...

What You'll Pay for Medicare in 2018.

| Income (adjusted gross income plus tax-exempt interest income): | ||

|---|---|---|

| $133,501 to $160,000 | $267,001 to $320,000 | $348.30 |

What is the Medicare Part a hospital deductible for 2018?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017.

What's the standard deduction for 2018?

But don't worry. The standard deduction nearly doubled to $12,000 if you are single and $24,000 if married filing jointly. Plus, there are still some tax deductions and credits you can take.

What will you pay for Medicare in 2018?

What You'll Pay for Medicare in 2018. For more information, see FAQs about Medicare. Also, the Medicare Part A inpatient hospital deductible in 2018 will increase for everyone by $24, to $1,340. The Medicare Part B deductible, which covers physician and outpatient services, will remain at $183 for 2018.

Who can deduct medical expenses on 2018 taxes?

Who can deduct medical expenses on 2018 taxes? For the 2018 tax year, you can deduct only the portion of your medical expenses that exceeds 7.5% of adjusted gross income. For the 2019 tax year, this threshold changes and you can only deduct medical expenses that exceed 10% of adjusted gross income.

How do I calculate Medicare deductions?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay. 2

What is the deductible for Medicare each year?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the annual Medicare deductible for 2019?

(Note: Most Medicare beneficiaries are exempt from paying the Medicare Part A premium since they or their spouse paid into Medicare while working.) The 2019 Part A deductible is $1,364 — $24 more than in 2018.

What is the current Medicare deduction from Social Security?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

What will the Medicare Part B deductible be in 2022?

$233The 2022 Medicare deductible for Part B is $233. This reflects an increase of $30 from the deductible of $203 in 2021.

What is the Medicare deductible for 2021 Part B?

$203 inMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What is the cost for Medicare Part B for 2018?

$134 per monthAnswer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What was the Medicare deductible for 2017?

$183 inCMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016). Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement.

Are Medicare premiums tax deductible?

You can deduct your Medicare premiums and other medical expenses from your taxes. You can deduct premiums you pay for any part of Medicare, including Medigap. You can only deduct amounts that are more than 7.5 percent of your AGI.

Does Medicare get deducted from your Social Security check?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

What is the Medicare premium for 2018?

What are Medicare premiums in 2018? The standard premium of $134 for Medicare Part B won't change, but some recipients will still end up paying more. by: Kimberly Lankford. October 12, 2018.

How much is Medicare Part B?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018. However, even though the standard premium remains the same, many people will have to pay much more for Part B in 2018 than they did in 2017.

How much will hold harmless pay for Medicare?

Another 28% of Part B enrollees who are covered by the hold-harmless provision will pay less than $134 because the 2% increase in their Social Security benefits will not be large enough to cover the full Part B premium increase. Most people who sign up for Medicare in 2018 or who do not have their premiums deducted from their Social Security ...

How much is the Part B premium?

Some 42% of Part B enrollees who are subject to the hold-harmless provision for 2018 will pay the full monthly premium of $134 because the increase in their Social Security benefit will cover the additional Part B premiums.

Why is Medicare holding harmless?

The reason is rooted in the "hold harmless" provision, which prevents enrollees' annual increase in Medicare premiums from exceeding their cost-of-living increase in Social Security benefits —if their premiums are automatically deducted from their Social Security checks. This applies to about 70% of Medicare enrollees.

How much is Part D deductible for 2017?

In 2017, you can expect the following costs: The Part D deductible is $1,316 per benefit period. Once you meet the deductible, you’ll pay nothing out of pocket for the first 60 days of your stay. For days 61 to 90, you’ll pay $329 per day. For days 91 and beyond, you’ll pay $658 per day.

