What is irmaa on Medicare?

What Is IRMAA? IRMAA stands for income-related monthly adjustment amount. IRMAA is an additional amount that some people might have to pay along with their Medicare premium if their modified adjusted gross income (MAGI) is higher than a certain threshold.

When did the irmaa change to include prescription drugs?

There have a been couple, with the biggest change being in 2010 with the passing of the Affordable Care Act (ACA) as it called for the IRMAA surcharges to include Part D (prescription drug coverage) too. The other change to the IRMAA brackets happened in 2018 with the passing of the Bi-Partisan Budget Act.

When did Medicare start?

But it wasn’t until after 1965 – after legislation was signed by President Lyndon B Johnson – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits launched for the following 12 months. Today, Medicare continues to provide health care for those in need.

What is the history of irmaa?

History of IRMAA, ORIGIN. Part D-IRMAA stands for the Income Related Monthly Adjustment Amount for Part D and this is mandated by the Affordable Care Act to help fund the Medicare Part D Trust Fund. It started on January 1, 2011. Now Part D-IRMAA is a set amount paid to the government in addition to and separate from the plan premium.

Who started Irmaa?

IRMAA was created in 2003 through the Medicare Modernization Act of 2003 as it was a way, according to the Act, for Congress and the people “to begin to address the fiscal challenges facing the Medicare program”.

How do I avoid Medicare Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).

How many years does Irmaa last?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually.

Do I have to pay Irmaa with Medicare Advantage?

IRMAA Part B and Part D and Medicare Advantage plans Yes, IRMAA may still apply if you're in certain income bracket. This is because you still have Medicare Part B with a Medicare Advantage plan. You still need to pay your Part B premium, as well as any premium the Medicare Advantage plan may charge.

Does retirement affect Irmaa?

Because IRMAA surcharges are calculated based on a two-year “lookback” period for MAGI, clients can be hit with IRMAA surcharges even if their income drops significantly in mid-retirement.

Is Irmaa based on AGI or taxable income?

That means your 2021 premiums and IRMAA determinations are calculated based on MAGI from your 2019 federal tax return. MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040) plus tax-exempt interest income (line 2a of IRS Form 1040).

How do I uninstall Irmaa?

Even if you haven't experienced a life-changing event, you can still appeal an IRMAA. Request an appeal in writing by completing a request for reconsideration form. To get an appeal form, you can go into a nearby Social Security office, call 800-772-1213, or check the Social Security website.

How do I know if I have to pay Irmaa?

SSA determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year that you start paying IRMAA. The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income.

What is the Irmaa amount for 2021?

The IRMAA rises as adjusted gross income increases. The maximum IRMAA in 2021 will be $356.40, bringing the total monthly cost for Part B to $504.90 for those in that bracket. The top IRMAA bracket applies to married couples with adjusted gross incomes of $750,000 or more and singles with $500,000 or more of income.

Why does Irmaa exist?

In 2003, IRMAA was added as a provision to the Medicare Modernization Act. The provision was set to help increase the financial stability of Medicare for future beneficiaries. Rather than paying the standard premium, those who qualify for IRMAA must pay a higher monthly premium based on their income bracket.

What will Irmaa be in 2022?

Your 2022 IRMAA is based on your Modified Adjusted Gross Income (MAGI) from 2020. The Medicare Part B 2022 standard monthly premium is $170.10. Updated 2022 IRMAA brackets can increase Medicare Part B monthly premiums by as much as $408.20 and Medicare Part D monthly premiums by as much as $77.90.

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

What happens if IRMAA is applied to my Medicare?

If the SSA decides that an IRMAA applies to your Medicare premiums, you’ll receive a predetermination notice in the mail. This will inform you about your specific IRMAA and will also include information such as:

What is an IRMAA?

Takeaway. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium. The surcharge amount you’ll pay depends on factors like your income ...

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

What is the state health insurance program?

The State Health Insurance Assistance Program (SHIP) provides free assistance with your Medicare questions. You can find out how to contact your state’s SHIP program here. Medicaid. Medicaid is a joint federal and state program that assists people who have a lower income or resources with their medical costs.

What is Medicare Part C?

Medicare Part C. Part C is also referred to as Medicare Advantage. These plans often cover services that original Medicare (parts A and B) don’t cover, such as dental, vision, and hearing. Part C is not affected by IRMAA.

What is a Part D insurance plan?

Part D is prescription drug coverage. Like Part C plans, Part D plans are sold by private companies. Part D is affected by IRMAA. As with Part B, a surcharge can be added to your monthly premium, based on your yearly income. This is separate from the surcharge that can be added to Part B premiums.

How many people are covered by Medicare?

It’s made up of several parts. In 2019, Medicare covered about 61.5 million Americans and is predicted to increase to 75 million by 2027.

What is the Income-Related Monthly Adjustment Amount for Medicare (IRMAA)?

