The best time to buy Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Are Medicare supplement plans worth it?

The best time to enroll in a Medicare Supplement plan may be your Medicare Supplement Open Enrollment Period. This period lasts six months and begins the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. For example, your birthday is August 31, 1953, so you turn 65 in 2018.

Who is eligible for a Medicare supplement insurance plan?

Mar 04, 2022 · The best time to buy a Medicare Supplement plan, or Medigap, is during your six-month open enrollment period. During this time, an insurance company cannot deny you coverage based on your health. After this period, you may pay more for a Medigap policy or get denied coverage due to poor health.

Is there open enrollment for Medicare supplements?

Buy a policy when you’re first eligible. The best time to buy a Medigap policy is during your 6-month Medigap open enrollment period. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the month you’re 65 and enrolled in Medicare Part B (Medical Insurance).

What is the best Medicare supplement insurance plan?

T he best time to purchase a Medicare Supplement plan is during your initial enrollment into Medicare itself. This initial enrollment period, sometimes called your “Medigap Open Enrollment,” begins the first day of the month you turn 65 and lasts for 6 months AND are enrolled in Medicare Part B. For example:

Can Medicare Supplements be purchased at any time of the year?

If you're in good health and comfortable answering medical questions, you can apply to change Medigap plans at any time of the year. Medicare Advantage plans and Medicare Part D prescription drug plans can only be changed during certain times of year, but Medicare supplements are different.Jan 26, 2021

Can you add a Medicare Supplement at any time?

One interesting feature of Medicare Supplement insurance plans is that you can apply for a plan anytime – you only need to be enrolled in Medicare Part A and Part B. However, a plan doesn't have to accept your application, unless you have guaranteed-issue rights.

What is a Medicare Supplement in birthday rule?

Q: What is the "Birthday Rule" and how does it apply to the new Medigap Plans? A: If you already have Medigap insurance, you have 30 days of "open enrollment" following your birthday each year when you can buy a new Medigap policy without a medical screening or a new waiting period.

When can a consumer enroll in a Medicare Supplement plan?

Open Enrollment Period for Medicare Supplement Plans Your Medicare Supplement Open Enrollment Period starts the first day of the month your Medicare Part B is in effect. For many beneficiaries, this is the first day of the month they turn 65.

When can I change my Medicare Supplement plan for 2022?

You can change your Medicare Supplement Insurance (Medigap) plan anytime, but there are a few things you should know before you do so. You can enroll in a Medigap plan during your Medigap Open Enrollment Period.Nov 22, 2021

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

Can I change my Medicare plan during my birthday month?

California: You have 60 days from the first day of your birth month to change to another Medigap plan with the same level or a lower level of benefits. You can also change insurance carriers during this time.Jan 22, 2022

What is California birthday rule for Medicare?

The birthday rule is the nickname for a law that allows those who are already on a Medigap plan to switch to another plan without medical underwriting. In CA, they have created an annual window of 60 days after your birthday to switch plans – hence the name “birthday rule.”Jan 28, 2022

What states have the Medigap birthday rule?

California and Oregon both have “birthday rules” that allow Medigap enrollees a 30-day window following their birthday each year when they can switch, without medical underwriting, to another Medigap plan with the same or lesser benefits.

When can I switch from Medigap to Medicare Advantage?

The best (and often only time) to switch from Medigap to Medicare Advantage is during the Open Enrollment Annual Election Period which runs from Oct 15th to Dec 7th. To switch during this time, you would enroll in a MA plan which can only start on Jan 1st of the following year.Jul 8, 2015

What is the difference between a Medicare Advantage plan and a Medicare supplement plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What are the four prescription drug coverage stages?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.Oct 1, 2021

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. .

Can you get Medicare if you are 65?

Some states provide these rights to all people with Medicare under 65. Other states provide these rights only to people eligible for Medicare because of disability or only to people with ESRD. Check with your State Insurance Department about what rights you might have under state law.

Medigap Open Enrollment Period

T he best time to purchase a Medicare Supplement plan is during your initial enrollment into Medicare itself. This initial enrollment period, sometimes called your “Medigap Open Enrollment,” begins the first day of the month you turn 65 and lasts for 6 months AND are enrolled in Medicare Part B.#N#For example:

Can I get a Medigap Plan after turning 65?

