How much does Medicare Part B costs?

The new standard Medicare Part B charge for 2013 will be $104.90 per month. This is an increase from the 2012 charge which was $99.90 per month. Medicare Part B Deductible: Before Medicare Part B coverage kicks in and covers the 80%, individuals must first pay an out-of-pocket deductible (once per year). The Part B deductible for 2013 will be increasing from the current …

What is the monthly premium for Medicare Part B?

Apr 03, 2013 · Medicare Part B (Medical Insurance) Monthly premium: Most people pay the Part B premium of $104.90 each month in 2013. Late enrollment penalty: If you don’t sign up for Part B when you’re first eligible, you may have to pay a late enrollment penalty for …

Does Medicare Part B cost money?

Oct 21, 2013 · How much will Medicare Part B premiums be in 2013? Most people will pay $104.90 per month for Medicare Part B premiums, which …

What is Medicare Part B monthly payment?

© 2013 Medicare Rights Center Helpline: 800-333-4114 www.medicareinteractive.org Original Medicare Costs in 2013 Hospital Insurance (Part A) Premium: Free if you’ve worked 10 years or more $243 per month if you’ve worked 7.5 to 10 years $441 per month if you’ve worked fewer than 7.5 years Medical Insurance (Part B) Premium: Deductible:

What was the Part B deductible in 2013?

The 2013 Medicare Part B annual deductible is $147.

What was Medicare Part B premium in 2015?

How much will Medicare premiums cost in 2015? Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.Oct 10, 2014

What was the Medicare Part B premium in 2010?

Medicare Part B Premiums for 2010 The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $110.50 in 2010. However, most Medicare beneficiaries will not see an increase in their monthly Part B premiums in 2010 because of a “hold-harmless” provision in current law.

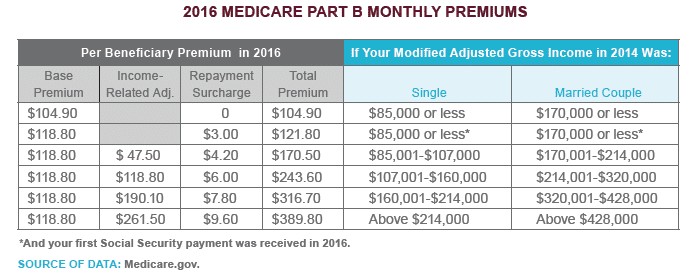

What were Medicare Part B premiums in 2016?

Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What was the Medicare Part B premium for 2014?

CMS said the standard Medicare Part B monthly premium will be $104.90 in 2014, the same as it was in 2013. The premium has either been less than projected or remained the same, for the past three years. The Medicare Part B deductible will also remain unchanged at $147.Oct 28, 2013

What was Medicare premium in 2013?

Today we announced that the actual rise will be lower—$5.00—bringing 2013 Part B premiums to $104.90 a month. By law, the premium must cover a percent of Medicare's expenses; premium increases are in line with projected cost increases.Nov 16, 2012

How much does Medicare Part B go up every year?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

How much does Medicare Part B go up each year?

2021 Medicare Part B Premiums Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income, up to to $504.90 for the 2021 tax year.

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What were Medicare premiums in 2017?

Days 101 and beyond: all costs. Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What were Medicare premiums in 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018....What You'll Pay for Medicare in 2018.Income (adjusted gross income plus tax-exempt interest income):$133,501 to $160,000$267,001 to $320,000$348.305 more rows

What was the Medicare Part B premium for 2018?

The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. However, a statutory “hold harmless” provision applies each year to about 70 percent of enrollees.Nov 17, 2017

How much is Medicare Part B 2013?

Medicare Part B Coverage Details 2013. You will be required to pay $147 for your part B deductibles this year. More payment in premiums will come about if one has an adjusted gross income from the previous 2 years on a certain amount. You will not required to pay for blood if the hospital gets it at no cost; You will only be required to pay ...

What is the Medicare premium for 2013?

Its premium for 2013 will essentially stand at $104.90 up from 99.90 in 2012 which is a 5% increase.

What changes were made to Medicare in 2013?

Medicare Fee Schedule and Medicare Eligibility Changes in 2013 are set to be experienced in Medicare part A and Medicare Part B premiums deductibles and the coinsurance paid by beneficiaries. The premiums paid on Part A and part B of the Medicare insurance is the ones that have been slightly changed. 2013 Medicare Premiums are set ...

How much of Medicare do you have to pay for outpatient services?

One will be required to pay for 20% of Medicare approved for most doctor services; this will mostly affect outpatient therapy and durable medical equipment. For outpatient mental health services, you will be required to cater for 20% of the Medicare approved amount.

How much does Medicare pay for mental health?

Partial hospitalization for mental health services will require one to pay 40% of the Medicare approved amount on each of the service one gets. Payment for outpatient hospital services will stand at 20% of the Medicare approved amount of the doctor services.

Does Medicare have a late enrollment penalty?

Medicare Part A also comes with a late enrollment penalty payment. The Medicare Part A Premiums will be set to go higher by up to 10% requiring one to pay for them for up to twice the number of years one ought to have paid for it.

Will Medicare premiums increase in 2013?

2013 Medicare Premiums are set to rise by $5 a month; this is less than what was anticipated but set to eat up to a quarter of a typical retiree’s cost of living. This will mainly affect social security payments. Deductibles premiums for Medicare part B will increase while premiums for Part A will experience a drop.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...