Full Answer

When do Medicare Part C and Part D plans take effect?

October 15 through December 7, 2022 – Open Enrollment Period for Medicare Advantage Plans (Part C) and Prescription Drug Coverage Plans (Part D). During this time you are able to join a Medicare Part C or D plan. Your plan will take effect on January 1, 2023.

What is the Medicare initial enrollment period?

You have an Initial Enrollment Period of seven months (3 months before and after you become eligible) to add additional Medicare health care coverage with an Advantage plan, or Supplemental Insurance (Medigap policies) and/or a Prescription Drug plan. Medicare enrollment or changes to plans you are already enrolled in are limited to specific times.

Do I have to sign up for Medicare Part D?

You don’t have to sign up for Medicare Part D, but if you need a lot of prescriptions or costly brand name ones, it’s a good idea to get a health or drug plan that covers them. You can enroll in Part D or a Medicare Advantage plan with drug coverage.

What does Medicare Part D cost in 2018?

In 2018, Part D costs include: If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions.

How many Medicare beneficiaries are in Part D?

What percentage of Medicare Part D enrollees are in stand alone plans?

How much is the PDP premium in 2018?

How much is Part D PDP?

How much does a LIS beneficiary pay in 2018?

How much is MA PD premium?

Do Part D plans charge coinsurance?

See more

About this website

What is the deadline for Medicare Part D?

Enrollment Periods This period is from October 15 through December 7 each year. Coverage begins the following January 1. For people who are new to Medicare, the Initial Enrollment Period (IEP) for Part D is 7 months long.

What is the Medicare enrollment time frame?

Your first chance to sign up (Initial Enrollment Period) This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

Is there a grace period for Medicare Part D?

A person enrolled in a Medicare plan may owe a late enrollment penalty if they go without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more after the end of their Initial Enrollment Period for Part D coverage.

How does Medicare determine eligibility date?

You will have a Medicare initial enrollment period. If you sign up for Medicare Part A and Part B during the first three months of your initial enrollment period, your coverage will start on the first day of the month you turn 65. For example, say your birthday is August 31.

What are the 4 phases of Medicare Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

What are the Medicare open enrollment dates for 2022?

Medicare open enrollment happens from October 15 through December 7 every year, giving you a dedicated time period to change your Medicare coverage.

Can you enroll in Medicare Part D at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

Can Medicare Part D be retroactive?

People with retroactive coverage may be eligible for reimbursement of covered Part D prescriptions they paid for, from any pharmacy, during any past months in which they were entitled to retroactive coverage under Medicare's Limited Income NET Program.

How can I avoid Medicare Part D Penalty?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

Do you have to enroll in Medicare every year?

In general, once you're enrolled in Medicare, you don't need to take action to renew your coverage every year. This is true whether you are in Original Medicare, a Medicare Advantage plan, or a Medicare prescription drug plan.

Is my Medicare active?

The status of your medical enrollment can be checked online through your My Social Security or MyMedicare.gov accounts. You can also call the Social Security Administration at 1-800-772-1213 or go to your local Social Security office.

How are Medicare premiums calculated 2022?

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How many Medicare beneficiaries are in Part D?