You can certainly apply for a Medicare Supplement plan at any time. You just need to know that after your initial Medigap Open Enrollment period, there are no guarantees that you’ll be approved for coverage. You’ll have to go through medical underwriting, which may or may not be a big deal (depending on your health).

Medicare Supplement Plans in South Carolina, Georgia, and surrounding states

If you’re in South Carolina, Georgia, North Carolina, Alabama, or Tennessee, we’ll be happy to talk with you to help you explore your options and find the best Medicare Supplement plan for you.

How Medicare works with other insurance

Learn how benefits are coordinated when you have Medicare and other health insurance.

Retiree insurance

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

What's Medicare Supplement Insurance (Medigap)?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

When can I buy Medigap?

Get the facts about the specific times when you can sign up for a Medigap policy.

How to compare Medigap policies

Read about different types of Medigap policies, what they cover, and which insurance companies sell Medigap policies in your area.

Medigap & travel

Read about which Medigap policies offer coverage when you travel outside the United States (U.S.).

Step 1: Qualify to buy a Medicare Supplement insurance plan

Medicare Supplement insurance plans are not available to everyone. The first requirement is to be enrolled in Medicare Part A and Part B.

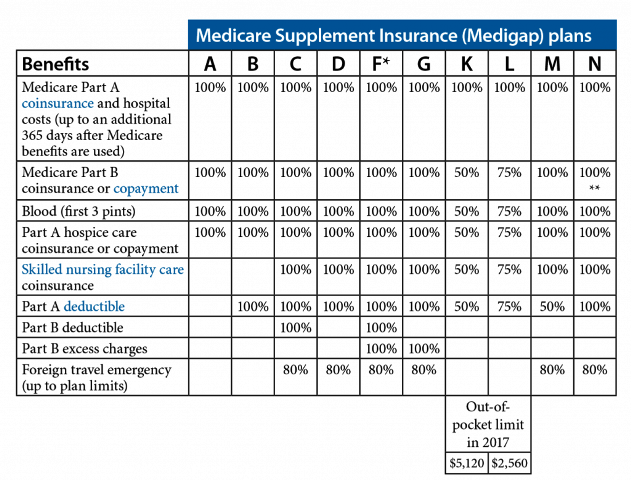

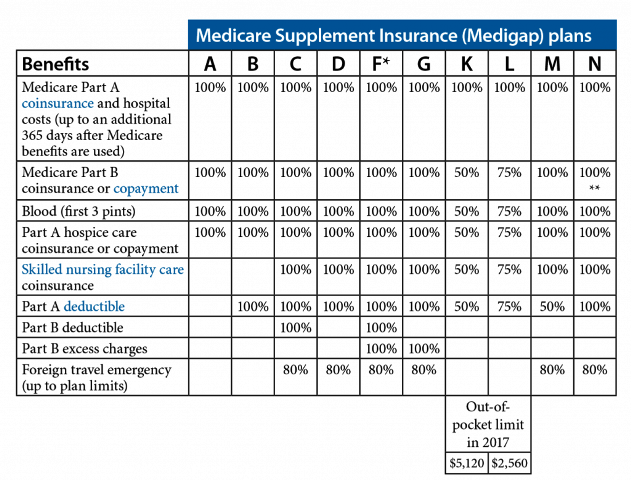

Step 2: Compare Medicare Supplement insurance plan benefits

Medicare plans cover a range of benefits, with some plans providing more coverage than others. Most states offer up to 10 Medicare Supplement insurance plans, as well as a high-deductible option for Plan F. The plans are identified as A, B, C*, D, F*, G, K, L, M and N.

Step 3: Understand Medicare Supplement insurance plan pricing

Medicare Supplement insurance plans are standardized in most states, meaning that plans of the same letter offered by different companies must cover the same basic benefits. However, pricing for the same plan may differ from company to company. Insurance companies use three ways to price Medicare Supplement insurance plans:

Step 4: Buy the Medicare Supplement insurance plan

If you have Original Medicare and you are 65 or older, you may be able to apply for a Medicare Supplement insurance plan at any time. However, whether a company accepts your application may depend on when you apply.