The best time to enroll in a Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

When to enroll in Medicare if still working?

· When can I enroll in a Medicare Supplement Plan? When newly eligible for Medicare, you enter a seven-month Initial Enrollment Period (IEP) which begins three months before your 65th birthday and ends three months after the month of your birthday.

When is it too late to enroll in Medicare?

· Since there is an open enrollment period, you might be wondering, “What is the deadline for Medicare Supplemental insurance?” Your open enrollment period is unique to you. This period will begin the month you turn 65 and enroll in Medicare Part B. After this 6-month period, you cannot repeat Open Enrollment.

When is the earliest you can get Medicare?

· The Medicare Supplement Open Enrollment Period begins the month you turn 65 and enroll in Medicare Part B. This period is outlined by federal law and ensures that all first-time enrollees get equal treatment, options, and protection the first time they choose a plan. During your Medicare Supplement Open Enrollment Period:

When should I apply for a Medicare supplement plan?

· Usually the best time to enroll is during your Medicare Supplement Open Enrollment Period. When is the Medicare Supplement Open Enrollment period? This six-month period runs from the first day of the month in which you are both age 65 (or older) and enrolled in Medicare Part B. What happens if I miss my Medicare Supplement Open Enrollment Period?

Can you add a supplement to Medicare at any time?

You can apply for a Medicare Supplement insurance plan anytime once you're enrolled in Medicare Part A and Part B – you're not restricted to certain enrollment periods as you are with other Medicare enrollment options.

When can a consumer enroll in a Medicare supplement plan?

General Enrollment Period (GEP): If you have Medicare Part A and are enrolling in Part B for the first time during the GEP, which is from January 1 – March 31 each year, you can also enroll in a Medicare Advantage plan (with our without prescription drug coverage) or a Part D prescription drug plan between April 1 – ...

Can Medicare supplement be purchased anytime of the year?

Generally, there is no type of Medicare plan that you can get “any time.” All Medicare coverage, including Medicare Supplement (Medigap) plans, is subject to enrollment periods. Other types of Medicare plans, like Medicare Advantage and Medicare Part D prescription drug plans, have open enrollment periods every year.

What is deadline for Medicare supplement?

You can certainly apply for a new Medigap plan during the annual Medicare open enrollment period (October 15 to December 7), but that's no different from any other time of the year.

When can you switch from Medicare Advantage to a Medicare supplement?

From January 1 to March 31 each year, a person can switch from one Medicare Advantage plan to another or drop their Medicare Advantage plan altogether in favor of original Medicare. During this time, a person can also join a prescription drug plan and Medigap.

How long before you turn 65 do you apply for Medicare?

3 monthsYour first chance to sign up (Initial Enrollment Period) It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

What is the average cost of supplemental insurance for Medicare?

Medicare Supplemental Insurance (Medigap) Costs. In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

Can Medigap insurance be denied for pre existing conditions?

Be aware that under federal law, Medigap policy insurers can refuse to cover your prior medical conditions for the first six months. A prior or pre-existing condition is a condition or illness you were diagnosed with or were treated for before new health care coverage began.

Which is true about Medicare supplement open enrollment?

Which is true about Medicare Supplement Open Enrollment? By federal law, Medicare Supplement Open Enrollment is the first 6 months a consumer is 65 or older and enrolled in Medicare Part B.

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Does Medicare coverage start the month you turn 65?

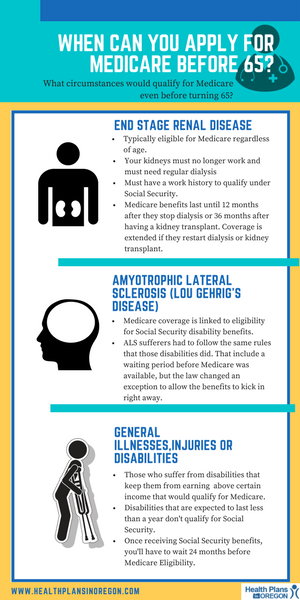

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare.

When Can I Sign Up For Medicare Part A and Part B?

If you’re already getting Social Security or Railroad Retirement Board benefits, usually you will be contacted a few months before you become eligi...

When Can I Sign Up For Prescription Drug Coverage?

You can sign up for stand-alone Medicare Part D Prescription Drug coverage during your Initial Enrollment Period.You must have Medicare Part A or P...