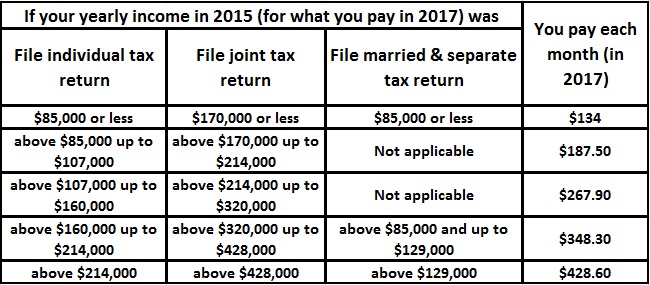

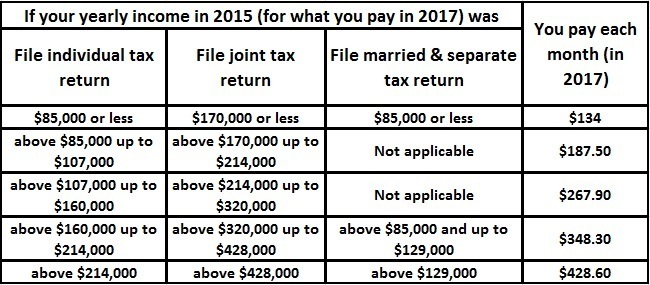

Most enrollees have their Part B premium taken out of their Social Security check before the beneficiary gets the deposit. If you are not earning income benefits with Social Security, you will typically receive a bill. Those in the highest income bracket can pay considerably more for their Medicare Part B costs. Social Security will determine what you pay based on your modified adjusted gross income (MAGI), as reported by the IRS.

How to appeal an IRMAA?

If you want to appeal your IRMAA, you should visit the Social Security website for the form called Request for Reconsideration. The form will give you three options on how to appeal, with the easiest and most common way being a case review. Documentation is an essential thing in any appeal.

How to request a new initial determination for Medicare?

You can request a new initial determination by submitting a Medicare IRMAA Life-Changing Event form. You can also schedule an appointment with Social Security. Documentation will be required with either your correct income or of the life-changing event that caused your income to go down.

What happens if you appeal Medicare Part B?

If you have a successful appeal, Social Security will automatically correct your Medicare Part B premium amount. If you’re denied, they will provide instructions on how to appeal the denial to an Administrative Law Judge. While you are in the process of the appeal, you will continue to pay the higher Medicare Part B premium.

How does Social Security determine if you owe an IRMAA?

The Social Security Administration determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior. If you feel you’re higher Part B premium is incorrect, there are steps you can take to appeal IRMAA.

What is modified adjusted gross income?

Your Modified Adjusted Gross Income amount is made up of your total adjusted gross income in addition to any tax-exempt interest income. On your IRS Form 1040, these are line items 37 and 8b; if you are unsure of your MAGI, you can quickly figure it out by looking at your tax return records. Income examples that you may have reported on your tax return would include wages, dividends, alimony received, rental income, investment income, capital gains, farm income, and SSA benefits.

Does income related monthly adjustment affect Part D?

The Income-Related Monthly Adjustment Amount also affects your Part D premium. You will pay the premium for your chosen plan, and then the adjustment will be added to that premium. Your prescription drug insurance company will collect the amount on behalf of Social Security.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

How much are Part D IRMAA surcharges?

For Part D, the IRMAA amounts are added to the regular premium for the enrollee’s plan (Part D plans have varying prices, so the full amount, after the IRMAA surcharge, will depend on the plan).

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

What is the Medicare surcharge for 2021?

This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 (or $176,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

Does delaying RMDs reduce IRMAA?

The reason this may be important is that it is possible that delaying receiving RMDs may also reduce IRMAA if your Modified Adjusted Gross Income is close to the limits stated in the Tables 1 and 2.

Is MAGI the same as IRMAA?

It’s important to understand that MAGI for calculating IRMAA isn’t the same as the normal MAGI that you might be accustomed to for non-healthcare purposes, nor is it exactly the same as MAGI for calculating premium tax credits and Medicaid/CHIP eligibility under the Affordable Care Act. Table 1 in this Congressional Research Service brief is useful in seeing how MAGI is determined for IRMAA calculations.

When was IRMAA enacted?

IRMAA was first enacted in 2003 as a provision of the Medicare Modernization Act. This provision applied only to high-income enrollees of Medicare Part B. In 2011, IRMAA was expanded under the Affordable Care Act to include high-income enrollees of Medicare Part D as well.

Who Pays IRMAA?

As noted above, only individuals who earn more than $88,000 and married couples filing jointly who earn more than $176,000 are required to pay IRMAA.

How Is IRMAA Calculated?

The government determines whether you qualify for IRMAA by finding your modified adjusted gross income (MAGI). Your monthly IRMAA payment for each year is determined by your MAGI from two years prior. Your MAGI is your adjusted gross income (AGI) with certain costs added back to it. Your AGI is a commonly used income figure to determine your income bracket for tax purposes. AGI includes your total income for a year with certain deductions subtracted. Your MAGI adjusts by adding some deductions back, and so it might, in some cases, be higher than your AGI. Most people’s MAGI is identical to or slightly higher than their AGI. Deductions added back to your MAGI can include:

How much will IRMAA increase in 2020?

