How much does Medicare cost the government?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare: Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure.

Does Medicare have monthly premiums?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021 ($499 in 2022). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 ($499 in 2022).

How much does Medicare Advantage plan cost?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

How much are the Medicare premiums for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Are Medicare costs going up in 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the cost of Medicare going to be for 2022?

California Health Advocates > Prescription Drugs - Blog > Why Did Medicare's Part B Premium Rise 14.5% in 2022? If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022.

What will the Medicare Part B premium be in 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

What will Medicare cost in 2023?

CMS finalizes 8.5% rate hike for Medicare Advantage, Part D plans in 2023. The Biden administration finalized an 8.5% increase in rates to Medicare Part D and Medicare Advantage plans, slightly above the 7.98% proposed earlier this year.

Are Medicare premiums going down in 2022?

About half of the larger-than-expected 2022 premium increase, set last fall, was attributed to the potential cost of covering the Alzheimer's drug Aduhelm.

Will Social Security get a raise in 2022?

Social Security beneficiaries saw the biggest cost-of-living adjustment in about 40 years in 2022, when they received a 5.9% boost to their monthly checks. Next year, that annual adjustment may even go as high as 8%, according to early estimates.

Will Medicare premiums increase in 2023?

SACRAMENTO, Calif. – The CalPERS Board of Administration today approved health plan premiums for calendar year 2023, at an overall premium increase of 6.75%. Overall premiums for CalPERS' Medicare Advantage plans decreased for the third straight year.

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

How much is the Part B premium for 2021?

The standard monthly Part B premium in 2021 will be $148.50. However, if you're a higher earner, you'll pay more, as follows: Keep in mind that these numbers are based on the income you reported on your 2019 taxes. In addition, you'll be subject to an annual Part B deductible of $203.

How much is Part A coinsurance?

Most enrollees don't pay a premium for it. However, you'll still face other costs under Part A: A $1,484 deductible for each hospital stay per benefit period (a benefit period begins the day you're admitted to a hospital or skilled nursing facility and ends when you've been out for 60 days in a row) $371 per day in coinsurance for days 61-90 of ...

What is Medicare Part B?

Medicare Part B covers outpatient services like diagnostic tests and doctor visits. If you're signed up for Social Security, you'll have your monthly part B premiums deducted directly from your benefits.

Is there a lot of money out of pocket for Medicare?

Clearly, there's the potential to spend a lot of money out of pocket on Medicare in the coming year, so it's crucial to know what to expect in advance. You'll also need to think about where the money to pay your healthcare costs will come from. If you have funds in a health savings account, that's a good start.

Will Medicare be used in 2021?

Otherwise, you may need to rely heavily on your retirement savings and Social Security income to keep up with your medical bills. The amount you'll spend in 2021 will ultimately depend on how extensively you need to use Medicare, but it's best to know what expenses you could potentially be in for. The Motley Fool has a disclosure policy.

How much is Medicare Part B 2021?

2021 Medicare Part B Costs. The standard Part B premium in 2021 is $148.50 per month. That's an increase of $3.90 from the 2020 Part B premium. While most people pay the standard Part B premium, other beneficiaries may pay more if they had a higher reported income two years prior (2019).

How much is the 2021 deductible?

The Part A deductible in 2021 is $1,484 per benefit period, which is an increase of $76 from the 2020 Part A deductible. The Part A deductible amount may increase each year, and it will likely be higher in 2022.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, provides coverage for certain Medicare Part A and Part B out-of-pocket expenses like deductibles, coinsurance and copayments . This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above.

What are the factors that affect the cost of a Medigap plan?

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates. Medigap premiums can increase over time due to inflation and other factors, so you can typically expect Medigap plan premiums to be higher in 2022 than they will be in 2021.

Is Medigap 2021 higher than 2021?

This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above. Some 2021 Medigap plan premiums may also be higher. Each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Medicare Part A Costs

Medicare Part A covers hospital care (including inpatient mental health) and skilled nursing facility care. Most people get Part A for free, meaning no premium. That’s because Part A is funded through work taxes.

