What Medicare reforms should Congress enact?

Nor can Congress improve the quality of care for enrollees or the rest of us until it frees the marketplace from Medicare's price and exchange controls. The next two sections describe the fundamental Medicare reforms that Congress should enact: individual vouchers and large health savings accounts.

Should the public listen to Medicare reform proposals?

The public should listen carefully to the many proposals being considered that would dramatically change Medicare under the guise of reform, modernization, and deficit reduction. Many of these proposals would abandon Medicare’s core values and increase expensive privatization.

Can Congress offer Medicare as a public option?

Some voucher proposals would preserve traditional Medicare (Parts A, B, and D) as one of the insurance plans from which enrollees would choose. But Congress simply cannot offer such a "public option" that does not enjoy some implicit taxpayer subsidies.

Are there any health improvements associated with Medicare?

Note that Medicare may have generated other health improvements that would not appear in mortality figures. 20 Budget of the United States Government, Fiscal Year 2011, Historical Tables (Washington, DC: Government Printing Office, 2010), Table 3.2 and Table 10.1.

What are some reforms of Medicare?

The plan has included the following:Government subsidies to private plans, renamed “Medicare Advantage,” ranging from 14% – 2% above traditional Medicare per-beneficiary costs;Additional benefits added to private Medicare Advantage, benefits that weren't added, and aren't allowed, in traditional Medicare;More items...

What are 4 types of Medicare plans?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What are the top five elements of the health care system that most need reform?

Key elements of health care reform relevant to promoting equity include access, support for primary care, enhanced health information technology, new payment models, a national quality strategy informed by research, and federal requirements for health care disparity monitoring.

What are examples of healthcare reform?

10 Important Health Care Reforms That Will Affect YouIndividual Mandate. ... Insured Young Adults. ... Guaranteed Issue. ... Medicaid. ... Medicare. ... State Health Exchanges. ... Subsidies. ... Annual Limits.More items...•

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Which of the following used to be called Medicare Choice plans quizlet?

Medicare Advantage (Medicare Part C), formerly called Medicare+Choice, includes managed care and private fee-for-service plans that provide contracted care to Medicare patients.

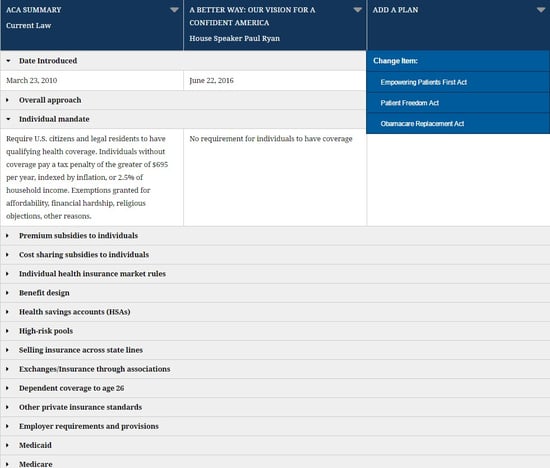

What is a healthcare reform plan?

Health reform in the US refers to the overhaul of its health care system and is frequently used interchangeably with the Affordable Care Act (ACA). Health reform includes addressing the ever- increasing costs of national health care by individuals, families, and the government.

What are the components of the health care reform?

Health Care Reform can be divided into three main tenets: The Individual Mandate, Exchanges, and Pay-or-Play.

What is healthcare reform and why do we need it?

In the U.S., Health Care Reform refers to the overhauling of America's healthcare system. This includes changes that affect the ever increasing costs of national health care by individuals, families, and the government. Also, addressing the benefits people receive and how people obtain health insurance.

What are reforms?

Reform (Latin: reformo) means the improvement or amendment of what is wrong, corrupt, unsatisfactory, etc. The use of the word in this way emerges in the late 18th century and is believed to originate from Christopher Wyvill's Association movement which identified “Parliamentary Reform” as its primary aim.

What was the goal of healthcare reform efforts in the 1990s quizlet?

The goal of health care reforms in the 1990s was. . . making health care affordable, comprehensive and accessible.

What are some recommendations for future healthcare reform?

4 Ideas That Should Be Considered For Any Health Reform PackageLimiting States' Ability to Use Provider Taxes to Inflate Reported Medicaid Costs.Incentivizing States to Reevaluate Medicaid Eligibility More Frequently.Further Means-Testing the Subsidy Schedule for the Individual Market.More items...•

How does Medicare Part D reform work?

Each of the proposals for reforming the Medicare Part D benefit structure contain four key components: capping beneficiary OOP spending, increasing insurer liability, requiring manufacturer liability to increase along with a drug’s price, and decreasing the government’s reinsurance liability. These changes should provide beneficiaries and taxpayers with less financial risk and increase insurers’ and drug manufacturer’s incentive to keep drug costs down. Nevertheless, while the plans are each conceptually similar, the differences in the details will result in significant variations in their impact, as detailed here.

