Medicaid Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…Medicaid

What does Medicaid pay for?

Medicaid, via Medicare Savings Programs, also helps to cover the costs of Medicare premiums, deductibles, and co-payments.

What's the difference between Medicare and Medicaid?

Medicare vs. Medicaid: What's the Difference? - GoodRx Medicare vs. Medicaid: What's the Difference? Medicare is a federal healthcare program for Americans age 65 and up plus people with disabilities and certain illnesses. Medicaid is a joint federal-state program that provides healthcare coverage to people with low income.

Can I have Medicare and Medicaid at the same time?

When you visit a provider or facility that takes both forms of insurance, Medicare will pay first and Medicaid may cover your Medicare cost-sharing, including coinsurances and copays. Medicaid can provide premium assistance: In many cases, if you have Medicare and Medicaid, you will automatically be enrolled in a Medicare Savings Program (MSP).

What are the financial costs of Medicare and Medicaid?

The financial costs incurred for both Medicare and Medicaid depend on the coverage options chosen by program enrollees. Pocketbook costs can include premiums, deductibles, copays and coinsurance. Medicaid costs are treated differently than Medicare.

What day of the month does Medicare take effect?

When coverage begins. When you switch coverage during the Open Enrollment Period, your new coverage starts January 1. When you switch back to traditional Medicare during the Medicare Advantage Disenrollment Period, your coverage will start on the first day of the month after the month in which you disenroll.

Is Medicare paid monthly?

$170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services. Who pays a higher premium because of income?

Does Medicare start mid month?

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security (or the Railroad Retirement Board). Coverage can't start earlier than the month you turned 65.

How is Medicare paid?

How is Medicare financed? Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

Does Medicare bill monthly or quarterly?

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

How long does it take for Medicare to start after applying?

Your Medicare coverage will begin between one and three months after you sign up, depending on when you enroll.

What should I be doing 3 months before 65?

You can first apply for Medicare during the three months before your 65th birthday. By applying early, you ensure your coverage will start the day you turn 65. You can also apply the month you turn 65 or within the following three months without penalty, though your coverage will then start after your birthday.

Can I retire at 62 with Medicare?

What Are the Age Requirements for Medicare? Medicare is health insurance coverage for people age 65 and older. Most people will not qualify for Medicare at age 62. At age 62, you may meet the requirements for early retirement but have not met the requirements for Medicare coverage.

Does Medicare pay for everything?

Original Medicare (Parts A & B) covers many medical and hospital services. But it doesn't cover everything.

Who pays for Medicaid?

