Which states have year-round Medicare Advantage plans?

Connecticut – Connecticut is a guaranteed year-round state, permitting you to make changes to your policy throughout the year. Maine – Those in Maine have an extension on the standard Medicare Advantage “trial right.” In other states, you have only one year to switch to a supplement when you try an Advantage plan.

Is Macra disrupting the US health care system?

MACRA: Disrupting the US health care system at all levels | Deloitte US The timeline for stakeholders to prepare for MACRA reporting and compliance is short and there is much to do. The timeline for stakeholders to prepare for MACRA reporting and compliance is short and there is much to do.

How will Medicare pay physicians Under MACRA?

Under MACRA, Medicare and other payers are increasingly paying physicians based on the value rather than the volume of their services. FAQs on MACRA Find answers to frequently asked questions related to MACRA. View the FAQs» MACRAnyms Confused by all the MACRA acronyms? Get a roundup of all the programs, organizations, and terms related to MACRA.

Which states have the birthday rule for Medicare Advantage?

Oregon – The birthday rule also applies to the state of Oregon. Connecticut – Connecticut is a guaranteed year-round state, permitting you to make changes to your policy throughout the year. Maine – Those in Maine have an extension on the standard Medicare Advantage “trial right.”

Does the new MACRA legislation which went into effect January 1 2020 applies to all carriers offering Medicare supplement plans?

The new MACRA legislation, which went into effect January 1, 2020, applies to all carriers offering Medicare supplement plans.

What is the difference between MIPS and MACRA?

MACRA is the federal law that brought MIPS into effect. You may be required to file MIPS data if you or your practice meet certain criteria. The MIPS program can yield higher reimbursements for your practice if you provide better care, just as lower-quality care can lead to lower reimbursements.

Who implemented MACRA?

Congress gave the Centers for Medicare and Medicaid Services (CMS) the task of developing regulations to implement MACRA. That process has been under way since May 2015, encompassing three comment periods that yielded some 4,000 comments. The agency issued final regulations October 14, 2016.

What did the Medicare access and CHIP Reauthorization Act MACRA do?

The Medicare Access and CHIP Reauthorization Act (MACRA) is a law that significantly changed how the federal government pays physicians. Passage of the law permanently repealed the flawed sustainable growth rate (SGR) and set up the two-track Quality Payment Program (QPP) that emphasizes value-based payment models.

What replaced MIPS?

In 2021, CMS replaced the “MIPS APM scoring standard” with the new “MIPS APM Performance Pathway (APP).” The APP is designed to be an optional pathway for clinicians that participate in an APM but still participate in MIPS either because: 1) their model does not meet the criteria to be considered an “Advanced APM;” or ...

What did MACRA repeal?

Yesterday evening, the Senate passed, by 92-8 vote, the Medicare Access and CHIP Reauthorization Act of 2015 ("MACRA"), a bipartisan bill to repeal Medicare's sustainable growth rate ("SGR") formula for physician compensation, with only hours left before further physician payment cuts were set to take effect.

Is MACRA mandatory?

By law, MACRA required the Centers for Medicare & Medicaid Services (CMS) to establish value-based healthcare business models that link an ever-increasing portion of physician payments to service-value rather than service-volume.

When did MACRA go into effect?

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) is a bipartisan legislation signed into law on April 16, 2015. MACRA created the Quality Payment Program that: Repeals the Sustainable Growth Rate (PDF) formula. Changes the way that Medicare rewards clinicians for value over volume.

What level of government oversees MACRA?

CMS (Centers for Medicare and Medicaid Services) Agency within the Department of Health and Human Services (HHS).

How does MACRA affect Medicare supplement plans?

MACRA prohibits the sale of Medigap policies that cover Part B deductibles to “newly eligible” Medicare beneficiaries defined as those individuals who: (a) have attained age 65 on or after January 1, 2020; or (b) first become eligible for Medicare due to age, disability or end-stage renal disease, on or after January 1 ...

What is MACRA and how is it affecting our health care system today?

In 2015 President Obama signed the Medicare Access and CHIP Reauthorization Act (MACRA) which repealed the Sustainable Growth Rate (SGR) mechanism for Medicare physician reimbursement and mandated that CMS develop alternative payment methodologies to “reward health care providers for giving better care not more just ...

How will MACRA affect physicians and the healthcare system?