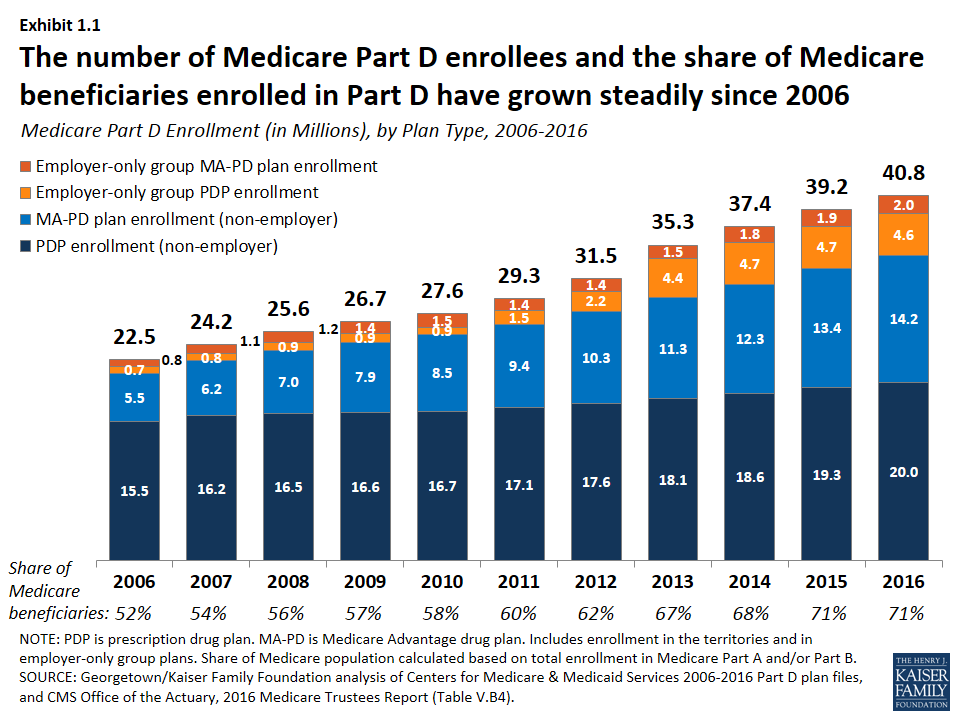

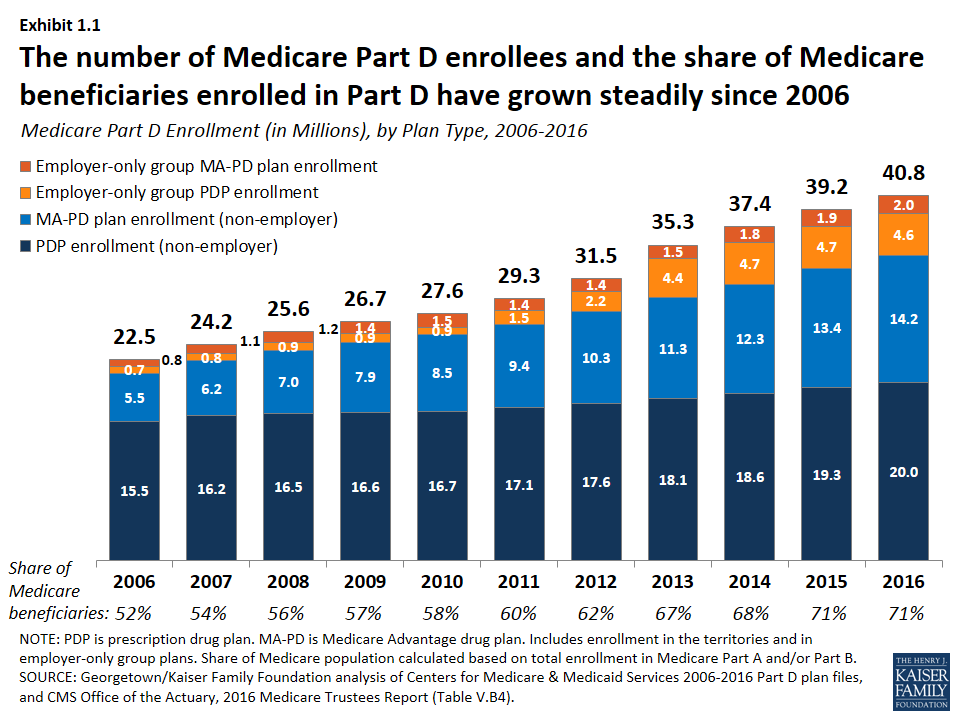

Enrollment. More than 43 million Medicare beneficiaries, or 72 percent of all Medicare beneficiaries nationwide, are enrolled in Part D plans. This total includes plans open to everyone and employer-only group plans for retirees of a former employer or union (Figure 2). Most Part D enrollees (58 percent) are in stand-alone prescription drug plans ...

What percentage of Medicare Part D enrollees are in stand alone plans?

Most Part D enrollees (58 percent) are in stand-alone prescription drug plans (PDPs), but a rising share (42 percent in 2018, up from 28 percent in 2006) are in Medicare Advantage prescription drug plans (MA-PDs), reflecting overall enrollment growth in Medicare Advantage.

How much is the PDP premium in 2018?

Deductibles: More than 4 in 10 PDP and MA-PD enrollees are in plans that charge no Part D deductible, but a larger share of PDP enrollees than MA-PD enrollees are in plans that charge the standard deductible amount of $405 in 2018.

How much is Part D PDP?

Premiums: Monthly Part D PDP premiums average $41 in 2018, but premiums vary widely among the most popular PDPs, ranging from $20 per month for Humana Walmart Rx to $84 per month for AARP Medicare Rx Preferred. Overall, average monthly PDP premiums increased by a modest 2 percent in 2018.

How much does a LIS beneficiary pay in 2018?

On average, the 1.2 million LIS beneficiaries paying Part D premiums in 2018 pay $26 per month, or more than $300 per year (Figure 12). This amount is up 13 percent from 2017 and is nearly three times the amount in 2006.

How much is MA PD premium?

The average MA-PD premium is $34 in 2018, which includes Part D and other benefits.

Do Part D plans charge coinsurance?

The vast majority of Part D plans (both PDPs and MA-PDs) charge copayments for preferred brand-name drugs rather than coinsurance. Among Part D enrollees in plans that use copayments for preferred brands, enrollees typically face lower copayments in PDPs than MA-PDs (Figure 9).

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

How much is Part D deductible for 2017?

In 2017, you can expect the following costs: The Part D deductible is $1,316 per benefit period. Once you meet the deductible, you’ll pay nothing out of pocket for the first 60 days of your stay. For days 61 to 90, you’ll pay $329 per day. For days 91 and beyond, you’ll pay $658 per day.

What is the donut hole in Medicare?

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

When is the AEP for Medicare?

If you’re a Medicare member, you’ve probably heard of the Annual Enrollment Period (AEP), which occurs every fall from October 15 to December 7. It’s the one time of year when Medicare members can make changes to their health plans and prescription drug coverage for the following year. 1

Can I change my Medicare plan during AEP?

