Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). In Texas, these programs pay for Medicare Part B premiums, Medicare Part A and B cost-sharing, and – in some cases – Part A premiums.

Full Answer

What states have the best Medicare coverage?

Only 15 weekdays are left for Medicare recipients to choose or change their plans. Only 15 days left for choosing the best Medicare coverage | News | annistonstar.com Thank you for reading! Please log in, or sign up for a new account andpurchase a subscription to continue reading.

What is the cheapest state to buy Medicare?

We ranked each state 1 to 50 on the following factors:

- Median House Cost

- Monthly Home Owner Cost

- Cost Of Living

- Medicare Advantage Cost

- State Medicare Spend Per Person

Do states pay for Medicare?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals. This process promotes access to Medicare coverage for low-income older adults and people with disabilities, and it helps states ensure that Medicare is the first and primary payer for Medicare covered services for dually eligible beneficiaries.

How does income affect monthly Medicare premiums?

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage or Reduction

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Do states receive federal funds to help with the costs of Medicare?

Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state. Both programs received additional funding as part of the fiscal relief package in response to the 2020 economic crisis.

What are the 4 ways people can pay for their original Medicare premiums?

4 ways to pay your Medicare premium bill:Pay online through your secure Medicare account (fastest way to pay). ... Sign up for Medicare Easy Pay. ... Pay directly from your savings or checking account through your bank's online bill payment service. ... Mail your payment to Medicare.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

What is the Medicare trust fund?

The Medicare trust fund finances health services for beneficiaries of Medicare, a government insurance program for the elderly, the disabled, and people with qualifying health conditions specified by Congress. The trust fund is financed by payroll taxes, general tax revenue, and the premiums enrollees pay.

Under which program does the federal government send Medicaid funding to states?

The Medicaid program is jointly funded by the federal government and states. The federal government pays states for a specified percentage of program expenditures, called the Federal Medical Assistance Percentage (FMAP).

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Who qualifies for free Medicare Part A?

age 65 or olderYou are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

How do I get Medicare Part B reduced?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

Medicare Premium: What Is It and How Does It Work?

Your Medicare premium is the monthly payment you make to have a Medicare insurance plan. Medicare insurance has four parts: Part A (hospital insura...

Medicare Premium Assistance: What Options Are available?

The Centers for Medicare and Medicaid Services (CMS) provide assistance with premium payments. Medicaid operates four types of Medicare Savings Pro...

How to Qualify For Help With Medicare Premiums

You may qualify for help with paying your premiums through Medicare Savings Programs if you: 1. Are eligible for or have Medicare Part A 2. Meet in...

Help Paying Medicare Prescription Drug (Part D) Premiums

You may be able to get help with Medicare premiums for your prescription drug coverage through the Part D Low-Income Subsidy (LIS) program, also ca...

Alternative Medicare Assistance Programs

Programs outside of Medicare that can help pay premiums are generally for Medicare Part D plans. Depending on the state you live in, you may be abl...

Evaluating Your Medicare Needs

With all the different parts of Medicare and different premiums for each part, it can be a little confusing to understand how Medicare works. Healt...

What is SSI benefits?

A monthly benefit paid by Social Security. SSI is for people with limited income and resources who are disabled, blind, or age 65 or older. SSI benefits aren't the same as Social Security retirement or disability benefits.

What is the PACE program?

PACE. PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health care needs in the community.

How do I apply for Medicare Savings Programs?

If you answer yes to these 3 questions, call your State Medicaid Program to see if you qualify for a Medicare Savings Program in your state:.

What is the number to call for Medicare?

If your provider won't stop billing you, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048.

How to stop Medicare charges?

If you have a Medicare Advantage Plan: Contact the plan to ask them to stop the charges.

Can you get help paying Medicare premiums?

You can get help from your state paying your Medicare premiums. In some cases, Medicare Savings Programs may also pay

Can you be charged for Medicare deductibles?

If you get a bill for Medicare charges: Tell your provider or the debt collector that you’re in the QMB Program and can’t be charged for Medicare deductibles, coinsurance, and copayments.

