When can you join a Medicare Advantage plan?

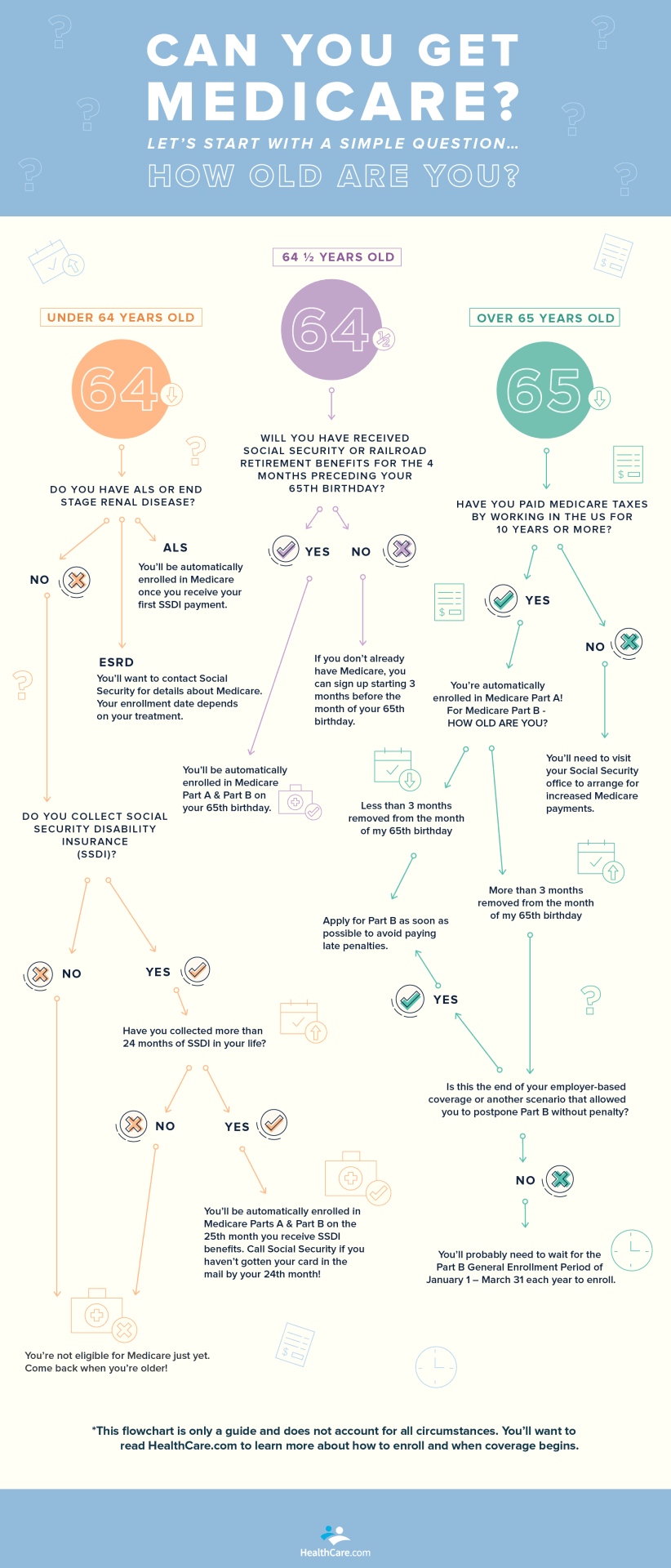

4 rows · Nov 18, 2021 · If you become eligible for Medicare before 65 due to a qualifying disability, you may be able ...

What companies offer Medicare Advantage plans?

Apr 18, 2022 · Medicare Advantage Open Enrollment Period (OEP) If you are enrolled in a Medicare Advantage plan, you can make changes during the Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31 of each year. During this period, you can: Switch to another Medicare Advantage plan, with or without drug coverage

Who has the best Medicare Advantage plan?