Medicare Part B Costs

Medicare Part B covers medically necessary outpatient care. This is a pretty broad portion of Medicare that includes things like:

Medicare Advantage Costs

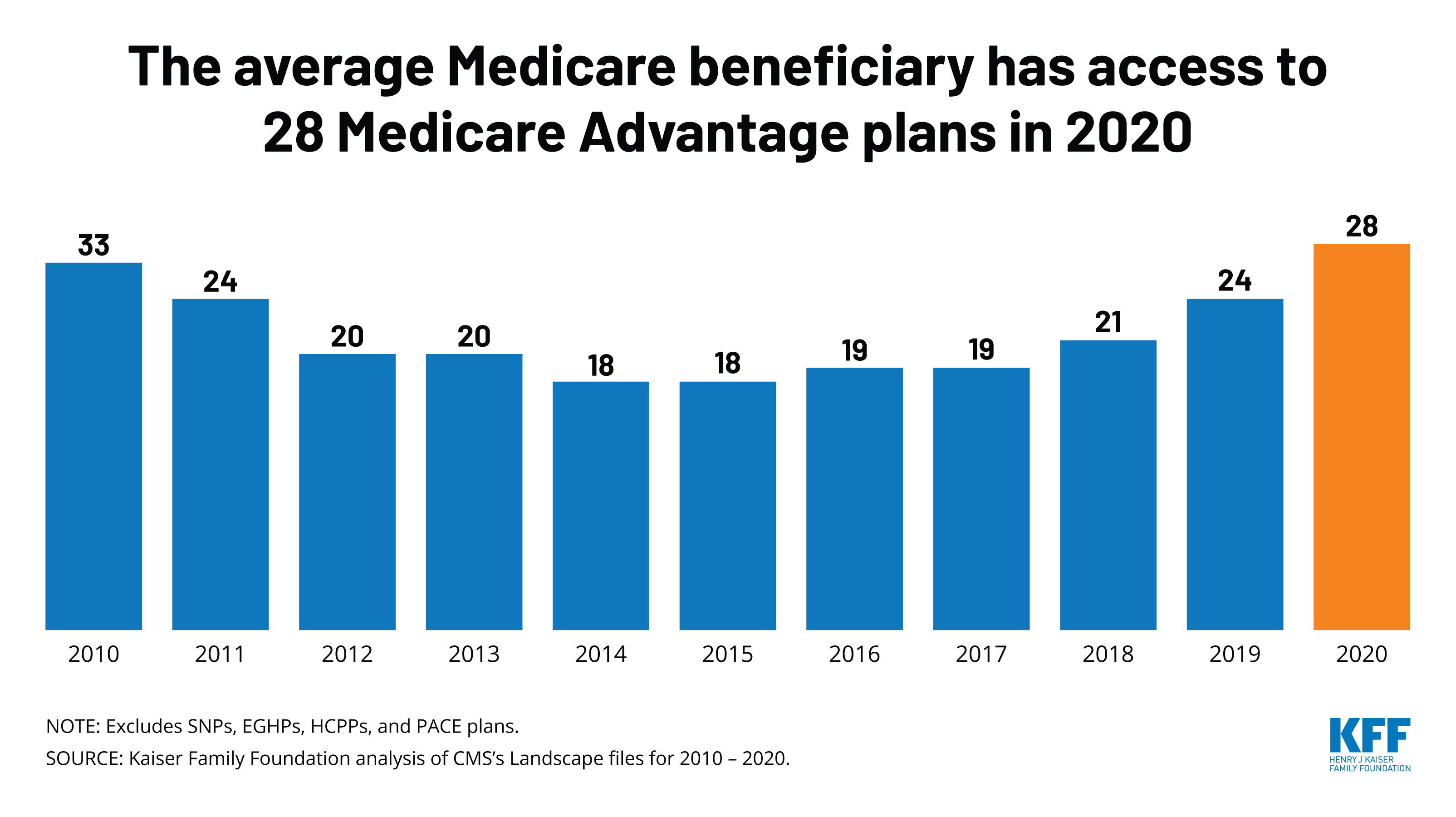

Medicare Advantage is the private alternative to Original Medicare. Sold by individual companies on the private market, these plans are nevertheless still regulated by the federal government. By law, for instance, Medicare Advantage plans have to cover at least the same benefits as Original (both Part A and Part B).

Medicare Part D Costs

Original Medicare doesn’t cover prescription drugs, with the exception of a set of specific medications that are typically administered in a clinical setting, such as chemotherapy treatments. But for regular prescriptions, like blood pressure pills or insulin, you’ll need to find separate coverage for these.

Medigap Costs

Medicare supplement plans, also called Medigap, help cover the gaps left by Original Medicare — the gaps in cost, that is. In other words, they help offset out-of-pocket costs under Part A and/or Part B.

How often does Medicare change benefits?

