Medicare Supplement Plan F Coverage is Comprehensive

- Plan F fully covers both your Part A hospital deductible and your Part B outpatient deductible.

- It covers all of the 20% that Medicare Part B normally leaves for you to pay.

- Medicare Plan F covers all Part B excess charges. ...

- Choose any doctor – from over 900,000 physicians in the United States.

- No referrals required! ...

- Guaranteed renewable. ...

How much does Medicare Part F cost?

Since Medicare Part F is the is the most comprehensive Medigap policy, the premium can be costly. Typically, these range from $120 to $140 per month for a 65-year-old. However, the exact cost will be determined by your location, plan provider, current health condition, and age and gender.

What is the difference between Medicare Part F and G?

- Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments.

- Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. ...

- Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. ...

What are the four parts of Medicare?

Medicare is the federal health insurance program for:

- People who are 65 or older

- Certain younger people with disabilities

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What information is required to apply for Medicare Part?

You’ll need to prove that you’re eligible to enroll in Medicare. You might need to submit documents that verify your age, citizenship, military service, and work history. Social Security can help...

What is Medicare Part F used for?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

What is the difference between Part C and Part F Medicare?

Plan F covers everything Plan C does, and also covers Medicare Part B excess charges. These two plans are some of the most comprehensive Medicare Supplement Insurance plans you can purchase, which makes them a very attractive option.

Is there a Medicare Part F?

What is Medicare Part F? Medicare Part F is one of the 10 MedSup policies Americans enrolled in Original Medicare can buy if they want additional health coverage, or if they want help paying for their Medicare Part A and Part B coverage.

Who is eligible for Medicare Part F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

Is plan C better than plan F?

Medicare Supplement (Medigap) insurance Plan C is one of the most comprehensive of the 10 standardized Medigap insurance plans available in most states. Out of the 10, only Medigap Plan F offers more coverage. Medigap Plan C covers most Medicare-approved out-of-pocket expenses.

Is plan F better than plan G?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

What is the difference between plan F and plan G?

Medicare Supplement Plan G is almost identical to Plan F, except for the Part B deductible. If you select Plan G, you'll need to pay your Part B deductible ($233 for 2022), yourself. After you pay your deductible, you have no other out-of-pocket costs, just like the Plan F.

What is the cost of Medicare Part F?

Since Medicare Plan F is the most comprehensive Medigap policy, the premium can be costly. Typically, the cost ranges from $161 to $410 per month for a 65-year-old. However, the exact cost will be determined by your location, plan provider, current health condition, age and gender.

What is the difference between plan F and plan G in Medicare?

The main difference between the two plans is how Plan G interacts with the Part B deductible. With Plan F, the Medicare Supplement plan pays for the Part B deductible. Under Plan G, you are responsible for the Part B deductible only. Otherwise, all Part A deductibles, copays, and coinsurance are covered.

Can I switch back to plan F?

You pay for Medicare-covered costs up to the $2,490 deductible (as of 2022) before the plan begins to pay for anything. If you currently have Medicare Supplement Plan F, you can switch to high-deductible Plan F by contacting your insurance provider.

Does Medicare Plan F cover prescriptions?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.

What does Medicare Supplement Plan F cover?

MedSup Plan F pays for 100% of the following: Medicare Part A deductible. Medicare Part B deductible. Part A coinsurance and hospital costs up to a...

What is Medicare Part F?

Medicare Part F is one of the 10 MedSup policies Americans enrolled in Original Medicare can buy if they want additional health coverage, or if the...

How does Medicare Part F compare to other MedSup plans?

The only way MedSup Plan F differs from Plan G is that Plan F pays your Medicare Part B deductible while Plan G does not. All other benefits are th...

What is the difference between Plan F and Plan F high deductible?

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium. As a reminder, your...

Does Plan F cover dental?

Original Medicare doesn’t cover routine dental care, like cleanings or extractions, and there are no supplement plans that fill the gap. If you wan...

Is there an alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers,...

Medicare Plan F

Historically, Medicare Plan F provided the most benefits of all the supplemental Medicare plans, says Price. It addresses some of the coverage gaps in Medicare parts A and B, which is why many people thought it was worth the extra premium, he notes.

Who Is Still Eligible for Medicare Plan F?

Those who were eligible for Medicare on or before January 1, 2020 can still sign up for Medicare Plan F. People who already had or were covered by Medicare Plan F before January 1, 2020 are also able to keep their plan.

What Other Medicare Supplement Plans Are Similar to Plan F?

People newly eligible for Medicare can’t sign up for Plan F, but they still have options when it comes to other Medigap plans. Here’s a look at what some experts say are the two best alternatives to Plan F.