When Can I Enroll in A Medicare Advantage Plan?

You must have Medicare Part A and Medicare Part B to enroll in a Medicare Advantage plan. People can enroll in a Medicare Advantage plan for the fi...

When Can I Sign Up For A Medicare Supplement Insurance Plan?

There are no cost penalties for late enrollment, but your eligibility for some Medicare Supplement insurance plans can be impacted if you delay enr...

What Happens If I Miss My Medicare Supplement Open Enrollment period?

Your eligibility may be impacted if you miss the Medicare Supplement Open Enrollment Period: 1. Your application could be declined if you have a pr...

When Can You Change Your Medicare Advantage Or Medicare Part D Prescription Drug Coverage?

1. During your Initial Enrollment Period for Medicare, described above 2. During Medicare’s Annual Election Period 3. During a Special Election Per...

When Is Medicare’S Annual Election period?

1. The Medicare Advantage and Prescription Drug Plan Annual Election Period runs from October 15 to December 7 each year.

What Can You Do During The Annual Election Period (AEP)?

Plan benefits can change from year to year, so you have the option to change your Medicare coverage every year during Medicare’s Annual Election Pe...

How long is the Medigap enrollment period?

Medicare Supplements are no different. There is a 6-month Medigap enrollment period, during which you can enroll at any time.

What happens if you don't buy Medigap?

If you don’t buy your Medigap plan during your open enrollment period, you are not guaranteed to be accepted. You will have to answer different questions about your health that may disqualify you for Medicare Supplement insurance outside of your normal enrollment period.

Does Medicare change every year?

Particularly, Medicare Advantage plans can (and do!) change every year. There’s lots of moving pieces when it comes to Medicare coverage, so it is important to know your options.

Do you have to renew Medicare if you love it?

No, you don’t. If you absolutely love your Medicare coverage, it will continue to renew, as long as you are paying your premiums throughout the year.

Does Medicare Allies do annual reviews?

However, Medicare Allies schedules annual reviews with each and every one of our clients to review coverage and shop the market again. If your rates go up or your needs change, this is a great time to discuss your options.

Is Medicare Supplement insurance private?

Because Medicare Supplement insurance is provided by private companies, these health questions and requirements vary per company.

Does Medicare cover medical expenses?

Your regular Medicare plan covers the bulk of your medical costs, but a Medicare Supplement plan can cover some remaining bills, including:

What Are Medicare Supplement Plans?

Since 2014, nearly 4 million people have purchased a Medicare Supplement Plan. But what are they, and why are they becoming more popular for people on Medicare?

Who Is Eligible to Enroll in a Medicare Supplement Plan?

Anyone who is eligible for Original Medicare coverage can buy Medicare Supplement Insurance.

When to Apply for Your Medicare Supplement Plan

Purchasing a Medicare Supplement Plan can be a stressful process, but signing up at the right time will ensure:

Medicare Supplement Open Enrollment Period

Your Medicare Supplement Plan Open Enrollment Period (also known as your Medigap Open Enrollment Period) is a one-time six month period when you can sign up for a Medicare Supplement Plan without having to worry about your health status or chronic conditions.

Special Enrollment Periods and Medicare Supplement Plans

Usually, a person will only get one opportunity to benefit from their Medigap Open Enrollment Period.

Applying at Any Time for a Medicare Supplement Plan

You can also purchase Medicare Supplement Insurance outside of your Medicare Supplement Open Enrollment Period, but remember that insurance companies don’t have to accept you as a member.

Choosing the Right Medicare Supplement Plan Can Make All the Difference

It’s also important to consider the type of cover you get when you sign up for a Medicare Supplement Plan.

When is Medicare Supplement open enrollment?

When is the Medicare Supplement Open Enrollment period? This six-month period runs from the first day of the month in which you are both age 65 (or older) and enrolled in Medicare Part B .

When is the first Medicare enrollment period?

The Initial Enrollment Period is a seven-month period that starts three months before you are first eligible for Medicare. For example, Mary Doe Jones turned 65 on April 27, 2021. She is first eligible for Medicare starting in April 2021 because she is turning 65. Her Initial Enrollment Period for Medicare starts January 1, ...

When is the Medicare election?

The Medicare Advantage and Prescription Drug Plan Annual Election Period runs from October 15 to December 7 each year.