What is Medicare premium?

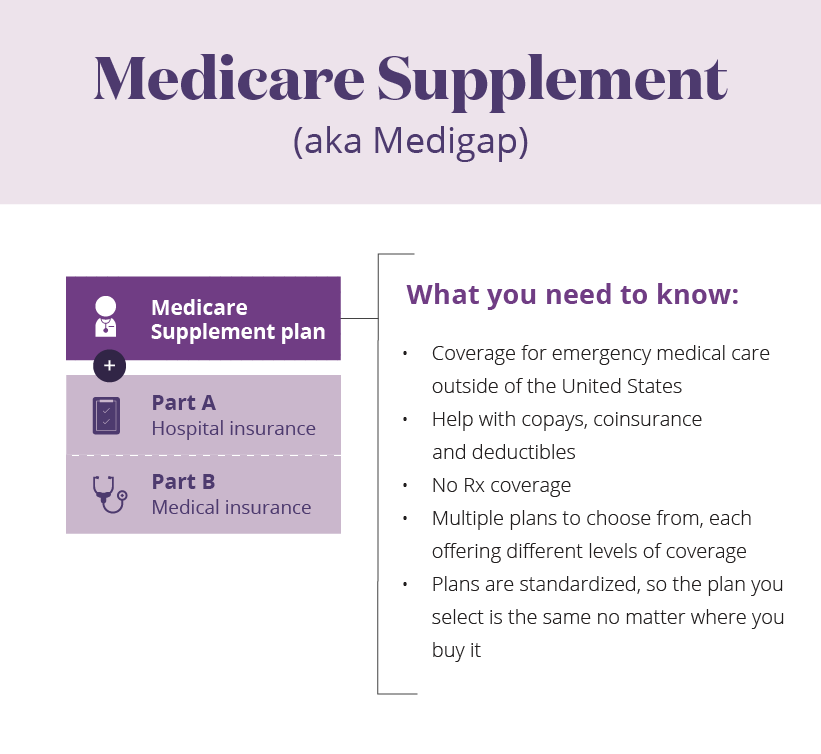

Your Medicare premium is the monthly payment you make to have a Medicare insurance plan. Medicare insurance has four parts: Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage). You pay a different premium for each part of Medicare. Medicare Parts A and B are known as Original Medicare because the insurance coverage is provided directly through the Medicare program.

Which states have different income limits?

Alaska and Hawaii are the only two states that have different income limits. Three of the four MSPs have the same resources limits, and these limits are the same for all states, including Alaska and Hawaii. If you earn equal to or less than these limits, then you may qualify for assistance. Program Name.

What is the CMS?

The Centers for Medicare and Medicaid Services (CMS) provide assistance with premium payments. Medicaid operates four types of Medicare Savings Programs (MSP): Most of the help you can get to pay premiums are available through these programs.

What percentage of FPL can I get for Medicare Part B?

Not have an income that is more than 200% of the FPL (You may only get partial aid if your income is between 150% to 200% of the FPL.) Part B Only: Both the Specified Low-Income Medicare Beneficiary (SLMB) and Qualifying Individual (QI) programs will help pay for Medicare Part B premiums.

What is the difference between Medicare Part A and Part B?

All programs require eligibility for Medicare Part A, but the main difference between each is the federal poverty level (FPL) range that those seeking help must be within.

How much is Medicare Part D 2022?

Medicare Part D plans are also provided through private insurance companies. The national average Part D premium is $33 for 2022. 3 But depending on where you live and the type of plan you have, Medicare Part D costs will vary.

How much is Part B insurance?

The standard Part B premium as of 2019 is $135.50, but most people with Social Security benefits will pay less ($130 on ).

How do I apply for Medicaid benefits or an MSP in my state?

In other states, you have to submit a paper application at a Medicaid or social services office – or send this by mail or fax.

What are the different types of Medicaid?