Mar 19, 2021 · When can I enroll in a Medicare Advantage plan? You must have Medicare Part A and Medicare Part B to enroll in a Medicare Advantage plan. People can enroll in a Medicare Advantage plan for the first time using the Initial Coverage Election Period. If you enroll in Medicare Part B when you are first eligible to do so, using the Initial Enrollment Period for …

When is it too late to enroll in Medicare?

Visit the plan's website to see if you can join online. Fill out a paper enrollment form. Contact the plan to get an enrollment form, fill it out, and return it to the plan. All plans must offer this option. Call the plan you want to join. Get your plan's contact information. Call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. When you join a Medicare Advantage Plan, you'll have to …

When can I add an advantage plan to my Medicare?

You're newly eligible for Medicare because you turn 65. Sign up for a Medicare Advantage Plan (with or without drug coverage) or a Medicare drug plan. During the 7‑month period that starts 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65.

Can you be turned down for a Medicare Advantage plan?

Generally, if you're eligible for Original Medicare (Part A and Part B), you can't be denied enrollment into a Medicare Advantage plan. If a Medicare Advantage plan gave you prior approval for a medical service, it can't deny you coverage later due to lack of medical necessity.

What is the Medicare Advantage initial enrollment period?

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

How do I switch from Medicare supplement to Medicare Advantage?

The best (and often only time) to switch from Medigap to Medicare Advantage is during the Open Enrollment Annual Election Period which runs from Oct 15th to Dec 7th. To switch during this time, you would enroll in a MA plan which can only start on Jan 1st of the following year.Jul 8, 2015

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What pre-existing conditions are not covered?

Health insurers can no longer charge more or deny coverage to you or your child because of a pre-existing health condition like asthma, diabetes, or cancer, as well as pregnancy. They cannot limit benefits for that condition either.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

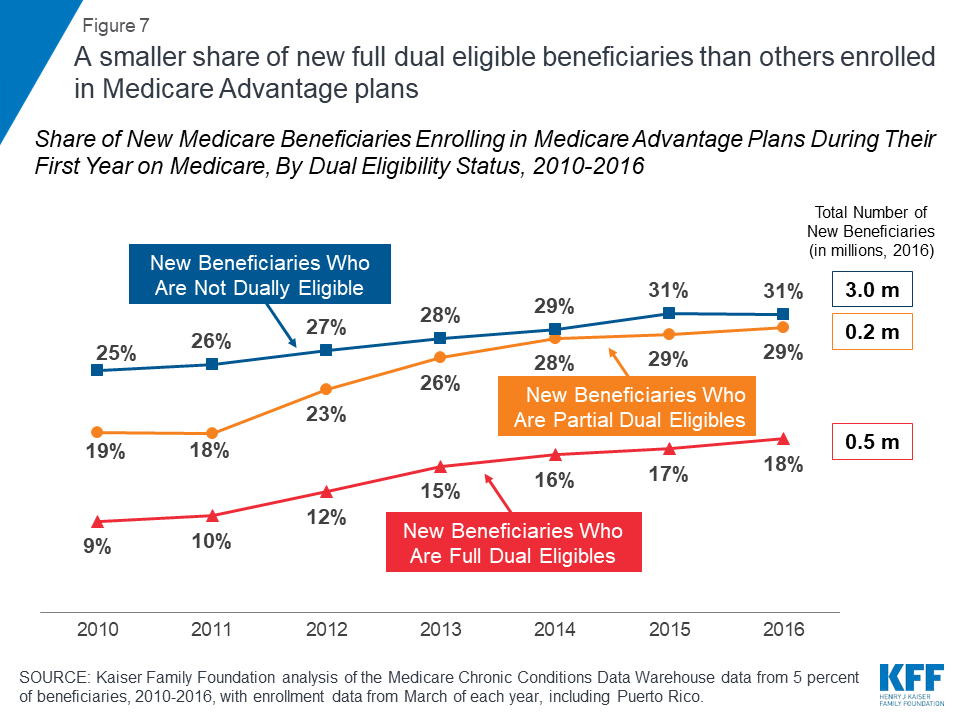

Can you switch Medicare plans anytime?

