Age for Receiving Full Social Security Benefits

| Birth Year | Full Retirement Age |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 and later | 67 |

How does age affect Social Security benefits eligibility?

7 rows · Nov 24, 2021 · Americans become eligible for Medicare and Social Security at different times. While you ...

What age is best to claim social security?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board. You are eligible to receive Social Security or Railroad benefits but you have not yet filed …

Is there a maximum age I can collect Social Security?

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later.

How do you become eligible for Social Security and Medicare?

May 28, 2019 · If you receive Social Security benefits for 24 months, usually you will automatically be enrolled in Medicare Part A and Part B at the beginning of the 25th month. If you have Lou Gehrig’s disease, usually you will automatically be enrolled in Medicare Part A and Part B as soon as you receive the first month of Social Security disability benefits.

Can you collect Social Security at 62 and get Medicare?

Can you get both Social Security and Medicare?

Medicare is linked to entitlement to Social Security benefits. It is possible to get both Medicare and Medicaid. States pay the Medicare premiums for people who receive SSI benefits if they are also eligible for Medicaid.

Do you get Medicare at 65 or 66?

At what retirement age can you get Medicare?

Can I get Medicare Part B for free?

Can I get Medicare at 55?

What age can I retire if I was born in 1955?

What happens if I retire at 65 instead of 66?

Can you collect Social Security at 66 and still work full time?

Can I draw Social Security at 62 and still work full time?

Does Medicare coverage start the month you turn 65?

How can I retire at 62?

How long do you have to be on disability to receive Social Security?

You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months. ( Note: If you have Lou Gehrig's disease, your Medicare benefits begin the first month you get disability benefits.)

When did Medicare start providing prescription drugs?

Since January 1, 2006, everyone with Medicare, regardless of income, health status, or prescription drug usage has had access to prescription drug coverage. For more information, you may wish to visit the Prescription Drug Coverage site.

How old do you have to be to get Medicare?

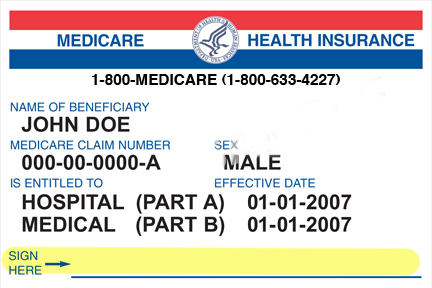

If you are age 65 or older, you are generally eligible to receive Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) if you are a United States citizen or a permanent legal resident who has lived in the U.S. for at least five years in a row.

When do you get Medicare Part A and Part B?

If you meet Medicare eligibility requirements and you have received Social Security benefits for at least four months prior to turning age 65, you will typically get Medicare Part A and Part B automatically the first day of the month you turn age 65.

What happens if you refuse Medicare Part B?

If you refuse it, you don’t lose your Medicare Part B eligibility. However, you may have to wait for a valid enrollment period before you can enroll . You may also have to pay a late enrollment penalty for as long as you have Medicare Part B coverage.

How long do you have to work to pay Medicare?

You or your spouse worked long enough (40 quarters or 10 years) while paying Medicare taxes. You or your spouse had Medicare-covered government employment or retiree who has paid Medicare payroll taxes while working but has not paid into Social Security. Normally, you pay a monthly premium for Medicare Part B, no matter how many years you’ve worked.

Is Medicare available to everyone?

Medicare coverage is not available to everyone. To receive benefits under this federal insurance program, you have to meet Medicare eligibility requirements. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

Do you pay Medicare Part B monthly?

Normally, you pay a monthly premium for Medicare Part B, no matter how many years you’ve worked. Read more about the Part A and Part B premiums.

When will I get Medicare if I am already on Social Security?

You’ll get Medicare automatically if you’re already receiving Social Security retirement or SSDI benefits. For example, if you took retirement benefits starting at age 62, you’ll be enrolled in Medicare three months before your 65th birthday. You’ll also be automatically enrolled once you’ve been receiving SSDI for 24 months.

How long do you have to wait to get Medicare?

Waiting period. You can also qualify for full Medicare coverage if you have a chronic disability. You’ll need to qualify for Social Security disability benefits and have been receiving them for two years. You’ll be automatically enrolled in Medicare after you’ve received 24 months of benefits.

How much does Medicare cost in 2020?

In 2020, the standard premium amount is $144.60. This amount will be higher if you have a large income.

