What to Do When Your Doctor Doesn't Take Medicare

- Pay the Difference. Even if your doctor doesn’t accept Medicare, you may still be able to continue your care with that professional.

- Request a Discount. There is another scenario where you’re better off looking for doctors in your area that accept Medicare.

- Consider Urgent Care Centers. ...

- Ask Your Doctor for a Referral. ...

- Use Medicare's Directory. ...

Full Answer

What do I do if my doctor doesn't accept my insurance?

If your health care practitioner doesn’t accept your health insurance, there are steps you can consider taking: Contact your insurance company "Call them and state your case. Sometimes they'll honor your appeal.

What happens if I choose a doctor who accepts Medicare?

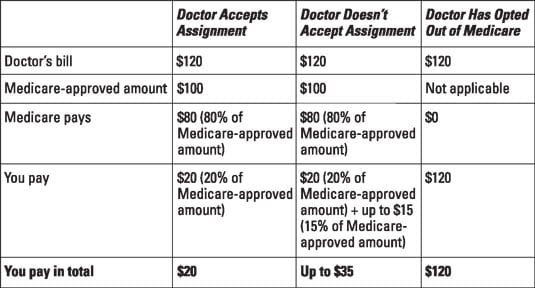

If you choose a doctor who accepts Medicare, you won't be charged more than the Medicare-approved amount for covered services. A doctor can be a Medicare-enrolled provider, a non-participating provider, or an opt-out provider. Your doctor's Medicare status determines how much Medicare covers and your options for finding lower costs.

Can doctors refuse to accept Medicare?

Can Doctors Refuse Medicare? The short answer is "yes." Thanks to the federal program's low reimbursement rates, stringent rules, and grueling paperwork process, many doctors are refusing to accept Medicare's payment for services.

Do I need to submit Medicare claims to my doctor?

You won’t need to worry about submitting claims to Medicare—your doctor will handle this for you at no charge. If your doctor is non-participating, you’ll usually need to pay out of pocket for all charges.

What does it mean if a doctor does not accept Medicare assignment?

A: If your doctor doesn't “accept assignment,” (ie, is a non-participating provider) it means he or she might see Medicare patients and accept Medicare reimbursement as partial payment, but wants to be paid more than the amount that Medicare is willing to pay.

Can a doctor refuse to treat a Medicare patient?

Can Doctors Refuse Medicare? The short answer is "yes." Thanks to the federal program's low reimbursement rates, stringent rules, and grueling paperwork process, many doctors are refusing to accept Medicare's payment for services. Medicare typically pays doctors only 80% of what private health insurance pays.

What are the consequences of non participation with Medicare?

Non-participating providers can charge up to 15% more than Medicare's approved amount for the cost of services you receive (known as the limiting charge). This means you are responsible for up to 35% (20% coinsurance + 15% limiting charge) of Medicare's approved amount for covered services.

Why do some doctors opt out of Medicare?

There are several reasons doctors opt out of Medicare. The biggest are less stress, less risk of regulation and litigation trouble, more time with patients, more free time for themselves, greater efficiency, and ultimately, higher take home pay.

Do doctors treat Medicare patients differently?

So traditional Medicare (although not Medicare Advantage plans) will probably not impinge on doctors' medical decisions any more than in the past.

Does a doctor have the right to refuse a patient?

Justice dictates that physicians provide care to all who need it, and it is illegal for a physician to refuse services based on race, ethnicity, gender, religion, or sexual orientation. But sometimes patients request services that are antithetical to the physician's personal beliefs.

When a provider is non-participating they will expect?

When a provider is non-participating, they will expect: 1) To be listed in the provider directory. 2) Non-payment of services rendered. 3) Full reimbursement for charges submitted.

Can a Medicare patient pay out-of-pocket?

Keep in mind, though, that regardless of your relationship with Medicare, Medicare patients can always pay out-of-pocket for services that Medicare never covers, including wellness services.

What does Medicare Non-Participating mean?

Non-participating providers haven't signed an agreement to accept assignment for all Medicare-covered services, but they can still choose to accept assignment for individual services. These providers are called "non-participating."

Is Medicare accepted everywhere?