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

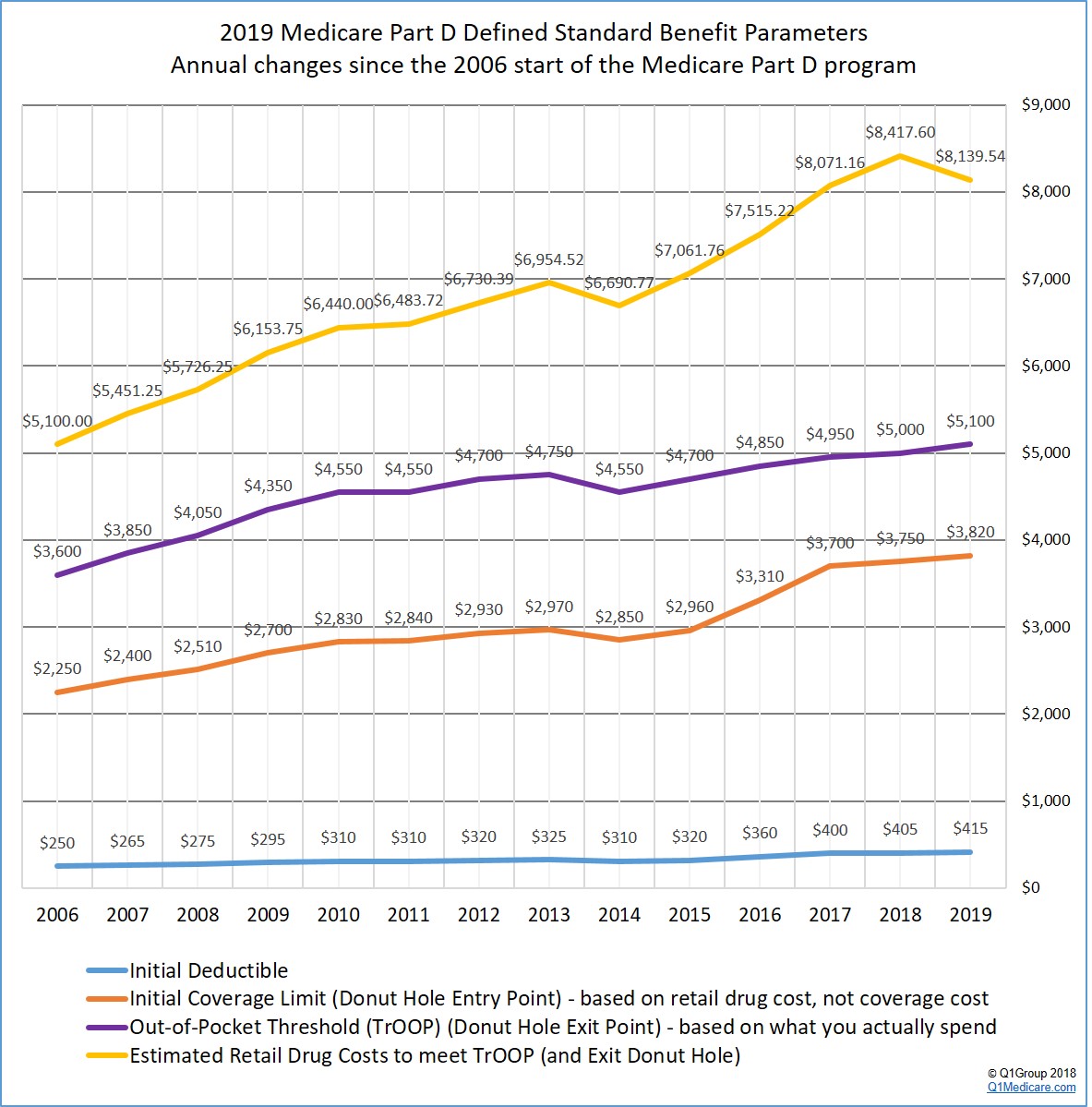

What is the donut hole in Medicare?

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much does it cost to get a quarter credit in 2017?

If you earn fewer than 30 quarter credits, the cost is $413 a month in 2017. Few people might pay the premium for Part A, but everyone with this coverage still must meet certain deductibles, and cost-sharing is still required. In 2017, you can expect the following costs:

What is the maximum Part D deductible for 2018?

The maximum Part D deductible for 2018 is $405 per year (though some plans waive the deductible). Also, if your adjusted gross income is over $85,000 (or $170,000 for a couple), you will pay a monthly adjustment amount to Medicare in addition to your monthly premium, as follows:

How much does Medicare cost a month?

If you first enroll in Medicare Part B during 2018, or you are not collecting Social Security benefits, your premium will be $134 per month.

How much does Medicare pay for a spouse?

Most people don't pay a monthly premium for Medicare Part A (hospital insurance). But if you have to pay for Part A because you or your spouse don't have a long enough work history, you'll pay between $232 (for 30-39 work credits) and $422 (for fewer than 30 work credits). In 2018, you'll also pay a $1,340 deductible for each benefit period in ...

How much is deductible for hospital days 61-90?

Hospital days 61-90: $335 coinsurance per day of each benefit period.

How much medical expenses can I deduct?

It’s now easier to qualify for the medical expense deduction 1 A taxpayer with adjusted gross income of $50,000 would need a minimum of $3,750 in medical expenses to reach the temporary 7.5 percent threshold. That compares with $5,000 — $1,250 more — at a 10 percent floor, which will be in effect in 2019. 2 About 8.8 million taxpayers used the deduction in 2015, saving themselves an aggregate $86.9 billion. 3 Some qualifying expenses are more easily overlooked, including the cost of getting you and your dependents to doctor’s appointments and the like.

How many people used medical deductions in 2015?

About 8.8 million taxpayers used the deduction in 2015, saving themselves an aggregate $86.9 billion. Some qualifying expenses are more easily overlooked, including the cost of getting you and your dependents to doctor’s appointments and the like. If you haven’t checked whether your medical expenses could get you a tax break on your 2017 return, ...