MACRA changes how the Centers for Medicare & Medicaid Services pays physicians who provide care to Medicare beneficiaries. It ties physician compensation to quality and encourages doctors to participate in alternative value-based payment models.

What is Medicare and CHIP reauthorization?

The Medicare and CHIP Reauthorization Act (MACRA) is a law that changed how the federal goverment pays physicians. A two-track Quality Payment Program (QQP) not in place emphasizes value-based payment models.

What is MACRA law?

MACRA. The Medicare Access and CHIP Reauthorization Act (MACRA) MACRA: The Basics. The Medicare Access and CHIP Reauthorization Act (MACRA) is a law that significantly changed how the federal government pays physicians. Passage of the law permanently repealed the flawed sustainable growth rate (SGR) and set up the two-track Quality Payment Program ...

What is a MIPS and AAPM?

MIPS and AAPMs are collectively referred to as the Quality Payment Program (QPP). Physicians will choose between two Medicare payment tracks: the Merit-based Incentive Payment System (MIPS) track or the Advanced Alternative Payment Model (AAPM) track.

Why did MACRA change Medicare membership cards?

The reason for this was to remove an individual’s Social Security Number (SSN) from the membership card to protect their personal and claim data.

When did MACRA become law?

Image credit: FatCamera/Getty Image. U.S. Congress passed MACRA in April 2015 and signed the act into law with effect from April 16, 2015. The government designed MACRA to ensure more patient-focused care, rather than a fee-for-service system.

What is the purpose of MACRA?

MACRA aimed to: reduce Medicare spending and discourage unwarranted doctors’ appointments. increase the quality of care a person receives. make healthcare providers more accountable for the care they provide to individuals. Following MACRA, Medicare introduced new rules about paying and reimbursing doctors and other healthcare providers.

What are the most similar plans to Medicare?

The most similar are Medigap plans D, G, and N . A person can look for a Medigap plan on the Medicare website.

What is a Medigap plan?

Effect on Medigap plans. Private health insurance companies administer Medigap plans. The policies help cover out-of-pocket costs, such as deductibles, copayments, and coinsurance. Plan providers offer a range of 10 Medigap plans, all with varying levels of coverage. They typically include: the Part A deductible.

What is MACRA deductible?

Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund.

What is the MACRA premium for 2021?

MACRA and income brackets. Original Medicare’s Part B coverage has a standard premium of $148.50 in 2021. This premium applies to those with an individual income of $88,000 or below or a joint income of $176,000 or below.

A changing payment system

The new law repeals Medicare's sustainable growth rate (SGR) formula and creates a narrow pathway to higher Medicare payments, largely through a consolidated and expanded incentive program called the Merit-Based Incentive Payment System (MIPS).

Ongoing advocacy

Even while supporting MACRA's final passage, the AOA was working with other physician groups to raise concerns about two misguided provisions in the legislation.

Resource Use Measurement Delay

Resource Use Measurement Delay The law delays for one year (to 2019) the ability of ODs to participate in a program that assesses how to better measure physician resource use during certain episodes of care and for specific patient conditions.

MACRA Proposed Rule Creates the Medicare Quality Payment Program

On April 27, 2016, the Centers for Medicare and Medicaid Services (CMS) announced a proposed rul e (summarized in this news release ), which outlines how CMS proposes to implement the law, including details regarding MIPS and APMs.

Explaining the Medicare Quality Payment Program

The U.S. Department of Health and Human Services offers an easy-to-understand video to help explain the complex regulation that is MACRA:

PCPCC Responds with Comments on MACRA Proposed Rule

On June 27, 2016, the PCPCC submitted its official comments to CMS on the MACRA proposed rule, which are summarized in a June 28 press release.

How does MACRA affect health care?

MACRA is most likely to directly impact clinicians, health systems , and health plans. However, the law may affect other stakeholders along the health care continuum. The Act’s intent is to reduce health care spending and overall utilization by rewarding providers for improved quality and outcomes.

What is MACRA survey?

MACRA is designed to be an opportunity to get better value from health care. But as the survey results show, stakeholders—health systems, payers, and other organizations—need to work with physicians to prepare for the law’s changes. Download the report for the full findings of the survey, or view the infographic for an overview below.

What is the purpose of MACRA?

MACRA is expected to drive care delivery and payment reform across the US health care system for the foreseeable future. Congress intended MACRA to be a transformative law that constructs a new, fast-speed highway to transport the health care system from its traditional fee-for-service payment model to new risk-bearing, coordinated care models.