What these state sections cover: 1 Medicare Savings Programs – the types of programs in each state and the income and asset limits for eligibility 2 Medicaid for the aged, blind and disabled – benefits and eligibility levels by state 3 Medicaid ‘spend down’ programs – income levels and whether long-term care is covered 4 Medicaid nursing home coverage – including eligibility limits 5 Home and Community Based Services waivers – benefits offered and income levels 6 State rules about transferring assets to qualify for Medicaid coverage of long-term care. 7 State financial tools that help beneficiaries to become eligible for Medicaid nursing home coverage or HCBS. 8 State policies that affect estate recovery from Medicaid enrollees who received long-term care. 9 State programs that help Medicare beneficiaries who struggle with the costs of prescription drugs. 10 How you can apply for Medicaid or an MSP in each state.

How many days does Medicare cover nursing home care?

This is why Medicaid covers nursing home care for an unlimited number of enrollees in each state. Medicare covers up to 100 days in a skilled nursing facility (SNF) for enrollees who require skilled nursing care or need physical or occupational therapy in an institutional setting.

How much does LTCI cost?

In 2019, nursing homes cost an average of $8,365 a month, which would rapidly deplete most couples’ savings. Medicare enrollees who need ongoing nursing home care often have to apply for Medicaid.

How much does nursing home care cost?

In 2019, nursing homes cost an average of $8,365 a month, which would rapidly deplete most couples’ savings. Medicare enrollees who need ongoing nursing home care often have to apply for Medicaid.

What is SPAP in Medicare?

Some states also operate State Pharmaceutical Assistance Programs (SPAPs), which provide assistance to Medicare Part D enrollees with low and moderate incomes. These programs can help pay for Part D premiums and co-pays, and may cover drugs that aren’t covered by Part D. SPAP enrollees also receive a once-yearly special enrollment period (SEP) to select or change Medicare Advantage and Part D plans.

Why do people need to reduce their assets to qualify for Medicaid?

Long-term care can be very expensive , which is why Medicare enrollees sometimes feel the need to reduce their assets so they qualify for Medicaid. This process can include giving away or transferring assets for less than they are worth.

What are Medicare Savings Programs?

Medicare Savings Programs (MSP) can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets. There are four different types of MSPs, and they provide varying benefits. Two of the MSPs only help to pay Medicare Part B premiums (but not Part A premiums or Medicare cost sharing), and one MSP helps disabled working individuals pay their Part A premiums.

What is extra help for Medicare?

Medicare offers “ Extra Help ” for Medicare enrollees who can’t afford their Part D prescription drug coverage. In 2020, if you’re a single person earning less than $1,615 per month ($2,175 for a couple), with financial resources that don’t exceed $14,610 ($29,160 for a couple), you may be eligible for “Extra Help.”.

What is QMB in Medicare?

Qualified Medicare Beneficiary Program (QMB). Helps to pay premiums for Part A and Part B, as well as copays, deductibles, and coinsurance. This is the most robust MSP, and has the lowest income limits for eligibility. A single person can qualify in 2021 with an income of up to $1,094 per month ($1,472/month for a couple).

Is Medicare a dual program?

Medicare-Medicaid dual eligibility. People who are eligible for MSPs are covered by Medicare, but receive assistance with premiums (and in some cases, cost-sharing) from the Medicaid program. But some low-income Medicare enrollees are eligible for full Medicaid benefits, in addition to Medicare. About 20 percent of Medicare beneficiaries are dually ...

Does MSP pay Medicare?

Two of the MSPs only help to pay Medicare Part B premiums (but not Part A premiums or Medicare cost sharing), and one MSP helps disabled working individuals pay their Part A premiums.

Does Medicare cover nursing home care?

Medicare does not cover custodial long-term care, but Medicaid does, if the person has a low income and few assets. The majority of the people living in American nursing homes are covered by Medicaid (virtually all of them are also covered by Medicare).

Do you have to apply for an MSP during Medicare's annual election period?

No. You can apply for MSP assistance anytime. As noted above, you’ll do this through your state’s Medicaid office, which accepts applications year-round.