If you have Original Medicare, you have coverage anywhere in the U.S. and its territories. This includes all 50 states, the District of Columbia, Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Northern Mariana Islands. Most doctors and hospitals take Original Medicare.

What happens if you opt out of Medicare?

If you don't sign up for Medicare Part D during your initial enrollment period, you will pay a penalty amount of 1 percent of the national base beneficiary premium multiplied by the number of months that you went without Part D coverage. In 2022, the national base beneficiary premium is $33.37 and changes every year.

How much is a doctor visit without insurance 2021?

The cost of a primary care visit without insurance generally ranges from $150-$300 for a basic visit and averages $171 across major cities in the United States....Cost of Primary Care Visit By City.ServicesCost without insuranceAverage$1715 more rows•Oct 27, 2021

What to do if your doctor doesn't accept Medicare?

If your doctor doesn’t accept Medicare, chances are you can get a good referral. Ask your doctor to suggest a good doctor in the area. It may also help to take a look at the Medicare participating provider list, research some local physicians, and take a list to your doctor to ask if any are recommended.

Can a doctor accept Medicare?

Even if your doctor doesn’t accept Medicare, you may still be able to continue your care with that professional. Medical practitioners who participate in the program have signed documentation to participate under something called a Medicare assignment. Providers who don’t sign the document can continue to care for you as a non-participating provider if they choose.

Can you pay extra for out of network care?

Patients who have insurance, including Medicare, can’t be charged extra for going to an out-of-network provider . That means even if your COVID-19 visit involved providers other than Medicare physicians, you won’t have to pay more out of pocket than you would for your COVID-related diagnosis and treatment.

Does Medicare save money?

Medicare saves money when you choose urgent care over visiting the emergency room, but urgent care centers can handle more than emergencies. Whether you’re happy or not with your search for doctors that take Medicare near me, urgent care is a good option for non-life-threatening situations like a low-grade fever, allergic reactions, and vaccinations, among many others.

Can I opt out of Medicare?

There is another scenario where you’re better off looking for doctors in your area that accept Medicare. Some doctors completely opt out of Medicare altogether, which means they’ll require you to sign something called a private contract before they’ll provide services.

Is Medicare a good program?

Medicare is a great program, but a good doctor is also important. You may find yourself making the tough decision of having your care covered or tracking down another provider. A good Certified Financial Planner® can help you decide the best option for your post-retirement financial health.

What to do before making an appointment with a doctor who accepts Medicare?

Before making an appointment, call to confirm the doctor is still taking new Medicare patients. 2. Ask your doctor for a referral to a physician who accepts Medicare. It could be a colleague or a protégé.

How many doctors don't accept Medicare?

Medicare officials say the number of doctors who don’t accept Medicare is very small. According to their figures, only about 4% of U.S. doctors don’t participate and most beneficiaries (as patients are called in Medicare lingo) can see the doctors they want.

What happens when you leave Medicare?

When doctors exit the Medicare system, their patients are basically left with two unpleasant choices: Either find another physician who accepts Medicare from what seems to be a narrowing list or continue seeing their doctor and take on responsibility for paying the entire bill.

What is the limiting charge for Medicare?

The cost over the Medicare-approved amount is called “the limiting charge.”. So if you get a $200 bill from a non-participating doctor and Medicare will pay $160, you’ll owe the $40 difference, plus the 20% copay.

Does concierge charge Medicare?

The concierge charge, however, covers an extensive annual physical, with more tests than allowed by Medicare. So this is an option to consider, if your budget permits, especially if you anticipate regular visits to your doctor and want to be sure you’ll get in anytime. That way, you know your doctor will take Medicare, and, more important, ...

Can I get Medicare at age 65?

To avoid the possibility that your doctor won’t accept Medicare when you hit 65, plan ahead. When you’re in your late 50s or early 60s, ask your physician whether he or she will still treat you when you enroll in Medicare. If the answer is “no,” think about switching to a doctor who will.

Do doctors accept Medicare?

These physicians do accept Medicare, just not its official reimbursement amounts. Rather, these doctors can bill patients up to 15 percent more than the official Medicare charges (some states, like New York, have a 5 percent limit). The cost over the Medicare-approved amount is called “the limiting charge.”.

