Full Answer

Are Medicare supplement plans worth it?

Medicare Supplement plans are worth it; doctor freedom, low out of pocket costs, and when Medicare pays the claim, your supplemental Medicare plan will pay the rest. Our team of experts is ready to answer your questions are share the most popular Medigap plans in your area. Call us today to find out if Medicare Supplements are worth it for you!

Who is eligible for a Medicare supplement insurance plan?

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. ...

- You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. ...

- A Medigap policy only covers one person. ...

Is there open enrollment for Medicare supplements?

Medicare open enrollment lasts from October 15 to December 7 each year ... Medicare Part D and Medicare Supplement insurance, so it’s your job to educate and help them determine which coverage combination best addresses their needs.

What is the best Medicare supplement insurance plan?

- United Healthcare: 26%

- Humana: 18%

- BCBS plans: 15%

- CVS (Aetna): 11%

- Kaiser Permanente: 7%

- Centene: 4%

- Cigna: 2%

- Other companies: 18%

Can Medicare Supplement be purchased at any time?

Generally, there is no type of Medicare plan that you can get “any time.” All Medicare coverage, including Medicare Supplement (Medigap) plans, is subject to enrollment periods. Other types of Medicare plans, like Medicare Advantage and Medicare Part D prescription drug plans, have open enrollment periods every year.

Can you change your Medicare Supplement anytime of the year?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

Can Medicare supplements be sold year round?

Did we mention that selling Medicare Supplements can earn you extra cash through carrier incentive programs or contests? Since Medicare Supplements can be sold-year round, there are often incentives offered throughout the year!

When can a consumer enroll in a Medicare Supplement plan?

Sign up for a Medicare Advantage Plan (with or without drug coverage) or a Medicare drug plan. During the 7‑month period that starts 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65.

Do you have to renew Medicare Supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the birthday rule Medicare supplement?

California: The birthday rule in California applies to all residents who already have a Medigap policy. Most importantly, the rule starts 30 days before their birthday and ends 60 days following. During this time, policyholders can change to any plan of equal or lesser benefit with the carrier of their choice.

What is the birthday rule in Medicare?

Q: What is the "Birthday Rule" and how does it apply to the new Medigap Plans? A: If you already have Medigap insurance, you have 30 days of "open enrollment" following your birthday each year when you can buy a new Medigap policy without a medical screening or a new waiting period.

What is the best supplemental insurance for Medicare?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

Who is the largest Medicare Supplement provider?

UnitedHealthCareAARP/United Health Group has the largest number of Medicare Supplement customers in the country, covering 43 million people in all 50 states and most U.S. territories. AARP licenses its name to insurer UnitedHealthCare, which helps make these policies so popular.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

What states do not offer Medicare Supplement plans?

Medigap plans are standardized across most states, meaning they offer the same benefits. The exceptions are Wisconsin, Minnesota and Massachusetts. Plans in those states may have options that differ from Medigap plans in other states.

Does Medicare pay for retirees?

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

Does Medicare Supplement Insurance cover health care?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

How long do you have to buy a supplement?

In most cases, you have to buy the supplement policy within 63 days of losing other coverage or leaving another plan.

Why is Medicare Supplement called Medigap?

They got the name Medigap because they're said to help fill the "gaps" in Original Medicare.

What happens after Medigap enrollment period ends?

After this enrollment period ends, your options for purchasing a Medigap policy may be more limited, or it could cost more due to your current health or pre-existing conditions.

How long does Medicare open enrollment last?

Medigap Open Enrollment begins automatically once you're enrolled in Medicare Part B and age 65 or older. It lasts for 6 months. For example, if you enroll in Part B and turn 65 in January, the best time to buy a Medigap policy is between January and June. This helps ensure you qualify for the policy and get the best rate because your application won't go through medical underwriting.

How long does it take for Medigap to cover out of pocket expenses?

Also keep in mind that in some cases, if you sign up for Medigap after Open Enrollment, the insurance companies can refuse to cover your out-of-pocket expenses for pre-existing conditions for up to 6 months, which is known as the pre-existing condition waiting period. After those 6 months you'll be covered, but you may have expenses related to those pre-existing conditions that you'll have to pay for yourself until then.

How long does it take to cancel a health insurance policy?

You can also cancel a policy within the first 30 days of enrollment for a full refund. After those 30 days, you can still cancel the policy at any time, but you may not be able to purchase another policy depending on your health.

What percentage of Medicare pays for medical care?