When can you change your Medicare Advantage plan?

During the Medicare Advantage Open Enrollment Period (January 1- March 31). You can’t change from one stand-alone Medicare prescription drug plan to another during this time.

When is Medicare Part B effective?

His coverage for Medicare Part B was effective July 1, 2020. His Initial Coverage Election Period was April– June 2020. If you delay Part B enrollment, you may have to wait until the Annual Election Period, which runs from Oct. 15 – Dec. 7 each year, to enroll in a Medicare Advantage plan.

When will Medicare Part B start in 2021?

If she chooses a Medicare Advantage plan in January and submits an enrollment request, her Medicare Advantage plan would typically begin April 1, 2021. If you delayed your enrollment in Medicare Part B, your Initial Coverage Election Period is only the three months before Medicare Part B coverage begins.

When does Mary Doe Jones start Medicare?

For example, Mary Doe Jones’s Medicare Initial Enrollment Period is January 1, through July 31, 2021. She went to Social Security and filled out an application on January 15, 2021. Her Medicare Part B coverage was effective April 1, 2021. Her Initial Coverage Election Period for Medicare Advantage is also January 1 – July 31, 2021. If she chooses a Medicare Advantage plan in January and submits an enrollment request, her Medicare Advantage plan would typically begin April 1, 2021.

When to enroll in Medicare Supplement Plan?

When to enroll in a Medicare Supplement plan. The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment Period, the six-month period that starts when you’re 65 or older and enrolled in Medicare Part B. During this time frame, you have “ guaranteed issue rights ,” meaning you have a guaranteed right ...

Does Medicare Supplement cover copayments?

If you’ve had Original Medicare for a while, you may have heard of how Medicare Supplement plans may help with certain costs that Medicare doesn’t cover. Medicare Supplement plans work alongside your Medicare Part A and Part B benefits to help pay for costs that Medicare doesn’t cover, like copayments, coinsurance, deductibles, and overseas travel coverage.

Can you get a guaranteed issue with Medicare?

You may have guaranteed-issue rights in some situations, like if you’re in a Medicare Advantage plan and move out of the plan’s area of service, or your Medicare Advantage plan leaves Medicare. But for the most part, you’ll generally have more limited options when it comes to the Medicare Supplement plans available to you.

Does Medicare cover pre-existing conditions?

However, if you enroll when you have a guaranteed issue right, the insurance company can’t make you wait before covering your pre-existing conditions.

Can you use medical underwriting to sell Medicare?

Medical underwriting can’t be used by the insurance company when deciding whether to sell you a Medicare Supplement plan. Your health status or pre-existing conditions can’t be taken into consideration when determining Medicare Supplement plan premiums. The insurance company must cover all of your pre-existing conditions.

Can Medicare deny you coverage?

Deny you coverage based on your health status. If you’re trying to enroll in a Medicare Supplement plan for the first time, it could be hard for you to find a plan that will accept you when you have pre-existing health conditions. And even if you’re already enrolled in a Medicare Supplement plan, it may be more difficult to switch ...

What is a select Medicare policy?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. . If you buy a Medicare SELECT policy, you have rights to change your mind within 12 months and switch to a standard Medigap policy.

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

Can you shorten the waiting period for a pre-existing condition?

It's possible to avoid or shorten waiting periods for a. pre-existing condition. A health problem you had before the date that new health coverage starts. if you buy a Medigap policy during your Medigap open enrollment period to replace ".

Can you charge more for a Medigap policy?

Charge you more for a Medigap policy. In some cases, an insurance company must sell you a Medigap policy, even if you have health problems. You're guaranteed the right to buy a Medigap policy: When you're in your Medigap open enrollment period. If you have a guaranteed issue right.

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

Can you get Medicare if you are 65?

Some states provide these rights to all people with Medicare under 65. Other states provide these rights only to people eligible for Medicare because of disability or only to people with ESRD. Check with your State Insurance Department about what rights you might have under state law.

Can you buy a Medigap policy with a guaranteed issue right?

If you buy a Medigap policy when you have a guaranteed issue right (also called "Medigap protections"), the insurance company can't use a pre-existing condition waiting period.

How long do you have to wait to get Medicare Supplement?

Keep in mind that even though a Medicare Supplement insurance company cannot reject your enrollment for health reasons, the company is allowed to make you wait up to six months before covering your pre-existing conditions.