How to Choose a Medicare Supplement Plan

Now that Medicare Plan F is only available to a certain subset of the population, those who are just signing up may struggle with their coverage decisions. Is a Medigap Supplement Plan necessary? And is Plan G the best option?

Sources

Meyers DJ, Trivedi AN, Mor V. Limited medigap consumer protections are associated with higher reenrollment in medicare advantage plans. Health Aff (Millwood). 2019;38 (5):782-787.

How much does Medicare Part F cost?

Since Medicare Part F is the is the most comprehensive Medigap policy, the premium can be costly. Typically, these range from $120 to $140 per month for a 65-year-old. However, the exact cost will be determined by your location, plan provider, current health condition, and age and gender. For this reason, it is vital to compare rates for ...

What is Medicare Plan F?

Medicare Plan F provides the most benefits out of all the supplemental Medicare plans available and can help reduce your out-of-pocket expenses. The policy is designed to address most of the coverage gaps in Medicare parts A and B. For this reason, many people covered by the standard Medicare policies are willing to pay ...

What is a high deductible Medicare plan?

What is a high-deductible Medicare Plan F? The benefits within the high-deductible Medicare Plan F policy are the same as the standard Part F policy, though you would have to meet the deductible before you can access its health benefits.

How much is Medicare Plan F compared to Plan G?

Additionally, typical premiums for Medicare Plan F are slightly higher when compared to Plan G — $140 versus $110, respectively — and have a larger rate increase from year to year. The increased premiums are because of the more comprehensive coverage that you receive through Plan F.

What is a plan F?

Plan F is a supplemental policy to the standard Medicare parts A and B plans and can fill many of the gaps of standard Medicare policy and provide broader assistance with out-of-pocket costs. However, not all health insurance gaps will be covered by Plan F.

How much does a colonoscopy cost on Medicare?

For example, say you needed to get a colonoscopy, which can cost up to $3,500. Under a standard Medicare parts A and B plan with Medigap Plan F, the first 80% of that bill ($2,800) would be paid for by Medicare Part B. The remaining 20% ($700) would be covered by Plan F.

What is the deductible for a 2019 F plan?

For 2019, the deductible for the high-deductible Plan F is set at $2,300. If you want to switch from a high-deductible plan back to the standard Plan F, you may need to undergo a medical exam for underwriting.

What is the deductible for Plan F?

High-deductible plan F. Plan F also has a high deductible option. While monthly premiums for this option may be lower, you must pay a deductible before Plan F begins paying for benefits. For 2021, this deductible is set at $2,370.

What is a plan F?

Plan F is a very comprehensive plan, helping cover expenses that original Medicare doesn’t. This includes your deductibles, coinsurance, and copays when receiving medical care. It even covers a portion of your medical expenses during foreign travel.

How many Medicare Supplement Plans are there?