What is the proposal to lower prescription drug costs?

One proposal that the Senate Finance Committee (Finance) has considered and approved is S. 2543, the Prescription Drug Pricing Reduction Act (PD PRA) of 2019. Among its several provisions, this legislation includes a redesign of the Medicare Part D Prescription Drug Program, similar to an American Action Forum (AAF) proposal from August 2018. The Senate Finance bill has since been modified, and this paper reflects those changes. Speaker Pelosi in September 2019 released another drug pricing reform package, H.R. 3, that also included an alternative proposal to redesign the Part D benefit structure. Then, in December 2019, the Republican leaders of the House Committees on Ways and Means, Energy and Commerce, and Judiciary introduced H.R. 19, the Lower Costs, More Cures Act; it too contains a proposal to restructure the Part D benefit. A companion bill with an identical Part D redesign proposal, S. 3129, was introduced in the Senate weeks later. Finally, the Medicare Payment Advisory Commission (MedPAC) announced recommendations for reforming the program’s benefit design in March 2020.

What would happen if the program's benefit design required the rebate in the catastrophic phase of coverage?

If the program’s benefit design required the rebate in the catastrophic phase of coverage, however, the rebate would no longer be capped, and the required rebate amount would increase, both nominally and as a share of the drug’s price, as the price increases, as shown under each of the proposals.

How much would government reinsurance decrease?

Government reinsurance would decrease to 20 percent when a manufacturer owes a discount and to 30 percent when it does not. MedPAC’s Recommendation. MedPAC’s proposal, as outlined in March 2020, is more similar to the AAF proposal in that it only requires manufacturer discounts in the catastrophic phase.

What percentage of the cost of a generic would be covered by insurance?

In the catastrophic phase, manufacturers of brand-name drugs, biosimilars, and high-priced generics would be responsible for 20 percent of the costs. Insurers would be responsible for 60 percent of the costs of such drugs and 80 percent when a beneficiary takes a lower-price generic.

What percentage of Medicare costs are covered by the federal government?

The federal government covers 80 percent of costs in the catastrophic phase and beneficiaries pay 5 percent of catastrophic costs, with no out-of-pocket (OOP) cap. The current structure of Medicare Part D has several notable problems. Because insurer liability is now quite limited beyond the deductible, insurers have little incentive ...

What percentage of reinsurance would be reduced for all drugs by 2024?

Federal reinsurance would be reduced to 20 percent for all drugs by 2024. Finally, the revised Finance legislation would also reduce beneficiaries’ premium liability from 25.5 percent to 24.5 percent.

Who introduced the Choose Medicare Act?

Another bill called the Choose Medicare Act, introduced in April by Senators Jeff Merkley and Chris Murphy, would allow anyone to buy into Medicare regardless of age and would also cap out-of-pocket costs for Medicare enrollees, including those currently eligible for the program. The legislation would create a new Medicare plan (Medicare Part E) that would be available for purchase in the ACA marketplaces (exchanges). The plan would also be available for employers to offer to their employees instead of private health insurance. 10

Who introduced Medicare for America?

In late 2018, the Medicare for America Act was introduced by Representative Rosa DeLauro and Representative Jan Schakowsky. While the Medicare for All proposals described above are designed to transition everyone to a single-payer system, Medicare for America would take a much more incremental approach. The legislation is based in large part on the "Medicare Extra for All" proposal that the Center for American Progress had outlined, and is the approach favored by former presidential candidate Beto O'Rourke. 5

What is Medicare Part E?

The legislation would create a new Medicare plan (Medicare Part E) that would be available for purchase in the ACA marketplaces (exchanges). The plan would also be available for employers to offer to their employees instead of private health insurance. 10 .

What does "Medicare for more of us" mean?

To avoid confusion, we can say "Medicare for more of us" as a reference to the collection of proposals under consideration . But while many of these plans include the word Medicare in their titles, they're generally calling for more robust coverage than current Medicare enrollees receive. It's fairly widely understood that ...

What is the GOP's approach to health insurance?

Rather than an expansion of single-payer coverage, GOP lawmakers tend to take the opposite approach, favoring an expansion of private health insurance—including a push towards more Medicare Advantage coverage for the existing Medicare population.

Why was the ACA discarded?

When the ACA was being debated, there were lawmakers who wanted to include a public option that would be sold alongside the private plans in the marketplace, but that idea was discarded very early on due in large part to opposition from the insurance lobby.

What is the Medicare X Choice Act?

Medicare-X Choice Act of 2019. The Medicare-X Choice Act of 2019 revived the public option idea. S. 981, introduced by Senators Michael Bennet and Tim Kaine, and H.R. 2000, introduced in the House by Representative Antonio Delgado, would create a new public option plan called Medicare-X.