How long does Medicare Supplement open enrollment last?

How can enrollment periods affect my eligibility for Medicare Supplement plans? The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period —for most people, this period starts the month that you turn 65 and have Medicare Part B, and goes for six months.

Can you sell a Medicare Supplement?

Important note: It’s illegal for anyone to sell you a Medicare Supplement policy if he or she knows you’re in a Medicare Advantage plan, unless you’re switching back to Original Medicare.

Can you move out of Medicare Advantage?

You move out of your Medicare Advantage plan’s service area.

How long is a trial period for Medicare Advantage?

Trial rights allow you to join a Medicare Advantage plan for a one-year trial period if you are enrolling in Medicare Part C for the first time. If you’re not happy with the plan, you can return to Original Medicare anytime within the first 12 months.

Can you change your Medicare Supplement plan if it goes bankrupt?

For example, if your Medicare Supplement insurance company goes bankrupt or misleads you, you may be able to change Medicare Supplement plans with guaranteed issue.

Can you get Medicare Supplement if you have health issues?

This is when you can get any Medicare Supplement plan that’s available in your area, regardless of any health issues you may have. The insurance company can’t charge you more if you have health problems or deny you coverage because of pre-existing conditions.

How long does it take to get a Medicare Supplement?

Once you select a specific Medicare Supplement plan, the application process should take less than an hour. It would be a mistake, though, to wait until the last minute to select a plan.

When does Medicare Part B open enrollment start?

Example B: You’re already 65, you sign-up for Medicare Part B and it begins June 1. This means that your Medigap Open Enrollment Period is from June 1 to November 30. If you get Medicare Part B before you turn 65, then your Open Enrollment Period starts the first day of the month you turn 65.

Can Medicare Supplements be sold online?

Medicare Supplements can only be sold by licensed insurance agents. These agents are trained to present you with multiple options from different companies. Agents make the process as easy and pressure-free as possible, on the phone or online.

How long does Medicare cover a condition?

While your Medicare Supplement plan can’t pick and choose which health issues to cover, your plan can delay coverage for conditions that were diagnosed or treated during the six months before you enroll and for up to six months after you enroll.

Is Medicare Supplement a replacement for Original Medicare?

Unlike Medicare Advantage programs, these are not replacement plans for Original Medicare. When you get sick or injured, deductibles and copayments with Original Medicare are harsh. The solution is Medicare Supplement plans. They’re designed by the federal government but sold by private companies.

Where do you live with Medicare Select?

You have Original Medicare and a Medicare SELECT policy, and you move out of the Medicare SELECT policy’s service area. You live in CT, MA, NY, or ME. Several states, including California, Oregon, and Missouri allow those who already have a Medicare Supplement to change to a plan with the same or lesser benefits.

How long does it take to disenroll from Medicare?

You decide to disenroll from a Medicare Advantage plan during a 12-month trial period. There are two times this happens.

How long does it take to apply for Medicare Supplement?

When to apply for a Medicare Supplement plan. Here's the quick answer: Most people should apply for a Medigap plan within six months of signing up for Part B. Medigap open enrollment begins when you sign up for Medicare Part B (at age 65) and lasts for six months. If you defer Part B coverage past age 65 because of health coverage ...

How many days do you have to enroll in Medigap?

In most of these scenarios, you have 63 days to choose and enroll in a Medigap plan. For a full description of these scenarios, see the table on Medicare.gov.

What is a six month enrollment period?

During your six-month enrollment period, federal law protects you with guaranteed issue rights (sometimes known as Medigap protection s). These rights allow you to purchase any policy available in your area, regardless of your current health. But outside of this window, insurance companies are legally allowed to refuse you a policy, charge more because of your health, or impose waiting periods on your coverage.

Is eligibility.com a Medicare provider?

Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.

Is eligibility.com a DBA?

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency (collectively "Medicare System Providers"). Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.

Can you keep Medicare and Medigap together?

Be sure to keep your Medicare and Medigap cards together in a safe place. Your Medigap plan will be guaranteed renewable if you apply within your window of guaranteed issue rights. Guaranteed renewable means that as long as you continue to pay your premiums, you’ll keep your plan for as long as you’d like.

What does MA mean in Medicare?

You’re enrolled in Medicare Advantage (MA) or have a Medicare SELECT policy, but you move out of the service area or the provider stops covering your area.