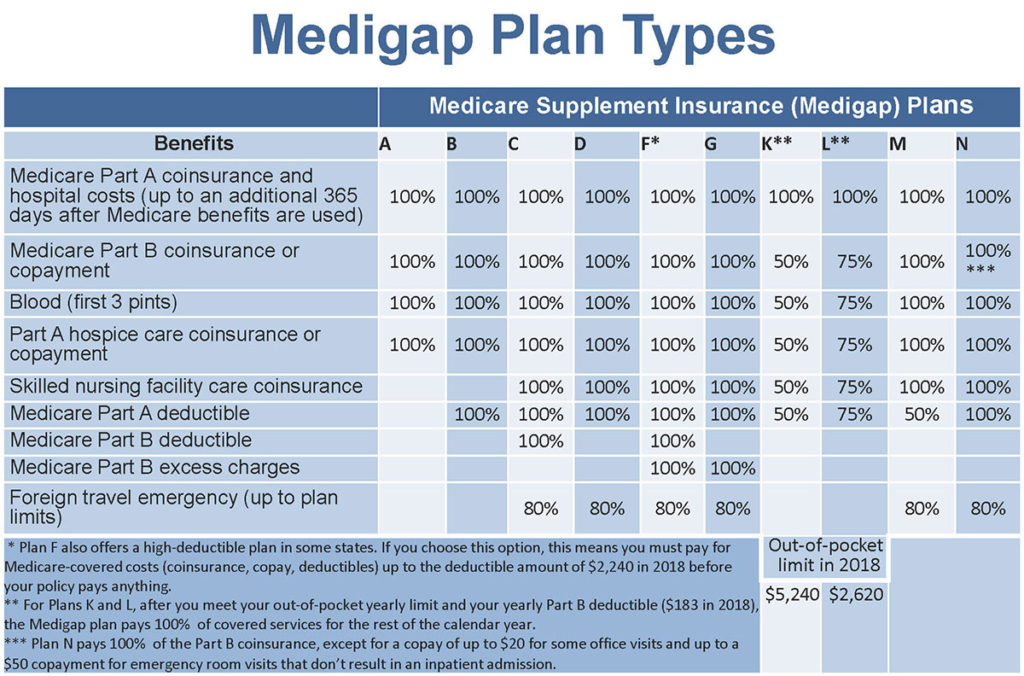

There are 10 different Medicare supplement plans. You’ll see them designated as letters: A through D, F, G, and K through N. Each of these different plans is standardized, meaning the same set of basic benefits needs to be offered.

What are the disadvantages of Medigap Plan F?

Disadvantages of Medigap Plan F. On the downside of this plan option, its large amount of coverage can be costly and have high monthly premiums. Also, if you’re newly eligible for Medicare as of January 1, 2020, or later, you will not be eligible to buy this plan, as it is being phased out for new enrollees.

Does Medicare Supplement cover healthcare?

Medicare supplement insurance can help pay for healthcare costs that original Medicare doesn’t cover. About 25 percent. Trusted Source. of people who have original Medicare are also enrolled in a Medicare supplement plan. Private companies sell Medicare supplement plans. There are 10 different Medicare supplement plans.

Is Medicare Supplement Plan F a part of Medicare?

You may have also heard of something called Medicare Supplement Plan F. Medicare Plan F isn’t a “part” of Medicare. It’s actually one of several Medicare supplement insurance ( Medigap) plans.

Is Medigap part of Medicare?

It’s actually one of several Medicare supplement insurance ( Medigap) plans. Medigap comprises several plans you can buy to help pay for things that original Medicare (parts A and B ) doesn’t. Keep reading to find out more about plan F, what it includes, and if it may be a good fit for you.

What is a Medigap Plan F?

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage.

What does Medicare Supplement Insurance Plan F cover?

Medicare Supplement Plan F covers costs that Medicare doesn’t cover, says Laura Decker, co-founder and president of the Employee Benefits Division at SSGI, a Maryland-based employee benefits insurance agency.

What doesn't Medicare Supplement Plan F cover?

Medicare Plan F won't cover any services not covered under Original Medicare.

How much does Medicare Part F cost?

The cost of Medicare Plan F depends on a few factors, including your age.

Medicare supplement plans comparison

Medicare Plan F is no longer available for purchase. However, several other Medigap supplement plans can help cover the out-of-pocket costs associated with Original Medicare.

Frequently Asked Questions

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Why is Medicare Plan F so popular?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

What is the most comprehensive Medicare plan?

If you became eligible for Medicare on or after January 1, 2020, you’ll find that Plan G is the most comprehensive Medigap plan available to you. (In recent years, Plan G has been the second most popular Medicare Supplement plan, and you can read more on that below.) A Medigap plan, or Medicare Supplement, pays after Medicare to help cover your ...

What is the best Medigap plan for 2021?

The best Medigap plans in 2021 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no longer available to new enrollees. Get a quote for both and see which ones offer you the best annual savings.

Is Medicare Supplement Plan F the #1 seller?

This post has been updated for 2021. Medicare Supplement Plan F has also been the #1 seller with Baby Boomers for many years. According to a report from America’s Health Insurance professionals in 2016, about 57% of all Medigap policies in force were a premium Medicare Plan F policy.

Does Medicare Plan F cover outpatient deductible?

Plan F fully covers both your Part A hospital deductible and your Part B outpatient deductible. It covers all of the 20% that Medicare Part B normally leaves for you to pay. Medicare Plan F covers all Part B excess charges. You will never pay the standard 15% excess charges that doctors under Medicare are allowed to charge for Part B services.

Is Medicare Plan F higher for males or females?

With most carriers, the Medicare Plan F cost for males will be slightly higher than females. Tobacco users of course will often have a higher Medigap Plan F cost than non-tobacco users. There are also a number of companies who offer household discounts for their Medicare Supplement policies.

What is Medicare Plan F?

These can include deductibles, copayments, and coinsurance. Medicare Plan F is a Medigap policy. These policies help people pay some of the extra expenses of Medicare Part A and Part B. Together, Medicare Part A and Part B are called Original Medicare. Part A covers hospital expenses, and Part B covers other medical expenses.

When will everyone be eligible for Medicare Plan F?

A person may not qualify for a Medigap policy after the Open Enrollment Period. Before January 1, 2020, everyone was eligible for Medicare Plan F.

How to enroll in Medicare Plan F?

