While you may be able to purchase a Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Who is eligible for a Medicare supplement insurance plan?

The best time to enroll in a Medicare Supplement plan may be your Medicare Supplement Open Enrollment Period. This period lasts six months and begins the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. For example, your birthday is August 31, 1953, so you turn 65 in 2018.

When can you sign up for Medicare supplement insurance?

Like employer health coverage, Medicare plans come with open enrollment periods. That means you cannot buy a Medicare Supplement plan (or any other Medicare plan) any time you want throughout the year. Generally speaking, you will need to use your Open Enrollment Period or the Annual Enrollment Period (AEP) to enroll in a Medicare Supplement Plan.

Is there open enrollment for Medicare supplements?

The best time to buy a Medicare Supplement insurance plan is typically during the Medicare Supplement Open Enrollment period. During this Open Enrollment period, you cannot be subjected to medical underwriting, where insurance companies could use a pre-existing health condition* as a reason to deny you coverage or charge you more for coverage.

When is open enrollment for Medicare?

Can Medicare Supplement plans be purchased any time of the year?

If you're in good health and comfortable answering medical questions, you can apply to change Medigap plans at any time of the year. Medicare Advantage plans and Medicare Part D prescription drug plans can only be changed during certain times of year, but Medicare supplements are different.Jan 26, 2021

Can you add a Medicare Supplement at any time?

One interesting feature of Medicare Supplement insurance plans is that you can apply for a plan anytime – you only need to be enrolled in Medicare Part A and Part B. However, a plan doesn't have to accept your application, unless you have guaranteed-issue rights.

What is the open enrollment period for Medicare Supplements?

Under federal law, you have a six-month open enrollment period that begins the month you are 65 or older and enrolled in Medicare Part B. During your open enrollment period, Medigap companies must sell you a policy at the best available rate regardless of your health status, and they cannot deny you coverage.

When can I change my Medicare Supplement plan for 2022?

Yes, at any time you can switch from a Medicare Advantage to a Medicare Supplement plan. You have 12 months from when you first enrolled in an Advantage plan to switch back to Original Medicare and pick up a Medigap plan with Guaranteed Issue.

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Can I switch from Plan N to Plan G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

Can you change Medicare supplement plans without underwriting?

During your Medigap Open Enrollment Period, you can sign up for or change Medigap plans without going through medical underwriting. This means that insurance companies cannot deny you coverage or charge you more for a policy based on your health or pre-existing conditions.Nov 22, 2021

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What are the four prescription drug coverage stages?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.Oct 1, 2021

When can I change Medicare Part D?

You can change from one Part D plan to another during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this period, you can change plans as many times as you want.Sep 26, 2021

Which states allow you to change Medicare Supplement plans without underwriting?

In some states, there are rules that allow you to change Medicare supplement plans without underwriting. This includes California, Washington, Oregon, Missouri and a couple others. Call us for details on when you can change your plan in that state to take advantage of the “no underwriting” rules.

When can I switch from Medigap to Medicare Advantage?

The best (and often only time) to switch from Medigap to Medicare Advantage is during the Open Enrollment Annual Election Period which runs from Oct 15th to Dec 7th. To switch during this time, you would enroll in a MA plan which can only start on Jan 1st of the following year.Jul 8, 2015

What is a select Medicare policy?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. . If you buy a Medicare SELECT policy, you have rights to change your mind within 12 months and switch to a standard Medigap policy.

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. .

Can you charge more for a Medigap policy?

Charge you more for a Medigap policy. In some cases, an insurance company must sell you a Medigap policy, even if you have health problems. You're guaranteed the right to buy a Medigap policy: When you're in your Medigap open enrollment period. If you have a guaranteed issue right.

Can Medigap refuse to cover out-of-pocket costs?

A health problem you had before the date that new health coverage starts. . In some cases, the Medigap insurance company can refuse to cover your. out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance.

Can you shorten the waiting period for a pre-existing condition?

It's possible to avoid or shorten waiting periods for a. pre-existing condition. A health problem you had before the date that new health coverage starts. if you buy a Medigap policy during your Medigap open enrollment period to replace ".

When should I enroll in a Medicare Supplement insurance plan?

Medicare Supplement insurance plans help cover out-of-pocket costs, such as coinsurance, copayments and deductibles, which Medicare (Part A and Part B) doesn’t pay. The best time to buy a Medicare Supplement insurance plan is typically during the Medicare Supplement Open Enrollment period.

What are guaranteed-issue rights?

Some situations may provide you with guaranteed-issue rights, where insurance companies cannot refuse you coverage or charge you more for a pre-existing condition* even outside of Open Enrollment. Situations that could result in guaranteed-issue rights are

When will I be subjected to medical underwriting?

Insurance companies may still sell you a Medicare Supplement insurance plan after your Open Enrollment period ends and you don’t have guaranteed-issue rights, but you may have to meet medical underwriting requirements.

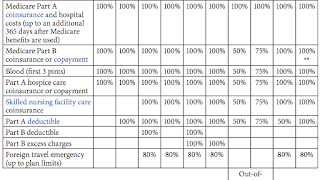

What does a Medicare Supplement insurance plan cover?

Medicare Supplement insurance plans are standardized, and in most states they’re labeled A through N (plans E, H, I, and J are no longer sold).