However, Medicare typically only pays around 80% of the pre-approved amount for these services (although Medicare pays 100% of the cost for some preventive screenings). The remaining 20% is your out-of-pocket cost. This can include:

When is the best time to buy a medicare supplement?

The best time to buy a Medicare Supplement plan, or Medigap, is during your six-month open enrollment period. During this time, an insurance company cannot deny you coverage based on your health. After this period, you may pay more for a Medigap policy or get denied coverage due to poor health.

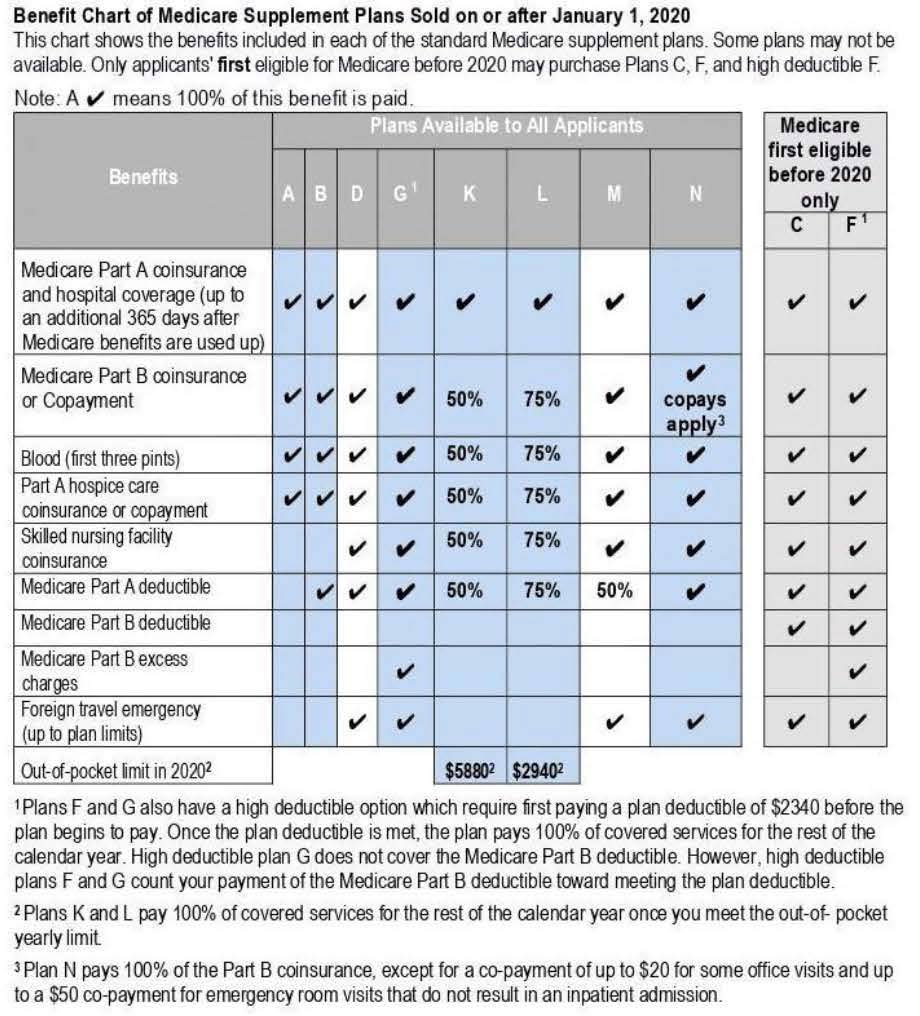

How many Medicare Supplement Plans are there?

There are 10 Medicare Supplement plans to choose from. Each has a specific letter, such as Plan F and Plan A. You pay the insurer a monthly premium for the policy.

How old do you have to be to get a guaranteed Medigap?

However, only a handful of states require continuous or annual guaranteed issue Medigap protections to all Original Medicare beneficiaries ages 65 and older, regardless of medical history.

What happens if you don't like Medigap?

If you join a Medigap plan during this six-month window and decide you don’t like the policy, you can switch to a different supplement plan and retain your guaranteed issue rights.

How long do you have to wait to get Medicare Part B?

Within six months of starting Medicare Part B benefits. You can either enroll in Part B when you’re first eligible at age 65 or you may choose to delay Part B enrollment until you or your spouse stops working for an employer that provides health insurance.

How long do you have to switch insurance plans?

You have a 60-day window around your plan anniversary each year when you can switch to the same plan offered by a different insurance company with guaranteed issue rights.

When is the best time to buy Medigap?

The best time to buy Medigap is when you are first eligible.

What is Medicare Supplement Plan?