If you're covered by both Medicare and Medicaid, you can switch plans at any time during the year. This applies to Medicare Advantage as well as Medicare Part D.

What is the difference between Medicare and Medicare Advantage plans?

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of- pocket costs than Original Medicare. In many cases, you'll need to use doctors who are in the plan's network.

When can I change my Medicare Supplement plan for 2022?

Yes, at any time you can switch from a Medicare Advantage to a Medicare Supplement plan. You have 12 months from when you first enrolled in an Advantage plan to switch back to Original Medicare and pick up a Medigap plan with Guaranteed Issue.

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

When Can I Sign Up For Medicare Part A and Part B?

If you’re already getting Social Security or Railroad Retirement Board benefits, usually you will be contacted a few months before you become eligi...

When Can I Sign Up For Prescription Drug Coverage?

You can sign up for stand-alone Medicare Part D Prescription Drug coverage during your Initial Enrollment Period.You must have Medicare Part A or P...

When Can I Enroll in A Medicare Advantage Plan?

You must have Medicare Part A and Medicare Part B to enroll in a Medicare Advantage plan. People can enroll in a Medicare Advantage plan for the fi...

When Can I Sign Up For A Medicare Supplement Insurance Plan?

There are no cost penalties for late enrollment, but your eligibility for some Medicare Supplement insurance plans can be impacted if you delay enr...

What Happens If I Miss My Medicare Supplement Open Enrollment period?

Your eligibility may be impacted if you miss the Medicare Supplement Open Enrollment Period: 1. Your application could be declined if you have a pr...

When Can You Change Your Medicare Advantage Or Medicare Part D Prescription Drug Coverage?

1. During your Initial Enrollment Period for Medicare, described above 2. During Medicare’s Annual Election Period 3. During a Special Election Per...

When Is Medicare’S Annual Election period?

1. The Medicare Advantage and Prescription Drug Plan Annual Election Period runs from October 15 to December 7 each year.

What Can You Do During The Annual Election Period (AEP)?

Plan benefits can change from year to year, so you have the option to change your Medicare coverage every year during Medicare’s Annual Election Pe...

What is ESRD in Medicare?

You have been diagnosed with end-stage renal disease (ESRD). You have been diagnosed with Amyotrophic Lateral Sclerosis (also known as ALS or Lou Gehrig’s disease). When you first qualify for Medicare you enroll during the Initial Enrollment Period.

When will Medicare Part B start in 2021?

If she chooses a Medicare Advantage plan in January and submits an enrollment request, her Medicare Advantage plan would typically begin April 1, 2021. If you delayed your enrollment in Medicare Part B, your Initial Coverage Election Period is only the three months before Medicare Part B coverage begins.

What is the Medicare premium for 2021?

In 2021, the “standard” Medicare Part B premium amount is $148.50 (the amount you pay may be different depending on your income). For example, Maya first qualified to enroll in Medicare Part B on 2/1/2019. She delayed her enrollment.

When is Medicare Part B effective?

His coverage for Medicare Part B was effective July 1, 2020. His Initial Coverage Election Period was April– June 2020. If you delay Part B enrollment, you may have to wait until the Annual Election Period, which runs from Oct. 15 – Dec. 7 each year, to enroll in a Medicare Advantage plan.

When does Medicare open enrollment start?

Plan benefits can change from year to year, so you have the option to change your Medicare coverage every year during Medicare’s Annual Election Period (AEP), also known as the “Open Enrollment for Medicare Advantage and Medicare prescription drug coverage” which runs from October 15 to December 7 each year.

Does Medicare have a yearly limit?

Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. Once you reach this limit, you’ll pay nothing for covered services. Each plan can have a different limit, and the limit can change each year. You should consider this when choosing a plan.

