Can you still purchase a Medicare Plan F?

Is the high deductible F plan going away?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles.Jul 9, 2020

Is Medicare Plan F available in California?

Plan F helps cover Medicare deductibles and some copayments and coinsurance. Per government regulation, Plan F is only available if you first became eligible for Medicare before January 1, 2020. Innovative F is available in California.

Is Plan F available in NJ?

Why was Plan F discontinued?

Can you switch from Plan F to Plan G in 2021?

What is blue Medicare Plan F?

What is the difference between Plan F and Innovative Plan F?

Is high deductible plan g available in California?

Is high deductible plan g available in NJ?

How Much Is Medigap monthly?

What are the Medicare income limits for 2022?

| If your yearly income in 2020 (for what you pay in 2022) was | You pay each month (in 2022) | |

|---|---|---|

| File individual tax return | File joint tax return | |

| $91,000 or less | $182,000 or less | $170.10 |

| above $91,000 up to $114,000 | above $182,000 up to $228,000 | $238.10 |

| above $114,000 up to $142,000 | above $228,000 up to $284,000 | $340.20 |

What is a high deductible plan?

High Deductible Plan F. High Deductible Plan F is an alternative version of the standard Plan F. The difference is the beneficiary agrees to pay the deductible before full coverage kicks in. Once you reach the deductible, the plan covers the left-over costs going forward, keeping the monthly premium low.

What is a standard plan F?

Standard Plan F is the Medigap plan offering the most comprehensive benefits. Yet, with more coverage comes higher monthly premiums. Thus, this plan, with its lower monthly premiums, could be a good choice for cost-conscious beneficiaries who find standard Plan F’s benefits attractive.

How much is the 2021 deductible?

In 2021, the deductible is $2,370. Therefore, you would have to pay $2,370 out-of-pocket on this plan. Once you reach this deductible, the plan will cover 100% of the costs.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F is not only the most comprehensive plan for lowering out-of-pocket costs, it is also the most popular.

Is Plan F still available?

Starting on January 1, 2020, Plan F is not available to people newly enrolled in Medicare. Plan F is still an option if you were eligible for Medicare before that date, whether based on age (65 years or older) or qualifying disability (regardless of age).

How long is the open enrollment period for Medicare?

Although Medicare has an annual Open Enrollment Period, there is only one Medigap Open Enrollment Period. This six-month period starts when you enroll in Medicare Part B. Signing up after that time will allow companies to increase your rates or deny you coverage based on preexisting conditions.

When did Humana start selling health insurance?

Founded in 1961, Humana started out as a nursing home company and began selling health insurance in the 1980s. It offers Plan F in all 47 states where traditional Medicare Supplement Plans are available. High-Deductible Plan F is available in all of those states except Georgia and Kentucky.

Is Aetna a subsidiary of CVS?

Now a subsidiary of CVS Health Corporation, these two reputable companies work together to bring you a well-rounded healthcare experience. Aetna offers Plan F in 41 states, excluding Alaska, Connecticut, Hawaii, Maine, Massachusetts, Minnesota, New York, Washington, and Wisconsin.

What is the difference between regular and high deductible insurance?

Regular Plan F will offer higher monthly premiums but will begin to pay toward out-of-pocket costs right away. High-Deductible Plan F, on the other hand, offers lower monthly premiums but requires you to pay an annual deductible, set at $2,370 for 2021, before it will pay toward out-of-pocket costs. 4

What is Mutual of Omaha?

Founded in 1909, Mutual of Omaha offers a wide range of products from accident and life insurance to financial planning. As one of the first carriers to service Medicare in 1966, it has also built a solid reputation for high-quality Medicare products, offering Plan F in all 47 states where traditional Medicare Supplement Plans are available. If you are looking for High-Deductible Plan F, this company offers it in the majority of states with the exception of Georgia, Hawaii, Maine, Mississippi, New Mexico, New York, Ohio, Tennessee, Texas, Virginia, Wyoming.

When will Medicare plan F be available?

The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020. High deductible G is available to individuals who are new to Medicare on or after 1/1/2020.

What is the high deductible plan for Medicare Supplemental?

The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020. High deductible G is available to individuals who are new to Medicare on or after 1/1/2020. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020.

What is the deductible for Medicare 2021?

Effective January 1, 2021, the annual deductible amount for these three plans is $2,370.

What is a high deductible plan?

High deductible Plan F provides the same level of coverage as the standard Plan F with potentially lower monthly premiums. The tradeoff for these lower monthly premiums is a high deductible.

How much will Medicare cover in 2021?

You must pay for Medicare-covered costs up to $2,370 in 2021 before your plan coverage will kick in. For example, if you need a blood transfusion, a traditional Medigap plan will cover the cost of the first three pints, and Medicare will cover the cost of pints four and beyond.

Is Medicare Supplement Plan F still available?

Yes. Medicare Supplement Plan F may eventually leave the market, starting in 2020 – but not for everyone. If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs.

What is the most comprehensive Medicare Supplement?

In most states, the most comprehensive Medicare Supplement insurance plan available will be Plan G. Plan G is similar to Medicare Supplement Plan F, except Plan G does not cover the Part B deductible. (In 2021, the Part B deductible is $203 per year.)

What is the Medicare Access and CHIP Reauthorization Act?

