| If you join | Your coverage begins |

|---|---|

| During one of the 3 months before you turn 65 | The first day of the month you turn 65 |

| During the month you turn 65 | The first day of the month after you ask to join the plan |

When exactly does your Medicare coverage begin?

If you: Do this: Don’t have any drug coverage. Join a Medicare drug plan or Medicare Advantage Plan with drug coverage within 3 months of when your Medicare coverage starts to avoid a monthly Part D late enrollment penalty .; Have drug coverage that’s creditable. You can wait to get Medicare drug coverage (Part D).

When do you start receiving Medicare?

Jan 06, 2022 · If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare. However, if you don’t receive retirement benefits yet, elderly people can begin to enroll in Medicare—beyond Part A—three months before they turn 65, the month of your birthday, and three months after it.

When can I start getting Medicare benefits?

Medicare eligibility starts at age 65. Your initial window to enroll is the seven-month period that begins three months before the month of your 65th birthday and ends three months after it. Seniors are generally advised to sign up on time to avoid penalties that could prove quite costly over the course of retirement.

When you should enroll in Medicare?

Nov 29, 2021 · Make changes to your Medicare plan coverage during the right time of year One especially useful time to review your Medicare coverage is during the fall Annual Enrollment Period, or AEP. The Medicare AEP lasts from October 15 to December 7 every year. During this time, Medicare beneficiaries may do any of the following:

When should I set up Medicare?

Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

Do you automatically go on Medicare at age 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What day of the month does Medicare start when you turn 65?

If you sign up for Medicare during the first three months of your IEP, your coverage starts the first day of your birthday month. For example: Sam's 65th birthday is on August 15. If he signs up for Medicare in May, June or July, his coverage will start on August 1.

What are the 3 requirements for Medicare?

You're 65 or older.You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and.You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.More items...•Nov 15, 2021

Can I drop my employer health insurance and go on Medicare?

You can drop your employer's health plan for Medicare if you have large employer coverage. When you combine a Medigap plan with Medicare, it's often more affordable for you and your spouse.

Do I need to contact Social Security when I turn 65?

If you aren't eligible for full Social Security retirement benefits at age 65, and you aren't getting Social Security benefits, you can still get your full Medicare benefits (including premium-free Part A) at age 65, but you must contact Social Security to sign up.

Does Medicare start the month of your birthday?

When your coverage starts If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65. (If your birthday is on the first of the month, coverage starts the month before you turn 65.)

Does Medicare start on the first of the month?

You will have a Medicare initial enrollment period. If you sign up for Medicare Part A and Part B during the first three months of your initial enrollment period, your coverage will start on the first day of the month you turn 65.

Can I change my Medicare Part B start date?

As long as your age and enrollment period allows you to select September as your month to begin Part B coverage then you should be able to change your month of enrollment either by amending your application or by submitting a new Part B application form (https://www.cms.gov/Medicare/CMS-Forms/CMS-Forms/Downloads/CMS40B ...Jun 16, 2018

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Do I have to pay for Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Is Medicare Part A free?

Medicare Part A (Hospital Insurance) Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.Dec 1, 2021

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

How does Medicare work with my job-based health insurance?

Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 — Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security (or the Railroad Retirement Board).

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

What happens if you don't sign up for Medicare?

Specifically, if you fail to sign up for Medicare on time, you’ll risk a 10 percent surcharge on your Medicare Part B premiums for each year-long period you go without coverage upon being eligible.

How long does it take to get Medicare?

Learn how to make sure they have health insurance once you’re enrolled. Medicare eligibility starts at age 65. Your initial window to enroll is the seven-month period that begins three months before the month of your 65th birthday and ends three months after it. Seniors are generally advised to sign up on time to avoid penalties ...

Does Medicare pay for Part A?

That said, it often pays to enroll in Medicare Part A on time even if you have health coverage already. It won’t cost you anything, and this way, Medicare can serve as your secondary insurance and potentially pick up the tab for anything your primary insurance (in this case, your work health plan) doesn’t cover.

What are the different types of Medicare?