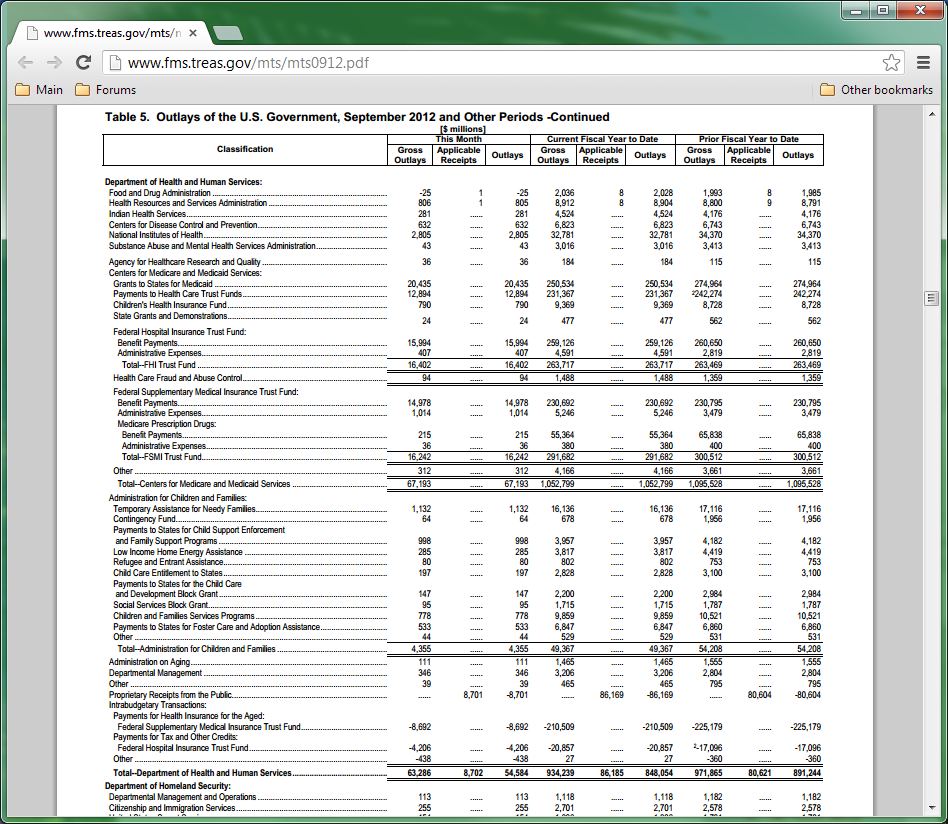

The Medicaid program is jointly funded by the federal government and states. The federal government pays states for a specified percentage of program expenditures, called the Federal Medical Assistance Percentage (FMAP).

Where does my Medicare money go?

What does it pay for?Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.benefits. The health care items or services covered under a health insurance plan. ... skilled nursing facility (snf) care. ... home health care. ... hospice.

How does Medicare work?

Medicare provides coverage for Americans who: Here’s how Medicare payments work: Essentially, your Social Security taxes go into a trust fund that grows throughout your working years. Money from that trust fund then pays all eligible bills incurred by people covered under the Medicare program.

What is Medicaid insurance?

Medicaid is a need-based joint federal and state insurance program that covers low-income individuals and families. That said, Medicaid coverage can vary significantly from state to state. That’s because the federal government covers up to 50% of each state’s Medicaid program costs.

How long does it take to get a disability after you have Lou Gehrig's disease?

While that two-year waiting period sounds like a long time, it’s calculated using your original SSDI entitlement date. For most people, that means five months after the date when your disability began.

How long do you have to wait to apply for SSDI?

(Those five months cover the waiting period before you became eligible to apply for SSDI benefits.) But if your disability started long before you applied for SSDI, that time counts toward your mandatory two-year waiting period.

What is Medicare Part B?

Medical: Medicare Part B works like most private insurance policies and covers doctor’s visits, lab work, and visits to the emergency room. Prescription Drugs: Medicare Part D helps cover prescribed medication costs. Medicare Part A and B participants are eligible for Part D (or you can purchase it as a standalone plan).

When did Medicare expand to cover disabled people?

When Congress expanded Medicare to cover seriously disabled Americans in 1972, the law also mandated that SSDI two-year waiting period. For this reason, the Social Security Administration (SSA) isn’t likely to change that requirement anytime soon.

Is there a waiting period for Medicare vs Medicaid?

If you’re getting SSI benefits, you’re also automatically enrolled in the Medicaid program unless you live in: If you reside in an automatic-enrollment state, there’s no waiting period for Medicaid coverage.

What is the difference between Medicare and Medicaid?

Medicare is a government program that provides health care coverage for Americans 65 years old or older. It also provides care coverage if you're incapacitated by ill health or by a severe disability. Medicaid is a government program run at both the federal and state level that provides health care coverage for low-income Americans.

How much does Medicare cost per month?

By and large, most Americans don't pay a premium for Medicare Part A, but for those who do, the standard premium is $422 per month if you paid Medicare taxes for less than 30 quarters. If you paid Medicare taxes for 30-39 quarters, expect to pay a standard Part A premium of $232. TST Recommends. PRESS RELEASES.

How much does Medicare Part A cost?

Also known as Original Medicare, Medicare Plan A offers health care coverage for inpatient hospital services, inpatient stays at professional nursing centers, and hospice and home health care services. By and large, most Americans don't pay a premium for Medicare Part A, but for those who do, the standard premium is $422 per month if you paid Medicare taxes for less than 30 quarters. If you paid Medicare taxes for 30-39 quarters, expect to pay a standard Part A premium of $232.

What are pocketbook costs for Medicare?

Pocketbook costs can include premiums, deductibles, copays and coinsurance. Medicaid costs are treated differently than Medicare.

What is Medicare Advantage?

