Is Medicare Plan G better than Plan F?

Jul 09, 2020 · Medicare Plan F is the most comprehensive Medicare Supplement plan, but starting in 2020 the plan will not be available to everyone enrolled in Original Medicare.

Is Medicare Plan F being discontinued?

Summary: Medicare Supplement Plan F is the most comprehensive of the standardized Medicare Supplement plans available in most states. These plans are being phased out, starting in 2021.

Why was plan F discontinued?

Jun 03, 2020 · This means that people who enroll in Medicare in 2020 and beyond will no longer be able to enroll in Plan F. If you were eligible for Medicare prior to …

Should I keep Medicare Plan F?

Jan 28, 2020 · Yes, it is – but not for everyone, so don’t panic. As of 2020, Plan F went away but not completely. Find out who can still get it. Medigap Plan F has been one of the most popular supplement plans on the market for decades. Millions of people will be affected, so Congress gave beneficiaries until 2020 to get ready for the change.

Is Medicare getting rid of Plan F?

Is Plan F going away in 2021?

Is Plan F still available in 2022?

Can you switch from Plan F to Plan G in 2021?

Why was Plan F discontinued?

Is AARP plan f still available?

Can I switch from Plan N to Plan F?

Why is Plan F more expensive than Plan G?

What is the deductible for Plan G in 2022?

Should I switch from F to G?

Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What is the difference between AARP Plan F and Plan G?

What is the difference between AARP Plan F and G?

When Is Plan F Going away?

Both Plan F and Plan C are going away in 2020. However, these Medicare changes in 2020 won’t affect everyone. Some people already on Medicare Plan...

Why Is Plan F Going away?

So what is happening with Plan F? Why is Medicare Plan F being phased out?Well, these changes to Medicare supplement plans are a result of the Medi...

Medicare Plan F 2020 Changes

So is Plan F going away? Yes, BUT only for new people starting in 2020. Here’s how it will go: 1. If you are are on Plan F already when 2020 rolls...

Will Plan F Rates Go Up Faster After 2020?

Some people are worried about this, and it’s certainly possible. Back in 2010, when Medicare discontinued Plans H, I and J, we did some price infla...

What Does 2020 Plan F Change Mean For You?

Here’s our advice about Medicare Plan F going away: 1. Make the best coverage decision for yourself right now. If Plan F feels best to you, it’s st...

Is Medicare Supplement Plan F still available?

But with recent changes, Plan F is no longer available to everyone as of January 1, 2020.

How much is Medicare Supplement 2020?

It’s $198 in 2020, a slight increase from $185 in 2019. While this means changes for individuals researching Medicare Supplement policies, Casey Schwarz, senior counsel for education and federal policy at the Medicare Rights Center, shared her insight in an interview with AARP.

Does Medicare Supplement Plan G cover Part B?

It includes the same benefits as Plan F. The only difference is it doesn’t pay Part B deductibles.

Does Medicare cover medical expenses?

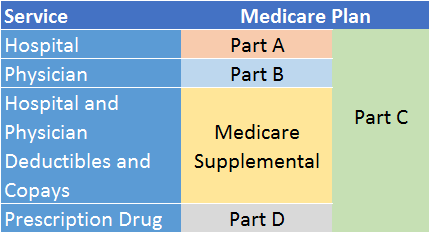

But even if you sign up for Original Medicare, this federal health insurance program doesn’t cover all medical expenses. With Original Medicare, you’re still responsible for copayments, deductibles, and coinsurance.

Does Medicare cover hospitalization?

But even if you sign up for Original Medicare, this federal health insurance program doesn’t cover all medical expenses.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F is a specific type of Medicare Supplement plan. Medicare Supplement (also called Medigap) insurance may help pay for out-of-pocket costs of Medicare Part A and Part B. These costs might be coinsurance, copayments, or (in some cases) deductibles. Please note: Medicare Part A and Part B make up the federal government’s ...

Does Medicare Supplement pay for out of pocket expenses?

Medicare Supplement (also called Medigap) insurance may help pay for out-of-pocket costs of Medicare Part A and Part B. These costs might be coinsurance, copayments, or (in some cases) deductibles. Please note: Medicare Part A and Part B make up the federal government’s Original Medicare program.

Is Medicare Part A the same as Part B?

Medicare Supplement plans are also named with letters, such as Plan A, but they are not the same thing. In 47 states, there are up to 10 Medicare Supplement plans that are standardized with lettered names – for example, Medicare Supplement Plan F.

How many states have Medicare Supplement Plans?

In 47 states, there are up to 10 Medicare Supplement plans that are standardized with lettered names – for example, Medicare Supplement Plan F. Each standardized plan has the same set of basic benefits. Plan F, for example, has the same basic benefits whether you buy it in Vermont from one company, or in Washington from another.

How much is Medicare Part B deductible in 2021?

The Medicare Part B deductible, which is the deductible amount involved in the MACRA legislation, can change every year. In 2021, it’s $203. That’s the amount you have to pay before Part B pays for covered services.

What is a Part B excess charge?

Part B excess charges (the amount a doctor is legally allowed to charge beyond the Medicare-approved amount for a medical service) There’s also a high-deductible version of Medicare Supplement Plan F. With that plan, you generally have to pay an annual deductible before Plan F pays your Medicare out-of-pocket costs.

Is Plan F going away?