What is the minimum medical expenses for 7.5 percent?

A taxpayer with adjusted gross income of $50,000 would need a minimum of $3,750 in medical expenses to reach the temporary 7.5 percent threshold. That compares with $5,000 — $1,250 more — at a 10 percent floor, which will be in effect in 2019.

How many people used the tax break in 2015?

In 2015, about 8.8 million Americans used the tax break, saving themselves an aggregate $86.9 billion, according to the AARP Public Policy Institute.

How much did healthcare cost in 2016?

The cost of health care has been on an upward trajectory for years. In 2016, the average amount spent on health care per person was $10,348, according to the Centers for Medicare and Medicaid Services. That’s up from $9,596 in 2012 and $7,700 in 2007. VIDEO.

Can I deduct my health insurance premiums?

If you pay for health insurance with after-tax dollars, your premiums might be able to count toward the deductible. For the self-employed, premiums for health, dental and long-term care insurance (within the limits) for you and your dependents may be deductible if you show a profit.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

It could save you money, but not all taxpayers have this option

When you incur big medical costs during the year, these expenditures can be a big hit to your budget. For some taxpayers, these expenses can be partly defrayed by taking a tax deduction for some of the amount spent on care.

Who can deduct medical expenses on 2018 taxes?

For the 2018 tax year, you can deduct only the portion of your medical expenses that exceeds 7.5% of adjusted gross income. For the 2019 tax year, this threshold changes and you can only deduct medical expenses that exceed 10% of adjusted gross income.

You have to itemize to claim the medical expense deduction

In order for you to be able to deduct your medical expenses, you must itemize on your tax return instead of claiming the standard deduction. Itemizing makes sense only for a limited number of taxpayers starting in tax year 2018 because the Tax Cuts and Jobs Act almost doubled the standard deduction for this tax year.

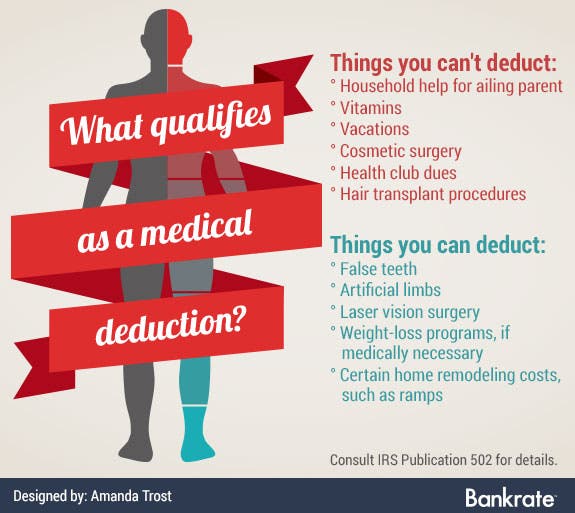

Only certain medical expenses count

It's also important to make sure any medical expenses you are trying to deduct are actually deductible. The IRS has a list of expenses you can deduct including:

Deducting medical expenses could save you money -- under the right circumstances

If your medical expenses exceed 7.5% of income and it makes sense for you to itemize, deductible medical expenses can cut your tax bill. For many taxpayers, though, it simply won't be possible in 2018 either because it makes no sense to itemize or because your expenses don't exceed the threshold to claim the deduction.

What is the medical deduction threshold for 2018?

Under the new law, the 7.5 percent medical deduction threshold will be in place only for the 2017 and 2018 tax years. After that, the threshold reverts back to 10 percent of income. AARP will be urging Congress to act to maintain it at 7.5 percent.

How many Americans deduct medical expenses in 2015?

Nearly 9 million Americans deducted medical expenses in 2015, and nearly three-quarters of those taxpayers were older than 50, according to an analysis by the AARP Public Policy Institute. Of filers who used this deduction, 70 percent had incomes under $75,000, with 49 percent earning less than $50,000 a year.

How much is the standard deduction for joint filers?

The provision of the Tax Cuts and Job Act that doubles the standard deduction — to $12,000 for individuals and $24,000 for joint filers — could significantly change the number of taxpayers who itemize, experts say.

What is out of pocket medical insurance?

Out-of-pocket fees to doctors, dentists, chiropractors, psychiatrists, psychologists, podiatrists and other medical professionals that are not covered by Medicare or other health insurance. Health insurance premiums — as long as they weren’t paid with pretax dollars, as most employer-based health benefits are.

Can you deduct Medicare Part B premiums?

You can deduct Medicare Part B premiums and any premiums you pay for a Medigap policy, Medicare Advantage plan or a Part D Prescription drug plan. Premiums for long-term care insurance and payments to nursing homes and other long-term care facilities. Inpatient alcohol and drug treatment programs.