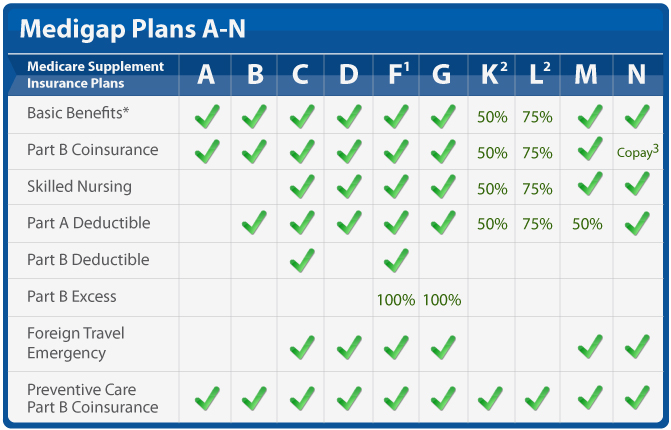

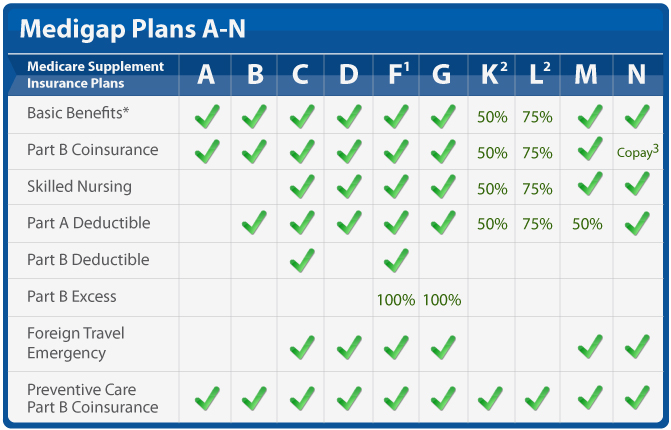

The basics of each type of Medicare plan is as follows: 1 Medicare Part A provides coverage for inpatient hospital stays. Every Medicare beneficiary will typically have Part A. 2 Medicare Part B is medical insurance and provides coverage for outpatient appointments and durable medical equipment. Part B is optional, but is required for anyone wanting to enroll in Medicare Part C, Part D or Medicare Supplement Insurance.#N#Part A and Part B are known together as “Original Medicare.” 3 Medicare Part C, also known as Medicare Advantage, provides all the same benefits as Medicare Part A and Part B combined into a single plan sold by a private insurance company. A Medicare Advantage plan replaces your Original Medicare coverage, although beneficiaries remain technically enrolled in Part A and Part B and continue to pay any required Original Medicare premiums.#N#Most Medicare Advantage plans offer additional benefits not covered by Original Medicare, such as dental, vision and prescription drug coverage. 4 Medicare Part D provides coverage for prescription medications, which is something not typically covered by Original Medicare. Part D beneficiaries must be enrolled in both Medicare Part A and Part B. 5 Medicare Supplement Insurance, also called Medigap, provides coverage for some of the out-of-pocket expenses faced by Original Medicare beneficiaries, such as Medicare deductibles and coinsurance or copayments.#N#There are 10 Medigap plans from which to choose (in most states), and beneficiaries must first be enrolled in both Part A and Part B.

What is Medicare Part B?

Medicare Part B is medical insurance and provides coverage for outpatient appointments and durable medical equipment. Part B is optional, but is required for anyone wanting to enroll in Medicare Part C, Part D or Medicare Supplement Insurance. Part A and Part B are known together as “Original ...

When to review Medicare coverage?

One especially useful time to review your Medicare coverage is during the fall Annual Enrollment Period , or AEP. The Medicare AEP lasts from October 15 to December 7 every year. During this time, Medicare beneficiaries may do any of the following: Change from Original Medicare to a Medicare Advantage plan. Change from Medicare Advantage back ...

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Is Medicare Part A and Part B the same?

Part A and Part B are known together as “Original Medicare.”. Medicare Part C, also known as Medicare Advantage, provides all the same benefits as Medicare Part A and Part B combined into a single plan sold by a private insurance company.

What is Medicare Advantage?

The Medicare Advantage program (also known as Medicare Part C) is an alternative way to receive your Medicare Part A and Part B benefits. Instead of getting your Medicare benefits directly from the federal government, they’re administered by a private, Medicare-approved insurance company.

Which Medicare Advantage plan offers more benefits?

Medicare Advantage plans often offer more benefits than Medicare Part A and Part B. Many Medicare Advantage plans offer additional benefits which may include one or more of the following (this may not be a complete list): Medicare Part D prescription drug coverage. Routine vision care.

Is hospice covered by Medicare?

Except for hospice care, which remains covered under Medicare Part A, a Medicare Advantage plan provides at least the same level of coverage as Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). Many Medicare Advantage plans contract with health-care facilities, doctors, and other medical professionals ...

What is a SNP in Medicare?

SNPs are designed to meet the special needs of some Medicare beneficiaries. You might be eligible for a Medicare Special Needs Plan if you have both Medicare and Medicaid coverage; you live in skilled nursing facilities or need skilled nursing care at home; or you have any of certain chronic medical conditions.

Do I have to have Medicare Part A and Part B to enroll in Medicare Advantage?

However, costs (such as deductibles, copayments, coinsurance, and premiums) vary among plans. To enroll in a Medicare Advantage plan, you must have Medicare Part A and Part B and live in the Medicare Advantage plan’s service area.

Do I have to pay Medicare Part B premium?

It’s important to note that if you pay a premium to your Medicare Advantage plan, it’s not the only premium you’ll need to pay. You still need to pay your monthly Medicare Part B premium as well, no matter what Medicare Advantage plan you might sign up for.