To enroll in Medicare Plan F, a person must determine whether they are eligible and whether it is available in their area. They can use the Medicare Plan Finder or contact the State Health Insurance Assistance Program (SHIP) or State Insurance Department.

How much does Medicare cost if you have worked for 10 years?

If a person has worked and paid Medicare taxes for between 7.5 and 10 years, the premium is $252 per month.

Is Medicare Plan F deductible higher?

If more benefits become added to the policy, its cost may be higher. Some states offer high deductible Medicare Plan F policies. People can use the Medicare Plan Finder to find the average cost of Medicare Plan F policies in their zip code.

Does Medicare plan F have the same benefits?

Private insurance companies offer the insurance plans. All Medicare Plan F plans offer the same benefits, but not all plans cost the same amount. Each insurance company can set its premiums and may provide more benefits. Not all insurance companies offer Medigap policies in every state.

Does Medicare Plan F cover Part B?

As Medicare Plan F covers the Medicare Part B deductible , it is not available to people who have only become eligible for Medicare after this date. In this article, learn more about Medicare Plan F, including who is eligible, what it covers, the costs, and how to enroll.

What is Medicare Supplement Plan F?

Licensed Insurance Agent and Medicare Expert Writer. July 29, 2020. Medicare Plan F covers more expenses than other supplement plans, and it's one of just two plans that pay for the Part B deductible. It also covers the Part B excess charge, a benefit that’s just as rare.

When will Medicare change to plan F?

The rules for who can enroll in Medigap plan F have changed starting January 1, 2020. If you're newly eligible for Medicare in 2020, skip ahead to find out how this update will affect you.

What is a plan F?

Plan F is one of two Medicare Supplement plans that covers Part B excess charges (what some doctors charge above what Medicare pays for a service). Plan C is the other. Like many other Medigap policies, Plan F also covers Part B copayments and the deductible.

How much does Plan F cost in 2020?

This plan covers everything a regular Plan F does, but in 2020, you’ll be responsible for paying the first $2,340 (up from $2,300 in 2019) of costs out of your own pocket before coverage kicks in. In return, you could pay lower premiums each month.

What is covered by Plan F?

Plan F also covers many Part A expenses, such as coinsurance for hospital stays, a skilled nursing facility, and hospice care. You’ll also have coverage for the first three pints of blood, should you ever need a transfusion. After that, Part A takes over to pay for additional blood.

Why did John choose Plan F?

He’s choosing Plan F because he needs regular kidney dialysis, as well as physical therapy for an old shoulder injury. He has a wife and helps care for two teenage grandchildren, so John needs fixed health care costs each month.

Is Plan F a good Medicare supplement?

As the most popular Medicare Supplement plan, Plan F could be a logical choice for many Medica re recipients. If it seems like the right choice, call a licensed insurance agent who can help you choose the right insurance company for your needs.

What is Medicare Plan F?

Medicare Plan F covers all of the gaps in Original Medicare. It is considered to be the “Cadillac” coverage among the available Medicare supplements today. Plan F gives you first-dollar coverage for all Medicare-approved services. Whether you have a hospital stay, or a diagnostic exam or a doctor’s visit, you will simply present your Medicare card ...

How much is Plan F for 2021?

Here’s a list view of your Plan F coverage at the hospital: Hospital deductible ($1,484 in 2021) and coinsurance. 365 days of additional hospital coverage after Medicare’s coverage is exhausted. Hospice care at any hospice facility. Blood (if needed in a transfusion)

What are the important imaging exams for Medicare?

Important imaging exams like colonoscopies and mammograms. Screenings for diabetes, cardiovascular conditions, bone density and other conditions. Medicare dictates which preventive screenings are allowed – your primary care doctor will know which screenings to provide to you that will be covered.

Does Plan F pay for deductible?

Then your Plan F supplement pays your deductible and the other 20%. Some doctors charge a 15% excess charge beyond what Medicare pays. Plan F covers that for you. Plan F also pays the 20% for a long list of other Part B services.

Does Medicare pay for eyeglasses after cataract surgery?

The answer is no if the matter is routine. Medicare will, however, pay for one pair of very basic eyeglasses after a cataract surgery. One exception is that Medicare supplement Plan F will cover up to $50,000 in foreign travel emergency benefits. Since this care occurs outside the U.S., Medicare obviously does not cover that.

Does Medicare cover outpatient prescriptions?

If Medicare pays its 80% share on such a drug, your Plan F will cover the rest of it. However, neither Original Medicare nor Plan F cover outpatient prescriptions.

Does Medicare pay for Supplement Plan F?

Then your Medicare Supplement Plan F will pay the remaining amount that Medicare does not cover.