This category, also known as Medicare Advantage, combines Part A (hospital insurance) and Medicare Part B (medical insurance) into one Medicare plan. Medicare Part C can also be combined into Medicare Part D prescription drug coverage. Costs vary, dependent on the plan you choose.

How old do you have to be to qualify for Medicare?

While Medicare covers Americans 65 years old and over, U.S. citizens under the age of 65 can qualify for Medicare under these conditions: If the individual has at least 24 months of Social Security disability benefits or a disability pension from the Railroad Retirement Board (RRB).

When was Medicare and Medicaid created?

Medicare and Medicaid are two government health care insurance programs created in 1965 as part of President Johnson's "Great Society" to help older Americans and impoverished Americans get good health insurance, but that's where the similarity ends. Both government-backed health care insurance programs deliver coverage to U.S.

How many people are covered by Medicare?

Medicare covers over 55 million people, and Medicaid covers over 69 million people, making them the largest U.S. agencies helping seniors and their caregivers pay for health care. Life in later years should be about enjoying quality time with your loved ones, not struggling with a financial burden.

How to find a nursing home that accepts medicaid?

To find a Medicaid-certified nursing home in your area, use Medicare’s Nursing Home Compare tool and search with your zip code. In the box on the side that reads “Filter by,” click the box that reads “Accepts Medicaid.”. The list will narrow down to only include those that accept Medicaid.

What is the maximum copayment for a doctor visit?

Currently, the maximum copayment for a doctor visit is 20 percent of what the office charges.

How much is coinsurance after 90 days?

After 90 days, if you still have lifetime reserve days (see below), the coinsurance is $658 per day. After 90 days in a hospital, you start using your lifetime reserve days, which are limited extra days of hospital coverage you can receive throughout your lifetime. Medicare recipients receive 60 lifetime reserve days.

How long does it take to pay a deductible on a hospital stay?

61–90 days. 91 days and beyond. This means that you pay a separate $1,316 deductible every time a new benefit period starts (at 61 days and at 91 days consecutively). The daily amount that you pay (known as coinsurance) for each benefit period goes up the longer you stay at the hospital.

Does Medicare cover skilled nursing?

Also, Medicare covers time spent in skilled nursing facilities, so if you require physical therapy, occupational therapy, speech-language pathology or intravenous injections in a controlled environment, you can stay in a skilled nursing facility as long as the care is medically necessary.

Does medicaid cover medical supplies?

Medicaid. Medicaid’s policy on medical supplies is similar to Medicare’s: they both cover supplies if they are considered by a doctor to be medically necessary. However, because Medicaid differs by state, not all state Medicaid programs will cover the same supplies in the same way.

How are Medicare and Medicaid similar?

Medicare and Medicaid do share one monumentally important similarity: both programs are rapidly shifting toward value-based payment models. In other words, CMS wants to encourage providers (and other payers) to focus on quality of care over quantity of care the only way they know how: by fiddling with reimbursement rates. In 2017, for instance, CMS kicked off the Part B-exclusive Merit-Based Incentive Payment System (MIPS), and it has consistently encouraged—and required—more and more providers to participate in MIPS each year. Additionally, in April 2019, CMS and the HHS announced new Medicare payment programs called Primary Care First (PCF) and Direct Contracting (DC). These programs are intended to improve healthcare quality—and they’re “specifically designed to encourage state Medicaid programs and commercial payers to adopt similar approaches,” said HHS Secretary Alex Azar.

How often does Medicare update its billing policies?

Medicare updates its billing policies each year following the release of the annual final rule. The final rule often introduces and explains coding and billing changes (e.g., when to use the KX modifier or the new X modifiers) and reporting programs (e.g., the implementation of the Merit-Based Incentive Payment System (MIPS) and the death of functional limitation reporting (FLR) ). There are many billing rules that participating Medicare providers must adhere to—and I can’t cover them all here. However, some of the most prominent and often-talked about documentation and/or billing policies are:

How often is Medicare's reimbursement rate updated?

Like its billing guidelines, Medicare’s reimbursement rates are updated each year in the annual final rule release. (Fun fact: The final rule is officially called the Physician Fee Schedule, as it determines the fees Medicare will pay providers for certain services.)

What are the different Medicare plans?

