Most people enroll in Medicare Part A (hospital insurance) and Part B (doctor visits and other outpatient services) during their seven-month initial enrollment period (IEP) around the time they turn 65.

Full Answer

What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

How to enroll in Medicare if you are turning 65?

- You have no other health insurance

- You have health insurance that you bought yourself (not provided by an employer)

- You have retiree benefits from a former employer (your own or your spouse’s)

- You have COBRA coverage that extends the insurance you or your spouse received from an employer while working

How do you add Part B to Medicare?

You can sign up for Medicare Part B during the following enrollment periods:

- The Initial Enrollment Period (IEP) for Part B, when you’re first eligible for Medicare. ...

- The General Enrollment Period (GEP), which runs from January 1 to March 31 of each year. ...

- While you’re still covered by the employer or union group health plan

Who qualifies for free Medicare?

- You’re eligible for or receive monthly benefits under Social Security or the railroad retirement system.

- You’ve worked long enough in a Medicare-covered government job.

- You’re the child or spouse (including a divorced spouse) of a worker (living or deceased) who has worked long enough under Social Security or in a Medicare-covered government job.

Can Medicare Part B be added at any time?

Special Enrollment Period If you are eligible for the Part B SEP, you can enroll in Medicare without penalty at any time while you have job-based insurance and for eight months after you lose your job-based insurance or you (or your spouse) stop working, whichever comes first.

When can you enroll in Medicare Part B?

Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

Do you have to have both Medicare Part A and B?

If you aren't eligible for free Part A, you don't have to enroll. However, if you want to buy Medicare coverage and you want Part A, you also have to buy Part B.

Does Medicare Part B have to start on the first of the month?

Coverage can't start earlier than the month you turned 65. I have a Health Savings Account (HSA). After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

How do I add Medicare Part B?

Contact Social Security to sign up for Part B:Fill out Form CMS-40B (Application for Enrollment in Medicare Part B). ... Call 1-800-772-1213. ... Contact your local Social Security office.If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

Can I delay Medicare Part B if I am still working?

Once you enroll in any part of Medicare, you won't be able to contribute to your HSA. If you would like to continue making contributions to your HSA, you can delay both Part A and Part B until you (or your spouse) stop working or lose that employer coverage.

Does Medicare Part B pay for prescriptions?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. covers a limited number of outpatient prescription drugs under certain conditions. A part of a hospital where you get outpatient services, like an emergency department, observation unit, surgery center, or pain clinic.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Do you have to enroll in Medicare Part B every year?

Do You Need to Renew Medicare Part B every year? As long as you pay the Medicare Part B medical insurance premiums, you'll continue to have the coverage. The premium is subtracted monthly from most people's Social Security payments. If you don't get Social Security, you'll get a bill.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

Does Medicare coverage begin the month you turn 65?

You will have a Medicare initial enrollment period. If you sign up for Medicare Part A and Part B during the first three months of your initial enrollment period, your coverage will start on the first day of the month you turn 65.

How do I change my Medicare Part B effective date?

If changing your initial month of Part B coverage is possible in your case, you'll likely need to submit a new form CMS-40B (https://www.cms.gov/cms40b-application-enrollment-part-b) along with any required documentation. You should probably first contact Social Security to see what options are available to you.

You Always Need Part B If Medicare Is Primary

Once you retire and have no access to other health coverage, Medicare becomes your primary insurance. While Part A pays for your room and board in...

You Need Part B to Be Eligible For Supplemental Coverage

Medigap plans do not replace Part B. They pay secondary to Part B.Part B works together with your Medigap plan to provide you full coverage. This m...

Do I Need Medicare Part B If I Have Other Insurance?

Many people ask if they should sign up for Medicare Part B when they have other insurance. At a large employer with 20 or more employees, your empl...

Enrolling Into Part B on A Delayed Basis

If you have delayed Part B while you were still working at a large employer, you’ll still need to enroll in Part B eventually. When you retire and...

Do I Need Medicare Part B If I’M A Veteran?

Some people have 2 different coverages that they can choose independent of one another. Federal employees who can opt to use their FEHB instead of...

Most Common Mistakes Regarding Part B

The most common mistake we see is from people who confuse Part B and Medigap. Just this week, a reader on our Facebook page commented that she was...

