Does Medicare charge a deductible?

2022 Medicare Deductibles 2022 Part A Deductible The Medicare Part A hospital inpatient deductible for 2022 increased to $1,556 per benefit period from $1,484 in 2021. 3 This is an increase of $72, or 4.85%.

How high will the Medicare Part B deductible get?

Nov 12, 2021 · The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,556 in 2022, an increase of $72 from $1,484 in 2021. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

When are Medicare premiums deducted from Social Security?

Dec 14, 2021 · In 2022, the Medicare Part A deductible is $1,556 per benefit period, and the Medicare Part B deductible is $233 per year. Medicare Advantage deductibles, Part D drug plan deductibles and Medicare Supplement deductibles can vary. Learn more about 2022 Medicare deductibles and other Medicare costs. There are several different types of Medicare insurance …

What is Plan B coverage?

Nov 18, 2021 · The Centers for Medicare & Medicaid Services (CMS) recently announced that the Medicare Part A deductible for inpatient hospital services will increase by $72 in calendar year (CY) 2022 to $1,556. The Part A daily coinsurance amounts will be: $389 for days 61-90 of hospitalization in a benefit period, up from the current $371.

What is the 2022 Medicare Part A deductible?

$1,556Medicare Deductibles. The 2022 deductible for Medicare Part A is $1,556 for each benefit period: $0 for days 1-60, $389 coinsurance per day for days 61-90 and $778 per each "lifetime reserve day" after 91 days. The Medicare Part B deductible is $233.

Are Medicare deductions going up 2022?

Medicare Part A and Part B Premiums Increase in 2022 But for those who have not paid the required amount of Medicare taxes, Part A premiums will increase. Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021).Jan 4, 2022

What is the plan g deductible for 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

How much does Medicare cost in 2022 for seniors?

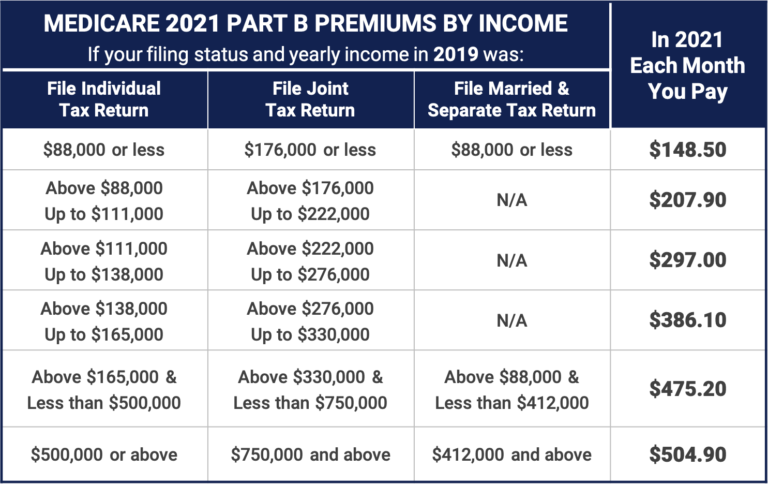

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

What changes are coming to Social Security in 2022?

Other changes for 2022 include an increase in how much money working Social Security recipients can earn before their benefits are reduced and a slight rise in disability benefits. Social Security tax rates remain the same for 2022: 6.2% on employees and 12.4% on the self-employed.

What is the out-of-pocket maximum for Medigap Plan G?

Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year.Dec 12, 2019

What is the deductible for Medicare Supplement plan g?

$233Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F.

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.Mar 1, 2022

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022.

Key Takeaways

Parts A and B of Original Medicare have deductibles you must meet before Medicare will pay for healthcare.

What is the Medicare Deductible for 2022?

A deductible refers to the amount of money you must pay out of pocket for covered healthcare services before your health insurance plan starts to pay. A deductible can be based upon a calendar year, upon a plan year or — as is unique to Medicare Part A — upon a benefit period.

Does Original Medicare Have Deductibles?

Original Medicare is composed of Medicare Part A and Medicare Part B. Both parts of Original Medicare have deductibles you will have to pay out of pocket before your plan starts to pay for your healthcare.

Medicare Advantage (Part C) Deductibles

Medicare Advantage (Part C) is an alternative type of Medicare plan that is purchased through a private insurer. Not every Part C plan is available throughout the country. Your state, county and zip code will determine which plans are available for you to choose from in your area.