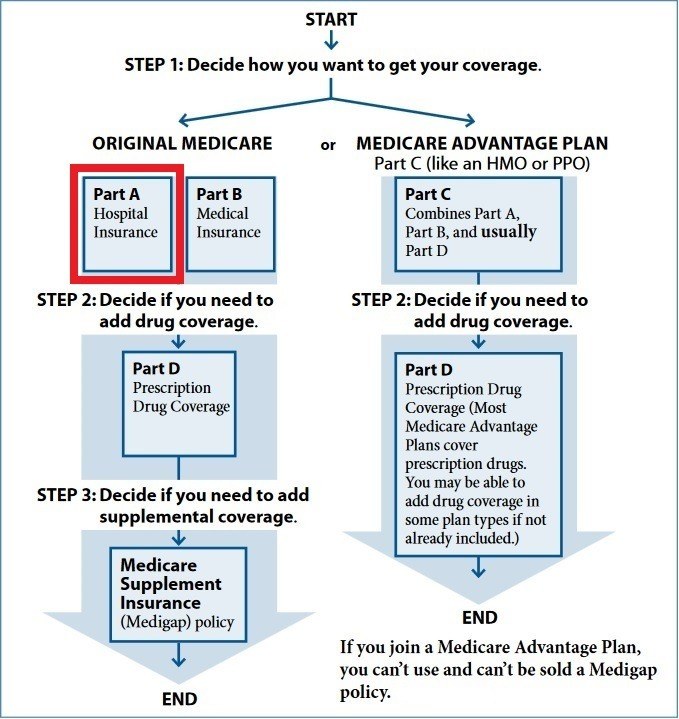

What is Medicare Part A?

Medicare Part A (hospital insurance). Part A covers services such as hospital stays, long-term care stays, and hospice care.

What is Medicare and Medicaid?

Medicare is a health insurance plan provided by the federal government. The program is managed by the Centers for Medicare & Medicaid Services (CMS), a department of the United States Department of Health and Human Services.

What is the difference between Medicare and Social Security?

Both programs help people who have reached retirement age or have a chronic disability. Social Security provides financial support in the form of monthly payments, while Medicare provides health insurance. The qualifications for both programs are similar.

How much can my spouse get from my retirement?

Your spouse can also claim up to 50 percent of your benefit amount if they don’t have enough work credits, or if you’re the higher earner. This doesn’t take away from your benefit amount. For example, say you have a retirement benefit amount of $1,500 and your spouse has never worked. You can receive your monthly $1,500 and your spouse can receive up to $750. This means your household will get $2,250 each month.

How long do you have to sign up for a health insurance plan?

You also have 8 months to sign up after you or your spouse (or your family member if you’re disabled) stop working or you lose group health plan coverage (whichever happens first).

When does insurance start?

Generally, coverage starts the month after you sign up.

When does Part A coverage start?

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65. (If your birthday is on the first of the month, coverage starts the month before you turn 65.)

How old do you have to be to get Medicare?

To be eligible for this benefit program, you must meet one of the following: Are age 65 or older. Receive Social Security Disability benefits. Have certain disabilities or permanent kidney failure (even if under age 65). Based on the information you gave you may be eligible to receive Medicare coverage because you have been receiving disability ...

What is Medicare for disabled people?

Medicare is health insurance for people over 65 and eligible disabled people. Program Contact. 1-800-772-1213. Additional Info. Apply for Medicare Benefits. Managing Agency. U.S. Social Security Administration. Check if you may be eligible for this benefit. Check if you may be eligible for this benefit.

How long does it take to get Medicare for Lou Gehrig's disease?

Please Note: If your disability is based on amyotrophic lateral sclerosis (ALS), also known as Lou Gehrig's disease, you do not need to wait 24 months for Medicare coverage to begin. Check if you may be eligible for this benefit.

Is Medicare a federal program?

Medicare is a federally funded program administered by the Centers for Medicare & . Medicaid Services (CMS). Medicare is our country’s federal health insurance. program for people age 65 or older. The Social Security Administration (SSA) processes your application and provides general information about the M.

How old do you have to be to get Social Security?

Depending on your year of birth, that age will fall out somewhere between 66 and 67.

When does Medicare start?

Your initial enrollment period for Medicare begins three months before the month of your 65th birthday , and ends three months after the month you turn 65.

What happens if you miss your Medicare enrollment window?

But holding off too long could cost you. If you wait too long to sign up for Medicare Part B, you’ll face a 10 percent increase in your Part B premiums for every year-long period you were eligible to enroll but didn’t. There are also financial implications associated with waiting too long to sign up for a Part D drug plan.

How long do you have to wait to get Medicare if you don't need it?

Therefore, if you don’t need the income from those benefits right away, you could conceivably sign up for Medicare at 65 and then wait another five years before filing for Social Security. There are also scenarios where it might pay to get on Social Security before enrolling in Medicare.

When do you get special enrollment for your 65th birthday?

That said, if you’re still working and have coverage under a group health plan during the seven-month period surrounding your 65th birthday, you’ll get a special enrollment period that begins when you separate from your employer or your group coverage ends. As such, you won’t have to worry about the aforementioned penalties provided you sign up during your special enrollment period.

Is Medicare insurance cheap?

Remember, health coverage under Medicare doesn’t necessarily come cheap. Between premiums, deductibles, and coinsurance, you might find that your out-of-pocket costs are substantially lower under a group health plan, in which case it pays to stick with it as long as you can.

Do seniors rely on Medicare?

A: Millions of seniors rely on Medicare for health benefits in retirement, and depend on Social Security as a key income source. But while the two programs are interrelated, participation in one doesn’t necessarily hinge on being signed up for the other.