When do Medicare Part C and Part D plans take effect?

October 15 through December 7, 2022 – Open Enrollment Period for Medicare Advantage Plans (Part C) and Prescription Drug Coverage Plans (Part D). During this time you are able to join a Medicare Part C or D plan. Your plan will take effect on January 1, 2023.

What is the Medicare initial enrollment period?

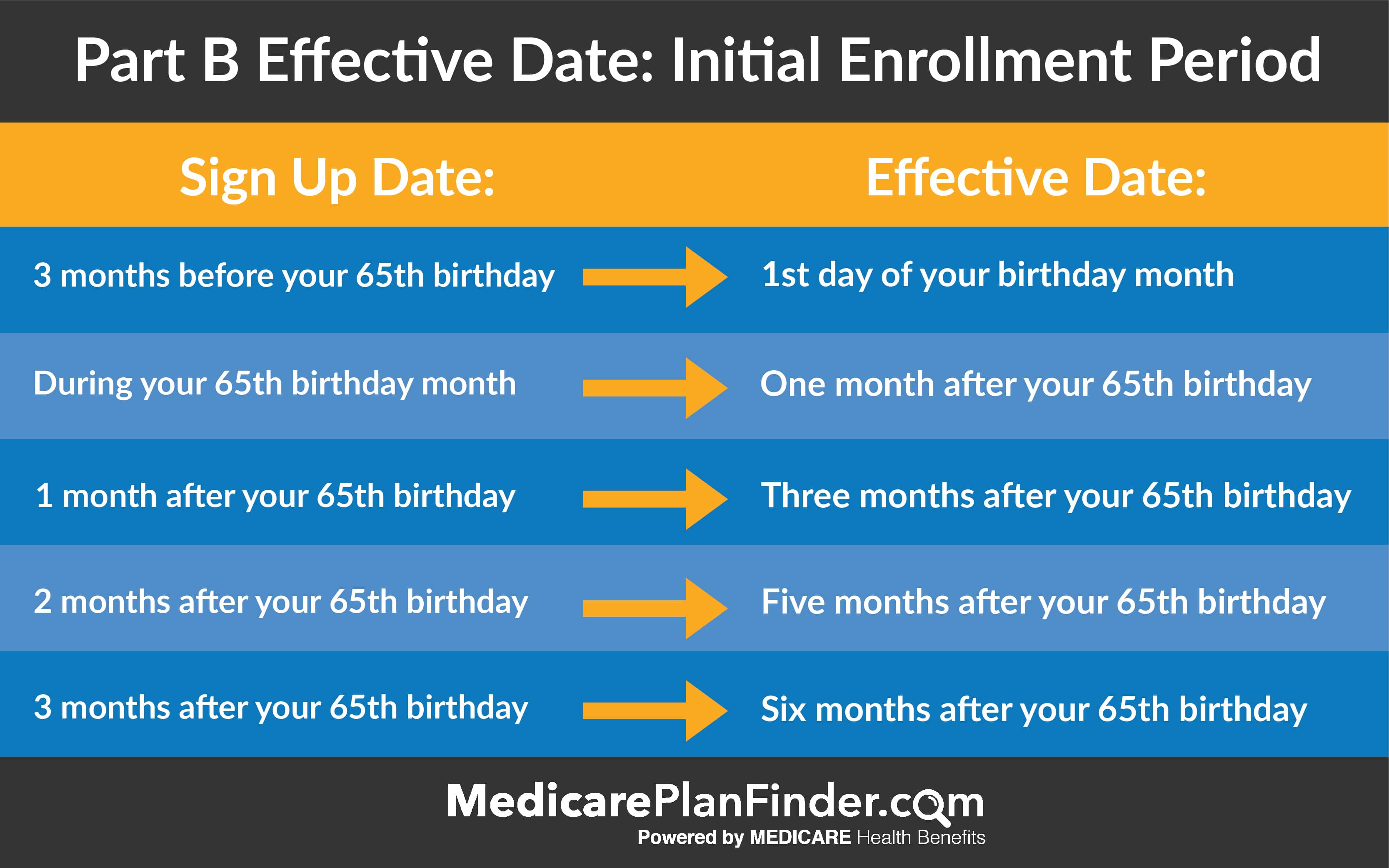

You have an Initial Enrollment Period of seven months (3 months before and after you become eligible) to add additional Medicare health care coverage with an Advantage plan, or Supplemental Insurance (Medigap policies) and/or a Prescription Drug plan. Medicare enrollment or changes to plans you are already enrolled in are limited to specific times.