How many pages are there in the MACRA rule?

CMS released its eagerly anticipated final rule outlining the new payment programs under MACRA. At nearly 2,400 pages, even for the most “schooled” in the health policy world, who are used to reading lots of health care regulations, this is a big one.

Is MACRA a disruptive law?

As we’ve said many times, MACRA is disruptive by design. Congress intended the law to put the industry on a path toward delivering much more cost-effective and outcomes-based health care. Congress and the Administration have made it clear that it will be an evolutionary process and will take place over many years.

Is MACRA poised to disrupt relationships?

The findings suggest that many executives believe MACRA is poised to disrupt relationships and in some cases, the way their business operates on a fundamental level. Some are speeding up their plans for value-based care payment arrangements due to the law.

How long can you switch Medicare Advantage plan in Maine?

But, in Maine, you can “try” the Advantage plan for three years, and you have 90 days after dropping the policy to switch to a supplement with Guaranteed Issue ...

How long can you change your Medigap plan?

Some states allow the “Birthday Rule,” which allows a 30-day timeframe for you to change your Medigap plan after your birthday every year. Also, you can change plans without underwriting as long as the policy benefits are equal to or less than your current plan.

How long does it take to switch Medigap plans?

Missouri – If you have a Medigap policy, you can switch plans within 60 days of your enrollment anniversary . New York – You can enroll in a Medigap policy without underwriting throughout the year. Washington – Allows Medigap enrollees to change Medigap plans (except for Plan A) at any point.

Is Medicare primary or secondary?

If your employer’s health care policy is the primary form of insurance, and Medicare is secondary.

Is Medicare open enrollment in 2021?

Updated on July 15, 2021. Even though Medicare is a Federal program, some states have different terms for Open Enrollment, Guaranteed Issue Rights, excess charges, disability, etc. Below, we’ll highlight what states have their own unique rules.

When did Medicare and Medicaid reauthorization act repeal SGR?

On April 14, 2015, with bipartisan support, President Obama signed into law the Medicare and CHIP Reauthorization Act of 2015 (MACRA), repealing the troubled sustainable growth rate (SGR) formula for determining Medicare payments for clinicians’ services. (The SGR formula had annually been threatening to make 25% to 30% cuts in physicians’ payments for services to Medicare beneficiaries.)

What is MACRA payment?

Participants will receive a lump-sum incentive payment equal to 5% of the prior year’s estimated aggregate expenditures under the fee schedule. The 5% incentive payment is available from 2019 to 2024. Beginning in 2026, the fee schedule growth rate will be higher for qualifying APM participants than for other practitioners.

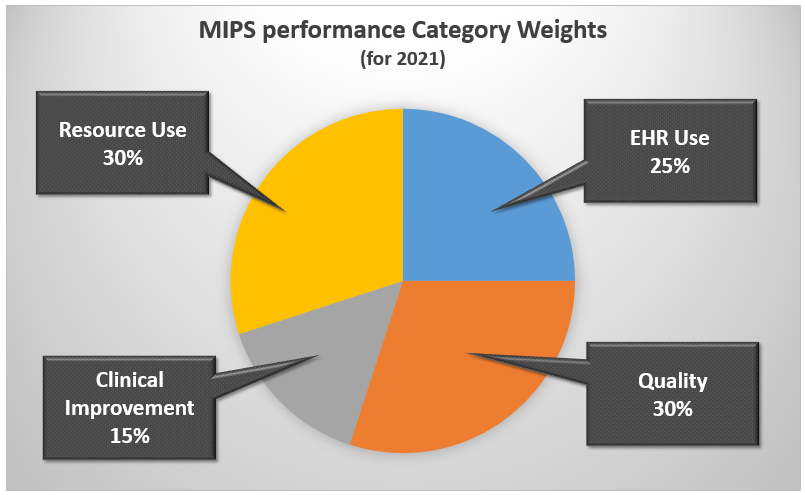

What is MIPS in Medicare?

MIPS is a pay-for-performance system in which the standard amounts that a physician is paid for services provided to Medicare beneficiaries will be increased or decreased by 4% to 9%, each year, based on the physician’s performance compared with other physicians. Four performance categories (ie, quality of care, resource use, clinical improvement, and meaningful use of certified electronic health record [EHR] technology) will be used to make up the composite performance score to determine payment adjustments.