As the cost of Medicare premiums for beneficiaries rise, IRMAA costs will rise for them as well. In 2020, there will be an increase of approximately 15 percent in IRMAA for Medicare Parts B and D for incomes between $133,501 and $214,000.

What does IRMAA mean?

IRMAA stands for income-related monthly adjustment amount. IRMAA is an additional amount that some people might have to pay along with their Medicare premium if their modified adjusted gross income (MAGI) is higher than a certain threshold.

Why did Obama expand Medicare eligibility?

Bush and Barack Obama expanded the eligibility of IRMAA payers to try to strengthen the financial stability of the Medicare program. The Obama administration did so as an attempt to save the federal government $20 billion over 10 years.

How does the government determine if you qualify for IRMAA?

The government determines whether you qualify for IRMAA by finding your modified adjusted gross income (MAGI). Your monthly IRMAA payment for each year is determined by your MAGI from two years prior. Your MAGI is your adjusted gross income (AGI) with certain costs added back to it. Your AGI is a commonly used income figure to determine your income bracket for tax purposes. AGI includes your total income for a year with certain deductions subtracted. Your MAGI adjusts by adding some deductions back, and so it might, in some cases, be higher than your AGI. Most people’s MAGI is identical to or slightly higher than their AGI. Deductions added back to your MAGI can include:

When did Medicare start?

But it wasn’t until after 1966 – after legislation was signed by President Lyndon B Johnson in 1965 – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits first took effect. Harry Truman and his wife, Bess, were the first two Medicare beneficiaries.

When did Medicare start covering kidney failure?

In 1972 , President Richard M. Nixon signed into the law the first major change to Medicare. The legislation expanded coverage to include individuals under the age of 65 with long-term disabilities and individuals with end-stage renal disease (ERSD). People with disabilities have to wait for Medicare coverage, but Americans with ESRD can get coverage as early as three months after they begin regular hospital dialysis treatments – or immediately if they go through a home-dialysis training program and begin doing in-home dialysis. This has served as a lifeline for Americans with kidney failure – a devastating and extremely expensive disease.

What is a QMB in Medicare?

These individuals are known as Qualified Medicare Beneficiaries (QMB). In 2016, there were 7.5 million Medicare beneficiaries who were QMBs, and Medicaid funding was being used to cover their Medicare premiums and cost-sharing. To be considered a QMB, you have to be eligible for Medicare and have income that doesn’t exceed 100 percent of the federal poverty level.

What is Medicare and CHIP Reauthorization Act?

In early 2015 after years of trying to accomplish reforms, Congress passed the Medicare and CHIP Reauthorization Act (MACRA), repealing a 1990s formula that required an annual “doc fix” from Congress to avoid major cuts to doctor’s payments under Medicare Part B. MACRA served as a catalyst through 2016 and beyond for CMS to push changes to how Medicare pays doctors for care – moving to paying for more value and quality over just how many services doctors provide Medicare beneficiaries.

How much was Medicare in 1965?

In 1965, the budget for Medicare was around $10 billion. In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. The ’70s.

What is the Patient Protection and Affordable Care Act?

The Patient Protection and Affordable Care Act of 2010 includes a long list of reform provisions intended to contain Medicare costs while increasing revenue, improving and streamlining its delivery systems, and even increasing services to the program.

How much has Medicare per capita grown?

But Medicare per capita spending has been growing at a much slower pace in recent years, averaging 1.5 percent between 2010 and 2017, as opposed to 7.3 percent between 2000 and 2007. Per capita spending is projected to grow at a faster rate over the coming decade, but not as fast as it did in the first decade of the 21st century.

What is IRMAA on Part B?

IRMAA is a monthly surcharge to your Part B and Part D based on your income level from two years ago.

What does IRMAA stand for?

IRMAA stands for Income-Related Monthly Adjustment Amount. What a mouthful-She is a modest penalty for a high-income retiree to swallow. What you do now affects your 2023 IRMAA Brackets!

How is IRMAA Calculated? Where is the Cliff?

IRMAA was frozen through 2019 thanks to the Affordable Care Act. However, in 2020 her cliff increased from $170k to $174k. And in 2021, it increased to 176k. Why is this important?

What are the indications for an IRMAA appeal?

Other specific indications for an IRMAA appeal: marriage, divorce, death of a spouse, income reduction, loss of income such as rentals or royalties, or loss of a pension.

How long before you enroll in Medicare can you control your MAGI?

Consider controlling your MAGI two years before you enroll in Medicare to control your Income-Related Monthly Adjustment Amount.

Is IRMAA a cliff penalty?

Remember, Minimizing Taxes In Retirement is a sure way to increase your retirement income. IRMAA, again, is a cliff penalty. One dollar over the limit and you pay the penalty all year. The tax return from two years ago year is used. It is expected that tiers 1-4 will increase by 2% year over year.

Do you have to take a QCD if you have an RMD?

Also, RMDs have to come out first. If you have already taken an RMD from your tax-deferred account, you can’t turn around and take a QCD or give that money to charity without recognizing the income from the RMD.