The Medicare program is split into four different coverage plans: parts A, B, C, and D. According to the Department of Health and Human Services (HHS), Part A covers “inpatient care in a hospital or skilled nursing facility (following a hospital stay), some home health care and hospice care.” Medicare Part B covers other medically necessary costs that aren’t covered by Part A, like outpatient physician and physical therapy services as well as other supplies and medical care. Part C, often referred to as Medicare Advantage, is provided by private companies that have partnered up with Medicare to offer all-in-one inpatient and outpatient coverage—sometimes with prescription plans bundled in. And finally, Part D is a prescription drug plan that’s provided by private companies.

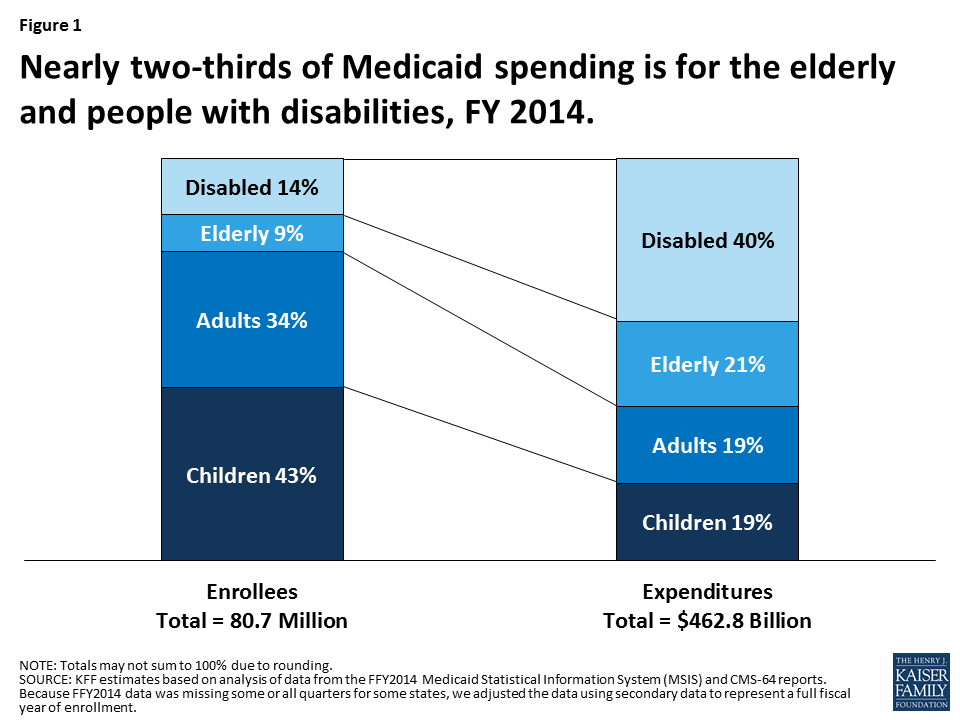

How many people use medicaid?

In 2019, 75.8 million Americans rely on this program.

When was Medicare established?

Medicare. Established in 1965 —and now overseen by the Centers for Medicare and Medicaid Services (CMS)—the Medicare program was designed to help our country’s elderly population pay their inpatient and outpatient medical bills.

Is Medicare reducing reimbursement rates?

All in all, Medicare’s reimburs ement rates tend to be a little lower than your average local payer.

How many days of skilled nursing care can you get with Medicare?

The Centers for Medicare & Medicaid Services booklet, “ Medicare Coverage of Skilled Nursing Facility Care ” explains that you have up to 100 days of skilled nursing facility care per benefit period. There are no limitations on the number of benefit periods.

How long do you have to stay in the hospital for Medicare?

When you are ready to leave the hospital, but are not yet well enough to return home, your doctor may determine that you need to go to a skilled nursing facility for a time, if you meet the Medicare requirement of a three-day inpatient hospital stay.

What is covered by Medicare for skilled nursing?

Skilled nursing care and services covered by your Original Medicare include a semi-private room, meals, medications, medical supplies and equipment, medical social services, dietary counseling, skilled nursing care, and specific therapies to meet your goals.

Does Medicare cover nursing home care?