What is a Medicare special enrollment period (Sep)?

Depending on your circumstances, you may potentially qualify for a Medicare Special Enrollment Period (SEP). Special Enrollment Periods do not have a scheduled beginning or ending date. These periods may be granted at any time throughout the year to beneficiaries who experience qualifying events such as :

How many people are enrolled in Medicare Part C?

Over 26 million Medicare beneficiaries are enrolled in a Medicare Advantage plan (Medicare Part C). 1 But how and when can you enroll in a Part C plan? The following chart illustrates the different Medicare enrollment periods when you can sign up for Medicare Advantage.

Can you add Medicare Part C at any time?

It runs from October 15 to December 7 each year. You can add, change, or drop Medicare Advantage plans during the AEP, and your new coverage starts on January 1 of the following year.

Can a Medicare supplement plan be purchased at any time of the year?

Generally, there is no type of Medicare plan that you can get “any time.” All Medicare coverage, including Medicare Supplement (Medigap) plans, is subject to enrollment periods. Other types of Medicare plans, like Medicare Advantage and Medicare Part D prescription drug plans, have open enrollment periods every year.

When can you get Medicare Part C?

65When you first get Medicare (Initial Enrollment Periods for Part C & Part D)If you joinYour coverage beginsDuring one of the 3 months before you turn 65The first day of the month you turn 65During the month you turn 65The first day of the month after you ask to join the plan1 more row

Can you sell Medicare supplements year round?

If you'd prefer to avoid CMS red tape, then Medicare Supplements are the products to sell. Plus, there's no annual enrollment so you can sell them year-round!

Can I switch Medicare Supplement plans anytime?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

Can I change Medicare plans in the middle of the year?

If you're covered by both Medicare and Medicaid, you can switch plans at any time during the year. This applies to Medicare Advantage as well as Medicare Part D.

During which period can a member enroll in a different Part C plan?

This includes three months before the month you turn 65, your birth month, and three months after the month you turn 65. During this time, you can enroll in original Medicare parts A and B, a Medicare advantage plan, part C, and a standalone Medicare prescription drug plan, part D.

Does Medicare Part C have a late enrollment penalty?

Medicare Part C (Medicare Advantage) doesn't have a late enrollment penalty. You can switch over to this type of plan during certain enrollment periods. Medicare supplement insurance (Medigap) also does not have a set penalty.

What is the Medicare initial enrollment period?

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Can you make good money selling Medicare?

Earning income potential is dependent on sales commissions, talent and location. On average, medicare sales agent jobs pay around $65,000 annually, but top agents can earn six-figure incomes in just three years, suggests Redbird Network.

Can you sell Medicare door to door?

MA/PD PLANS May not market to beneficiaries door to door, including leaving materials at a beneficiary's doorstep. May call a beneficiary they enrolled in a plan to discuss plan business, as well as discuss the availability of other plan options/types within the same parent organization.

Is it easy to sell Medicare?

No, it's not hard to sell Medicare Supplements. When you're first starting, it should be easy, because everyone on Medicare needs one. It's just an insurance product. You're not a member – you're a policyholder, and that means a lot to people.

What is Medicare Part C Advantage?

When you enroll in a Medicare Part C Advantage plan, Medicare pays a fixed monthly amount to the plan insurance carrier to provide your care. The insurance carriers will offer you a monthly premium as low as possible to attract you to their plan.

Do you have to pay Medicare premiums for Part B?

You will also still pay your monthly premium for Part B when you are enrolled in Medicare Advantage plans. You must be actively enrolled in both Part A and Part B to qualify for enrollment into a Advantage plan.

When does Medicare open enrollment end?

- Sign up for a Medicare Advantage plan. Fall Medicare Open Enrollment Period for Medicare Advantage plans (aka Annual Enrollment Period, or AEP) Starts October 15. Ends December 7. - Sign up for a Medicare Advantage plan.

How long do you have to be on Medicare Advantage?

After that point, you have 7 full months to enroll in a Medicare Advantage Plan. Your coverage will begin on your 25th month of receiving disability benefits. If you have Amyotrophic Lateral Sclerosis (ALS), you are eligible for Medicare the first month you receive your disability benefits.

How long do you have to be on Medicare before you can get a disability?