Medicare Part D Deductibles

Medicare Part D is prescription drug coverage. People are often surprised to learn that Part D is not included in Original Medicare. This is understandable since prescription medications are very often integral to health.

Medicare Supplement Plan Deductible Coverage

Medicare Supplement Insurance is also known as Medigap. Medigap is supplemental insurance sold by private insurers. It is designed to fill in the cost “gaps” for people who have Original Medicare.

Do You Have to Pay a Deductible with Medicare?

You’ve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.

How much is Medicare Part B deductible in 2021?

Medicare Part B. The deductible for Medicare Part B is $203 per year in 2021. After you spend this amount out of pocket on covered services, you will usually pay 20% of the Medicare-approved amount for most services.

How much is Medicare Part A 2021?

For 2021, the Medicare Part A deductible is $1,484. However, this is not a yearly deductible. Rather, it is a deductible for each benefit period. The benefit period begins the first day you enter a hospital or skilled nursing care facility for an inpatient stay.

How does Medicare Supplement Insurance save money?

A Medicare Supplement Insurance plan can save you money by helping to pay for some of your Medicare deductible costs and other out-of-pocket Medicare costs. Call today to speak with a licensed insurance agent who can help you compare Medigap plans in your area.

What is Medicare Part C?

Medicare Part C (Medicare Advantage) The deductibles for Medicare Advantage plans are more like those of conventional private health insurance. Part C plan deductible amounts will vary from one plan to the next. This is different from Medicare Part A and Part B (Original Medicare) where deductibles come at a fixed amount for everyone enrolled.

What is a Medicare deductible?

Your Medicare deductible is the amount you must pay out of pocket before the benefits of Medicare insurance begin to take effect. Once you satisfy your deductible, you may still have to pay copayments and coinsurance.

Does Medicare Advantage have a deductible?

Medicare Advantage plans that offer prescription drug coverage may sometimes feature two different deductibles, with one being for medical costs and the other for prescription costs.

Can Medicare reduce deductibles?

There is one way in which Medicare patients can reduce their Medicare Part A and Part B deductibles. A Medicare Supplement Insurance plan, or “Medigap,” can provide coverage for Medicare Part A and Part B deductibles, among other out-of-pocket expenses. There are several Medigap plans that offer full coverage for the Medicare Part A deductible ...

What is a Health Insurance Deductible?

Deductibles are the amount of money you need to pay out-of-pocket for health care services before your plan starts coverage. In most cases, the insured pays 100% of the costs until the deductible is reached.

What is Coinsurance & Copay for Medicare?

Coinsurance is the percentage of a medical bill that Medicare beneficiaries are responsible for paying after reaching the set deductible. Coinsurance is a percentage of the medical care bill, but a copayment (copay) is typically a flat fee.

Medicare Part A Deductible in 2022

For 2022, Medicare Part A deductible is $1,408 for each benefit period.

Medicare Part B Deductible in 2022

Medicare Part B covers two areas of services: Medically Necessary Services and Preventive Care Services.

Medicare Part D Deductibles, Copayments & Coinsurance

The Medicare Part D deductible is the amount you must pay for prescription drugs before the plan starts to pay.

Social Security COLA

The Social Security COLA is the Cost-of-Living Adjustment that happens each year. For 2022, the Social Security Administration has announced a 5.9% increase to be applied to retirees’ monthly checks. More than 64 million Americans will see an average of a $70 increase in their benefits.

Medicare Part A in 2022

Most individuals won’t notice a premium in change for Part A since the majority of Medicare beneficiaries receive premium-free Part A. As long as you’ve paid Medicare taxes for ten years, you’ll have this benefit.

Medicare Part B in 2022

Unlike Part A, no Medicare beneficiary receives premium-free Part B. This past year, the standard premium was $148.50. In 2022, it will be increased to $170.10.

Medicare Part C in 2022

There are no one-size-fits-all changes for Part C plans in 2022. Since these plans are offered by private insurance companies, their rates and deductibles will vary.

Medicare Part D in 2022

Like the Part C plans, there is no specific increase to these plans – it will be dependent on the insurance carrier. However, most plans utilize the standard deductible, which is also the maximum deductible that any plan is allowed to have. The Part D deductible is increasing from $445 to $480.