This is important to know because Medicare coverage for skilled nursing facility services varies from coverage for a nursing home stay even if the facility provides both skilled nursing care services and nursing home care at one location. One primary difference is the fact that nursing home residents live there permanently.

Is Medicaid a federal program?

Although Medicaid is a U.S. Federal Government Program, Medicaid gives a great deal of opportunity for individual states to make decisions on coverage and benefits for Medicaid recipients. This is true of all groups, including seniors, receiving Medicaid or who are dually eligible for both Medicare and Medicaid.

Does Medicaid cover nursing?

Medicaid covers skilled nursing facility care and services such as nursing services, rehabilitative services, pharmaceutical services, medical social services, meals, and other care. Medicaid reveals that it provides coverage for skilled nursing care that allows each eligible recipient the opportunity to “Attain or maintain ...

What is Medicare and Medicaid?

Differentiating Medicare and Medicaid. Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. Since it can be easy to confuse the two terms, Medicare and Medicaid, it is important to differentiate between them. While Medicare is a federal health insurance program ...

How to apply for medicaid?

How to Apply. To apply for Medicare, contact your local Social Security Administration (SSA) office. To apply for Medicaid, contact your state’s Medicaid agency. Learn about the long-term care Medicaid application process. Prior to applying, one may wish to take a non-binding Medicaid eligibility test.

How much does Medicare Part B cost?

For Medicare Part B (medical insurance), enrollees pay a monthly premium of $148.50 in addition to an annual deductible of $203. In order to enroll in a Medicare Advantage (MA) plan, one must be enrolled in Medicare Parts A and B. The monthly premium varies by plan, but is approximately $33 / month.

What is the income limit for Medicaid in 2021?

In most cases, as of 2021, the individual income limit for institutional Medicaid (nursing home Medicaid) and Home and Community Based Services (HCBS) via a Medicaid Waiver is $2,382 / month. The asset limit is generally $2,000 for a single applicant.

How old do you have to be to qualify for medicare?

Citizens or legal residents residing in the U.S. for a minimum of 5 years immediately preceding application for Medicare. Applicants must also be at least 65 years old. For persons who are disabled or have been diagnosed with end-stage renal disease or Lou Gehrig’s disease (amyotrophic lateral sclerosis), there is no age requirement. Eligibility for Medicare is not income based. Therefore, there are no income and asset limits.

Does Medicare cover out-of-pocket expenses?

Persons who are enrolled in both Medicaid and Medicare may receive greater healthcare coverage and have lower out-of-pocket costs. For Medicare covered expenses, such as medical and hospitalization, Medicare is always the first payer (primary payer). If Medicare does not cover the full cost, Medicaid (the secondary payer) will cover the remaining cost, given they are Medicaid covered expenses. Medicaid does cover some expenses that Medicare does not, such as personal care assistance in the home and community and long-term skilled nursing home care (Medicare limits nursing home care to 100 days). The one exception, as mentioned above, is that some Medicare Advantage plans cover the cost of some long term care services and supports. Medicaid, via Medicare Savings Programs, also helps to cover the costs of Medicare premiums, deductibles, and co-payments.

Does Medicaid cover nursing home care?

Medicaid also pays for nursing home care, and often limited personal care assistance in one’s home. While some states offer long-term care and supports in the home and community thorough their state Medicaid program, many states offer these supports via 1915 (c) Medicaid waivers.

Does Medicaid cover cost sharing?

If you are enrolled in QMB, you do not pay Medicare cost-sharing, which includes deductibles, coinsurances, and copays.

Does Medicare cover medicaid?

If you qualify for a Medicaid program, it may help pay for costs and services that Medicare does not cover.

Is medicaid the primary or secondary insurance?

Medicaid can provide secondary insurance: For services covered by Medicare and Medicaid (such as doctors’ visits, hospital care, home care, and skilled nursing facility care), Medicare is the primary payer. Medicaid is the payer of last resort, meaning it always pays last.

Does Medicaid offer care coordination?

Medicaid can offer care coordination: Some states require certain Medicaid beneficiaries to enroll in Medicaid private health plans, also known as Medicaid Managed Care (MMC) plans. These plans may offer optional enrollment into a Medicare Advantage Plan designed to better coordinate Medicare and Medicaid benefits.