As we have discussed, Medicare Advantage plans can change benefits, premiums, and out-of-pocket costs each year. One of the things all insurance companies must provide every year is a document called the Annual Notice of Change (ANOC). This is a long and complicated document that outlines all of the changes made to your Medicare Advantage plan for the coming year. If you are currently enrolled in a Medicare Advantage plan, you will receive it at the beginning of October for the following plan year. This can be a complicated document to understand, so it is vital to review it with an independent agent or call the insurance company if you have questions about changes for the coming year.

How often does Medicare update?

Every year, the Centers for Medicare and Medicaid Services (CMS), the Federal Government agency responsible for Medicare, updates the premiums, coinsurance, and copay amounts for Medicare Part A and Medicare Part B. The same services and tests provided under Part A and Part B are updated continuously throughout the year, but the high-level categories of benefits covered do not change often. If you are interested in seeing if Original Medicare covers a particular service, item, or test, you can search for it on the Medicare website. As is the case in most years, the costs for Medicare Part A and B services have increased slightly. Below are the changes for 2021.

What is Medicare Advantage Part D?

As mentioned earlier, Medicare Advantage and Part D plans are not standardized, so every plan has different benefits and costs. Part D plans can change the covered drugs (the list is called a formulary) as well as the deductibles, copays, and coinsurance. Earlier in this article, we talked about IRMAA, which adjusts the Part B and Part D premiums you pay based on your income. The changes to Part D are listed in that chart. The amounts listed for Part D are in addition to the plan premium you pay the insurance company so take this into account if your income requires an IRMAA adjustment. Your insurance company will provide an ANOC for any changes to your Part D plan for the coming year.

Does Medicare Supplement Plan change year over year?

Medicare Supplement benefits do not change year over year; they are standardized plans, and no matter which insurance company sells a Medicare Supplement Plan, the benefits are the same.

What is the Medicare premium for 2021?

Although Part A, which pays for hospital care, is free for most beneficiaries, you’ll pay a monthly premium for Part B, which covers doctor visits and outpatient services. In 2021, the standard monthly premium will be $148.50, up from $144.60 in 2020.

How much is Medicare Part D in 2021?

Medicare Part D. The average premium for Part D, which covers drug costs, will be about $30 a month in 2021. Seniors with high drug costs may run into a coverage gap, although it has been shrinking. For 2021, the gap begins when the total your plan has paid reaches $4,130, up from $4,020 in 2020.

What is Medicare Supplemental Insurance?

Medicare supplemental insurance, or medigap, policies are offered by private insurers and cover deductibles and co-payments. Medigap policies are identified by letters A through N. Each policy that goes by the same letter must offer the same basic benefits, and usually the only difference is the cost.

What is the alternative to Medicare?

An alternative to having both traditional Medicare and a medigap plan is to enroll in a Medicare Advantage plan. Such plans provide medical and prescription drug coverage through private insurance companies. The monthly premium, in addition to Part B, varies depending on which plan you choose. The Center for Medicare and Medicaid Services estimates ...

What is the most popular plan for 2020?

Plan F is the most popular policy because of its comprehensive coverage, but as of 2020, Plan F (as well as Plan C) is unavailable for new enrollees. The closest substitute for Plan F is Plan G, which pays for everything that Plan F did except the Medicare Part B deductible. Monthly premiums for Plan G in 2020 ranged from $90 to $170, ...

What is the premium for 2021?

In 2021, the standard monthly premium will be $148.50, up from $144.60 in 2020. But if you’re a high earner, you’ll pay more. Surcharges for high earners are based on adjusted gross income from two years earlier.

Does Medicare cover dental care?

If you’re new to Medicare, you may be surprised to discover what it doesn’t cover. Part B pays for only 80% of doctor’s visits and other outpatient services. In addition, Medica re doesn’t cover dental care, eye appointments or hearing aids. There are two ways to address your uncovered expenses.