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

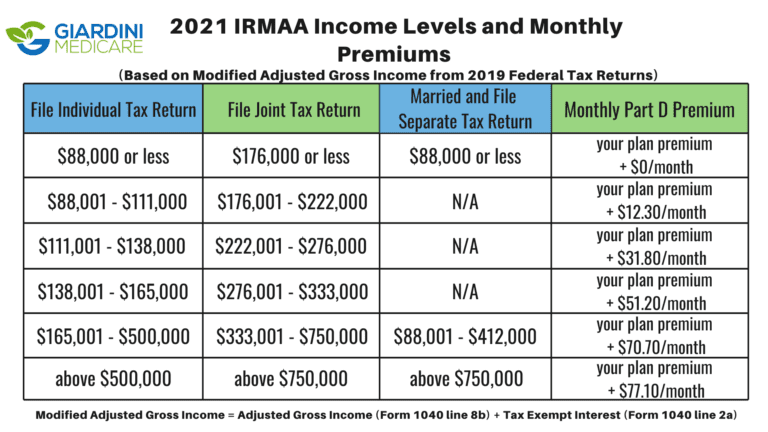

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

What happens if you don't enroll in Part A?

If an individual did not enroll in premium Part A when first eligible, they may have to pay a higher monthly premium if they decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years the individual could have had Part A, but did not sign up.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

What is MEC in Medicare?

Medicare and Minimum Essential Coverage (MEC) Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

Answer a few questions to find out

These questions don’t apply if you have End-Stage Renal Disease (ESRD).

Do you have health insurance now?

Are you or your spouse still working for the employer that provides your health insurance coverage?

How long do you have to enroll in Part B if you retire?

When you retire and lose your employer coverage, you’ll be given a 8-month Special Enrollment Period to enroll in Part B without any late penalty.

How much is Part B insurance?

Most people delay Part B in this scenario. Your employer plan likely already provides good outpatient coverage. Part B costs at least $148.50/month for new enrollees in 2020.

How much does Medicare pay for outpatients?

Your healthcare providers will bill Medicare, and Part B will then pay 80% of your outpatient expenses after your small deductible. Medicare then sends the remainder of that bill to your Medigap plan to pay the other 20%. The same goes for Medicare Advantage plans.

What happens if you opt out of Part B?

Be aware that if you opt out of Part B and then later decide to join, you will pay a Part B late penalty. You’ll also need to wait until the next General Enrollment Period to enroll, which means there could be a delay before your coverage becomes active. In my opinion, most Veterans should sign up for Part B.

Does Medigap replace Part B?

Medigap plans do not replace Part B. They pay secondary to Part B. Part B works together with your Medigap plan to provide you full coverage. This means you must be enrolled in Part B before you are even eligible to apply for a Medicare supplement.

Do you have to be enrolled in Part B for Medicaid?

When you are 65 or older and enrolled in Medicaid. All of these scenarios require you to be enrolled in Part B. Without it, you would be responsible for the first 80% of all outpatient charges. Even worse, your secondary coverage may not pay at all if you are not actively enrolled in Part B as your primary coverage.

Do all veterans qualify for VA?

Not all veterans qualify for VA coverage. Your length of military service and your discharge characterization affect your eligibility. If you plan to use VA healthcare coverage as your only coverage, be sure that you apply for VA coverage before your initial enrollment window for Medicare expires.

When do you have to take Part B?

You have to take Part B once your or your spouse’s employment ends. Medicare becomes your primary insurer once you stop working, even if you’re still covered by the employer-based plan or COBRA. If you don’t enroll in Part B, your insurer will “claw back” the amount it paid for your care when it finds out.

How long can you delay Part B?

You can delay your Part B effective date up to three months if you enroll while you still have employer-sponsored coverage or within one month after that coverage ends. Otherwise, your Part B coverage will begin the month after you enroll.

What is a SEP for Medicare?

What is the Medicare Part B Special Enrollment Period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse’s current job. You usually have 8 months from when employment ends to enroll in Part B. Coverage that isn’t through a current job – such as COBRA benefits, ...

What is a Part B SEP?

The Part B SEP allows beneficiaries to delay enrollment if they have health coverage through their own or a spouse’s current employer. SEP eligibility depends on three factors. Beneficiaries must submit two forms to get approval for the SEP. Coverage an employer helps you buy on your own won’t qualify you for this SEP.

What to do if your Social Security enrollment is denied?

If your enrollment request is denied, you’ll have the chance to appeal.

When do you get Part A and Part B?

You will automatically get Part A and Part B starting the first day of the month you turn 65. (If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.)

What happens if you don't get Part B?

NOTE: If you don’t get Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part B because you have coverage based on your (or your spouse’s) current employment.

What is the individual health insurance marketplace?

NOTE: The Individual Health Insurance Marketplace is a place where people can go to compare and enroll in health insurance. In some states the Marketplace is run by the state and in other states it is run by the federal government. The Health Insurance Marketplace was set up through the Affordable Care Act, also known as Obamacare.