Where can Medicare beneficiaries get help in Florida?

Free volunteer Medicare counseling is available by contacting the Florida SHINE at 1-800-963-5337. This is a State Health Insurance Assistance Program (SHIP) offered in conjunction with the State Department of Elder Affairs.

When did Medicare start recovering from Medicaid?

Congress exempted Medicare premiums and cost sharing from Medicaid estate recovery starting with benefits paid after December 31, 2009, but Medicaid may attempt to recover MSP benefits received through that date.

How does Florida regulate long-term services and supports (LTSS)?

Medicare beneficiaries increasingly rely on long-term services and supports (LTSS) – or long-term care – which is mostly not covered by Medicare. In fact, 20 percent of Medicare beneficiaries who lived at home received some assistance with LTSS in 2015. Medicaid fills this gap in Medicare coverage for long-term care, but its complex eligibility rules can make qualifying for benefits difficult. What’s more – eligibility rules vary significantly from state to state.

How do I apply for Medicaid in Florida?

Medicaid eligibility is determined by the Department of Children and Families (DCF) in Florida. You can apply for Medicaid ABD or an MSP using this website. The DCF website also lists local partners who can help you file a Medicaid application.

How much can a spouse keep on Medicaid in Florida?

If only one spouse needs Medicaid, the other spouse can keep up to $128,640. In Florida, the asset limit for nursing home enrollees increases – to $5,000 if single and $6,000 if married – if an applicant’s income is below $961 a month if single and $1,261 a month if married, meaning they also qualify for Medicaid ABD.

What is Medicare Savings Program in Florida?

A Medicare Savings Program (MSP) can help Florida Medicare beneficiaries who struggle to afford the cost of Medicare coverage. The MSPs help some Floridians pay for Medicare Part B premiums, Medicare Part A and B cost-sharing, and – in some cases – Part A premiums. Qualified Medicare Beneficiary ...

How long does it take to recover Medicaid in Florida?

There is a 5-year lookback period for asset transfers in Florida. Florida has chosen to pursue estate recovery for all Medicaid costs received starting at age 55. The state where you reside has a significant impact on the care you receive and how much you pay as a Medicare beneficiary.

Where can Medicare beneficiaries get help in Missouri?

Free volunteer Medicare counseling is available by contacting the Missouri State Health Insurance Assistance Program at 800-390-3330. The SHIP program in Missouri is called “CLAIM.”

What is the income limit for Medicare?

The income limit is $1,083 a month if single or $1,457 a month if married.

How much do nursing home enrollees pay?

Nursing home enrollees must pay nearly all their income each month toward their care, other than a small personal needs allowance ( of $50 a month) and money to pay for health insurance premiums (such as Medicare Part B and Medigap ).

What is the income limit for HCBS in Missouri?

The income limit for HCBS is $1,370 a month per applicant in Missouri. In Missouri in 2020, spousal impoverishment rules allow spouses who aren’t receiving LTSS (and don’t have Medicaid) to keep an allowance that is between $2,155 and $3,216 per month.

How much equity can you have in a nursing home in Missouri?

Applicants for nursing home care and HCBS can’t have more than $595,000 in home equity in Missouri. In Missouri, applicants for LTSS may be penalized if they transfer or give away assets for less than their value. Missouri has chosen to pursue estate recovery for all Medicaid covered expenses.

Does Medicare cover dental and vision?

Medicare covers a great number services – including hospitalization, physician services, and prescription drugs – but Original Medicare doesn’t cover important services like vision and dental benefits. Some beneficiaries – those whose incomes make them eligible for Medicaid – can receive coverage for those additional services if they’re enrolled in Medicaid for the aged, blind and disabled (ABD).

Does Medicare cover long term care?

Medicare beneficiaries increasingly rely on long-term services and supports (LTSS) – or long-term care – which is mostly not covered by Medicare. In fact, 20 percent of Medicare beneficiaries who lived at home received some assistance with LTSS in 2015.