A Medicare Supplement plan (also known as Medigap) is used for exactly what the name suggests — it supplements the gaps in your original Medicare coverage. This means you must have Medicare Parts A and B in order to get a Medigap plan.

What happens if you don't buy Medigap?

If you don’t buy your Medigap plan during your open enrollment period, you are not guaranteed to be accepted. You will have to answer different questions about your health that may disqualify you for Medicare Supplement insurance outside of your normal enrollment period.

How long is the Medigap enrollment period?

Medicare Supplements are no different. There is a 6-month Medigap enrollment period, during which you can enroll at any time.

Does Medicare cover medical expenses?

Your regular Medicare plan covers the bulk of your medical costs, but a Medicare Supplement plan can cover some remaining bills, including:

Is it confusing to have Medicare?

Making sure you have the right Medicare coverage can be confusing. Enrollment timing, different plans, and personal requirements can make shopping around for Medicare a hassle.

Does Medicare Allies do annual reviews?

However, Medicare Allies schedules annual reviews with each and every one of our clients to review coverage and shop the market again. If your rates go up or your needs change, this is a great time to discuss your options.

Can you get Medicare Advantage and Medicare Advantage at the same time?

Yes , you can. These plans cannot work together at the same time, so if you wanted to get on a Medicare Advantage plan, you would have to drop your Medigap coverage.

Medicare Supplements Explained

When you first become eligible and sign up to join Medicare, most beneficiaries will also consider and look at the potential Medicare Supplements available to them for additional financial support.

When Is The Best Time To Enroll With Medigap Supplement Insurance?

You will first be able to enroll with Medigap supplement insurance on the first day of the month that you turn 65 years of age and your Medicare Part B coverage becomes effective. Starting on this date, you will have 6 months of an Open Enrollment Period during which time you will be able to sign up for Medigap.

What Other Options Do You Have - Besides Medigap?

One of the most popular solutions for those not sure if they need full Medigap coverage or not is to opt for the Medicare Select policy instead.

When does Medigap coverage start?

Ask for your policy to become effective when you want coverage to start. Generally, Medigap policies begin the first of the month after you apply. If, for any reason, the insurance company won't give you the effective date for the month you want, call your State Insurance Department.

How long is the open enrollment period for Medigap?

Medigap Open Enrollment Period. A one-time only, 6-month period when federal law allows you to buy any Medigap policy you want that's sold in your state. It starts in the first month that you're covered under Part B and you're age 65 or older.

How to fill out a medical application?

Tips for filling out your application 1 Fill out the application carefully and completely, including medical questions. The answers you give will determine your eligibility for open enrollment or guaranteed issue rights (also called "Medigap protections"). 2 If your insurance agent fills out the application, check to make sure it's correct. 3 Remember that the insurance company can't ask you any questions about your family history or require you to take a genetic test. 4 If you buy a Medigap policy during your#N#Medigap Open Enrollment Period#N#A one-time only, 6-month period when federal law allows you to buy any Medigap policy you want that's sold in your state. It starts in the first month that you're covered under Part B and you're age 65 or older. During this period, you can't be denied a Medigap policy or charged more due to past or present health problems. Some states may have additional open enrollment rights under state law.#N#, the insurance company can’t use any medical answers you give to deny you a Medigap policy or change the price. 5 If you provide evidence that you're entitled to a guaranteed issue right, the insurance company can't use any medical answers you give to deny you a Medigap policy or change the price.

What to do if you didn't get your Medigap policy?

If it's been 30 days and you didn't get your Medigap policy, call your insurance company.

Can insurance companies use medical answers to deny you a Medigap policy?

If you provide evidence that you're entitled to a guaranteed issue right , the insurance company can't use any medical answers you give to de ny you a Medigap policy or change the price.

How to find a Medigap policy?

Do any of the following: 1 Use our site to find a Medigap policy. 2 Call your State Health Insurance Assistance Program (SHIP). Ask if they have a "Medigap rate comparison shopping guide" for your state. SHIPs can give you free help choosing a policy. 3 Call your State Insurance Department . Ask if they keep a record of complaints against insurance companies that can be shared with you. Consider any complaints against the insurance company when deciding which Medigap policy is right for you. 4 Look online for information about the insurance companies. 5 Talk to someone you trust, like:#N#A family member#N#Your insurance agent#N#A friend who has a Medigap policy from the same Medigap insurance company 6 Call the insurance companies.

Can you contact more than one insurance company that sells Medigap policies in your state?

Since costs vary between companies, contact more than one insurance company that sells Medigap policies in your state.