Plan F is one Medigap option. Though there are changes to it in 2020, this popular plan is not going away for everyone. But some people will no longer be able to enroll in it. Continue reading to learn more. Share on Pinterest.

Is Medicare Supplement Insurance going away?

Medicare supplement insurance (Medigap) is a type of Medicare insurance policy that can help pay for some costs that original Medicare (parts A and B) doesn’t cover. Plan F is one Medigap option. Though there are changes to it in 2020, this popular plan is not going away for everyone. But some people will no longer be able to enroll in it.

What is a plan F?

The takeaway. Plan F is one of the 10 types of Medigap plans. It covers a wide breadth of expenditures that original Medicare doesn’t pay for. Starting in 2020, new rules prohibit Medigap policies from covering the Medicare Part B deductible. Because of this, people who are new to Medicare in 2020 won’t be able to enroll in Plan F.

Can you keep Medigap if you are already enrolled?

People who are already enrolled in Plan F can keep it. Medigap policies are guaranteed renewable as long as you maintain enrollment and pay the monthly premium associated with your policy.

Does Plan F pay for doctor visits?

So at the time of service, people currently on Plan F pay no copay for their Medicare-related doctor visits. No deductible either. Lawmakers fear that this lack of cost-sharing results in people running to the doctor for minor issues that may not really require medical care.

What is the deductible for Medicare 2021?

Currently this annual deductible is $203 in 2021. Since Plan F covers that deductible, it is going to be phased out for new enrollees. The goal of this measure, in the view of Congress, is to make Medicare beneficiaries put a little more “skin in the game.”. You see, people with Plan F have what we call “first dollar” coverage.

Does Medigap cover Part A?

Medigap plans can still cover the Part A Hospital deductible, but as of 2020, the plans can no longer cover the Part B deductible for new enrollees. Currently this annual deductible is $203 in 2021. Since Plan F covers that deductible, it is going to be phased out for new enrollees. The goal of this measure, in the view of Congress, ...

Is Medicare Plan F going away?

Is Medicare Plan F (Medigap Plan F) Really Going Away? Medicare Plan F, or what people call Medicare Plan F, isn’t a Medicare plan at all. In reality, it’s a Medicare Supplement Insurance (Medigap) plan. It covers all the coinsurance, copays, and deductibles that would usually be your obligation after original Medicare pays its part.

What is a plan F?

In reality, it’s a Medicare Supplement Insurance (Medigap) plan. It covers all the coinsurance, copays, and deductibles that would usually be your obligation after original Medicare pays its part. If you have a Plan F, you pay $0 for hospital stays, doctor visits, lab works, and many more. That is why Plan F has been America’s most popular Medigap ...

Does Medicare cover Part B deductible?

Medicare Plans C and F both cover Part B deductible, which is why these are being phased out. The powers that be thought, if insurance covers your Part B deductible, you’ll go to the doctor more often. But hang in there, this will not take effect yet until the 1st of January 2020. So you still have some time.

Does Medicare cover coinsurance?

It covers all the coinsurance, copays, and deductibles that would usually be your obligation after original Medicare pays its part. If you have a Plan F, you pay $0 for hospital stays, doctor visits, lab works, and many more. That is why Plan F has been America’s most popular Medigap plan for decades. However, in 2015, Congress passed the Medicare ...

Is Medicare going away?

No, Medicare is not going away! Don’t panic! Both Medicare Plan F and Medicare Plan C will be discontinued on January 1, 2020, but other options may be available in your area. We get it, Medicare coverage and plan options can be confusing and stressful.

Is Plan G the same as Plan F?

Great news! Plan G is almost identical to Plan F! The only difference is that Plan G does not cover the Part B deductible. Plan F may technically cover more, but many people consider Plan G to be a better value. Yes, you will need to pay your Part B deductible upon your first outpatient visit, but after you pay the deductible, you won’t need to pull your wallet out for the remainder of the year. Since you have to pay the Part B deductible yourself, Plan G has lower monthly premiums, and you could save more than $400 a year!

Is Medicare a Medigap plan?

Through the years, Medicare has discontinued several Medigap plans. Some of these plans have been notoriously popular among enrollees. One of the primary things to know about Medigap plans is that the different plan options vary by letters. The letter plans are A through N. Over the years, several letter plans are no longer available.

What does "first dollar" mean in Medicare?

When a plan provides first-dollar coverage, that means it covers the Part B deductible. The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) became law to end first-dollar coverage for newly eligible beneficiaries.

What is MIPPA in Medicare?

MIPPA – Reduction of Standardized Plans. Beginning on June 1, 2010, Plans E, H, I, and J became no longer available. This came as a result of the Medicare Improvements for Patients and Providers Act of 2008 (MIPPA). The Act reduces the number of available plans. The federal government standardizes all Medigap plans.

What is Medicare Improvements for Patients and Providers Act of 2008?

This came as a result of the Medicare Improvements for Patients and Providers Act of 2008 (MIPPA). The Act reduces the number of available plans. The federal government standardizes all Medigap plans. Plans H, I, and J are no longer available due to the addition of a prescription drug benefit, Part D, to Medicare after a 2003 act became a law.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What does MACRA mean?

MACRA – Elimination of First Dollar Coverage Plans for the Newly Eligible. When a plan provides first-dollar coverage, that means it covers the Part B deductible. The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) became law to end first-dollar coverage for newly eligible beneficiaries.