If you become eligible for Medicare before 65 due to a qualifying disability, you may be able to enroll in a Medicare Advantage plan after you have been getting Social Security or Railroad Retirement Board benefits for 21 full months. After that point, you have 7 full months to enroll in a Medicare Advantage Plan.

How many types of Medicare Advantage Plans are there?

The availability of Medicare Advantage plans in your area will vary and is subject to how many insurance companies offer plans where you live. There are five primary types of Medicare Advantage plans that are the most prevalent, and the availability of each type of plan will also vary based on your location.

What are the factors that affect Medicare Advantage?

Several factors can affect your Medicare Advantage plan costs, such as: Whether your plan offers $0 monthly premiums. The drug deductible included in your plan, if your plan offers prescription drug coverage. Any network restrictions your plan may include regarding approved providers who are in your plan network.

What are the benefits of Medicare Advantage?

Some of the potential benefits offered by a Medicare Advantage plan can include coverage for: Dental care. Vision care.

When does Medicare AEP happen?

Medicare AEP occurs every year from October 15 to December 7. During this time, those who are already enrolled in Original Medicare can enroll in a Medicare Advantage plan. During AEP, you may also switch Medicare Advantage plans or drop your plan entirely to return to Original Medicare. YouTube. MedicareAdvantage.com.

Why Sell Medicare Advantage Plans?

Typically, insurance carriers offer higher commissions for MA plans than Medicare Supplements or Part D plans.

How to Sell Medicare Advantage Plans

Before you can start selling Medicare Advantage plans, you must receive the proper training, licensing, and certifications. Check with your state’s department of insurance to learn about state-specific requirements. After you’re licensed, the next step is marketing your services.

When Can I Sell Medicare Advantage?

Many Medicare-eligibles have restrictions on when they can enroll in new plans. You need to know the specifics of each enrollment period and how they apply to your clients.

Selling Medicare Advantage Over the Phone

You may have heard that you can sell Medicare Supplements over the phone, but you want to know how to sell Medicare Advantage plans over the phone.

How Much Can I Make Selling Medicare Advantage Plans?

The Centers for Medicare and Medicaid (CMS) sets maximum compensation amounts that carriers can pay agents for sales. Click here to read more about agent compensation.

Important Terms to Know When Selling Medicare Advantage Plans

You want to answer clients’ questions with confidence, so it’s important to know the terms they’ll ask about. Here are some common terms beneficiaries will ask about:

Start Selling Medicare Advantage Insurance Today

Selling Medicare Advantage plans can be a lucrative career. At Senior Market Advisors, we give our agents tools for success such as extensive training so you can answer questions with confidence.

Medicare Initial Enrollment Period

For most people, enrolling in Medicare Part A is automatic.

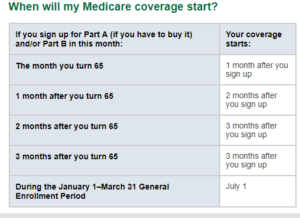

Medicare General Enrollment Period

If you did not enroll during the IEP when you were first eligible, you can enroll during the General Enrollment Period. The general enrollment period for Original Medicare is from January 1 through March 31 of each year.

Medicare Special Enrollment Period

You may choose not to enroll in Medicare Part B when you are first eligible because you are already covered by group medical insurance through an employer or union.

How many enrollment periods are there for Medicare Advantage?

There are 2 separate enrollment periods each year. See the chart below for specific dates.

What is the late enrollment penalty for Medicare?

The late enrollment penalty is an amount that’s added to your Part D premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there’s a period of 63 or more days in a row when you don’t have Part D or other creditable prescription drug coverage. Creditable prescription drug coverage is coverage (for example, from an employer or union) that’s expected to pay, on average, at least as much as Medicare’s standard prescription drug coverage. If you have a penalty, you may have to pay it each month for as long as you have Medicare drug coverage. For more information about the late enrollment penalty, visit Medicare.gov, or call 1‑800‑MEDICARE (1‑800‑633‑4227). TTY users should call 1‑877‑486‑2048.

Can you change your Medicare Advantage?

You can make changes to your Medicare Advantage and Medicare prescription drug coverage when certain events happen in your life, like if you move or you lose other insurance coverage. These chances to make changes are called Special Enrollment Periods (SEPs) and are in addition to the regular enrollment periods that happen each year. Rules about when you can make changes and the type of changes you can make are different for each SEP.