Full Answer

When can I enroll in a Medicare supplement plan?

When can I enroll in a Medicare Supplement Plan? When newly eligible for Medicare, you enter a seven-month Initial Enrollment Period (IEP) which begins three months before your 65th birthday and ends three months after the month of your birthday.

How long does it take to enroll in Medicare Advantage?

Enrolling in a Medicare Advantage plan during your Initial Enrollment Period When you first become eligible for Medicare, you have a 7-month Initial Enrollment Period (IEP) to enroll in Medicare. Then once enrolled in Part A and Part B, you can sign up for a Medicare Advantage plan (also known as Medicare Part C).

How do I enroll in a Medicare cost plan?

Companies that offer Medicare cost plans must provide Medicare beneficiaries with an open enrollment period of at least 30 days. During this time, you’ll submit an application to the plan’s provider to enroll. Enrollment details may be different depending on the company that’s offering the cost plan.

Who is eligible to join a Medicare cost plan?

Eligible enrollees who live within a Medicare cost plan’s service area can join the plan when it’s accepting new members. A cost plan that is accepting new enrollees must have an annual open enrollment window of at least 30 days, although they can set an enrollment cap and close enrollment once it’s reached.

What is the enrollment period for Medicare cost Plans?

30 daysCompanies that offer Medicare cost plans must provide Medicare beneficiaries with an open enrollment period of at least 30 days. During this time, you'll submit an application to the plan's provider to enroll. Enrollment details may be different depending on the company that's offering the cost plan.

What is a Medicare cost share plan?

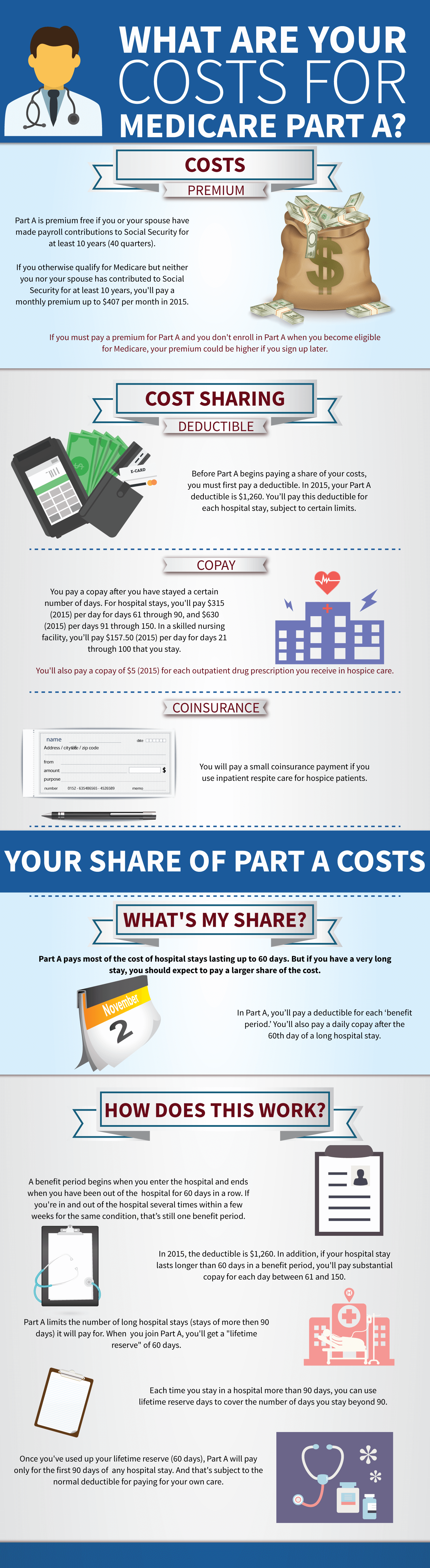

The share of costs covered by your insurance that you pay out of your own pocket. This term generally includes deductibles, coinsurance, and copayments, or similar charges, but it doesn't include premiums, balance billing amounts for non-network providers, or the cost of non-covered services.

What is a cost plan?

But unlike Medicare Advantage plans, a cost plan offers policyholders the option of receiving coverage outside of the network, in which case the Medicare-covered services are paid for through Original Medicare.

When should I start looking at Medicare plans?

65This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month....When your coverage starts.If you sign up:Coverage starts:2 or 3 months after you turn 653 months after you sign up3 more rows

Do Medicare cost plans have copays?

A Medicare Advantage (Part C) plan is offered by private companies. It is an alternative to original Medicare Part A and Part B, and may offer additional benefits. In addition to plan premiums, a person will have to cover copays and deductibles. Costs may vary among plans.

Is the cost of Medicare going up in 2022?

In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022.

What is the difference between a cost estimate and a cost plan?

In the construction industry — a good example of project management — a cost estimate is a prediction of the costs of construction. A cost plan determines the fiscal feasibility of an initiative.

What should be included in a cost plan?

It may include an outline plan for how that money will be spent, and a breakdown of the items it will be spent on. Budgets set a limit for expenditure and this can help determine what is affordable. They should be set as early as possible so that expectations can be managed.