If your current coverage is meeting your needs and it’s available in 2018, you can stick with what you have. If you’re planning to keep your current plan, you don’t have to do anything; you’ll be enrolled automatically.

What is the average Medicare premium for 2018?

The average monthly premium for a basic Medicare prescription drug plan in 2018 is projected to decrease by $1.20 to an estimated $33.50 per month.

What is the final call letter for Medicare?

The 2018 Rate Announcement and Final Call Letter advances broader efforts by CMS to encourage the Medicare Advantage and Part D prescription drug programs to continue providing high quality health services to Medicare enrollees . The policies adopted in the 2018 Rate Announcement and Final Call Letter support flexibility, efficiency, and innovative approaches that improve quality accessibility and affordability in Medicare Advantage and the Part D prescription drug programs.

How much did Medicare Advantage cost in 2015?

Over the past three years, the average monthly premiums in Medicare Advantage have decreased, from $32.91 in 2015. Access to Medicare Advantage will remain nearly universal, with 99 percent of Medicare beneficiaries having access to at least one health plan in their area. More than 85 percent of Medicare beneficiaries will have access to ten ...

Does Medicare Advantage have a prescription drug program?

Both the Medicare Advantage and the Part D prescription drug programs continue to grow and provide high quality care and services to more than one-third of Medicare beneficiaries. The Centers for Medicare & Medicaid Services (CMS) is committed to strengthening Medicare Advantage and the Part D prescription drug programs by providing additional flexibilities and efficiencies so that organizations are encouraged to continue developing innovative plan offerings that provide Medicare enrollees with high quality healthcare services.

Medicare Part D: The Basics

Medicare eligibility begins at 65. Most older adults approaching 65 feel overwhelmed when it comes to signing up for Medicare coverage. Learning about enrollment periods, the parts of Medicare, and plan options can be stressful.

What is Medicare Part D?

Before we discuss when to enroll in Medicare Part D, it’s important to first understand what Medicare Part D is. Medicare Part D is the part of Medicare that helps Medicare beneficiaries pay for some or all of their prescription drug costs. Part D plans are offered by private insurance companies as stand-alone prescription drug plans.

Who can Enroll in Medicare Part D?

A Medicare Part D plan is available to anyone who is eligible for Medicare. However, you must be enrolled in Original Medicare (Part A and Part B) or a Medicare Advantage plan to enroll in a Part D prescription drug plan. It is important to note, enrolling in Original Medicare does not automatically enroll you in a prescription drug plan.

Medicare Part D Enrollment Periods

There are a few specific enrollment periods to be aware of when signing up for a Medicare Part D plan:

How to Enroll in Medicare Part D

Enrolling in Medicare Part D is simple. However, before you begin the enrollment process it’s important to shop and compare plans to ensure you receive the right coverage for your needs. Here are some questions to consider before enrolling in a Part D plan

Appealing a Late Enrollment Penalty

Medicare Part D enrollees have the right to appeal a decision they believe to be wrong about a late enrollment penalty. Common reasons individuals appeal a decision include

Medicare Part D Enrollment FAQs

Should I enroll in Medicare Part D if I don’t currently take any medications?

How many Medicare beneficiaries are in Part D?

Enrollment. More than 43 million Medicare beneficiaries, or 72 percent of all Medicare beneficiaries nationwide, are enrolled in Part D plans. This total includes plans open to everyone and employer-only group plans for retirees of a former employer or union (Figure 2). Most Part D enrollees (58 percent) are in stand-alone prescription drug plans ...

What percentage of Medicare Part D enrollees are in stand alone plans?

Most Part D enrollees (58 percent) are in stand-alone prescription drug plans (PDPs), but a rising share (42 percent in 2018, up from 28 percent in 2006) are in Medicare Advantage prescription drug plans (MA-PDs), reflecting overall enrollment growth in Medicare Advantage.

How much is the PDP premium in 2018?

Deductibles: More than 4 in 10 PDP and MA-PD enrollees are in plans that charge no Part D deductible, but a larger share of PDP enrollees than MA-PD enrollees are in plans that charge the standard deductible amount of $405 in 2018.

How much is Part D PDP?

Premiums: Monthly Part D PDP premiums average $41 in 2018, but premiums vary widely among the most popular PDPs, ranging from $20 per month for Humana Walmart Rx to $84 per month for AARP Medicare Rx Preferred. Overall, average monthly PDP premiums increased by a modest 2 percent in 2018.

How much does a LIS beneficiary pay in 2018?

On average, the 1.2 million LIS beneficiaries paying Part D premiums in 2018 pay $26 per month, or more than $300 per year (Figure 12). This amount is up 13 percent from 2017 and is nearly three times the amount in 2006.

How much is MA PD premium?

The average MA-PD premium is $34 in 2018, which includes Part D and other benefits.

Do Part D plans charge coinsurance?

The vast majority of Part D plans (both PDPs and MA-PDs) charge copayments for preferred brand-name drugs rather than coinsurance. Among Part D enrollees in plans that use copayments for preferred brands, enrollees typically face lower copayments in PDPs than MA-PDs (Figure 9).