Does Medicare pay for Part B?

Medicare Part B premiums must be paid directly to Medicare. The monthly cost may increase based on your annual household income from two years prior. In addition to the Medicare Part B premium, Medicare Advantage plans often charge a monthly premium for coverage. You may even find a Medicare Advantage plan in your area with a monthly premium as low ...

How much is the deductible for Medicare Advantage 2020?

Enrolling in a plan with a low MOOP limit could be another way to lower your Medicare costs. The average Medicare Advantage deductible decreased 22% from $129 in 2020 to $116 in 2021 among the plans studied, according to eHealth research.*.

Does Medicare Advantage have a deductible?

Medicare Advantage plans frequently offer more benefits than Original Medicare and may have lower out-of-pocket costs. Your health insurance rate and out-of-pocket costs will depend on the particular Medicare Advantage plan you choose. Some plans charge monthly premiums, and many plans have an annual deductible.

Do dental plans have a deductible?

Some plans charge monthly premiums, and many plans have an annual deductible. Other costs may include copayments for each doctor or hospital visit, and premiums for optional benefits, such as vision, hearing, and/or dental coverage.

Does Medicare cover out of network?

It is important to note that most annual out-of-pocket spending limits apply only to in-network Medicare provider s. If you choose to go out-of-network for services, you may either be subject to a higher out-of-network MOOP limit or your payments may not be figured into your annual expenditures at all.

What is Medicare Part B?

What Do I Need to Know about Medicare Part B? Medicare Part B covers your outpatient medical services, like your annual wellness exam. On average, it pays up to 80% of these costs, which prevents you from having to pay the majority of your bill out-of-pocket.

What is the Medicare Part B premium for 2021?

Medicare Part A and Part B together are referred to as Original Medicare. The typical Medicare Part B premium in 2021 is $148.50. Most people gain Medicare Part B eligibility on the first day of the month in which they turn 65.

What is creditable coverage?

Creditable coverage includes the insurance provided to you or your spouse through work. Scenarios in which you can’t delay Part B without facing penalties include: – You only have VA coverage. – Your place of employment consists of less than 20 employees.

How long do you have to apply for Social Security?

You have seven months in which to apply, beginning three months before your birth month, and ending three months after. If you’re drawing Social Security, you’ll be automatically enrolled. You can sign up for or postpone your Part B by contacting the Social Security Administration directly.

When does Part B coverage start?

You’ll have to wait until the General Enrollment Period to apply for Part B, which runs from January 1 st – March 31 st, and the coverage won’t come into effect until July 1 st.

What is creditable coverage?

You may have “ creditable coverage ” that Medicare regards as equivalent to Part B.#N#Situations in which you have creditable coverage include:#N#Having an employer health insurance plan#N#Having a retiree health plan provided by a prior employer#N#Being covered under someone else’s (such as a spouse) employer health insurance or retiree health insurance plan 1 Having an employer health insurance plan 2 Having a retiree health plan provided by a prior employer 3 Being covered under someone else’s (such as a spouse) employer health insurance or retiree health insurance plan

What is Medicare Advantage Plan?

A Medicare Advantage (Medicare Part C) plan is an alternative to Part A and Part B (though you still need to enroll in Part B before you can enroll in a Medicare Advantage plan). Your Medicare Advantage plan carrier (a private insurance company) provides all of your Part A and Part B benefits, instead of the federal government.

How long does it take to enroll in Medicare?

During this 7- month period, you can enroll in Original Medicare and a Medicare Advantage plan. Annual Enrollment Period (AEP, also called the Annual Election Period) ...

When is the Medicare AEP?

Annual Enrollment Period (AEP, also called the Annual Election Period) This enrollment period (also called the Open Enrollment Period for Medicare Advantage & Medicare prescription drug coverage) lasts from October 15 to December 7 every year. During Medicare AEP, you can enroll in a Medicare Advantage plan or switch from one Medicare Advantage ...

Is Medicare Part B optional?

Medicare Part B is optional. Whether or not you need Part B depends on your individual situation . You need to be aware that once you become eligible for Part B (generally when you turn 65), you will incur a late enrollment penalty for not signing up for Part B and decide you want it later, unless you meet one of the exceptions to ...

What happens if you don't have creditable coverage?

If you do not have “creditable coverage” after you first become eligible for Medicare Part B, you incur a penalty that you will pay when you eventually do enroll in Part B . The late enrollment penalty fee amount is a 10 percent increase in your Part B premium (which is $135.50 per month for most people in 2019) for each 12-month period you could ...

Do retirees have to enroll in Medicare?

You may be automatically enrolled in Medicare Part A. Your retiree health plan (if you have one) may require you to enroll in Medicare. Whether or not this is the case, many health plans coordinate benefits with Medicare. Medicare is the usually the primary payer.