How many doctors don't accept Medicare?

Only about 4% of American doctors don’t accept Medicare. And if you’re a Medicare beneficiary, as you can see, provider enrollment can make a huge difference, primarily for your pocketbook.

What are the benefits of choosing a doctor who accepts Medicare?

Benefits of Choosing a Doctor Who Accepts Medicare. When you use a doctor who accepts Medicare, you’ll know exactly what to expect when you pay the bill. An enrolled provider won’t charge more than the Medicare-approved amount for covered services.

What happens if you opt out of Medicare Supplement?

If you use a Medicare Supplement plan, your benefits won’t cover any services when your provider has opted out of Medicare. When you see a non-participating provider, you may have to pay the “limiting charge” in addition to your copay. The limiting charge can add up to 15% of the Medicare-approved amount to your bill.

How much does a limiting charge add to Medicare?

The limiting charge can add up to 15% of the Medicare-approved amount to your bill. If your provider has opted out of Medicare, the limiting charge does not apply, and your provider can bill any amount he or she chooses. Of course, Medicare provider enrollment is just one of the things you’ll need to consider when you choose a doctor.

Do Medicare enrollees have to accept Medicare?

Medicare-Enrolled Providers will only charge the Medicare-approved amount for covered services and often cost less out of pocket than services from doctors who don’t accept Medicare. Non-Participating Providers have no obligation to accept the Medicare-approved amount. However, they can choose to do so for any service.

Why Would a Doctor Not Accept Medicare?

Medicare is convenient for patients, but not for medical staff. For a doctor, Medicare requires a lot of paperwork – way more than what would come from a traditional insurance plan. Medicare does not give the same level of reimbursement that other insurance plans do.

What Can You Do?

Just because a doctor doesn’t accept Medicare doesn’t mean you don’t have options. While it’s true that certain doctors will refuse Medicare, they may offer alternatives such as a slight discount or a payment plan allowing you to make several small payments instead of one large payment. These doctors are known as opt-out providers.

What Can We Do?

We can help you find doctors in your area who accept Medicare, and if you choose to enroll in Medicare Advantage, we can help you find providers in your network to get treatment from. And no matter what the circumstances are, we at Turning 65 Solutions will help you find a way as we help you along the way. All it takes is a call at (830) 217-6711.

What to do if your doctor is out of network?

"If your physician is outside of your insurance network coverage, ask if they will submit an out-of-network claim as a courtesy to you," Talakoub says. "If not, ask if they will provide documentation that can help you submit a claim yourself with the necessary paperwork and documentation attached."

Why do doctors stop taking insurance?

Many doctors don't take some types of health insurance and some even don't accept any insurance. Doctors may stop taking insurance if they believe the health insurance company isn't offering enough compensation. If a doctor stops taking your health insurance, you have a few avenues, including asking if the doctor will take a reduced fee ...

How do doctors negotiate the price of treatment?

Physicians negotiate the price of treatment with health insurers. The health insurance company sets the rates that it will pay the doctor. Insurance companies may also include quality metrics that doctors must meet to get full reimbursement. Insurers set rates, but that doesn't mean that the physician has to agree to these rates.

Why are insurance companies denying claims?

Insurance companies are denying claims and making it harder for doctors to accept patients in their plans by lowering reimbursements. Consequently, lots of doctors are dropping plans," says Lily Talakoub, MD, FAAD, a board-certified dermatologist in McLean, Virginia.

What is direct primary care?

Direct primary care is one type of program in which the patient and health care providers sets up a finacial arrangement. Direct primary care removes health insurance from the equation. So, the provider doesn't file health insurance claims, but instead works directly with the patient.

Does direct primary care include a monthly fee?

That may include a monthly fee and/or a membership fee. The benefit of direct primary care is that you may like not dealing with health insurance companies. However, you may also have to pay more for care since a plan is no longer helping you pay for coverage.

Do doctors have to accept insurance?

Yes, doctors aren't required to accept health insurance plans or the rates that insurance companies decide to pay doctors. The Affordable Care Act looked to improve health insurance access, but it didn't resolve the issue of rising costs and lower reimbursements offered by some payers. Many choose not to work with particular insurers ...