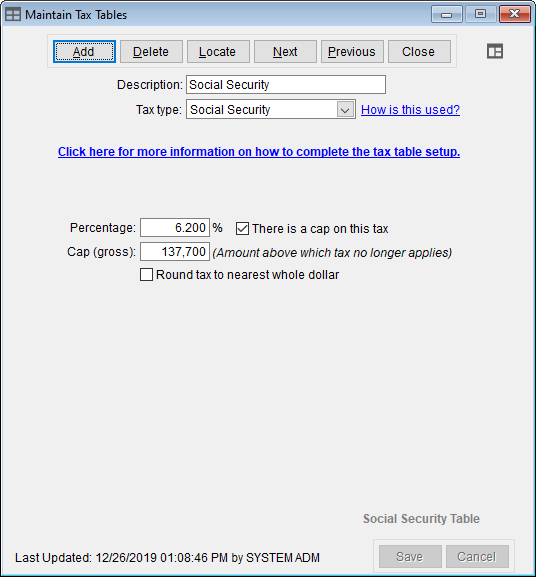

The Medicare wage base will not have a dollar limit for 2020. The employer and employee tax rates will remain the same in 2020. The Social Security (full FICA) rate remains at 7.65% (6.20% Social Security plus 1.45% Medicare) for wages up to $137,700. All wages over $137,700 are subject only to the 1.45% Medicare rate.

Does the 3.8 Medicare tax apply to wages?

First off, the new Medicare tax increases the existing 2.9% Medicare tax rate on wages and earnings to 3.8% (on wages above $200,000 on a single return, $250,000 on a joint return, or $125,000 if married filing separately), of which the additional amount is borne only by the employee.

How do you calculate Medicare tax 2020?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.Feb 13, 2020

What are the tax withholding rates for 2020?

Jurisdiction (Click on the state name to access the withholding tables in effect as of the revision date shown)Revision dateSupplemental rateAlabama1/1/20195.00%Arizona1/1/2020N/AArkansas4/3/20196.90%California1/1/20206.60% and 10.23% on bonus and stock options38 more rows•Jan 20, 2020

Can Medicare wages be higher than wages?

There is no maximum wage base for Medicare taxes. The amount shown in Box 5 may be larger than the amount shown in Box 1. Medicare wages include any deferred compensation, retirement contributions, or other fringe benefits that are normally excluded from the regular income tax.

Is there a cap on Medicare tax?

Income tax caps limit do not apply to Medicare taxes, but Social Security taxes have a wage-based limit—meaning, they don't apply to earnings above a certain amount.

What income is subject to the 3.8 Medicare tax?