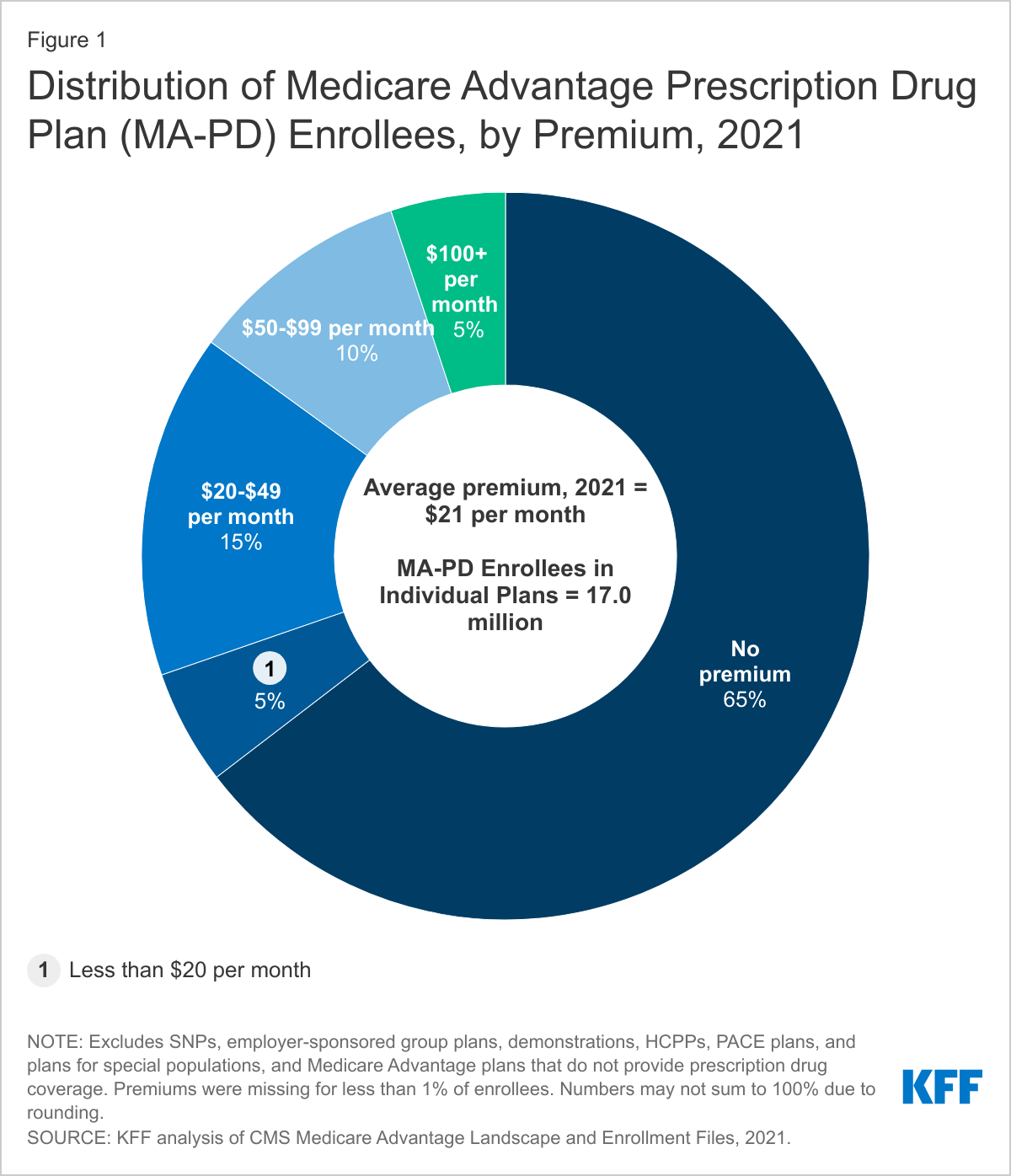

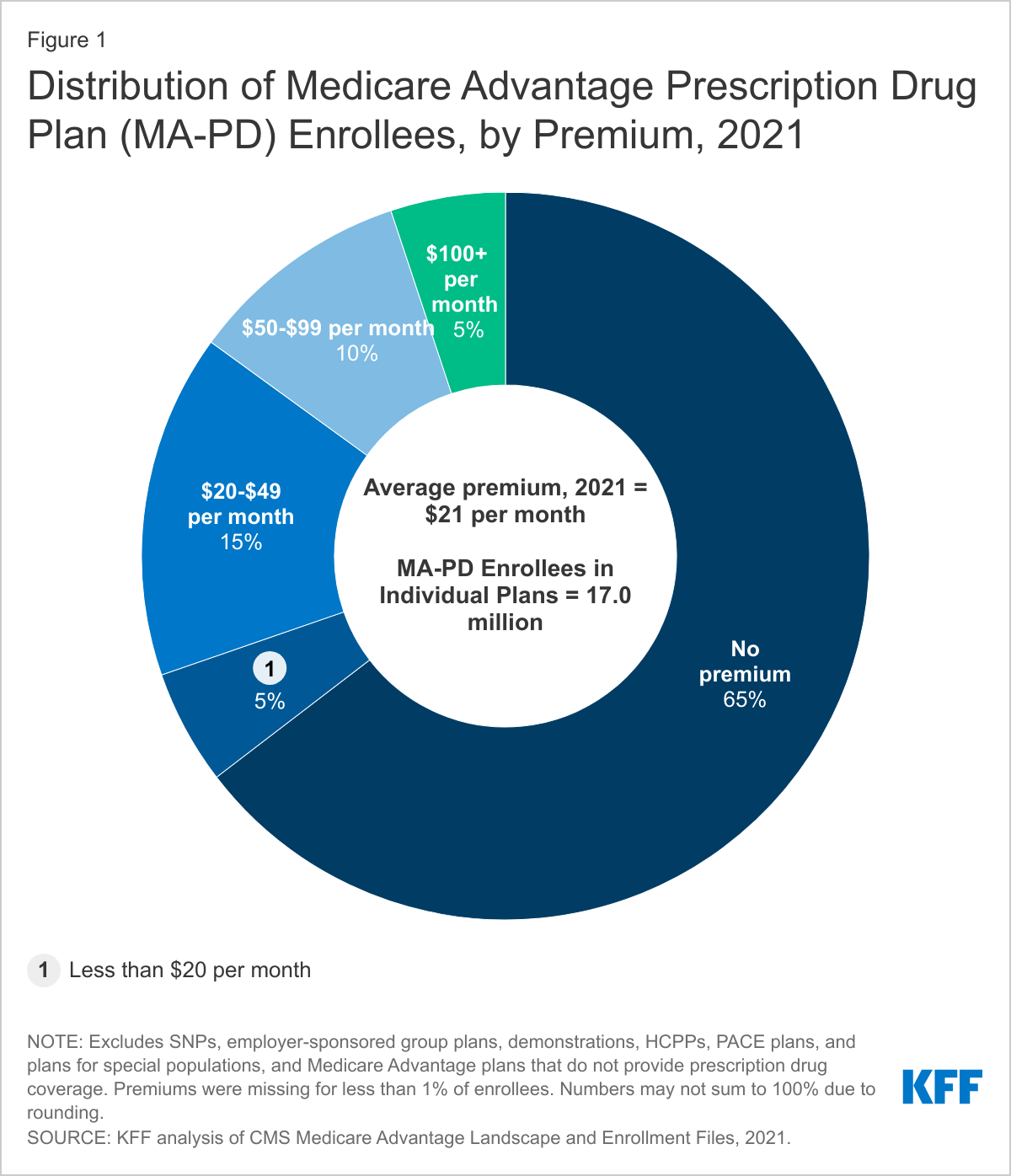

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much is Medicare Part B 2021?

The standard monthly Medicare Part B premium for 2021 is $148.50, which is up only $3.90 from $144.60 in 2020. Medicare Part B helps pay for doctor visits and outpatient care. Most people will pay the standard Part B premium amount, but you could pay more based on your income. Medicare uses your reported income from two years ago to determine ...

What is the Medicare deductible for 2021?

What are the Medicare Part A Deductible, Coinsurance and Premium amounts in 2021? The Medicare Part A deductible for 2021 is $1,484, which is up $76 from $1,408 per benefit period in 2020. A benefit period begins the day you’re admitted to the hospital and ends when you’ve been out for 60 days in a row.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is the Part A premium for 2021?

The Part A premiums for 2021 are as follows: ·$259 for individuals who had at least 30 quarters of coverage, or who are married to someone with 30 quarters of coverage. ·$471 for certain uninsured individuals or with less than 30 quarters of coverage, ...

Does Medicare Part A cover hospitalization?

Medicare Part A covers hospital and inpatient care. If you have a Medicare Advantage plan (Part C ), the Part A deductible and other Part A costs usually won’t apply. Each plan sets its own cost-sharing terms for hospitalizations .

Will Medicare cost increase in 2021?

Costs for the upcoming year are announced in the late fall, and the new costs go into effect January 1. For 2021, Medicare did increase costs for both Medicare Part A and Medicare Part B. The average premiums for Medicare Advantage (Part C) and Part D prescription drug plans; however, are at an all-time low.

Does Medicare change each year?

Remember, the costs for Medicare can change each year. And the total costs you will have for your Medicare coverage will vary depending on the coverage you have along with the health care items and services you use. 1 https://www.aarp.org/retirement/social-security/info-2020/biggest-social-security-changes-for-2021.html.