In 2015, Congress passed the Medicare Access and CHIP Reauthorization Act. The act was meant to improve provider payments for covered Medicare services. At the same time, however, Congress knew there’s an increasing strain on the Medicare Trust Fund budget, as more and more people age into Medicare.

Is Medicare Supplement Plan F deductible?

Medicare Supplement Plan F and Plan G are available as high-deductible plans. Here’s what to know about Plan F and Plan G: Each has a regular version, meaning you generally don’t have to wait for plan benefits to start. Each has a high-deductible version.

What is a high deductible Medicare Supplement?

Two of these Medicare Supplement plans, Plan F and Plan G, have high-deductible options – often with lower premiums. A deductible is an amount you have to pay toward your covered medical costs before your Medicare Supplement insurance plan starts paying its share. So, if you have a high deductible, that means you pay more before plan benefits kick ...

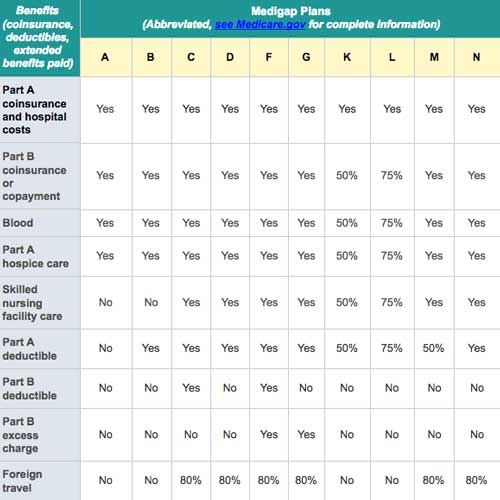

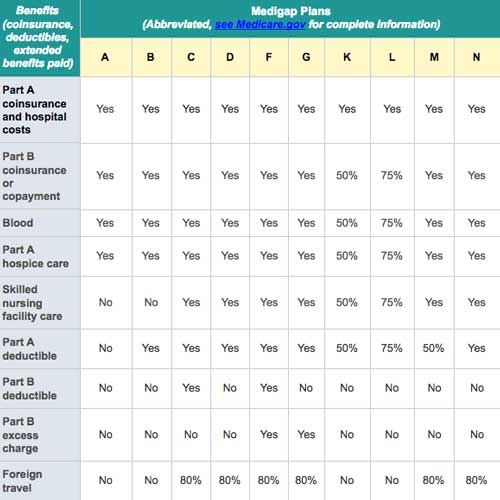

What are the benefits of Medicare Supplement?

All Medicare Supplement insurance plans provide certain basic benefits. This means no matter what letter name your Medicare Supplement insurance plan has, it may pay all, or at least part, of your Medicare costs related to: 1 The Medicare Part A deductible 2 Hospice care copayment/coinsurance 3 Up to 365 additional hospital days after your Medicare benefits are used up 4 Medicare Part B coinsurance and copayments 5 The first 3 pints of blood if you need a transfusion

Do you have to have Medicare Part A and Part B?

You have to have Medicare Part A and Part B to get any Medicare Supplement insurance plan. This includes high-deductible plans. Note that the best time to buy Medicare Supplement Plan F or Plan G is usually during your Medicare Supplement Open Enrollment Period (OEP).

Does Medicare Supplement pay for coinsurance?

When you have a Medicare Supplement insurance plan, it generally helps pay your Medicare Part A and Part B coinsurance or copayments. Some plans may pay your Part A and/or Part B deductible, skilled nursing care coinsurance, hospice care coinsurance, and more.

Does Medigap Plan G have a high deductible?

High-deductible Medigap Plan G will offer the same benefits as standard Medigap Plan G, except the plan won’t pay its share of covered costs until you meet annual deductible amount. Once you spend a certain amount in qualified out-of-pocket Medicare expenses, you will meet your deductible and your Plan G benefits will kick in.

How much is Medicare Part A deductible?

Medicare Part A comes with a deductible, which is $1,408 per benefit period in 2020. Medigap Plan G will cover your deductible in full for each benefit period you require.

What is Medicare Part A?

Medicare Part A Coinsurance. Medicare Part A is known as hospital insurance, and it includes cost-sharing measures like coinsurance. Inpatient hospital stays covered by Medicare Part A require coinsurance fees if they exceed 60 days.

What is Medicare Part B coinsurance?

Medicare Part B Coinsurance and Copayment. Medicare Part B usually charges a coinsurance and copayments for doctor visits and other outpatient care . Medicare Part B typically pays for 80% of the Medicare-approved amount for covered services, leaving a 20% coinsurance in most cases.

Does Medicare cover 4 pints of blood?

Original Medicare only covers the four th pint of blood and beyond. If you need blood while in the hospital, Medigap Plan G covers the cost of the first 3 pints after you meet your deductible.

What is excess charge in Medicare?

Medicare Part B Excess Charges. Doctors can bill a procedure for up to 15% higher than what Medicare pays for it. The extra expenses are called “excess charges.”. If there are any excess charges for an approved visit, a person insured under Plan G would be fully covered after they meet their deductible.

How does a high deductible plan work?

How Does High-Deductible Plan G Work? High-deductible Medigap Plan G will offer the same benefits as standard Medigap Plan G, except the plan won’t pay its share of covered costs until you meet annual deductible amount. Once you spend a certain amount in qualified out-of-pocket Medicare expenses, you will meet your deductible ...