Does Medicare cover vision?

You still get complete Part A and Part B coverage through the plan. Some plans offer extra benefits that Original Medicare doesn’t cover – like vision, hearing, or dental. Your out-of-pocket costs may be lower in a Medicare Advantage Plan.

How to enroll in Medicare Advantage?

How to enroll in a Medicare Advantage plan 1 Click the Find Plans button on this page and follow the prompts to display a list of plans in your area. From there, you can compare plans and even enter your medications to compare plans in more detail (click Rx Drugs). Once you decide on a plan, you can enroll online by clicking the Enroll button. 2 Arrange a time to talk with us, and we can help you enroll. Use the links below to set up a phone call. 3 Call the insurance company that’s offering the plan you want. 4 Call Medicare at the number below.

What is Medicare Advantage Part C?

Medicare Advantage (Medicare Part C) is an optional way to receive your Original Medicare (Part A and Part B) benefits. Under Part C, these benefits are delivered to you through a private insurance company that contracts with Medicare.

How long does Medicare enrollment last?

That period spans seven months. It starts three months before your birthday month, includes the birthday month, and continues three more months.

When is the enrollment period for Medicare Part B?

Another enrollment period that comes up every year is the Fall Open Enrollment, also called the Annual Election Period. It goes from October 15 to December 7 every year. You can enroll in a Medicare Advantage plan, ...

Do you have to pay Medicare Part B premium?

When you’re enrolled in a Medicare Advantage plan, you’re still in the Medicare program. You still need to pay your monthly Medicare Part B premium, as well as the plan premium (if it charges one).

Can I get Medicare if I am 65?

If you are under 65 and have end-stage renal disease (ESRD, which is permanent kidney failure), you can generally enroll in a Medicare Advantage plan. Start comparing plans by entering your zip code on this page.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

How to switch

If you're already in a Medicare Advantage Plan and want to switch, follow these steps:

If you have other coverage

Talk to your employer, union, or other benefits administrator about their rules before you join a Medicare Advantage Plan. In some cases, joining a Medicare Advantage Plan might cause you to lose employer or union coverage. If you lose coverage for yourself, you may also lose coverage for your spouse and dependents.

How long does it take to enroll in Part D?

This includes three months prior to your 65th birthday, the month of your birthday and then three months after your 65th birthday. Failing to enroll within this time period, also known as the initial enrollment period, means that you may face a late enrollment penalty if you choose to add Part D coverage at a later date.

Why is Medicare important?

Enrolling in Medicare is an important step for many people in protecting their health and their finances as they age. The Medicare program assists millions of seniors and certain individuals with qualifying disabilities, and without Medicare, some Americans would struggle to afford the cost of healthcare and related expenses.

What is a qualified Medicare beneficiary?

The Qualified Medicare Beneficiary program is a type of Medicare Savings Program (MSP). The QMB program allows beneficiaries to receive financial help from their state of residence with the costs of Medicare premiums and more. A Qualified Medicare Beneficiary gets government help to cover health care costs like deductibles, premiums, and copays.

What is QMB in Medicare?

Qualified Medicare Beneficiary (QMB) Program. If you’re a Medicare beneficiary, you know that health care costs can quickly add up. These costs are especially noticeable when you’re on a fixed income. If your monthly income and total assets are under the limit, you might be eligible for a Qualified Medicare Beneficiary program, or QMB.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is QMB insurance?

The QMB program pays: The Part A monthly premium (if applicable) The Part B monthly premium and annual deductible. Coinsurance and deductibles for health care services through Parts A and B. If you’re in a QMB program, you’re also automatically eligible for the Extra Help program, which helps pay for prescription drugs.

Does Medigap cover copays?

This program helps you avoid the need for a Medigap plan by assisting in coverage for copays, premiums, and deductibles. Those that don’t qualify for the QMB program may find that a Medigap plan helps make their health care costs much more predictable.