What is the process of cost planning?

Cost planning and project estimating is the process of budget formation, cost control through the design process and finally cost control through procurement and the construction phases. The project costplan is an evolution of the feasibility stage costing as well as risks identified through design development.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Do I automatically get Medicare when I turn 65?

You automatically get Medicare when you turn 65 Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

What is Medicare cost plan?

What is a Medicare cost plan? A Medicare cost plan is similar to a Medicare Advantage plan in that enrollees have access to a network of doctors and hospitals, and may have additional benefits beyond what’s provided by Original Medicare.

Who can join Medicare?

Who can join a Medicare cost plan? Eligible enrollees who live within a Medicare cost plan’s service area can join the plan when it’s accepting new members. A cost plan that is accepting new enrollees must have an annual open enrollment window of at least 30 days, although they can set an enrollment cap and close enrollment once it’s reached.

What is the competition clause in Medicare?

The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (which rebranded Medicare+Choice as Medicare Advantage) created a competition clause that banned Medicare Cost plans from operating in areas where they faced substantial competition from Medicare Advantage plans.

How many Medicare plans are there in Minnesota?

There wee 27 cost plans available in Minnesota as of 2018, and although that dropped in 2019, there are still 21 plans available in Minnesota in 2020. People who still have Medicare cost plans available in their area can still enroll, and there are cost plans available in 2020 in Colorado, Iowa, Illinois, Maryland, Minnesota, Nebraska, ...

How many people are on Medicare in 2019?

According to a Kaiser Family Foundation analysis, the total number of cost plan enrollees dropped to about 200,000 people as of 2019.

Which states do not have Medicare?

The rest were spread across Colorado, District of Columbia, Iowa, Illinois, Maryland, North Dakota, South Dakota, Texas, Virginia, and Wisconsin; most states do not have Medicare cost plans available. But there were far fewer Medicare cost plan enrollees as of 2019, due to the implementation of the Medicare Advantage competition clause.

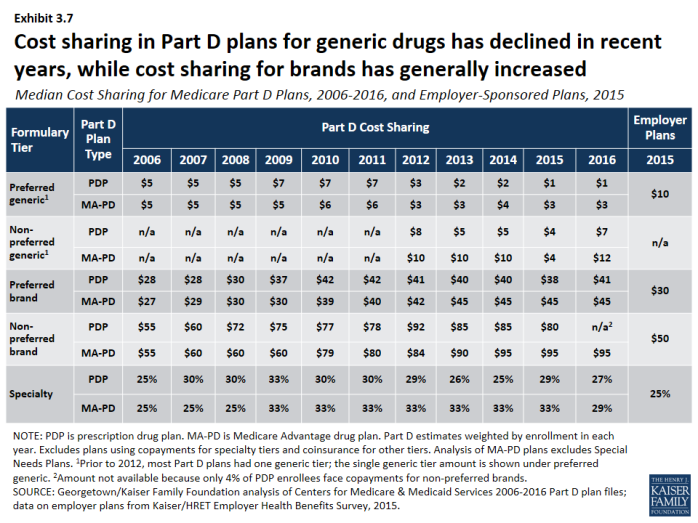

Does a cost plan have supplemental Part D?

If the cost plan offers optional supplemental Part D prescription coverage, enrollment in (or disenrollment from) the Part D coverage is limited to the normal annual open enrollment period for Part D plans. If the cost plan does not have a supplemental Part D plan available — or if it does and the enrollee would prefer a different Part D plan — ...

How long does it take to enroll in Medicare?

Companies that offer Medicare cost plans must provide Medicare beneficiaries with an open enrollment period of at least 30 days. During this time, you’ll submit an application to the plan’s provider to enroll. Enrollment details may be different depending on the company that’s offering the cost plan.

What happens when you enroll in Medicare?

When you enroll in a Medicare cost plan, you gain access to the plan’s network of healthcare providers. You can either choose a provider within this network or an out-of-network provider. When you go out of network, it’s covered by original Medicare.

What are the benefits of Medicare Advantage?

These plans offer many of the extra benefits that come with Medicare Advantage plans, such as dental, vision, and hearing care . However, unlike Medicare Advantage plans, people with Medicare cost plans have more flexibility to use out-of-network doctors and to choose a separate Part D plan.

What is Medicare cost plan?

A Medicare cost plan blends parts of both original Medicare and Medicare Advantage. These plans work together with your original Medicare coverage while providing additional benefits and flexibility. Medicare cost plans are very similar to Medicare Advantage plans. However, there are some key differences between the two.

How to enroll in Medicare Part B?

To enroll in a Medicare cost plan, you must meet the following eligibility requirements: 1 be enrolled in Medicare Part B 2 live in an area where Medicare cost plans are offered 3 find a Medicare cost plan that’s accepting new members 4 complete an application during the plan’s enrollment period 5 agree to all cost plan rules that are disclosed during the enrollment process

How old do you have to be to get Medicare?

To enroll in a Medicare cost plan, you must first be enrolled in Medicare Part B. To be eligible for Part B, you must meet one of the following criteria: be age 65 or older. have a disability and receive Social Security Disability Insurance.