Why was Medicare created?

The Medicare program is a success story. It was designed and enacted in 1965 as a social insurance program because private companies failed to insure older people. It was intended to provide basic coverage through one health insurance system, with a defined set of benefits.

Why was Medicare enacted in 1965?

Medicare was enacted in 1965 because private industry failed to insure more than 50% of older people. It would be ironic if privatization condemned Medicare now, returning older and disabled people to the vagaries of the private, for-profit insurance industry.

Why was the nursing home billed for $13,000?

She went from a hospital to a nursing home and was being billed for $13,000 because the nursing home was out of her MA plan’s network. She had been told by both the hospital and nursing home staff that original Medicare would cover her nursing home stay, even though she had an MA plan. This is not true.

Why was the hospital bill denied by Medicare?

The hospital bill came to $100,000 and was completely denied by the Medicare Advantage plan because Mrs. B was "out of network". The Center appealed. Finally, after an administrative hearing most of the bill was paid in recognition that the care received after Mrs. B’s reaction to treatment was emergency services.

How much more do taxpayers spend on Medicare?

Studies by MedPAC, the Congressional Budget Office, and the Commonwealth Fund and numerous scholars confirm that taxpayers are spending between 12% – 19% more on private plans than it would cost to serve the same people in the traditional Medicare program.

When did Newt Gingrich say Medicare would be privatized?

In 1995 Newt Gingrich predicted that privatization efforts would lead Medicare to wither on the vine. He said it was unwise to get rid of Medicare right away, but envisioned a time when it would no longer exist because beneficiaries would move to private insurance plans. Well … that's what's happening.

When did Medicare extend to disabled people?

In 1972 Medicare coverage was extended to people with significant disabilities. But Medicare's success in providing access to health care for millions of people is in danger. Ironically, the threat comes from private insurance plans.

What is the Medicare program?

The Medicare program consists of two primary programs: traditional Medicare (a FFS model) and MA, which is based on market-driven health plan competition.

When did Medicare start?

Originating in the Social Security Amendments Act of 1965 (H.R. 6675), Medicare began its life as a traditional FFS health plan with the aim of providing coverage to impoverished elderly Americans in the remaining few years of their life; average life expectancy at birth was 70.5 years. 7.

What is Medicare Advantage?

Medicare Advantage, an alternative that uses defined contribution payments to private companies that administer health care benefits, provides greater financial protections and benefits for consumers while providing the potential for budgetary control in a way that does not exist in traditional Medicare.

When did HMOs become mandatory?

The HMO Act of 1973 required employers with 25 or more employees offering private health insurance to offer an HMO option. The Medicare program was no exception, with the Tax Equity and Fiscal Responsibility Act of 1982 creating a pathway for HMOs in Medicare.

What is MA in healthcare?

MA, as it exists today, represents a series of trade-offs for both beneficiaries and policymakers. Beneficiaries gain limitation on their personal financial liability along with supplemental benefits, both in exchange for some utilization and network controls for health care products and services.

What would Medicare reforms do to the health care system?

Medicare reforms that allow individuals to control their health care dollars would eliminate wasteful spending, would provide enrollees better choices and better medical care, and would do so at a lower cost to taxpayers.

What would happen if Medicare funding gap was filled?

Furthermore, every effort to fill Medicare's funding gap with higher taxes would damage the economy, increase tax avoidance, and shrink the federal tax base, which, in turn, would create economic and political barriers to further tax increases.

Why does Medicare spending increase?

Second, Medicare spending grows because the government keeps expanding the list of goods and services that Medicare subsidizes. Congress created the huge Part D prescription drug program in 2003, which has added hundreds of billions of dollars to the federal debt because legislators provided no funding source.

How to transition Medicare to voucher based?

At the same time policymakers begin transitioning Medicare to a voucher-based system, they should take steps to expand the ability of younger Americans to save for their future medical needs. As a first step, Congress should expand current health savings accounts (HSAs) to give workers ownership over all their health care dollars, including the portion that their employers now control. As a second step, Congress should give workers the freedom to deposit their Medicare payroll taxes into these "large HSAs" to fund their medical needs in retirement.

What was the main program of the 20th century?

4 Congress funds the two main programs for the elderly—Social Security and Medicare —primarily by taxing younger workers.

How much did Medicare cost in 2010?

Medicare is the third-largest federal program after Social Security and defense, and it will cost taxpayers about $430 billion in fiscal year 2010. 1 Medicare is one of the fastest-growing programs in ...

How much money did Medicare have to deposit in 2009?

In 2009, Medicare's trustees reported that if Congress wanted to cover all future gaps in Medicare's finances, it would have to deposit a staggering $86 trillion in an interest-bearing account. 11 For comparison, the U.S. gross domestic product was about $14 trillion in 2009.