How high will the Medicare Part B deductible get?

2022 Medicare Deductibles 2022 Part A Deductible The Medicare Part A hospital inpatient deductible for 2022 increased to $1,556 per benefit period from $1,484 in 2021. 3 This is an increase of $72, or 4.85%.

When are Medicare premiums deducted from Social Security?

Nov 12, 2021 · The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021. The increases in the 2022 Medicare Part B premium and deductible are due to:

What is the current Medicare premium amount?

Dec 14, 2021 · In 2022, the Medicare Part A deductible is $1,556 per benefit period. That means when you are admitted to a hospital or other medical facility as an inpatient, you are responsible for paying the first $1,556 of covered care before Medicare Part A begins picking up any costs.

How much is monthly premium for Medicare?

Nov 18, 2021 · The Centers for Medicare & Medicaid Services (CMS) recently announced that the Medicare Part A deductible for inpatient hospital services will increase by $72 in calendar year (CY) 2022 to $1,556. The Part A daily coinsurance amounts will be: $389 for days 61-90 of hospitalization in a benefit period, up from the current $371.

What is the plan g deductible for 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Is the Part B deductible going up in 2022?

The annual deductible for Part B will rise to $233, up from $203. Once you meet that deductible, you typically pay 20% of covered services. Keep in mind that beneficiaries in Advantage Plans might pay a different amount through copays, and Medigap policies either fully or partially cover that coinsurance.Dec 31, 2021

What will the Medicare Part B monthly premium be in 2022?

$170.10The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $170.10 in 2022, an increase of $21.60 from $148.50 in 2021.

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

How much is deducted from Social Security for Medicare?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

How Much Will SSI checks be in 2022?

$841 per monthFor individuals receiving SSI, the maximum federal benefit for 2022 will rise to $841 per month. The figure is $1,261 for couples. Actual payments could be higher since some states contribute more.Jan 10, 2022

How can I reduce my Medicare Part B premiums?

Those premiums are a burden for many seniors, but here's how you can pay less for them.Sign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.Jan 3, 2022

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $148.50 per month. The maximum cost of Medicare Part B coverage is $504.90 per month in 2021, and that's for individuals reporting half a million dollars or more in income in 2019.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

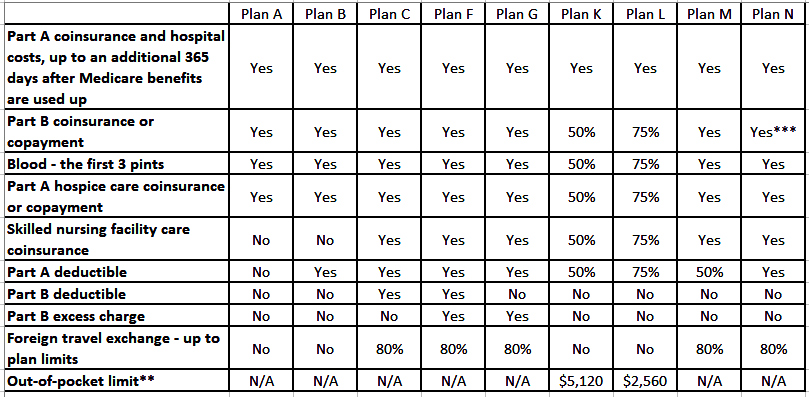

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,370 in 2021.