There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI.Nov 9, 2021

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

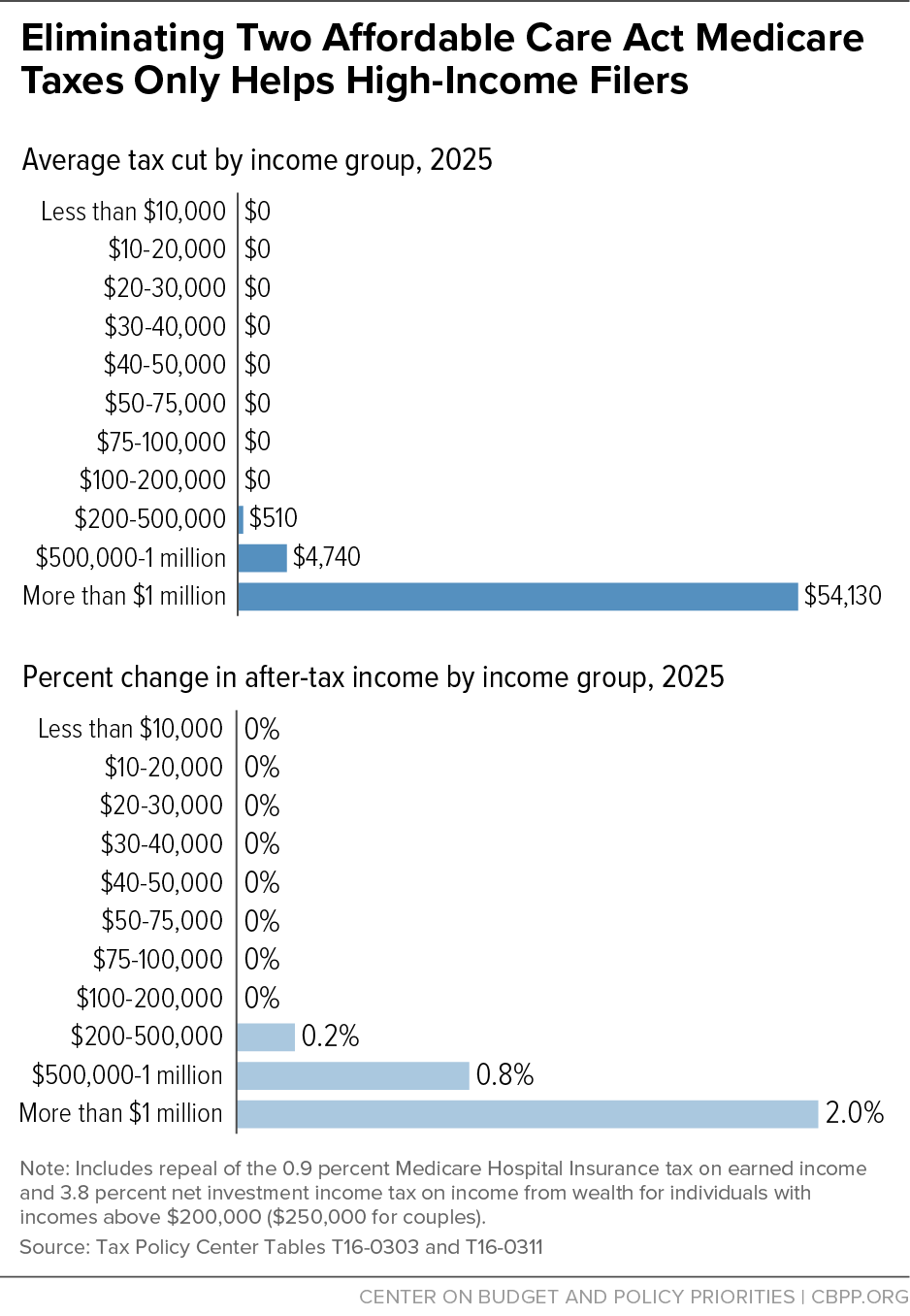

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the Medicare tax rate for 2020?

The Medicare tax rate for 2020 is 2.9 % of all covered wages. 1.45 % contributed by the employer and 1.45 % withheld. In other words, contributed by the employee.

How much is FICA tax?

Every U.S. citizen that earns wages must pay FICA (Federal Insurance Contributions Act) taxes. These taxes comprise: 6.2 % Social Security. 1.45 % Medicare tax. These taxes are contributed by both the employee and the employer, so in fact a total of 15.3 % of an employee’s gross salary is taxed. If you are self-employed, you are responsible ...

Do employers have to pay Medicare and Social Security taxes?

By law, employers are required to collect both Social Security and Medicare tax. This money is then submitted to the IRS (Internal Revenue Service) every quarter. If you, or you and your spouse, earn wages over a certain threshold, you will be liable for additional Medicare tax.

What is the wage base limit for Social Security?

The Wage Base Limit helps determine the maximum amount to social security tax to be withheld. That's because the employee wages are taxed only to a certain limit. Note: For 2021, social security and Medicare taxes also apply to wages paid to household employees if the wages are $2,300 or more in cash.

How does Medicare work?

The program is funded by payroll taxes paid by the employees with matching contributions from their employer, and also self-employed individuals.

What is FICA tax?

What are FICA Taxes? Federal Insurance Contributions Act (FICA) is an act that mandates withholding of taxes from employees’ paycheck and matching that with an equal contribution from the employer to fund the Social Security and Medicare Program .

How much does a self employed person pay in taxes?

Self-employed individuals pay a combined employer and employee amount towards social security taxes, which is at 12.4% up to $142,800 on their net earnings. They also pay a 2.9% Medicare tax on their entire net earnings. An additional Medicare tax rate of 0.9% is applicable to the threshold amount mentioned.

What is the FICA tax rate for 2021?

FICA Tax Rates 2021. FICA tax is a combination of social security tax and Medicare tax. The taxes imposed on social security tax will be 6.2% and 1.45% for Medicare tax for each employee with matching contributions from their employer. FICA Tax Rates. Employee Contribution.

What is the wage base limit?

The Wage Base Limit is the annual limit on the wages earned for which the social security tax is paid. It is set on a yearly basis and adjusted based on the change in wage growth. This wage base limit will change every year.

What is the federal unemployment tax?

The Federal Unemployment Tax Act (FUTA) is used to fund the federal unemployment program that benefits people who lose their job. No taxes are withheld from the employee paycheck towards FUTA tax. Only the employer contributes to this program.

What is the cap on Social Security?

The cap limits how much high earners need to pay in Social Security taxes each year. Critics argue that income tax caps unfairly favor high earners compared to low-income earners. Others believe that raising the cap would result in one of the largest tax hikes of all-time.

Why is the cap on wages subject to the tax controversial?

The cap on wages subject to the tax is the subject of controversy, partly because it means that, while the average worker pays tax on every dollar of their income (the vast majority of workers earn less than the wage base limit), the highest earners pay tax on only part of their income. Critics argue that caps on FICA taxes are not fair for ...

What is the payroll tax for 2020?

It is 12.4% of earned income up to an annual limit that must be paid into Social Security and an additional 2.9% that must be paid into Medicare.

How much is Social Security tax in 2021?

5 . For 2021, the wage base limit for Social Security taxes increased to $142,800, a $5,100 increase from $137,700 in 2020.

Who is Jean Folger?

Jean Folger has 15+ years of experience as a financial writer covering real estate, investing, active trading, the economy, and retirement planning. She is the co-founder of PowerZone Trading, a company that has provided programming, consulting, and strategy development services to active traders and investors since 2004.

Is there a wage cap on Medicare?

There is no income cap (or wage base limit) for the Medicare portion of the tax, meaning you continue to owe your half of the 2.9% tax on all wages earned for the year, regardless of the amount of money you make. 4 . The Social Security tax, however, has a wage-based limit, which means there is a maximum wage that is subject to the tax for ...