Full Answer

When do I apply for Medicare Part?

You can:

- Enroll in Medicare when you turn 65

- Enroll in only Medicare Part A when you turn 65

- Delay Medicare until you lose your coverage

When do you start receiving Medicare?

When Does Medicare Start? For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare.

When should I enroll in Medicare?

Question: I received a letter from Medicare saying I might have to sign up for Part B. I have insurance through my employer. What should I do? Answer: This question had many possible answers. The letter you received from Medicare is part of an effort to ...

When should one apply for Medicare?

Otherwise, you need to apply for Medicare. The best time to do that depends entirely on your own situation. Broadly, there are two options: During your Initial Enrollment Period (IEP) This lasts for seven months, of which the fourth one is the month in which you turn 65.

When should a person enroll in Medicare Part A?

Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after you turn 65. Find out if: Your state will sign you up for Medicare (or if you need to sign up). Your Medicaid coverage will change after you're eligible for Medicare.

Are you automatically enrolled in Medicare Part A when you turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Does Medicare Part A come automatically?

You automatically get Part A and Part B after you get disability benefits from Social Security or certain disability benefits from the RRB for 24 months. If you're automatically enrolled, you'll get your Medicare card in the mail 3 months before your 65th birthday or your 25th month of disability.

What happens if you don't enroll in Medicare Part A at 65?

If you don't have to pay a Part A premium, you generally don't have to pay a Part A late enrollment penalty. The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled.

Is Medicare Part A free?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

What do I need to do before I turn 65?

Turning 65 Soon? Here's a Quick Retirement ChecklistPrepare for Medicare. ... Consider Additional Health Insurance. ... Review Your Social Security Benefits Plan. ... Plan Ahead for Long-Term Care Costs. ... Review Your Retirement Accounts and Investments. ... Update Your Estate Planning Documents.

How long before you turn 65 do you apply for Medicare?

3 monthsYour first chance to sign up (Initial Enrollment Period) It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

Do I need to contact Social Security when I turn 65?

Is it automatic when I turn 65? To enroll in Medicare, most people need to contact Social Security directly. Do this before your 65th birthday to avoid a lapse in health coverage.

What documents do I need to apply for Medicare?

What documents do I need to enroll in Medicare?your Social Security number.your date and place of birth.your citizenship status.the name and Social Security number of your current spouse and any former spouses.the date and place of any marriages or divorces you've had.More items...

Can you delay Medicare Part A?

However, if you have to pay a premium for Part A, you can delay Part A until you (or your spouse) stop working or lose that employer coverage. You will NOT pay a penalty for delaying Part A, as long as you enroll within 8 months of losing your coverage or stopping work (whichever happens first).

Who is not eligible for Medicare Part A?

Why might a person not be eligible for Medicare Part A? A person must be 65 or older to qualify for Medicare Part A. Unless they meet other requirements, such as a qualifying disability, they cannot get Medicare Part A benefits before this age. Some people may be 65 but ineligible for premium-free Medicare Part A.

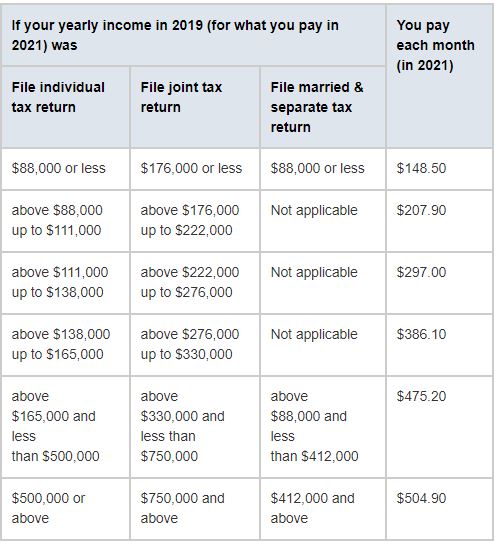

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

Answer a few questions to find out

These questions don’t apply if you have End-Stage Renal Disease (ESRD).

Do you have health insurance now?

Are you or your spouse still working for the employer that provides your health insurance coverage?

Sign Up for Medicare Part A as Soon as You Can

Consumers can purchase Part A at a few opportunities. The Initial Open Enrollment period is the best opportunity to sign up for Part A.

Sign Up for Part A to Get Original Medicare

Without Medicare Part A, there is no hospital coverage. If you do not sign up for Part A, you neglect a major, potentially life-saving portion of health insurance.

Complete Your Coverage with a Medicare Health Plan

A comprehensive combination of Medicare insurance would cover hospital care, medical services, and prescription drugs.

Medigap Fills in Costs

Original Medicare leaves as much as twenty percent of covered benefits for payment by the consumer.

When do you get Part A and Part B?

You will automatically get Part A and Part B starting the first day of the month you turn 65. (If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.)

What is the individual health insurance marketplace?

NOTE: The Individual Health Insurance Marketplace is a place where people can go to compare and enroll in health insurance. In some states the Marketplace is run by the state and in other states it is run by the federal government. The Health Insurance Marketplace was set up through the Affordable Care Act, also known as Obamacare.

What happens if you don't get Part B?

NOTE: If you don’t get Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part B because you have coverage based on your (or your spouse’s) current employment.

Do you have to pay a penalty if you don't get Part A?

NOTE: If you don’t get Part A and Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part A and Part B because you have coverage based on your (or your spouse’s) current employment.

What does Medicare Part A and B cover?

There are four total parts of Medicare: Medicare Part A, Part B, Part C, and Part D. However, the two main parts of Medicare are Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance). So what exactly does Medicare Part A and Part B cover?

Who qualifies for Medicare Part A and B?

With so many rules and regulations surrounding Medicare Part A and B, it can be difficult to understand who qualifies for Medicare Part A and Part B coverage. Generally, Medicare Part A and B are available for: people 65+, those under age-65 with disabilities, and those with End Stage Renal Disease. Let’s break that down.

Will I be enrolled in Medicare Part A and B automatically?

Some people will be enrolled in Medicare automatically, however some won’t. 6 Whether or not you qualify for automatic enrollment in Medicare is largely determined on whether or not you are already getting Social Security or Railroad Retirement Board benefits.