Does Medicare have a Part D plan?

Additionally, some Medicare cost plans come bundled with Part D prescription drug coverage . If your plan doesn’t include Part D, you can enroll in a separate Part D plan that best suits your needs. There’s also additional flexibility in switching plans.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap or MedSup), sold by private companies, helps pay some health care costs that Original Medicare (Part A and Part B) doesn’t cover. Policies can include coverage for deductibles, coinsurance, hospital costs, skilled nursing facility costs, and sometimes health care costs when traveling outside the U.S.

How long is the free look period for Medigap?

If you’re within your six-month Medigap Open Enrollment Period and considering a different Medigap plan, you may try a new Medigap policy during a 30-day “free look period.”. During this period, you will have two Medigap plans, and pay the premium for both.

What happens if a Medigap policy goes bankrupt?

Your Medigap insurance company goes bankrupt and you lose your coverage , or your Medigap policy coverage otherwise ends through no fault of your own. You leave a Medicare Advantage plan or drop a Medigap policy because the company hasn’t followed the rules, or it misled you.

How long does it take to get Medicare Advantage?

This is the period that begins three months before your birth month and ends three months after it. While there is no cost penalty for signing up at any time during this period, it is highly desirable to sign up as early in the period as possible. This is because any plan with a Part D component takes approximately three months to kick in, which means you could see a temporary gap in your drug coverage if you sign up any time after your birthday. This gap could last as long as three months after the time you lose the coverage you had before switching to Medicare, so it’s helpful to start your research before the ICEP and get the forms submitted prior to the first day of the month you turn 65.

What is Medicare Part A?

Medicare Part A is the basic coverage Medicare provides for its beneficiaries. This is a no-cost plan that covers the cost of inpatient hospitalization for eligible seniors. All U.S. citizens are automatically enrolled in Part A when they become eligible, since there is no out-of-pocket cost or monthly premium for this coverage. Services covered under Part A generally revolve around admissions to the hospital and treatments provided as part of regular inpatient care. Providers bill the Original Medicare program directly, which then pays for services according to a fixed or negotiated schedule. All Medicare-qualified providers are part of the Part A network, and they are required to bill only Medicare for covered services, unless the patient has a Medicare Advantage plan that provides the same coverage.

Is Medicare Supplement Part C?

Medicare supplements are not strictly part of the Medicare system, but they are a consequence of it. Whether you have Original Medicare or Medicare Advantage, there could easily be some gaps in coverage that leave certain services out. Many seniors also face high copayments and extra out-of-pocket expenses for services not covered by their Part C plan. Medicare supplement plans plug these gaps with various coverage options. These are highly variable, and each plan has to be discussed with an insurance agent to make sure the coverage is adequate for your situation.

Can you enroll in Medicare Advantage outside of the normal enrollment period?

Sometimes circumstances force beneficiaries to enroll in Medicare Advantage outside of the normal enrollment periods. This can be tricky to do without incurring a penalty rate, but there are special circumstances you can invoke to justify an out-of-period enrollment. Examples of special circumstances include:

When is Medicare open enrollment?

The Medicare Open Enrollment Period, also known as the Annual Election Period (AEP), runs yearly from October 15 to December 7 , during which Medicare beneficiaries can apply for Medicare Advantage plan coverage.

How long does it take to enroll in Medicare Advantage?

Enrolling in a Medicare Advantage plan during your Initial Enrollment Period. When you first become eligible for Medicare, you have a 7-month Initial Enrollment Period (IEP) to enroll in Medicare. Then once enrolled in Part A and Part B, you can sign up for a Medicare Advantage plan (also known as Medicare Part C).

How to change Medicare Advantage plan?

The Medicare Open Enrollment Period, also known as the Annual Election Period (AEP), runs yearly from October 15 to December 7, during which Medicare beneficiaries can apply for Medicare Advantage plan coverage. Beneficiaries can make the following changes to their coverage during this two-month period: 1 Switch from Original Medicare to Medicare Advantage 2 Switch from a Medicare Advantage plan back to Original Medicare 3 Switch from a Medicare Advantage plan to a different Medicare Advantage plan in their service area 4 Switch from a Medicare Advantage plan that doesn’t include drug coverage to one that does, and vice versa

What is Medicare Advantage?

Medicare Advantage plans are provided through private insurance companies and offer the same benefits as Original Medicare, with some also offering prescription drug coverage and vision, dental or hearing care.

What happens if you miss the enrollment period?

If you missed the other enrollment periods, you generally have to wait for the next Annual Election Period. However, there are certain special circumstances that could qualify you for a Special Enrollment Period, such as: You moved out of your current Medicare Advantage plan’s service area. You are eligible for Medicaid.

When does IEP end?

If you are aging into Medicare, then your IEP begins 3 months before the month that you turn 65 and ends 3 months after the month you turn 65. For example, if you age into Medicare in May, then your Initial Enrollment Period begins February 1st and ends August 31st. People with End-Stage Renal Disease generally cannot enroll in a Medicare Advantage ...

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.